Bitcoin Gold Hard Fork: The Facts

In two weeks, Bitcoin will undergo yet another hard fork. A new cryptocurrency will be created as a result: Bitcoin Gold (BTG). Private keys holding Bitcoin on October 23rd will be credited with an equal amount of Bitcoin Gold when the new currency goes live on November 1st. The new funds will likely be unavailable for some time until a wallet is developed to support them. Bitcoin Gold will bring with it new mining protocol, a new hope for a truly decentralized bitcoin currency, and new benefits.

In two weeks, Bitcoin will undergo yet another hard fork. A new cryptocurrency will be created as a result: Bitcoin Gold (BTG). Private keys holding Bitcoin on October 23rd will be credited with an equal amount of Bitcoin Gold when the new currency goes live on November 1st. The new funds will likely be unavailable for some time until a wallet is developed to support them. Bitcoin Gold will bring with it new mining protocol, a new hope for a truly decentralized bitcoin currency, and new benefits.

Equihash – Bitcoin Gold’s new protocol

Bitcoin itself uses a hashing algorithm called SHA-256 (Secure Hash Algorithm – 256 bit), a subsect of the SHA-2 algorithm developed by the National Security Administration. With Bitcoin Gold it will be replaced by Equihash, which some believe to be a superior hashing protocol for some intents. Equihash is not new technology. It has been employed since October 2016 when ZCash was launched, and has earned a solid reputation since. While SHA-256 has been abused by optimized ASIC miners, Equihash is a memory-hard problem, making it perfectly suited for graphics processing units found in common computers rather than specialized mining hardware. This is key in achieving one of the goals of the Bitcoin Gold developers: decentralizing the bitcoin ecosystem.

Bitcoin has become centralized with respect to mining. Miners have amassed enormous ASIC networks with enough collective hash power to dominate the bitcoin ecosystem. As a result, too much authority has been consolidated in the hands of a few. As it stands, one or two mining factions can have enough hash power to cause a hard fork to be “contentious”, therefore splitting the blockchain in two and creating a new currency.

This is a growing problem that has been tracked for years. Prof. Alex Biryukov, head of University of Luxembourg research group CryptoLUX,developed Equihash as a finite fix. Equihash’s memory hardness makes it naturally ASIC resistant. Advanced miners will be unable to gain competitive advantage over recreational miners by “out-equipping” them. The cost to do so would be exorbitant enough to deter the effort. Even if someone manages to develop an ASIC miner specialized for Bitcoin Gold, h4x3rotab, BTG’s lead developer, says he will go to great lengths to protect the Equihash advantage.

In other words, the team would change the entire algorithm before they let any mining conglomerate gain an advantage.

Also, Bitcoin Gold’s difficulty setting will adjust every block. This allows it to fluidly regulate itself according to how much hash power is present on the network, ensuring that blocks are mined at a consistent rate. Need for this arose from the Bitcoin Cash fork in August, as hash power has since been fluctuating unpredictably between the two.

Bitcoin Gold will use Ethereum’s hand-me-down mining equipment

Ethereum’s roadmap forecasts a move from its current proof of work (PoW) system to proof of stake (PoS) mid 2018. This is a colossal milestone in its development which has both perks and drawbacks. First, PoS is key to transforming the Ethereum blockchain into a more eco-friendly infrastructure. Mining (PoW) is incredibly energy intensive, but PoS accomplishes the same work at a fraction of the energy cost. A report from Vice published June 2017 suggests that each Ethereum transaction requires energy exertion of about 45 kilowatt hours (kWh). Comparatively, an average US household consumes about 30 kWh per day. Vice further compared it to a Visa transaction which requires only 0.00651 kWh.

This transition introduces another problem, however: What happens to all of Ethereum’s GPU mining equipment after the change? Enter Bitcoin Gold.

Bitcoin Gold has positioned itself to be the natural recipient of the eventual obsolete GPU mining equipment. Ethereum miners will not let their processing power go to waste, leaving only two prominent options: ZCash or Bitcoin Gold. Although ZCash has seen success, the bitcoin household name is likely to draw the majority of miners.

Bitcoin Gold could be used as a testbed for Bitcoin

Long before Segregated Witness went live on the bitcoin network, it’s functionality and viability were tested on Litecoin. The project was a success, and it was subsequently implemented on BTC’s blockchain. Bitcoin developers have other upgrades planned in the future, and Bitcoin Gold intends to play a supportive role. Litecoin has managed to stay relevant by this virtue, and BTG likely will as well. H4x3rotab, Bitcoin Gold’s lead developer, commented on this in an interview with Brave New Coin.

“Bitcoin Gold is also a real blockchain to pilot Bitcoin upgrades.”

Bitcoin Cash market cap has steadily plummeted from its high of almost $15 billion on August 19th to its current cap of $6 billion. Since its inception it has been dormant, offering nothing to holders. Bitcoin Gold on the other hand has an active development lineup and the aforementioned offerings to avoid the same fate.

Could Bitcoin Gold be the way forward?

Bitcoin Gold will maintain a close resemblance to bitcoin. This is perhaps the most important characteristic of the new currency. Segwit2x is set to go live in November, and it’s surrounded with more and more controversy as that date approaches. Some question whether or not it is still a valid upgrade. In the event that it ends up being a catastrophe, Bitcoin Gold could end up being its “golden parachute.” Bitcoin Gold will be equipped with Segwit, so it will also be compatible with Lightning in the future. BTG will have replay protection (Bitcoin’s Segwit2x enabled blockchain is NOT scheduled to have replay protection), making it impossible to be “double spent” or sent involuntarily through a replay attack. It will have the same block time, same max supply, and a more decentralized proof system. You could almost say it is a better coin with less notoriety… but that could change. If Bitcoin Gold needs to step in and take over for Legacy Bitcoin, it will.

How to Monetize the Split

Remember, investors have finite capital. They move capital between assets, always holding what they believe will deliver the best return. With Bitcoin Gold looming, Bitcoin is starting to look like the best prospect. Bitcoin has appreciated ~20% in the past two weeks (since BTG started making headlines), and shows no sign of letting up.

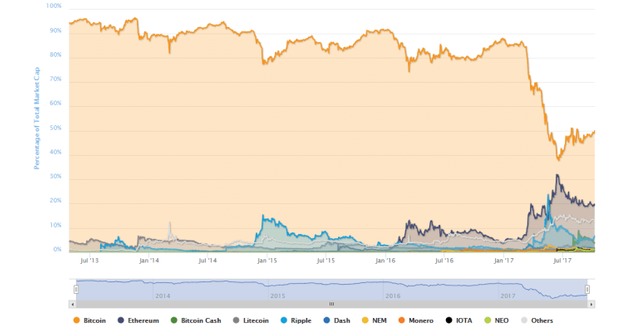

For anyone who holds Bitcoin, this is fantastic. It does, however bring consequences to the broader market. As investors pile into Bitcoin, we are seeing slow capital outflow from altcoins. NEO and TenX — two market favorites — have been hit particularly hard, and even Ethereum is lagging Bitcoin. The image below shows Bitcoin’s market dominance by percentage compared to 9 other top currencies. You’ll notice the near-perfect mirror image between BTC and ETH — evidence that a dramatic short term rise in one can punish the other.

Bargain hunting in this scenario dictates that Bitcoin may offer the best near term ROI, at least until Bitcoin forks. Demand continues to rise as more investors look to lock in their Bitcoin Gold dividend. If this fork is as successful as the last (or even more so), supporters will be handsomely rewarded.

source - www.cryptoanswers.net