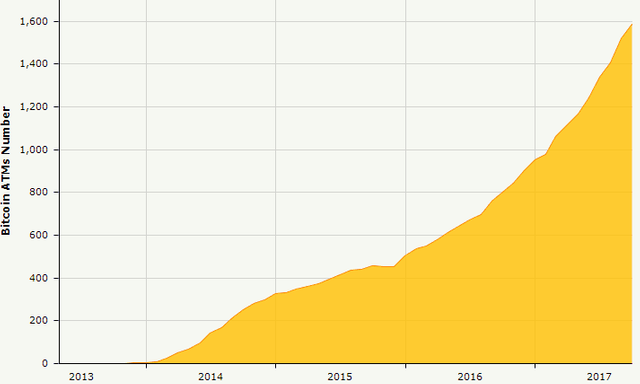

Bitcoin ATMs in United States Near 1,000

The United States now showcases 997 Bitcoin ATMs (called BTMs), as tracked by coinatmradar.com at press time, and that number continues to grow exponentially. In January the number was 550, and by the end of the year it will likely have doubled. Desire for bitcoin on-demand continues to rise, as does the price of bitcoin itself.

The United States now showcases 997 Bitcoin ATMs (called BTMs), as tracked by coinatmradar.com at press time, and that number continues to grow exponentially. In January the number was 550, and by the end of the year it will likely have doubled. Desire for bitcoin on-demand continues to rise, as does the price of bitcoin itself.

With 997 of the 1588 worldwide BTMs, the United States has established clear dominance in that arena. Canada and the United Kingdom take 2nd and 3rd with 255 BTMs and 85 BTMs respectively. This might seem impressive, but CoinATMRadar depicts another 36,000 non-BTM locations if kiosks and retail outlets are included. Oddly enough, it is the developed countries that have the most BTMs rather than the developing or economically unstable countries which stand to reap far greater benefits from divesting from their native currencies. Capital control is speculated to be the limiting factor in many cases.

Why use a BTM instead of an exchange?

Users appreciate the familiarity of ATMs. The interfaces are different, but the functionality is similar. Rather than navigate the internet to fill out forms and set up accounts on sites that may or may not be trustworthy, tapping a few buttons to be rewarded with cryptocurrency feels natural and rewarding.

BTMs provide access to bitcoin and other digital currencies without the need for a bank account. They allow you to convert cash into crypto on the spot easily, securely, and almost instantly. In most cases transactions can be completed in a minute or less. No more 7 day Coinbase settlement. No more 2-4 business day fund release from banks. Storage wallets are not even needed at the time of purchase, as the machines can print out a piece of paper with a QR code on it to be scanned at a later time. If you want to reimburse a friend with bitcoin, give bitcoin as a gift, or toss some into a stocking as a Christmas goody, BTMs have you covered.

BTM Fees are lower than alternatives such as Western Union. A person wishing to send/give $20 in cryptocurrency would pay a $4.99 fee with WU, opposed to a ~$1.85 fee using a teller machine.

Is Privacy a Factor at BTMs?

Until recently, fiat could be converted to crypto with nothing more than cash in your pocket. Personal details were unnecessary, and transactions could be made anonymously. This was great for innocent users to take advantage of the above perks, but also catered to those with less than innocent intentions. Most BTM manufacturers are beginning to incorporate identification features now to comply with increasing regulation. Operators may opt to disable those features but are often mandated to use them. Some locations are still able to be used anonymously, but generally a phone number will be required at a minimum. BTMs are still the go-to resource for private transactions, however. Exchanges maintain an arsenal of client data, while BTMs do not. They help distance users from centralized banks and exchanges and keep private details safe. Anyone off-put by the phone number requirement can sidestep using a burn phone.

Interesting Takeaway Statistics

All of the data below was pulled directly from CoinATMRadar:

ATMs with Bitcoin support: 1588 ATMs with altcoin support: 418 ATMs with Litecoin support: 385 ATMs with Ether support: 153 ATMs with DASH support: 70 ATMs with Dogecoin support: 4 Average buy fee: 9.64% Average sell fee: 6.44% Average overall fee: Average BTM installations per day: 4.72 Number of BTMs installed over time: