A response to mrmoneymustache

Over the past few months I have been reading quite a bit in mainstream media about Bitcoin, and occasionally about other crypto. Most of it has been ill-informed and generally negative, which is no great surprise. After all, new technology always takes time to achieve acceptance and mass-market appeal, so I haven’t been particularly irritated by it. But one recent article did irritate me, enough to attempt to write a response. The article in question was published a couple of weeks ago in the Guardian, a left-of-centre British, high quality newspaper. The author, mrmoneymustache, is a blogger on financial matters and might be expected to have some grasp of the world of finance. It would appear not. Links to the article and the author’s blog are at the bottom of this post.

So let’s begin with the first complaint, that crypto is not investment, it’s speculation.

Getty Images, cartoon from Punch Magazine

This criticism implies that stock market or fiat currency trading and investment is not speculation. The implication is that the markets in these assets are rational and guaranteed to increase in value, or at least accurately to value the underlying asset. We have plenty of historical evidence to suggest this is not the case, from Dutch tulips to the Wall St Crash – never mind the Credit Crunch. Economists recognise this and even have a name for it. It’s called “irrational exuberance” and occurs when the herd behaviour of humans – and, in modern trading, automated trading algorithms or “bots” - leads the market collectively to over-buy an asset. The asset price therefore becomes totally detached from any real value and reaches levels that cannot be justified. The reverse, irrational pessimism, also occurs, which can lead to potentially good ideas never getting off the ground and to the loss of huge amounts of money from the real economy. Historically, investment bubbles formed around many new technologies – just look at Railway Mania and the record of George Hudson during the Victorian era in Britain. Now, whether the current price of Bitcoin or any other crypto is justifiable is a matter for debate. But to claim that the purchase of crypto is substantially different in nature to that of purchasing some other kind of asset is factually erroneous. Markets may be supposed to provide a price discovery mechanism that correctly values assets, but they are unreliable at it at best, particularly when that asset is a new technology.

So why do we hear this claim so frequently? It stems, I think, from a fundamental failure to grasp the principles of the technology. As mrmoneymustache correctly points out, Bitcoin is not the same as blockchain. However, the point he and most other mainstream financial writers miss, is that without Bitcoin, the Bitcoin blockchain would not exist. A blockchain without an associated currency is a mere database, admittedly a rather secure one. The fact that to complete a block, it is necessary to inject large amounts of capital – both in physical assets and revenue (computers and electricity) – means that unless a profit can be made from generating each new entry on the blockchain, no sane person would ever get involved in setting up a mining rig. The costs would be prohibitive. Even if the costs were lower, there would still be a tiny number of people or institutions willing to put their own time and technological resources into providing the nodes necessary to run a network. Look at Tor, for example. While many people use Tor regularly, very few set up a Tor server. Why? Because money. It’s necessary to have a machine running all the time, and while it’s running, you can’t really interrupt it so that you can play a game or use some other resource-hungry software. So you need an additional machine. You also need the most bandwidth you can buy from your ISP, as your Tor server is going to be sending and receiving data continuously, meaning you are likely to find your children complaining that they can’t watch Netflix unless you’ve spent a decent amount of cash on your connections. Similar considerations apply to torrents. Most people don’t seed torrents, they just download, as while they are willing to accept limitations on the use of their resources if they are getting something in return – the album or film they are downloading – they are not willing to accept those limits permanently. Once they’ve got the file, most people close the torrent client with a sigh of relief and get on with using the computer for something else, which requires the computing resources previously occupied downloading the torrent. And no-one wants to pay for the electricity their computer is using unless they benefit personally from that expenditure, even if the benefit is a purely transient leisure activity such as gaming or watching a film.

So if you wish to create a truly decentralised network of any kind if is necessary to monetise it. To do so using conventional fiat currencies would be incredibly complex, involving the co-operation of multiple institutions, most of whom would have vested interests in not doing so. Banks, ISPs and power companies have no incentives to monetise data transmission and recording, not because these are not useful to them, but because there is no reason for these disparate players in the game to work together. Indeed, ISPs generate profits from controlling data transmission, so why on earth would they get involved in assisting others to transmit and record data? Banks may attempt to use blockchain technology to record their internal transactional data, but the system will not be as secure as a decentralised model due to fact that it is easier to attack a single point in a data storage system than to locate and attack multiple nodes. And do we really trust the banks to store our data, or our private keys, securely?

The question of trust is fundamental to the functioning of any economic system. Most consumers are aware that they could be paying the wrong price for an item, but pay it anyway because they want the product. Hedonistic pricing, for example in the UK housing market, occurs when the value of a product rises above its intrinsic worth and remains there due to a combination of factors, usually involving benefit to the supply side of the market. First time house buyers in the UK are only too well aware of this. There have been attempts to better align the cost of UK housing with intrinsic value, in the form of compulsory disclosure by sellers of energy consumption, necessary or recent renovations and so forth. This demonstrates a problem with trust in this particular market. This lack of real trust can be found in the regulations that apply in most markets and payment systems, as without these regulations, trust in these markets is undermined, which in turn erodes confidence in the market and can lead to irrational pessimism. This is just as economically inefficient as irrational exuberance. The trustless transaction system that is inherent in blockchain transactions solves this particular problem by recording transactions on a ledger, which in most cases is public in some form or another. This solves one of the fundamental problems of fiat currencies, in that the only intrinsic value to a fiat currency is that of trust. The moment that trust dissolves, the currency crashes in value. Current examples of this would be the collapse in the value of the UK pound following the result of the Brexit referendum, or to go back a little further, the massive loss of global economic value caused by the banking crisis of 2007/2008. To claim that our trust in fiat currencies is permanent is to ignore the evidence. We use existing fiat currencies not out of choice, but necessity. They’re all there is. The regulations that are sometimes enforced by governments in an attempt to inject reality into a market are in themselves a source of market inefficiency, in that the agents in the market are then compelled to undertake additional work to demonstrate their compliance with these regulations, which costs money. While crypto at its current stage of development does not entirely solve this problem, it is by its very nature more able to provide checks and balances due to the consensus nature of block creation. This can even be automated, so that those regulations that are necessary can be integrated into the payment system, reducing the inefficiency of the system by reducing the cost of compliance. And most importantly, crypto payment systems allow for complete, publicly available recording of transactions which in turn permits a wider variety of actors in any given market place, as reputation is generated by each transaction and does not require the backing of a large amount of capital or a long track record in the market. This makes it easier for new entrants to a market to succeed, which also solves one of the problems with the modern economy – that of corporate monopolies and the resultant inefficient markets. The non-national nature of crypto currencies also weakens the effect of cross-border market asymmetries, which are a major source of global economic inefficiencies.

So, in essence, to trust fiat currency, you have to trust not only the other party in your transaction, but a whole plethora of third-party actors – governments, stock market speculators, currency markets and so forth. To trust in cryptocurrency, you have only to trust the technology. And the market will quickly weed out those cryptos that are untrustworthy, whether through poor coding, poor economic models or other failings. The current wild fluctuations in value are common to all new markets, as there is as yet no means of assessing fair value. The same applies in the markets attached to any new technology, which is why such markets are fraught with risk – and with the potential to generate huge wealth. As the technology matures, prices and trends will stabilise, making it perfectly possible to set prices in crypto.

This may take some time…

The sad fact is that many outside the crypto community conflate “cryptocurrency” with Bitcoin, not understanding that there are many cryptocurrencies with a whole range of functions and uses. True, there are some that are little more than scams but this is common with any new technological development. Charlatans use ignorance of the technology to generate personal wealth by relieving those with no understanding of the field of their investments and giving nothing in return. This is the reason ICOs have been banned in China and have acquired a dubious reputation more widely. During the DotCom bubble of the late ‘90s, plausible seeming individuals attracted huge amounts of venture capital to projects that were never going to make any kind of return. But other projects are anything but scams. Indeed, several address one of mrmoneymustache’s other points, that of deflation and hoarding. It is true to say that Bitcoin is rather similar to gold as an investment. Gold was used in the past as both a currency and a store of value but its use as a currency became increasingly difficult. It is heavy and cumbersome to move around, as is Bitcoin. Like gold, Bitcoin is an expensive means of exchange and is rather slow, making it ill suited to the role of “means of payment”. Initially, this problem was dealt with in the case of gold by making gold the store of value that underpinned conventional currency. However, the deflationary nature of gold – increasing scarcity pushes up the price of gold, effectively diminishing the value of currencies based on it – eventually ended even this role for gold, and currencies were decoupled from precious metals and allowed to float freely on markets. Precious metals have continued to perform the store of value function, however, as part of a diverse portfolio of investments even for nation states. It seems likely that Bitcoin will go in a similar direction, as other cryptocurrencies demonstrate their greater utility as a means of exchange. Hoarding of Bitcoin probably will occur, as it already does, but as other cryptocurrencies take on the role of means of exchange, this is not a massive problem – any more than is hoarding of precious metals. A global economy based on Bitcoin seems unlikely, but some role for Bitcoin within the global economy seems entirely plausible, indeed, quite likely.

And so to the final point made by mrmoneymustache, the point of storage and safety. He states, quite rightly, that there have been attacks, some of them successful, on crypto exchanges. However, it is blindingly obvious that this is a not a fault of cryptocurrencies themselves, or of the blockchain technology, but of the current state of the ecosystem, reliant as it is on centralised exchanges. It is also the case that many current users of these exchanges are unaware of the alternative storage systems available. In fact, crypto is more secure than any bank account. Why? Because you can store your crypto on any device you choose, by sending it from the exchange where it was purchased to a software wallet installed on some electronic device. If this device is kept off-line, for example a pen drive or an old laptop that is not connected to the internet, then there is no way any hacker can access your funds, or steal them. The record of your ownership of your funds is permanently stored on the blockchain and cannot be altered, which means that even if you lose the device, or it is destroyed, so long as you have your password(s) you can regenerate the wallet and the funds it once contained will be restored. Those of us that have been exploring cryptocurrencies for some time have generally tried this as an experiment, and guess what? It actually works!

Other common criticisms are already being addressed. Cryptos such as Monaco will make the process of moving funds from fiat to crypto and vice-versa far quicker than they currently are, indeed, will make them almost instantaneous. Interestingly, the current delays in moving funds from fiat into crypto are largely associated with the three day limit artificially imposed by banks as such transfers usually involve some kind of international transfer of funds. Banks ensure this takes three days, although it needn’t do so. Fast transactions, contract fulfilment and recording is provided by Digibyte, removing the need for banks to be involved in these transactions. You do not need a witness to a contract if that witness is already present in the blockchain. The demonisation of crypto as a means of tax evasion or money laundering is equally questionable. The fact is that other than a few anonymous blockchains, most cryptos and their associated blockchains work using a public ledger, which makes it rather difficult for criminals to use them, or tax dodgers to hide their earnings, as those institutions with the publicly accepted right to intrude (the Police) can easily trace the transactions made by ne’er-do-wells once they have a link between the individual and their blockchain address. Fiat can be withdrawn from a bank anonymously in cash, which is next to untraceable, hence the stereotypical Mafioso’s preference for unmarked, used bills. Crypto cannot. Once one address is associated with a criminal, all transactions from that address can be traced by anyone, including me, simply by using that blockchain’s block explorer software. Similarly, corporate tax evasion becomes a thing of the past if all transactions are recorded on a blockchain, as it will no longer be possible to pay an expensive accountant to shift a company’s financial assets into tax havens – the record of the origin of the funds on the blockchain means that companies can easily be taxed on earnings in each jurisdiction, making the cross-border obfuscation currently employed by many corporations in order to evade taxation impossible.

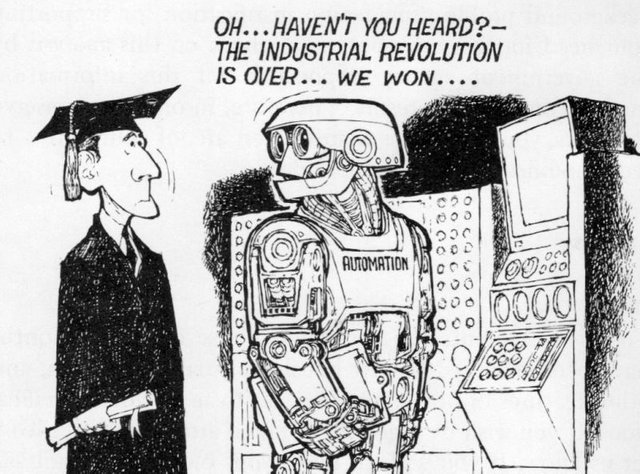

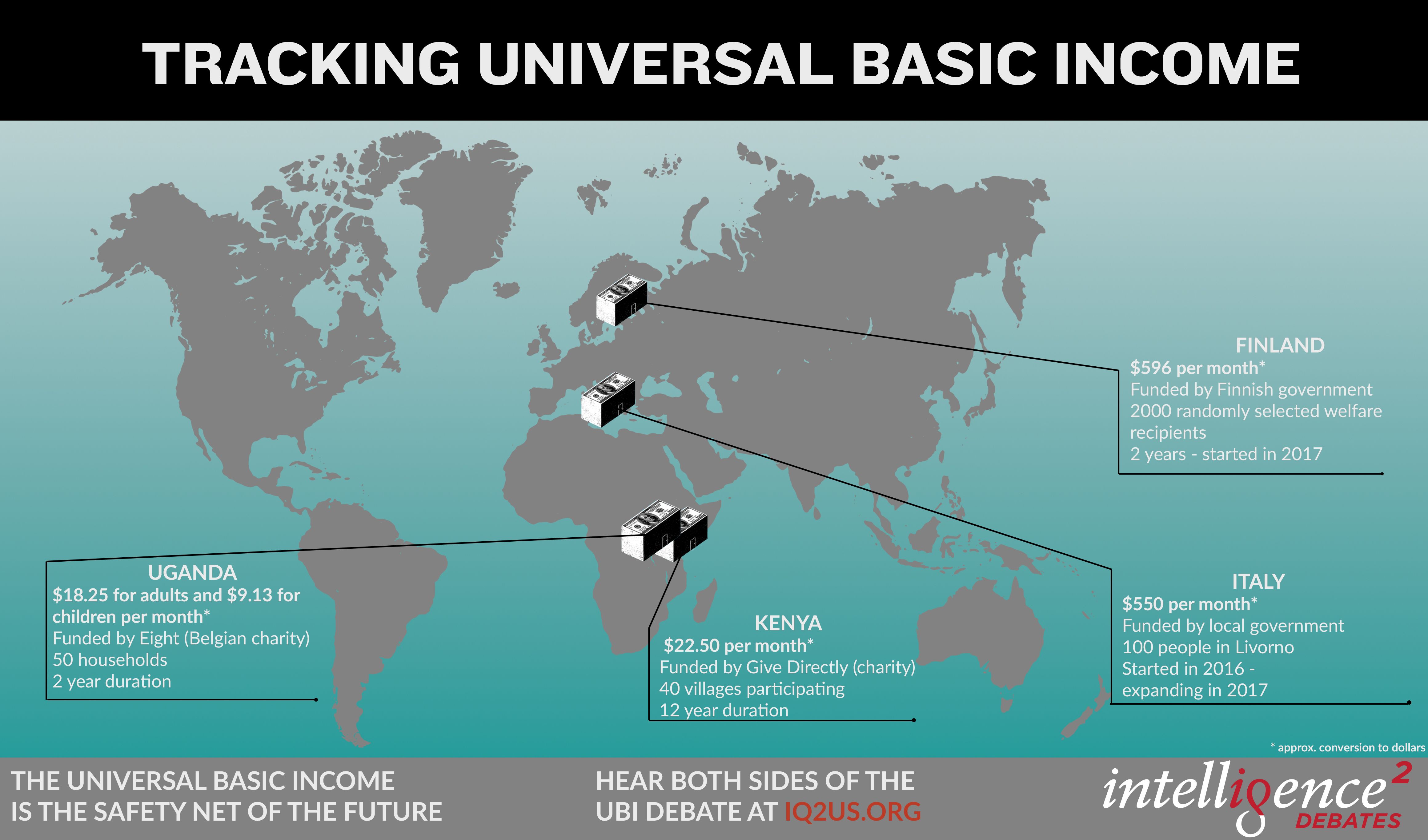

However, to my mind, all the above arguments are almost irrelevant. The elephant in the room in much of the current discussion of economics, above and beyond crypto, is the growth of AI and the increasing automation of tasks that until now have required humans. It is inevitable, barring some kind of total global disaster such as nuclear war or catastrophic climate change, that this process will continue. Some forward-thinking countries are already looking at various solutions, in particular that of a Universal Basic Income. While this is undoubtedly a potential solution in those cultures that accept and welcome a considerable amount of governmental intervention in the labour market and elsewhere, in the form of unemployment benefits, free healthcare paid from taxation and so forth, there are many jurisdictions where such interventions would be considered unacceptable. While the prevailing cultures in these nations might change over time, it is likely that UBI will in any event be only a partial solution, as with fewer and fewer people working and therefore paying tax, where will the tax income to pay for UBI come from?

I recently had an interesting conversation with two investment bankers on a train from London. Naturally enough, given my interests and the book I was reading (The Death of Money by Jim Rickards), the conversation turned to banking, economics and crypto. I have to say that I didn’t find Rickards’ particularly convincing and neither did my banker friends. However, they were less inclined to dismiss cryptocurrencies. Once of them indeed suggested that personal data is currently taken as a form of rent by websites such as Facebook, as the value returned to the user by Facebook – free use of their servers and software – is of negligible worth compared to the data Facebook gains in the exchange. His view was that crypto provides an obvious means of properly rewarding the access to personal data that Facebook and other services then monetise for their own profit by providing a price discovery mechanism for personal data, which in the information age in which we live has enormous value to information aggregators such as Facebook, Instagram and the rest, but for which users receive no reward. Neither were the bankers blind to the difficulties facing the labour market as automation replaces work. Both of them were quite interested in the potential of crypto to monetise many leisure activities and even passive consumption. Cryptocurrencies such as Basic Attention Token and AdToken reward consumption of advertising, AudioCoin rewards artists for each listen to their music, Steem rewards content creators for posting interesting items online, and so on. This is direct monetisation of time, which is of immense value to all of us, yet currently has no direct value in the economy. True, we get paid for our labour, at variable rates depending upon our skill sets and qualifications. Not to mention luck. But as there is less labour to be done by humans, it seems perfectly reasonable to foresee an economy in which our chosen activities are monetised through the process of recording the activity on a blockchain and rewarding the activity in crypto. After all, if no-one attends a live concert, or watches a film legitimately, as they do not have the funds to do so, what happens to the financial incentive to artists, film-makers, theme park owners and the rest to provide the leisure activities we value? What happens when very few can afford to pay for their internet connection? The conventional mechanisms of delivery and financialisation of human activity will break down without sufficient humans to generate the income needed to fund these activities. And crypto has many of the solutions already. Nexus will provide a global network that monetises access to the internet, Lunyr monetises knowledge, ArtByte and Synereo Amp reward content creation. The attention economy will become increasingly important, and crypto is the obvious solution to both recording and rewarding the attention of audiences to artists and content creators across a multiplicity of platforms and disciplines. Blockchain solutions for online marketplaces such as Blockmarket/SysCoin and BitBay already exist and work, projects such as Vtorrent and JoyStream intend to monetise peer-to-peer data exchange. Monetisation of exercise, of travel, even of communication are all possible, plausible and in many cases, already in existence, albeit in embryonic form.

Of course, all of this activity will be recorded on blockchains and will, therefore, be taxable, permitting the continuation of state provision of public services such as healthcare, which in itself will be part of the information economy – patient records on the blockchain is already under development by Patientory, for example. The possibilities are endless and the outcome, that of a world in which cryptocurrencies form an essential, intrinsic part of the global economy, inevitable. Lazy, arrogant dismissals of the new technology by ill-informed gamblers such as mrmoneymustache will become the salutary lessons of future history textbooks, listed alongside the Jehovah’s Witnesses’ refusal of modern medicine and every self-satisfied technophobe that ever said “it’ll never catch on...”

The future’s here. It’s crypto. We’re the early adopters, the first movers in the market. Congratulations, people.

Full disclosure – I own Monaco, SysCoin, Nexus and Digibyte in quantities that might make me some money one day. I also day trade some of the coins mentioned, but have no long-term stake in them, I just feel they are good projects. Perhaps one day I’ll have enough liquidity to own a small stake in all the projects I feel have a future!

Sources

Guardian article https://www.theguardian.com/technology/2018/jan/15/should-i-invest-bitcoin-dont-mr-money-moustache

Mrmoneymustache homepage http://www.mrmoneymustache.com/

crypto cant be speculation when it is backed by a total supply, thanks for the post !

Possibly, but when it's almost impossible to be certain of the value of a thing, as it currently is with crypto, it being a new tech, the supply is less relevant. If for some reason, every long term holder of, say, BTC, sold up and bought, say, whiskey as their new long term investment, BTC would crash in price and whiskey prices would soar. There'd still be the current amount of BTC, but it would have become almost devoid of value.

I've been thinking more about this since posting, and it occurs to me that the cryptos with intrinsic value are those that have added functionality on their blockchain. Those that are merely currencies, as it were, lack that underlying worth, and are reliant on trust... Interesting, I'm probably going to post more of these random musings, thanks for reading, hope you'll take the time to read any further musings. An upvote would be nice too, I'm trying to make some cash to pay uni fees and rent... ;)

dang nice comment man! Thanks for the effort, yes I understand you point it makes sense. I like the perspective you have haha.

Fantastic article. I truly believe that the missing link in cryptocurrency is Monaco as you mentioned. It is the technology gap bridge that is required to enable the world to see that cryptocurrency isn't as scary as they first thought and give them an easy way to see it's uses.

Great work!

Completely agree. A lot of the misconceptions about crypto stem from lack of exposure to it, once the mechanisms are available for anyone to try out the new technology, the fear of it will vanish and people will be saying "why didn't I do this before..?"

Well, because Monaco didn't exist to enable it, that's why! :D