Dow Dips, Bitcoin Clings to Gains as Tuesday Promises Volatility

Dow Trades Sideways in Advance of Opening Bell

Traditional markets remain shaky ahead of Tuesday’s opening bell, and futures contracts tracking the Dow and its peers spent much of the day bouncing around their levels at Monday’s close.

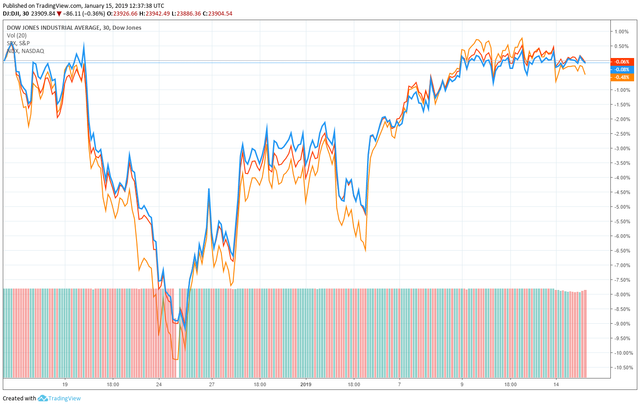

Dow (blue), S&P 500 (red), and Nasdaq (orange) futures have been shaky this week. As of the time of writing at 8:32 am ET, Dow futures were down just 2 points to 23,865, while S&P 500 and Nasdaq futures both traded slightly in the green with gains of 0.11 percent and 0.42 percent, respectively.

Yesterday, the Dow, S&P 500, and Nasdaq all closed in the red for the second consecutive day after posting a five-day winning streak. The Dow dropped 86.11 points or 0.36 percent, once again failing to break through and hold above the elusive 24,000 mark. The S&P 500 shed 13.65 points or 0.53 percent, and the Nasdaq endured a 65.56 or 0.94 percent drop-off.

The Dow (blue), S&P 500 (red), and Nasdaq (orange) have mostly erased their mid-December losses. Nevertheless, all three indices remain firmly in positive territory for 2019 and have mostly erased the mid-December losses that contributed to the stock market’s dismal end to last year.

Concern as JP Morgan Misses Profit for First Time in 15 Quarters

Jamie Dimon, perhaps best known as one of bitcoin’s fiercest critics, led JP Morgan to 15 straight quarters of beating analyst profit forecasts. | Source: Flickr/Fortune Live Media Wall Street continues to closely monitor corporate earnings as analysts weigh the risk of the US economy slipping into a recession.

Sentiment turned sour on Tuesday morning after JP Morgan missed profit expectations for the first time in 15 quarters. According to CNBC, the Jamie Dimon-led banking giant accrued $1.98 per share in profit during the fourth quarter of 2018, well below the $2.20 per share that analysts had expected.

Like Citigroup, which missed revenue targets but nevertheless rallied on stronger-than-expected profit figures, JP Morgan blamed a decline in bond trading revenue for weighing on its fourth-quarter performance.

“Despite a challenging quarter, we grew markets revenue in the investment bank for the year with record performance in equities and solid performance in fixed income,” CEO Jamie Dimon said in the earnings release.

Dimon, who has said that he does not believe the US is heading into the outer rings of a recession, nevertheless admonished the country’s leaders to “strike a collaborative, constructive tone, which would reinforce already-strong consumer and business sentiment. Businesses, government and communities need to work together to solve problems and help strengthen the economy for the benefit of everyone.”

Brexit Hangs in the Balance

British Prime Minister Theresa May will likely suffer defeat in today’s Brexit vote. | Source: Shutterstock But while corporate earnings promise to remain a lingering concern for the stock market’s recent recovery, today’s Brexit vote could be a far more pressing threat.

British Prime Minister Theresa May’s Brexit plan is expected to fail in parliament today — perhaps spectacularly — but analysts predict that the vote will inject significant volatility into the markets, so much so that many brokers have limited leverage for UK stocks and currency futures.

As Marc Chandler, Bannockburn Global Forex chief market strategist, told CNBC:

We could see knee-jerk volatility. She could lose by a historic margin. This could be a historic loss by the government.In preparation for this seeming eventuality, May told senior ministers that she would continue to work to facilitate Britain’s orderly exit from the European Union and “respond quickly” to the outcome of the vote, which is expected to take place between 7 pm and 9 pm GMT.

“The prime minister said the government is the servant of the people and she believes passionately that we must deliver on the result of the 2016 referendum,” a spokesman for the prime minister said in remarks quoted by Reuters. “She added that after the vote has taken place, she would respond quickly to the result.”

Bitcoin Clings to Gains as Ethereum Braces for Constantinople

Neither Brexit nor corporate earnings season is expected to have much direct impact on the cryptocurrency markets, though some analysts including eToro’s Mati Greenspan maintain that bitcoin and its peers are more connected to other asset classes than many investors realize.

The bitcoin price made a moderate recovery on Monday but has ebbed a bit lower on Tuesday. In any case, the crypto market saw a moderate recovery on Monday. The bitcoin price, which had on Sunday slipped below the so-called “GTFO” level of $3,500, popped above the $3,700 mark on Bitstamp and other cryptocurrency exchanges, though it has since ebbed to $3,647 as of the time of writing.

The ethereum price, meanwhile, is up 8 percent on the day, owing to optimism over the Jan. 16 Constantinople hard fork. The fork, which will activate at block 7080000, will introduce a number of upgrades into the Ethereum protocol, which developers say will better prepare it to scale to the requirements of future mainstream adoption.

The ethereum price traded up ahead of the Constantinople hard fork. Equally as important is that Constantinople will reduce the ethereum inflation rate by 33 percent, as the cryptocurrency’s block reward will decline to 2 ETH per block from 3 ETH. This should reduce selling pressure from miners.

Importantly, this hard fork, unlike the recent one which roiled Bitcoin Cash, is not expected to splinter the Ethereum network into multiple competing versions — and cryptocurrencies. While a group of disgruntled users could always refuse to migrate to the new protocol version, miners, exchanges, and other infrastructure providers have committed to supporting the network upgrade.

Nevertheless, traders will be closely watching the hard fork’s activation, as unforeseen bugs and other disruptions could lead to significant price volatility in the short-term.

Featured Image from Shutterstock. Price Charts from TradingView.

Posted from my blog with SteemPress : https://bittreat.com/dow-dips-bitcoin-clings-to-gains-as-tuesday-promises-volatility/