How Expensive is it to Take over the (PoW) Network of Bitcoin, Ethereum or Monero? Why We Might See More 51% Attacks in the Future

Recently we’ve seen two 51% attacks on Verge (XVG) and one on Bitcoin Gold (BTG). It basically means that one party had control over these Proof-of-Work coins, making it possible to put fraudulent transactions on the blockchain and for instance double spend coins. This can be very profitable! It is estimated that in this way, the attacker had extracted $3.5 million worth of XVG (two attacks combined) and in the case of BTG $18 million was double spent.

In order to be able to conduct a 51% attack someone must own or rent enough mining power to have 51% or more of the hashrate and use it to control the network. Based on the characteristics of the current state of the network hashrate, it is possible to calculate costs of having control over a network. This is what researcher Husam Abboud has done.

One week ago, it would have cost you around $2.27 billion per day to run a 51% attack on Bitcoin (BTC), around $3.22 billion per day on Ethereum (ETH) and $449 million per day on Monero (XMR). Those numbers are quite high and I don’t think that is an interesting investment for anyone.

Image source

But, apparently the Verge and Bitcoin Gold 51% attacks were interesting enough to perform. It is estimated that a 51% on BTG only would cost around $200,000 per day. That is pretty cheap and dangerous!

Small Proof-of-Work coins (with a low hashrate) are more and more at risk. Miners can switch to mining a different coin without letting anyone know upfront. This decreases the hashrate of the previous coin, leaving it more vulnerable to attacks. Also, the hashrate of the big coins are so much higher than the hashrate of the smaller coins. When a few % of the mining power of a big coin switches to the small coin, they can take over that network.

Besides the obvious incentives of for instance double spends, of course the attacker could combine the 51% attack with shorting the coin on the market. And even combine that with a leveraged trading strategy of x10 or even x100. When the attack is happening, people lose trust in a coin, therefore might sell it and the price will go down. Short positions will profit!

Anyway, some serious concerns here. Will we see more 51% attacks in the near future? Will PoW projects increase the numbers of confirmations needed for a transaction? Will this result in more popularity for the Proof-of-Stake consensus mechanism?

I guess we’ll have to see how this all plays out. What are your thoughts on the matter?

Interesting reads on the subject:

- https://medium.com/@HusamABBOUD/rindex-the-robustness-index-87cdcf284faf

- https://medium.com/@HusamABBOUD/the-realistic-lucrative-case-of-ethereum-classic-attack-with-1mm-today-8fa0430a7c25

---> 👍🏼 Follow me for regular updates on my cryptocurrency portfolio, crypto related articles and inspiring articles about personal time & life management.

---> 👍🏼 Resteems and upvotes are appreciated ;-)

Disclaimer: I am not a financial advisor, trader or developer. I am just a blockchain & cryptocurrencies enthusiast. Make sure you do your own research, draw your own conclusions and do not invest any money that you cannot afford to lose.

I thought if it would be rhetorical to ask if BTG did not get to 0, and then I read that XVG suffered it twice.

Instead of asking how stupid people are, I ask why did people bought XVG after one 51% attack and why some still do?

There is only one reason: they expect to find someone in the future that is willing to pay more for their coin than what they paid. Speculation.

Obviously, but why do they expect it from such lousy currencies?

Their vulnerabilities have already been exposed.

We should find some of these people and ask, because I don't have the faintest idea...

You got a 26.63% upvote from @luckyvotes courtesy of @stimialiti!

You got a 18.02% upvote from @sleeplesswhale courtesy of @stimialiti!

@youtake pulls you up ! This vote was sent to you by @stimialiti!

I think part of the answer is quite simple. Lots of people are clueless of what they're buying. Another part is greedy and hoping it to become much more valued.

Further I guess that some coins have a large stake being hold by the owners.

I am greedy too, and because of it I will not buy a currency that I know that was already "compromised".

Maybe trade bots bought it.

You got a 66.67% upvote from @voteme courtesy of @stimialiti! For next round, send minimum 0.01 SBD to bid for upvote.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to voteme by clicking following links: 10SP, 25SP, 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

You don't have a lot of Steem for being a greedy monster 😋😂😜

You are very observant.

I was kidding.

I donated everything that I ever got to the church, so they can donate it to the poor and for the praise of god.

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

You got a 26.11% upvote from @sleeplesswhale courtesy of @stimialiti!

You got a 22.22% upvote from @luckyvotes courtesy of @stimialiti!

You got a 18.18% upvote from @sleeplesswhale courtesy of @stimialiti!

@youtake pulls you up ! This vote was sent to you by @stimialiti!

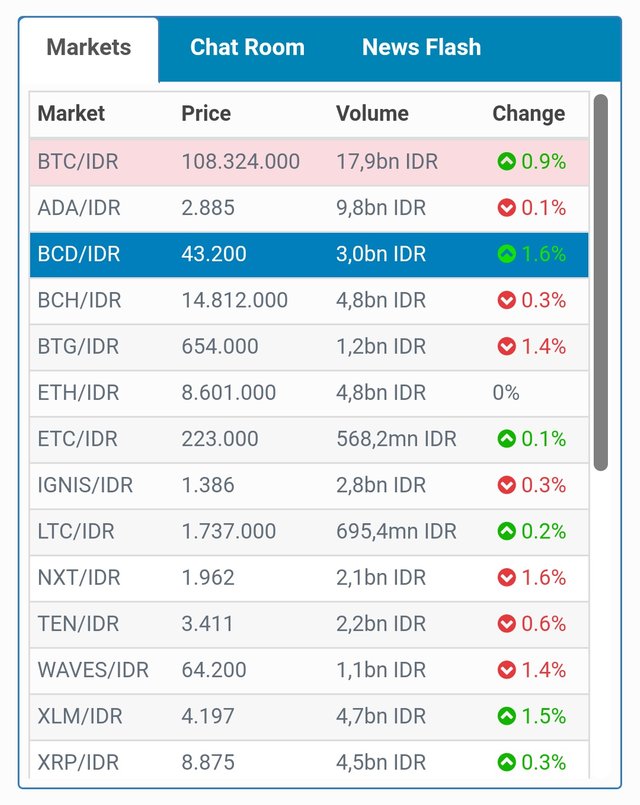

Indonesia market

Source: indodax.com

I think we will see more of them for sure.

I'm not entirely sure what is behind the attacks in terms of motivation. I can think of several reasons to attack:

Truthfully, I think it's actually good that these attacks are happening. It is a great filter to weed out all the shitcoins from the good coins. A good coin should not be 51% attackable, after all.

Great point, could definitely be the case. The latter two are quite 'conspiracy-ey' though. Have you recently been listening to what Roger Ver is telling? He speaks a lot about how deep censorship and manipulation is done by the Bitcoin Core people. Sounds a bit like your last 2 points :-P

Yes, I think you mean the interview with Ivan on Tech? I saw it and have heard him speak of it before. I actually don't think it's untrue. I'm pretty sure there is actual censorship against BCH and there actually is a lot of BTC (price/market/media/sentiment) manipulation going on.

But.. the same can be said for BCH obviously.

Still I wouldn't underestimate the power of whales and influencers to work to manipulate the price and market. Quite frankly, I firmly believe that people are willing to spend money in order to use game theory to drive people to do what they want.

When I first entered the crypto space I believed the conspiracy theories were just that too: fun conspiracy theories to entertain us. But as time progresses I find that I have been switching camps and the longer I am in crypto the more convinced I am getting that manipulation is not only real, but potentially a lot bigger than even the theorists are theorizing about. Sometimes I wonder if the price graphs are even price indicators, or rather carrots-on-a-stick.

Also, if we wanna go total tinfoil hat.. let's not forget who owns Blockstream, the company that pays the BTC (core) developers: AXA (insurance), owned by the Bilderberg group.

Oh man! I have been wondering about this. Thanks for explaining it. Fascinating!

Man this should be a serious concern. If large financial institutions can heavily influence trade and the value of a currency, and covert operations can cause a hijack in the PoW currencies, we could be at the mercy of 2 more entities we want nothing to do with.

You could start your evil empire hitting the small market cap coins to build up some funds and attack the larger ones.

Good food for thought for sure and I would love to discuss solutions the regular folk could participate in.

True, definitely a bit scary. I am curious how this will unfold :-)

$200k to make $18 million? Seems like there will be a lot more of such attacks. Is the whole proof of work model now obsolete? Re-steemed.

I don't think the model is obsolete. Other models also have disadvantages. What most likely will happen is that we will see hybrids of PoW/PoS or other consensus mechanisms. Also, within PoW there is still quite a lot of things developers can do to make it more difficult for 51% attacks to happen.

actually its reall great post,very information and very good post

Coins mentioned in post:

As economist I would say we will definitely see more of these hacks. It's just too profitable.

From the IT side I'm not sure. As you need to stay anonymous. I don't know if that's possible?

Lots of Crypto enthousiastics say that bankers are bad news and the cause of many issues. And those bankers scammed many people and they were very greedy Wolfs. So it looks like those bankers are now on the blockchain. I only wonder where they learned their very strong IT skills to execute such profitable hacks?

😜😋

Oh man! I have been wondering about this. Thanks for explaining it. Fascinating!