John Oliver does a good job explaining Bitcoin & cryptocurrencies. But, there are a few things he left out...

On Sunday, March 11th, 2018 John Oliver covered Bitcoin, cryptocurrency and Blockchain technology. For many crypto enthusiasts, this will go do down as a cultural staple, the point at which millions of Americans first learned about the real implications of Bitcoin.

Scroll to the bottom for a brief recap

John Oliver has a keen way of relaying complicated, and often controversial, topics to the general public. He does a solid job with Bitcoin, providing a broad, yet level-headed perspective on what all this really means. John Oliver touches on some fundamental concepts like security and efficiency but merely scrapes the surface when talking about how the technology works.

Let's take a look at John Oliver's segment and discuss what he did and didn't say.

Where will Bitcoin be in 5 years?

| Using Google Glass as an example, John Oliver kicks off his segment by acknowledging "it is dangerous to make predictions about where tech is going." |

|---|

Although Google Glasses sounded great, Google failed to see that the product's safety concerns, social implications and high price would deter most people from buying them. John Oliver used the hard-to-predict nature of new technology to segue into his main topic of the night, cryptocurrencies.

| "Tonight we’re going to talk about cryptocurrencies. Everything you don’t understand about money combined with everything you don’t understand about computers." |  |

|---|

When John Oliver says it, it's easy to laugh and lean in for more, but for many this would normally be a stopping point. Money is kind of an arbitrary concept and computers are a mystery to most people, making cryptocurrency an ultra hard concept to grasp. To provide some clarity, remember:

Money only has value because we agree it has value (take a look at the history of money)

Economics is basically the study of supply and demand (i.e. human behavior in the context of our current systems of wealth)

Cryptocurrencies are analyzed using cryptoeconomics, because they operate under fundamentally different systems. To compare & simplify...

USD Cryptocurrencies • centralized (primarily)

• fiat

• dependent on 3rd parties (e.g. banks)

• verified by middle-men• decentralized

• digital

• trustless

• secured by autonomous mathematics & computingCryptocurrencies can be seen as currencies, as I just described, but they can also be seen as commodities.

Currencies = used as a medium of exchange

Commodities = have intrinsic value

Cryptocurrencies were built to be a medium of exchange, but they are also powered by technology. Some cryptocurrencies are developed with very sophisticated technology that's fast, cheap and efficient. But, others are not.

Because technology has inherent value, a cryptocurrency can also be seen as commodity. Because of this, people tend to treat cryptocurrencies as investments, like stocks.

Investing in Cryptocurrencies

| "A few years ago you'd only hear about Bitcoin from that one guy in your office who wouldn't shut up about it. Let's call him Dan." Though, "lately, more and more normal people, or non-Dan's, have been getting into cryptocurrencies" |

|---|

Buying and investing in a cryptocurrency is easy to do nowadays. Log on to a site (like Coinbase.com), purchase some Bitcoin with your credit card or checking account, and voilà! You now own a cryptocurrency.

But, if you don't have investing experience, this can be especially risky, and John Oliver insists on calling it "gambling." While I don't think it is a total gamble, there is definitely something to be said about the intense volatility and sporadic nature of cryptocurrencies in the current climate.

So, why do people keep buying cryptocurrencies without much forethought?

I agree with John Oliver's explanation: FOMO (i.e. fear of missing out)

The Blockchain

Okay, so we've established that Bitcoin and other cryptocurrencies have some sort of value, despite whether or not they are a sound investment. But, as John Oliver brings up, Bitcoin doesn't necessarily have the infrastructure in place to support it, citing a large Bitcoin conference in Miami that had problems accepting Bitcoin transactions.

Another way to illustrate that point:

| "When I tried to pay for access to the Republican National Convention using Ronald Reagan's dusty skeleton boats everyone there agreed they had value, there just wasn't an adequate network in place for the completion of our transaction." |  |

|---|

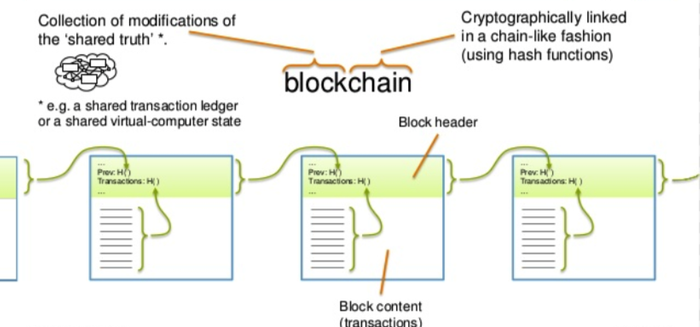

That said, whether or not Bitcoin survives isn't as important as the technology that drives it, called the Blockchain.

Blockchain is the technology that allows Bitcoin to exist, or in the words of John Oliver,

"... a database that is nearly impossible to hack or tamper with and which could possibly improve security, efficiency and trust."

Unfortunately, John Oliver doesn't go on to say how this process works, which is kind of a bummer because it can definitely be relayed in simple terms. To quote Einstein, "If you can't explain it simply, you don't understand it well enough."

He did, however, provide us with a metaphor on Blockchain's tamper-proof nature:

| "The way I like to think of it, is that a blockchain is a highly processed thing sort of like a Chicken McNugget. And, if you wanted to hack it, it'd be like turning a Chicken McNugget back into a chicken. Now, someday, someone will be able to do that, but for now it's going to be tough... because if anyone ever figures out how to turn a Chicken McNugget back into a chicken, that chicken is going to be fucked up. He's going to spend the rest of his life suffering from PTSD and writing haunting poetry about the experience." |

|---|

|

Though, if that metaphor left you even more confused, I wouldn't blame you.

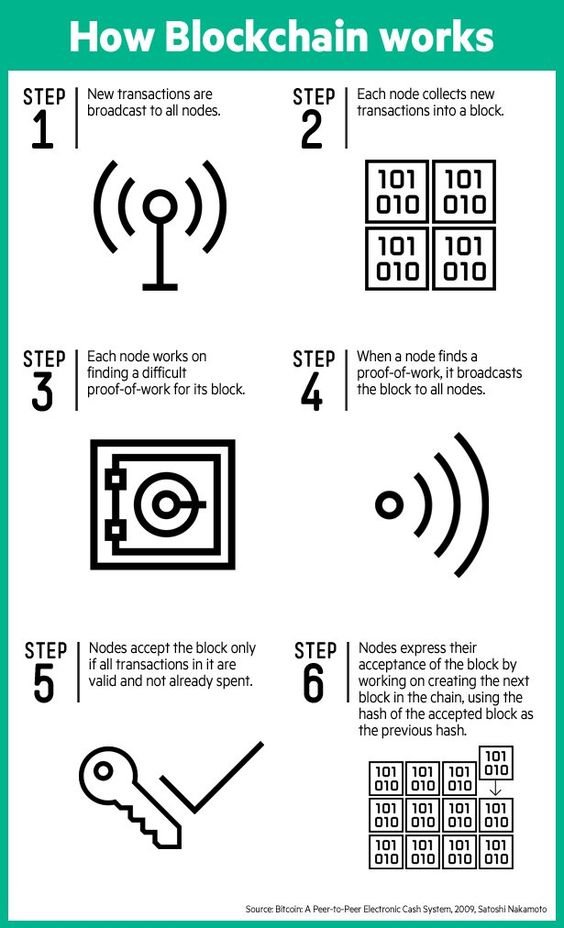

So, how does Blockchain actually work, and why is it so secure and efficient?

Before we go over the steps, a brief disclaimer — this isn't meant to give you a full overview of the Blockchain and covers Bitcoin's Blockchain specifically.

While different Blockchain servers may share fundamental principals with each other, like decentralization, they usually have some key differences. Some of them even exist outside the realm of cryptocurrencies. For example, Blockchain is being applied towards supply chain management (it is no wonder Amazon has already started to invest.)

For those interested in learning deeper concepts, I recommend you look-up and read about SHA-256, mathematical trap door functions, and Merkle trees.

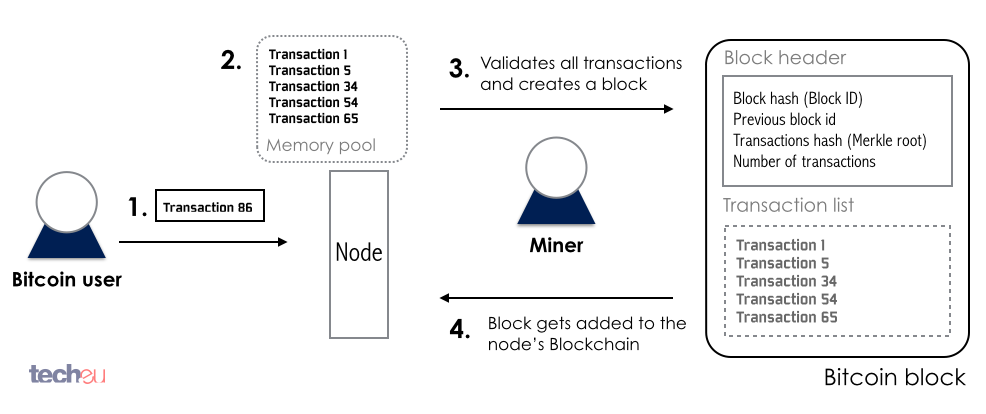

Keeping all this in mind, let's take a closer look at how Bitcoin's Blockchain operates:

Step 1: Broadcasting and Signing

Unlike your financial institution, which holds all of your records on centralized servers, Blockchain technology distributes the information so there is no one point of attack. Since the information is distributed, anyone can see what's going on.

|  |

|---|

Fortunately with the Blockchain, we don't have to rely on trust. We can rest assured that the system will operate securely without the need for overhead or regulation.

How does this work?

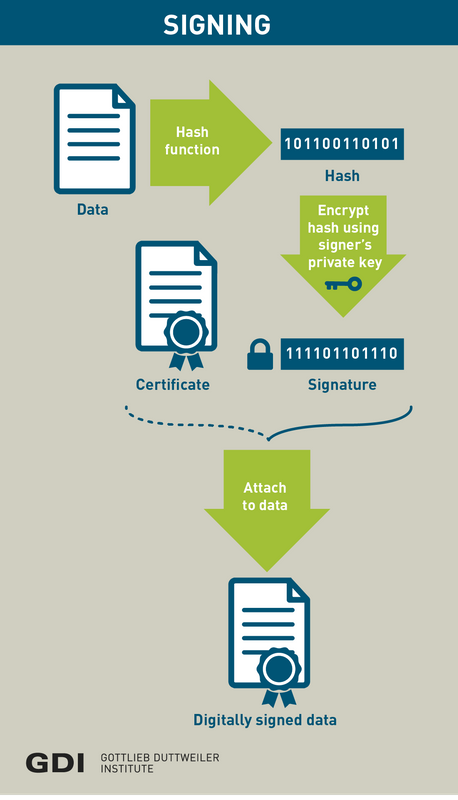

It starts with signing your own transaction.

But, you don't attach your personal name or email to the transaction, instead, you sign your transaction by using your 'private key.' This string of numbers and letters gives you access to your Bitcoin wallet, so it is important that it stays encrypted.

Through some clever cryptography, and hash functions, you are able to sign your transaction using your private key, without anyone finding out what it is.

Step 2: Verifying and Consolidating

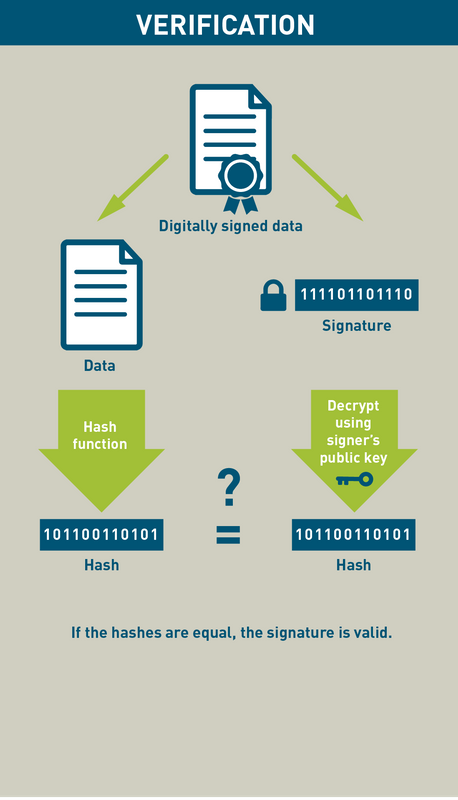

Once a signed transaction is sent out to the network, it is the job of the 'miners' to verify it and add it to a block. Miners are essentially the people running nodes (click here to learn more about mining).

In verifying a transaction, it is important to confirm that the sender of the transaction is also the owner of the Bitcoin being sent. But, personal information like one's name or email is never sent alongside a transaction.

So, how can we verify their identity, without knowing their private key?

Every Bitcoin wallet has both a private key, which can open it up, so-to-speak, and a 'public key.' As the name implies, this key is made public to everyone. In order to prove that the sender really is who they say they are, miners use the sender's public key to decrypt their signature.

Thanks again to cryptography, trap door functions and Merkle trees, a public key is virtually the only piece of personal information needed to verify a sender's transaction.

As transactions are broadcasted, miners verify them and place them in blocks. As displayed here:

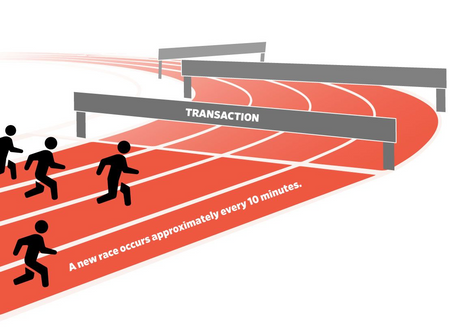

Step 3 & 4: The Race

Step 5 & 6: The Review

Though, it's important to note than each block is connected. Information from one block is used in the creation of the next. So, you're prevented from getting a head start and working on more than one block in advance.

As you can see, the arrows link one block to the next, reinforcing that each block is integral in the creation of the subsequent one. Every block gets a time-stamp so they stay in order.

If you're ever confused about a term or definition, I recommend you reference this Glossary put together by the Blockgeeks.

Are cryptocurrencies the wave of the future?

At the very least, there is a lot of hype.

| "The very word 'blockchain' has become a magnet for investments. Reuters found that existing companies that merely added the word blockchain to their name saw their stock price on average increase more than three fold... Long Island Iced Tea renamed themselves to Long Blockchain Corp., and guess what happens.... yeah their stock tripled." |

|---|

This is reminiscent of a study that showed that by putting a picture of a brain on your product label, sales would increase. Similar to the brain, Blockchain is mostly uncharted territory. While there have been all sorts of Blockchain innovations, there is still a lot we haven't figured out yet. Scalability, security and sustainability are among the main talking points.

You may be surprised to know it was a company called CryptoKitties that played a pivotal role in bringing Blockchain scalability issues to light.. CryptoKitties was one of the first recreational Blockchain applications, and it significantly congested the Ethereum network when it launched due to the influx of transactions.

There are also huge sustainability/energy concerns. It is estimated by one source that the Bitcoin network consumes as much energy as Denmark..

But, there is something really important to note here. The reason Bitcoin takes up tons of energy is due to it's proof-of-work mechanism. Simply put, miners must put in tons of computational energy (which uses quite a bit of electricity) to verify and secure the network.

This isn't very eco-friendly, so many Blockchain developers are trying to figure out different mechanisms that don't consume as much energy. For example, some Blockchains use proof-of-stake, an alternative system that doesn't require miners to perform large computational tasks but still ensures the system is secure.

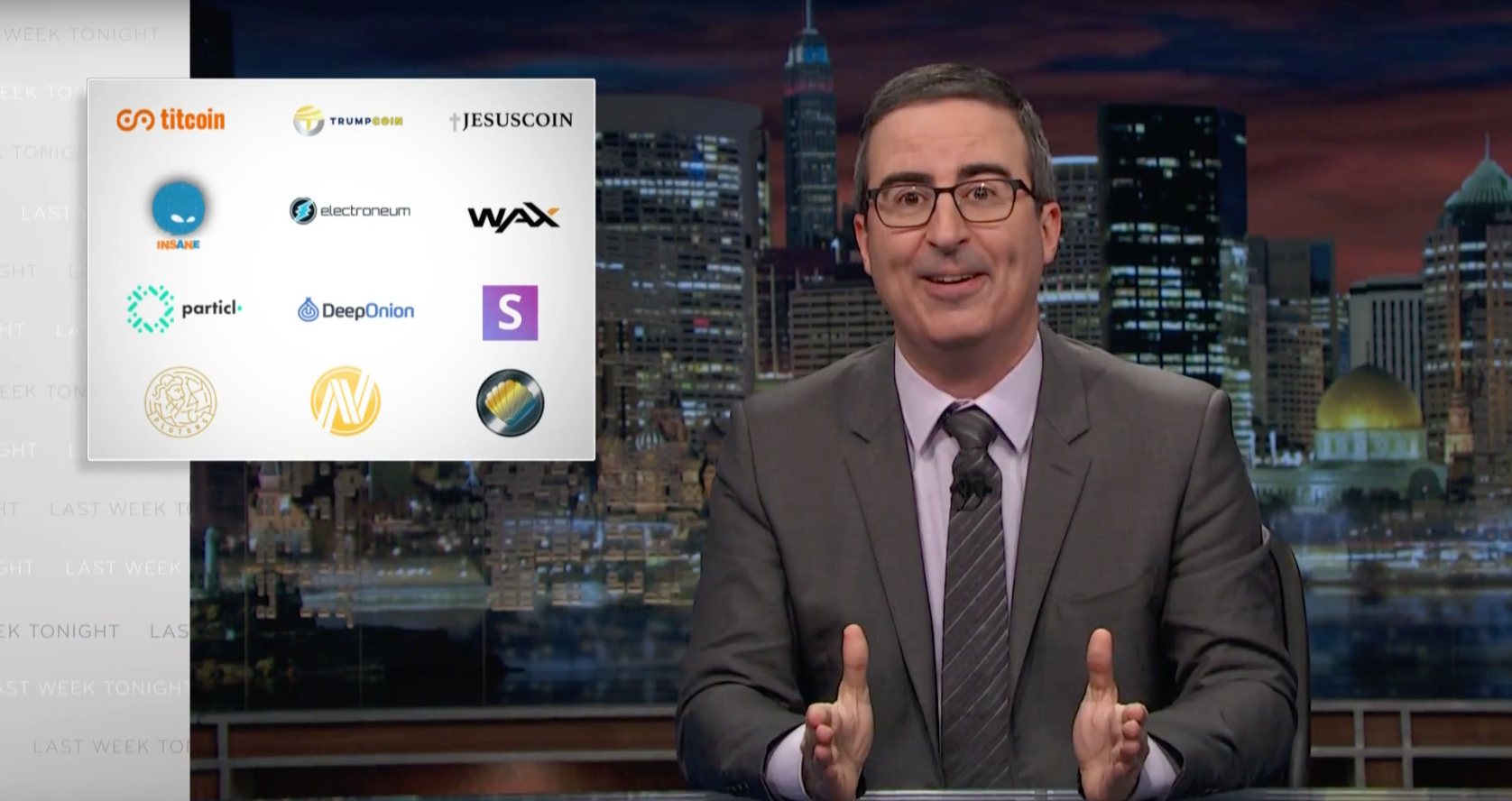

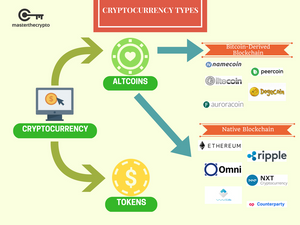

What about all the other cryptocurrencies?

| "...a list so insane that you can't tell which ones are real and which ones are made up, because they're all real. I didn't make any up." |  |

|---|

Here are the main points to remember:

- Cryptocurrencies aren't difficult to create, which has led to a massive influx of what are called "alt-coins," or alternative coins to Bitcoin. There are currently thousands of other cryptocurrencies that can be traded online. Coinmarketcap.com is a great site to reference if any of that piques your interest.

- Many cryptocurrencies are actually considered to be utility tokens. Start-ups will develop a service or product and require that those services or products be paid for with the utility tokens they've developed. Similar to buying Chuck E. Cheese tokens to play arcade games, you may buy some of a company's token to access their service or product.

- Running an ICO (i.e. Initial Coin Offering) is a popular way for start-ups to crowdsource money and a cheap way for consumers to buy alt-coins/tokens, since they are usually heavily discounted. They are like IPOs (i.e. Initial Public Offerings), in essence, and have become commonplace in the crypto community.

- John Oliver touches on the "subculture of YouTube personalities and subreddits that have a cult-like devotion to buying these coins." This is true to some extent. Cryptocurrencies are in their infancy and current supporters view their role as early adopters to be foundational, in support of a projected disruptive technology.

- There are many terms crypto-enthusiasts use frequently. Among the most popular are: HODL, MOON, and Whale. You can check out this article for a comprehensive list.

In the most controversial part of his segment (at least in my opinion), John Oliver criticizes EOS, an infrastructure for dApps, or decentralized applications, but doesn't actually address aspects of the technology that makes it unique. He criticizes EOS mainly on the premise that they talk big game without much to show for it.

This is where John Oliver gets a little lazy. Rather than taking the time to make an informed opinion on the technology itself, he takes a short-cut, speaking only to EOS' reputation and leadership.

If you're interested in learning more about EOS and what John Oliver failed to mention, I recommend you read a Steemit post by @shikharsri, Everything John Oliver forgot to tell you about EOS.

Final words

Towards the end of his act, I was half-expecting John Oliver to announce his own cryptocurrency. He didn't, but it wouldn't surprise me if his team spent hours discussing it. Seems I wasn't the only one with that thought.

John Oliver actually mentions Dogecoin on the show but calls it a "complete joke." Though, this is a little misleading. In addition to leading the Jamaican bobsleigh team to the 2014 Winter Olympics, Dogecoin (pronounced like dojo, without the "o" at the end) is considered to be a fast and user-friendly cryptocurrency.

Also, kickstarting their own cryptocurrency would have detracted from one of John Oliver's main points, that blockchain technology is important and isn't going away anytime soon. Microsoft, IBM, Maersk, J.P. Morgan and Walmart are among many companies investing time and resources into Blockchain technology. As it turns out, Blockchain technology has the potential to disrupt all sorts of industries.

While John Oliver doesn’t want to make a mockery of a technology that could possibly be the next big thing, he also makes a point that it may very well not be.

At the end of the clip, John Olivers invites Keegan-Michael Key on stage to speak enthusiastically about caution:

"Investing in crypto could be like getting in on Google on the ground! [Applause] ...or it could be like getting in on Google glass on the ground floor and that turned out to be a one, single-story!"

Who knows where Bitcoin, cryptocurrencies and Blockchain will take us. From everything I've seen, read, heard and talked about with others, I strongly believe cryptocurrencies are going to be around for a while, and, while they might not turn into a global currency, they are sure to shake things up a bit.

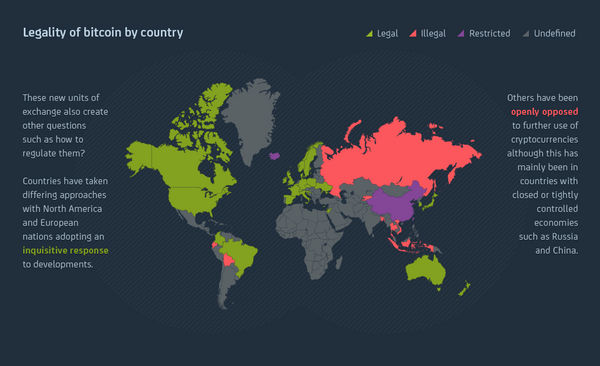

Just look at how other countries have already responded:

All in all, John Oliver depicts Blockchain and cryptocurrencies in appropriate terms, emphasizing caution while also giving light to new technological innovations. He does a good job explaining why Blockchain is important, but leaves the audience with many unanswered questions, such as how this technology is secure.

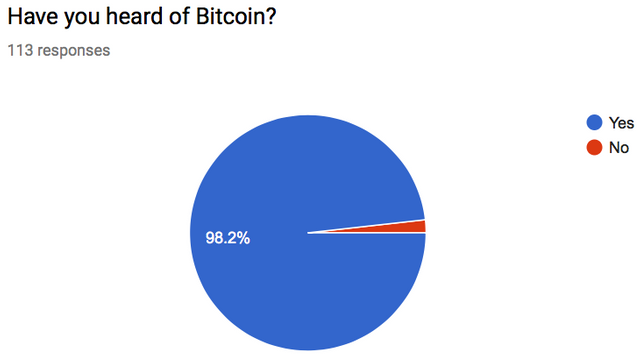

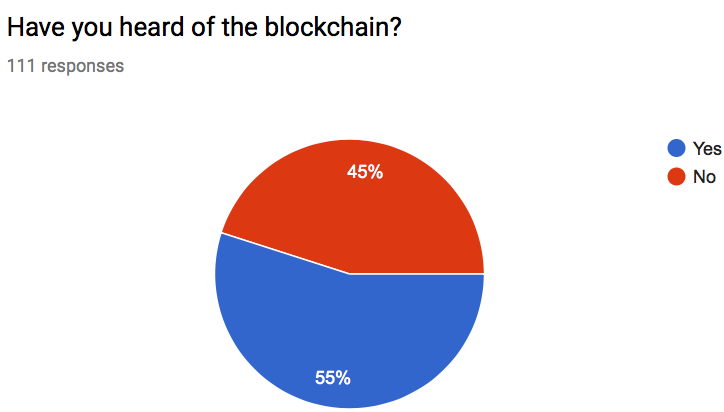

Around two months ago, I conducted a survey on people's perceptions towards Bitcoin. It was interesting to find that out of ~110 respondents, nearly every person had heard of Bitcoin before, but only a little more than half had heard of the Blockchain.

|  |

|---|

I am happy that more people have been exposed to the Blockchain, possibly for the first time, because the blockchain has powerful implications.

If anyone is interested, I am happy to share the rest of my findings! Perhaps, I will write about that in my next posting.

This is only my second post, so your upvotes will mean a lot! If you think this was helpful or have suggestions for me, please let me know :) I challenge myself to provide content that is easily accessible to others, despite their level of tech understanding.

If you have any questions or want me to cover a specific topic, please let me know in the comment section! I just kickstarted a Telegram channel that I am going to use to post useful educational tools and keep my followers up-to-date with crypto-related news stories. If that's appealing to you, check it out.

Funny detail: did you notice the 'yeees' from John Oliver after the Bitconnect Carlos Matos clip?

He mimicks the Korean presenter.

That attention to details is just awesome!! Go #lastweektonight!!

Thank you for the mention and for a very detailed look into all this hysteria. Next time I see someone share the John Oliver video on facebook and attempt to undermine the entire crypto space based on one satire piece, I will share this post with them :)

You have hit the nail on the head here and this post deserves to explode because of exactly this reason. I am going to do the same RE sharing this as response to John Oliver hysteria amongst some of my Facebook friends. Content like this is incredibly valuable to Steem blockchain I think.

Not a prob! Most of the stuff John Oliver said was accurate, or at least somewhat accurate, but he left so much out it definitely leaves the audience member with a skewed perception. But, people are at least gaining a slightly more informed view.

I have resteemed this on my main account and given my 100% upvote through my r-bot curation account because I think this post is incredibly valuable to the STEEM blockchain. I have personally had Facebook friends messaging me John Oliver based FUD. Now I can just share this article back, and not only is it the perfect response, it is a perfect advertisement for STEEM blockchain. I hope you do well here because we need more quality posts like this!

Much love - Carl

Carl, this means a lot! I also have tons of friends with FUD, so I'll be posting more stuff like this.

Agreed.

Great post. I saw the episodes and loved it, and you filled in the holes perfectly. Keep up the good work.

Thanks! I love John Oliver, but I knew that he was speaking to millions of people with very little information to fact-check him. Fortunately, he's hyper attentive to detail and being right, but even so, I'm sure tons of people are taking him at face value.

That was very good quality!

Thanks, I appreciate it!

If he would have done some more research, he would have found that instead of going on Etsy, he could have got a Beanie Baby for only $10 of Bitcoin where on the description lists it's true value "Good for cuddling only!"

Wow congrats on the curie vote for your number two post! That is impressive! I watched this episode and enjoyed it quite a bit. He definitely threw a bit more shade at it then I would've but he spoke on it's merits too, and I got some chuckles out of it. I thought it was awesome for crypto to get more mainstream media coverage.

I agree! Upwards of 4 million people watch his videos every week, and I wouldn't be surprised if many of them look to John Oliver for regular news updates on what's important in the world. So, this was definitely a big moment. I thought some of his criticisms were out of context and in the wrong direction, but there's nothing wrong with throwing shade at cryptos right now, given how absurd some people can be. Though, it all needs to be very specific, otherwise people will make huge mental leaps that are not factual. It'll be interesting to watch how the culture (US and abroad) shifts in 2018.

Upvoted on behalf of @thehumanbot and it's allies for writing this great original content. Do not use bid bots for at least 1-2 days, as your post may get picked up by top curators.

Great Original Works are rewarded by top Curators.If you like this initiative, you can follow me in SteemAuto and upvote the posts, that I upvote.

And remember to do some charity when you are rich by contributing to me.If you have any concerns or feedback with my way of operation, raise it with @sanmi , my operator who is freaking in Steemit chat or discord most of the time.

Thanks for the upvote!

Really good article. I found the summary of John's segment quite accurate, and the concept.summaries and links very useful.

Glad you thought so! It's super easy to get carried away with this stuff on all sides of the aisle. I believe it's important to stay level-headed, especially amidst a huge Bitcoin frenzy.

Coins mentioned in post:

Greetings! I am a minnow exclusive bot that gives a 5X upvote! I recommend this amazing guide on how to be a steemit rockstar! I was made by @EarthNation to make Steemit easier and more rewarding for minnows.