$4 Billion: ICO Fundraising Hits New Milestone as Regulators Curtail Hype

Initial coin offering (ICO) fundraising passed another historic milestone this week, surpassing $4 billion just days after U.S. Securities and Exchange Commission (SEC) Chairman Jay Clayton issued a statement that, essentially, accused the vast majority of ICO organizers from violating federal regulations governing securities laws.

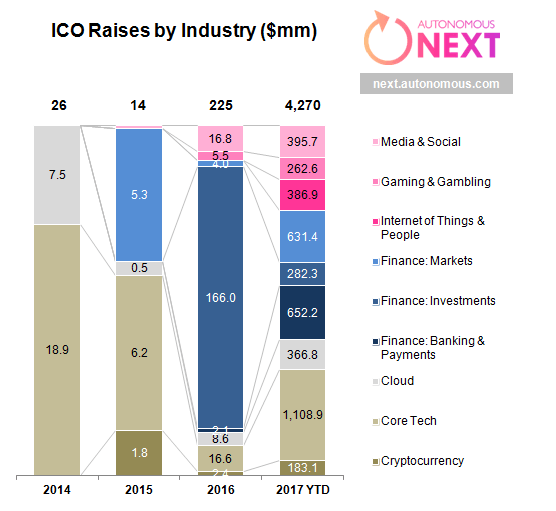

According to fintech research firm Autonomous NEXT, ICOs have now raised more than $4.2 billion in 2017, eclipsing the $265 million raised from 2014 to 2016 combined.

Unlike in previous years, the funds have been distributed to a wide variety of project types, with the most-funded industries being core technology (e.g. new blockchains) and finance.

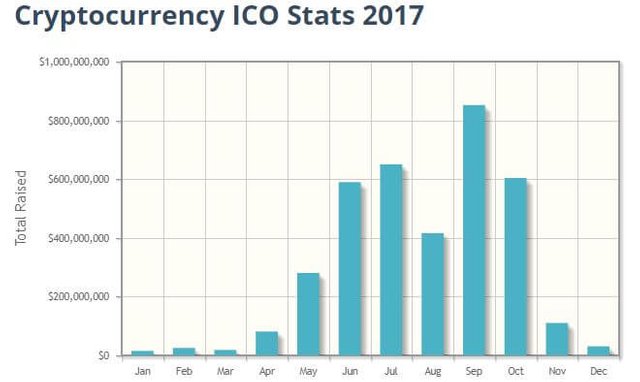

However, although it has been a record-setting year for ICOs, data indicates that the nascent fundraising model may be entering the latter half of a hype cycle.

According to ICO tracking service CoinSchedule, the fervor reached a peak in September, when — spurred by Filecoin’s $257 million crowdsale — ICOs raised more than $800 million. Approximately $600 million was raised in three different months: June, July, and October, but fundraising made a precipitous decline in November.

There are several possible reasons for this. The first is that, given bitcoin’s meteoric Q4 rally, many investors are hesitant to sacrifice the potential gains they can make by holding bitcoin — especially if that means placing bets on assets that may not net them meaningful returns for months or even years.

Another potential factor is that investors are beginning to eye ICOs with more scrutiny. Not only have multiple projects turned out to be scams, but even a much-touted project like Tezos has been beset by management infighting, causing development to lag targets and multiple investors to file class-action lawsuits.

Finally, the SEC has begun cracking down on non-compliant token sales, causing organizers to take a more careful approach when launching ICOs.

Autonomous Next’s Lex Sokolin believes that the reduction in funding is an indication that the ICO marketplace — and its participants — are maturing.

“It is harder than before to get funded, so on average the market is cooler towards any particular project,” Sokolin told Business Insider. “But overall, ICOs are becoming more mature, both in operating models, code and regulatory approach.”

This maturation may mute funding during the short-term, but it will likely yield long-term fruit. Due to increased regulatory oversight, several established companies are building infrastructure to help startups launch ICOs in a compliant manner. Crowdfunding service Indiegogo recently launched an ICO platform that supports both utility and security tokens, and one of e-commerce pioneer Overstock’s portfolio companies is building a compliant token marketplace that will allow startups to sell equity to investors.