Want to Short Bitcoin? It’s Going to Cost You

The largest U.S. electronic brokerage firm now allows clients to short bitcoin futures through the nascent bitcoin futures market on regulated exchange CBOE, but the margin requirements may price small-scale traders out of the market.

Interactive Brokers, which processes more daily average revenue trades than any other electronic brokerage firm in the U.S., made the announcement this week, several days after the first bitcoin futures launched on CBOE.

Like many brokerage firms, Interactive Brokers did not initially allow clients to take up short positions in CBOE’s bitcoin futures market. However, the firm changed its mind after observing the large premium that the January contracts were trading at over the spot price of bitcoin.

“The introduction of short sales was necessitated by the large premium of the January futures contract over the price at which Bitcoin trades on the physical venues,” said Thomas Peterffy, founder and chairman of Interactive Brokers.

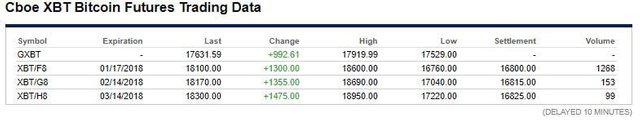

At the time of writing, January futures were trading at $18,100, while the spot price of bitcoin was $17,631, according to CBOE’s index price.

“That says to me that there aren’t enough brokers allowing shorting,” Peterffy explained in an interview with BuzzFeed News, “because if there were, there would be people that buy the cash and sell the futures.”

Peterffy, many will remember, has been one of the most vocal critics of bitcoin futures and the exchanges that decided to list them. Last month, he took out a full-page ad (PDF) in The Wall Street Journal to warn about the risks that bitcoin futures could have on the wider financial markets.

Nevertheless, Interactive Brokers ultimately determined that since the futures products were going to be listed anyway, they would not prevent clients from trading them.

The firm said that it processed approximately 50 percent of all trading volume during the first few days that bitcoin futures were listed on CBOE, so its decision to allow clients to short bitcoin could have significant ramifications on the market.

However, the firm’s strict requirements will likely price many retail investors out of the market. All clients taking short positions will be required to maintain a margin of $40,000 per contract in their trading accounts for each short sale. Since each CBOE contract is equivalent to 1 BTC, that margin requirement works out to more than 200 percent of the contract value. Clients taking long positions, for reference, must maintain a margin of $9,000 per contract, a rate of approximately 50 percent.

@originalworks