RIPPLE Partners With India’s LARGEST IT Provider!! $19 BILLION in Revenue! 😱

Today we have a Daily Token Review and two really awesome cryptocurrency news segments to share with you.

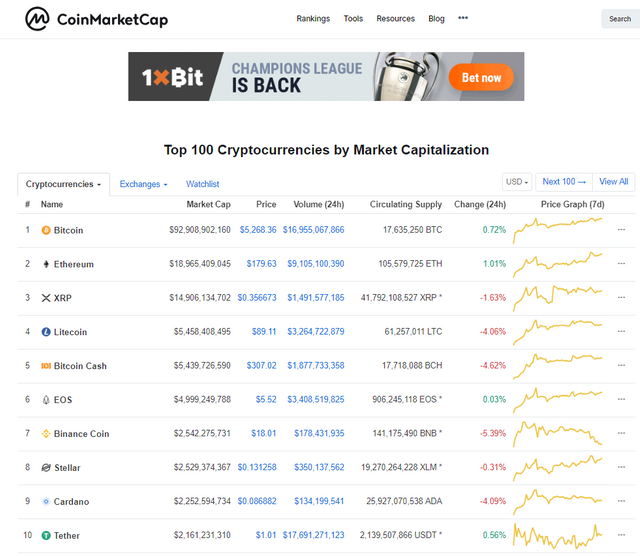

As seen on CoinMarketCap, we’ve got a mixture of greens and reds on the market. The world’s flagship cryptocurrency, bitcoin (BTC) has increased by 0.72 percent. Ether (ETH) still maintains its “second in command” status, with an increase of 1.01 percent. Ripple’s XRP maintains the number three position, and it’s currently losing by 1.63 percent. Other considerable movements in the market which include Litecoin, Bitcoin Cash, Binance Coin and Cardano, losing 4.06, 4.62, 5.39, and 4.09 percent respectively.

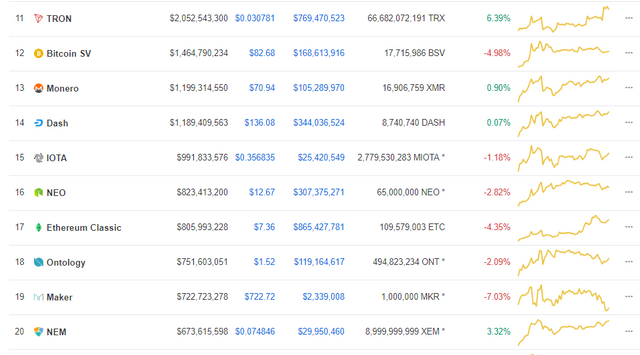

Now, if I scroll down to the top 20, we’re also having a mixture of a green market with many shades of red across the board. TRON has increased by 6.39 percent, I’m assuming it’s probably due to the USDT and TRON Partnership as I have mentioned yesterday. Maker has decreased by 7.03 percent, but what do we have here, Ethereum Classic has decreased by 4.35 percent! A significant change from yesterday increase!

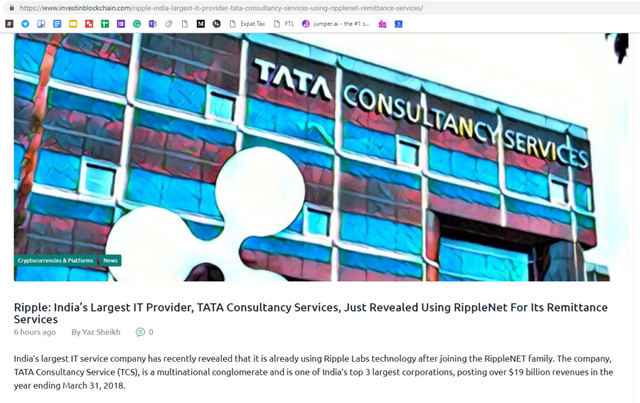

Now onto the news! According to a report by Invest In Blockchain, Ripple the San Francisco-based financial technology company that created the XRP altcoin has added another feather to its hat, as TATA Consultancy Services (TCS), which is India’s largest IT firm, has revealed it’s now using RippleNet for remittance payments. Established in 1968, TATA Consultancy Services is a multinational conglomerate and its one of India’s top three largest corporations. In 2018, TCS generated an impressive $19 billion in revenues.

What does the RippleNet adoption mean for both TCS and Ripple? With the integration of RippleNet into its operations, TCS will now be able to facilitate superfast, cost-efficient and transparent cross-border payments with its Quartz Cross Border Remittance Service.

The TCS team has revealed that its Quartz solution which is based on Ripple’s blockchain system, will enable financial institutions to seamlessly process cross-border foreign exchange remittances with distributed ledger technology (DLT). That’s not all, TCS has made it clear that the Quartz gateway also connects its existing BaNCS payments system which has more than 450 active integrations, plus over 1 billion active accounts, to RippleNet through application programming interfaces (APIs).

In essence, Quartz will work alongside RippleNet and all the clients of the firm, including General Electric, Citibank UK, Microsoft and others will be able to use Ripple’s cutting-edge technology via Quartz. These are good times indeed for Ripple Labs, as the firm’s blockchain-powered payment solutions are gaining huge traction in the cryptospace at the moment, coupled with a slew of significant partnership deals.

Now, onto the second news item for today! Per a report by Cryptoslate, Coinme’s partnership with Coinstar is beginning to yield excellent results, as 90 percent of U.S. residents can now buy bitcoin (BTC) in cash-enabled kiosks scattered all around the country. For those who are not aware, Coinme is a startup whose primary objective is to enable crypto enthusiasts to buy and sell their favorite digital assets. Coinme runs a Bitcoin ATM business, and it also has a “private client group” whose primary function is to advise people on how to invest in bitcoin. Coinstar, on the other hand, is a platform that allows users to turn their coins into cash. Interestingly, Coinstar operates 20,000 cash-operated kiosks across 12 countries.

Reportedly, the CEOs of both firms, Neil Bergquist (Coinme) and Jim Gaherity (Coinstar) have revealed that the bitcoin kiosks are now generating more than 315 million impressions weekly, with transaction volumes surging by 17 percent week-over-week. The Coinme-Coinstar partnership is massively boosting broader adoption of bitcoin (BTC), making it easier for even crypto newbies to trade their fiat for king bitcoin! From all indications, this may just be a tip of the iceberg, as Bergquist and Gaherity who were present in a moderated panel at TF3 on March 28, 2019, stated categorically that they are working round the clock to foster mainstream adoption of bitcoin. “People are using our services to solve everyday problems. Yes people are buying bitcoin as an investment, or as a store of value, or just for speculation, but they’re also doing remittances and payments,” said CEO of Coinme, Neil Bergquist.

So what are your thoughts on this situation?

Are you confident about Ripple’s progress? Do you think that RippleNet has true value to

add in the future? And what are your thoughts about the Coinme and Coinstar partnership?

Will it usher in more investors into the nascent world of bitcoin?

Let me know what you guys think below.

If you liked the content, please subscribe and watch our latest videos. It’s Cindy with CryptoPig, Catch you guys around!

Please join us at our Telegram Group and follow us.

Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.