Can this one CRYPTO TIP save you MILLIONS of DOLLARS?

The crypto market has been on a massive slow down this year and its recovery has been hampered by the media, by whales and by shoddy ICO’s and projects. In my video “Are ICO’s dead?“, I mentioned how an in-depth study of the sector revealed that 80% of all ICO’s were scams.

The dirty tricks of the ICO industry are destroying it from within. So today we are going to look at the tricks and scams that plague the industry, how to spot them and I am going to give you the most important tip I can give anyone in this investment space.

Can you trust any ICO these days? How can you know you are making a smart investment? What is this mega tip I’m hyping? Is this the most clickbait title I’ve used so far? To find out let’s take a look.

Week after week, I get messages about dodgy ICO’s and scammy investments which is why in today’s video we’re looking at the most common dirty tricks that ICO’s will play.

The first trick that happens begins even before an ICO goes on public sale and is something called coin flipping. You can see we briefly talked about this in my video on Ian Ballina.

ICO’s often work in stages there may be a venture capital stage, where initial money is found through traditional financing methods, followed by a private sale, pre-sale, and a public sale. Not all ICO’s follow this path but many do and typically the minimum investment starts higher but with more discount until the ICO reaches public sale where the tokens are not discounted but the minimum investment is relatively low.

Ballina created a super investor group. He pools their money together in order to strike deals with ICO’s at the private sale stage. He is then able to get a very heavy discount on the token price and then once the token is on the exchanges the private pool dumps them immediately but because they bought them at a discount they still make huge gains leaving those who bought at the public ICO stage with an immediate loss. This is coin flipping.

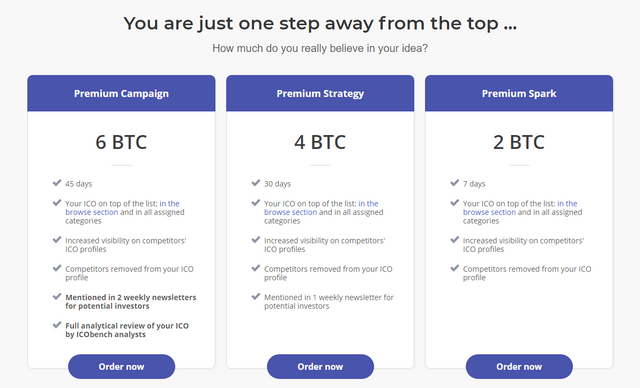

The next trick is the bribing of ICO reviewers and sites. While ICO bench doesn’t directly accept bribes as such they do have advertising space and premium listing options that they sell for literally several thousands of dollars. The idea is that because the reviews are aggregated and submitted by independent reviewers ICObench’s acceptance of advertising money doesn’t constitute a conflict of interest.

The thing is that an investigation by Markus Hartmann and Alethena found that there were dozens of people out there acting as ICO rating consultants or specialists who could guarantee for several hundred dollars that an ICO receives 5-star reviews on ICO bench. This has reportedly been seen on other review sites as well. This means that some of the reviews out there can’t be trusted fully.

Influencer marketing is big business and getting a YouTube star to promote your product can seriously boost sales. This is the final trick. It works for Apple, Gucci, and Sprint. So why not an ICO? ICO’s have been found to pay YouTube crypto influencers hundreds of thousands of dollars to promote ICO’s. Those prices were back in the height of December but it’s still happening even now though I doubt that YouTubers are able to command that level of payment in the current market.

In my opinion, I don’t think it’s necessarily wrong that a YouTuber with influence and a strong following promotes a project and is paid for it but I do think it’s unethical if they don’t state that they either hold tokens or have been paid in some way to review the ICO. This trick is called shilling and there are some high profile crypto influencers involved in it.

Datadash a popular YouTuber admitted back in January to accepting $300,000 to review and promote Substratum something he didn’t disclose and then ended up giving a groveling apology.

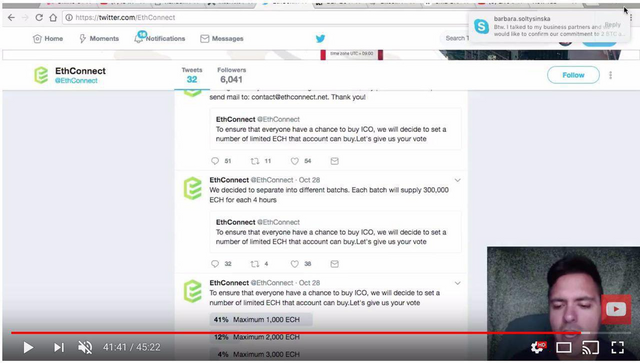

Suppoman, someone I actually really like and follow turned out to be paid for promoting Indahash and that was a cat let out of the bag because a Skype message confirming his 2 bitcoin payment popped up during a live stream. He also famously pumped up the hype over a mystery ICO saying he was going to reveal it for days only to hit viewers with a catch. Viewers had to buy his Udemy course to find out. After buying it the ICO was revealed as Seele and to make it worse the project turned out to be a scam.

He did offer a sincere apology and I guess it didn’t hurt him too much in the long run. I’m still a subscriber.

Some YouTubers are open and disclose the nature of their sponsored content. Quinton from Young & Investing made some good points in a video explaining that he has always been transparent about his sponsored content. Yet he complained that he loses subscribers when he makes videos where he clearly says he is being sponsored. I think the top comment on that video sums up my feelings on the subject though. “Losing subscribers is not a big deal, but losing respect is very bad.”

One thing that all of these YouTubers say at the end of their videos including myself is this is not financial advice and you should ‘Do your own research’. Most YouTubers do this simply as a legal precaution to make sure they don’t get sued if you follow their suggestion but that’s my hot tip for you. Do your own research. Okay, hold on don’t get mad I’m not going to leave it with just those four words because let’s be honest on their own they mean nothing. I admit this was pretty much as clickbait as you can get but my important tip wouldn’t be any use unless I showed you how to actually apply it.

The first thing to do is to get cynical, research shows that 80% of ICOs are scams or fail in some way. I know that sounds depressing but it means that if you’re not one of those private or presale investors you should really believe in the project or at least in its ability to make a return if you are going to invest.

With any ICO it can always be a good starting point to check out YouTube videos but only ever do this as a way to get an overview of the ICO, what it does and how the company and product will work, etc. The DYOR is where you expand on that and it can be done without taking too much time and let’s face it if a bit of research takes you an hour but could save you several thousands of dollars in a lost investment it’s worth your time.

Check out the website for the ICO, look for spelling mistakes, errors in the site’s functionality and make sure that it looks professional. These small details can say a lot about a company even before you begin a proper look. They can all be warning signs.

Once that’s done its time to check out the promotional material: any slide decks or one-pagers, they are normally short because they are aimed at giving investors the key points, so with these, I recommend you read them fully and ask yourself some questions. Does this business need tokens to operate are they integral to its ecosystem? Why do they need to do an ICO when traditional venture capital would be more appropriate?

Look at the companies roadmap. Are the time frames realistic and can the proposed hard cap they are looking for realistically support the company until it becomes profitable? If not it’s unlikely they will finish the product and this would spell disaster for your investment.

Look at the team on the project, look for LinkedIn links, follow those links and look through the person’s job history. Do they have relevant experience to the company they are running? If the site is missing photos or directors of the company aren’t mentioned on it and there aren’t LinkedIn profiles for the key players, walk away immediately. Also, another good idea is to check that the companies they worked for previously are real by clicking on the company’s name seeing if the profile has more than one employee, etc. Don’t be afraid to reach out to the team members on Twitter or by email. They want you to invest substantial amounts of money in their company. If they can’t take time to respond to legitimate questions, they aren’t worth investing in any way. While you’re at it, join the companies Telegram Group and ask tough questions, see what other people are saying and how the company have responded to the questions being put forward. If you ask fair but tough questions and you get banned, then it’s best to avoid that company.

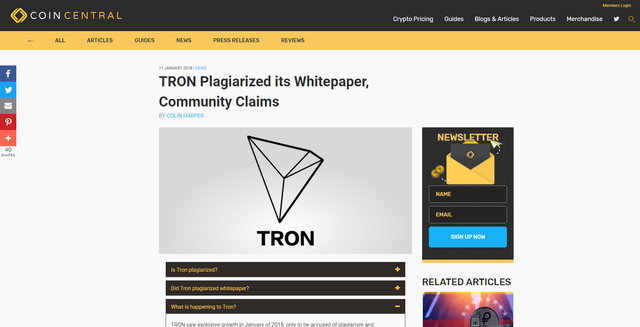

Once you’ve done that, it’s time for the whitepaper. Most people never even read the WhitePaper and I get it. They are long and full of technical information that you don’t have time to read but you should at least have a quick look at the important parts. The first thing I would do is if you have something like Grammarly is to put the text through a plagiarism screening. It is pretty quick to do and will let you know if the whole thing is copied and pasted directly from the Ethereum whitepaper. Not pointing any fingers at Tron of course.

Checking a WhitePaper is a process which I will cover in a future video but a brief version of it is to look at the legal statements. Is it SEC-registered, exempt or working outside the SEC framework altogether? Are there any legal risks?

Check for the companies information: Is it registered and who makes up the board of directors in what country are they registered?

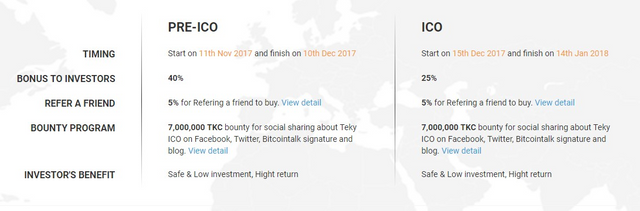

Look for token information: How is it distributed? What is the value of the token and what are the discounts or bonuses being offered to early investors? If it’s over %35 discount there’s a high risk that coin flipping will occur.

It’s also important to look for a funding use explanation. If a company can’t provide a breakdown of where the money they raise will be spent, don’t be surprised if their CEO blows it all on a fancy Lamborghini.

As I said though there is a lot that can be looked at in a WhitePaper and we will cover this another time in detail but what we’ve discussed so far should be enough to figure out how good an investment an ICO is.

That’s it my amazing tip!!

I know it sounds like common sense but honestly how many of you hear do your own research and actually do it? Well now you know what to look for and hopefully just hopefully if you follow my advice you’ll save millions of dollars.

If you want to keep the conversation going join us on our Telegram group.

Disclaimer: You know what to do.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

This post has been upvoted for free by @millibot with 0.1%!

Get better upvotes by bidding on me.

More profits? 100% Payout! Delegate some SteemPower to @millibot: 1 SP, 5 SP, 10 SP, custom amount

You like to bet and win 20x your bid? Have a look at @gtw and this description!

I just skimmed, but OMG I cannot WAIT to watch this. This is everything I've been thinking hmmmm about --

EXCELLENT

We really appreciate your comment, please check our Youtube Channel for more content.

https://www.youtube.com/cryptopig

You're welcome!

Congratulations @cryptopigmedia! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: