Don't lose money! (video/podcast)

According to Warren Buffett, there are two rules to making money:

- Don't lose money.

- Don't forget Rule #1.

Sounds pretty obvious, but the question is how to apply it to build your wealth over time? One vital tool is asset allocation - carefully dividing your portfolio over several markets, and rebalancing when they gain or lose share.

Scroll down to watch and listen to this episode.

Obviously if you can continue to make money, and you don't lose money, you will get richer with time. One idea that is very important, and often lacking in discussions about crypto, is asset allocation.

A lot of people, including me, realised in the crypto crash of January 2018, with a rude awakening, that we were over-exposed to the crypto market. We had a lot more money than we wanted in a volatile market, and we paid the price dearly. When times are good, it's easy to say that you have a high risk tolerance. As soon as the market goes down, reality looks very different.

The size of the boat

When you have a small portfolio, like one week's wages or one month's wages, it can make sense to bet on an asset with a high risk and high reward. You have less to lose, and your portfolio can easily be replenished by saving for a few months. If you are going to put your money is something risky, you can look for asymmetric gains. That is, an asset class where you're limited in your losses, but have very large potential gains - such as cryptocurrency.

Once you build up some wealth, it doesn't make sense to bet it all on one asset any more. The more you have to lose, the more you want to protect it. By spreading it across several assets, you can protect it. Generally, the more wealth you have, the more markets you want to be exposed to, as there's less risk that a failure in any one market can harm you.

Divide your wealth

There are many classes of assets, such as stocks, bonds, futures, options, precious metals, and alternative investments such as cryptocurrency. However, another way to think about it is in terms of safe assets that will preserve your wealth, and growth assets which will expand it.

Age and security

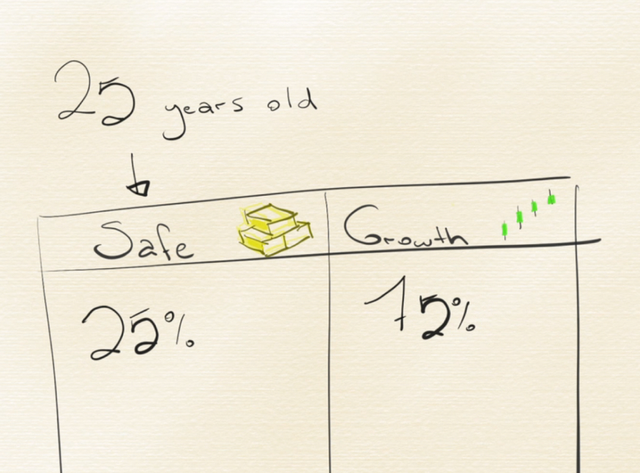

One strategy that people use to divide their assets is to put their age as a percentage, and use that as the amount of safe assets that they hold. For example, if you are 25 years old, then you might hold 25% of your assets as bonds, and 75% as stocks. When you're 75, it would be the opposite.

The logic behind it is, when you're young, you have a long time to gain wealth, and ride through the ups and downs of markets. When you get older, it's important to have a more reliable stream of income, receiving the payouts from bonds, dividends, and annuities.

Manage the volatility

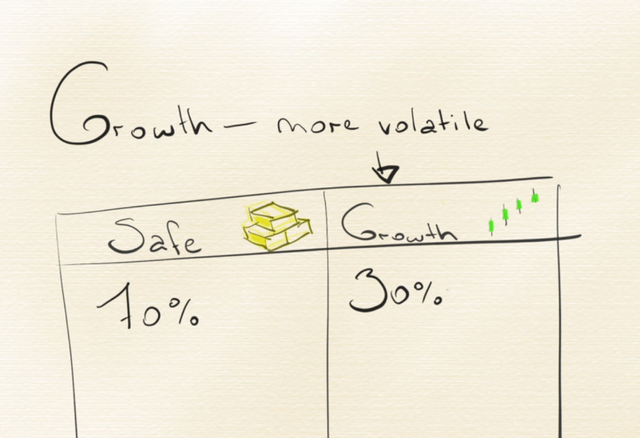

Another strategy is to ignore your age and put 30% into growth assets, and 70% into safe assets. The reasoning is, growth assets are always going to be more volatile, and so you put more into the safe basket to balance that out.

Nassim Taleb in times of trouble

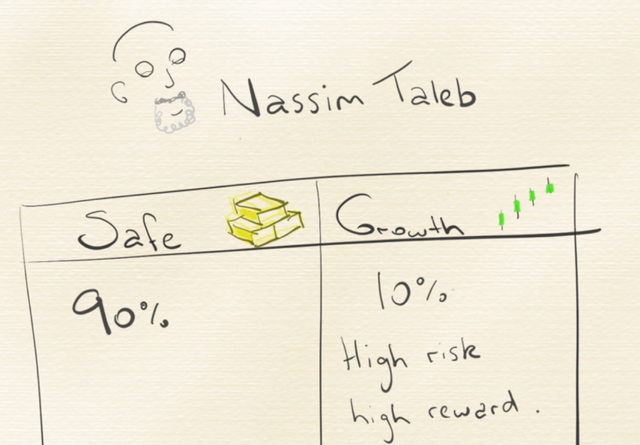

Nassim Taleb is a quant and trader who was one of the few people who did very well during the dot com bubble. The way he did it was using "the dumbbell method". That is, he held assets only in one of two extremes - either very stable or very volatile, with no inbetween.

On one side, he had things like government bonds as 90% of his holdings, and on the other side, 10% worth of options and other derivatives. The options were longshots, bets that likely wouldn't pay off, but if they did, the would be worth a lot, possibly increasing his entire wealth by 10 or 20%.

Choose your warrior

Now, the point isn't to select any particular one of these strategies. The point is to plan, to write something down, to have a firm idea of how you should split up your assets in a way that's going to help meet your goals - starting with "don't lose money".

When things start to go crazy in crypto, when the media whips everyone into a frenzy and the price of bitcoin is in a feedback loop - that's not the time to be planning, because emotions are likely to get the better of you. The time to plan is now, when things are nice and relaxed. Bear markets present a wonderful opportunity to see how silly you were in the last bull market, and how smart you will be in the next one.

Depth and breadth

You might hear people say certain things during a bull market, like "Yes, I'm diversified - I have bitcoin, ethereum, and monero." People say it as a joke, but it is a serious joke. That's not real diversification - it's depth in a market. To be truly diversified, you must have breadth across several markets.

The assets within one market are normally highly correlated. When bitcoin goes up or down, you're going to see the rest of the market boom or tank with it. Likewise, when the stockmarket crashes, it's not just a couple of the highest valued companies - it's most of the market.

When you're active in several markets, and one goes up, you can move that into other markets. When one goes down, you can move money into that market to take advantage.

When to rebalance

Assume you have a finance plan that says you'll put 20% in crypto. The market goes up over a month, and all of a sudden you have 25% of your assets there. When should you realign the percentages with your original plan?

Traditionally, wealth managers would balance their assets once a year or once a quarter. With crypto, things can move very quickly - with the market moving as much as 20% in a day, and so it's prudent to have extra rules to know when to rebalance.

Say you have your spreadsheet with your list of assets, and you notice that your total wealth suddenly crossed another $1,000 mark, $10,000 mark or $100,000 mark. Or perhaps you notice that bitcoin has gone over $9,000. You might have those as signals to move some of your growth assets into safe assets - perhaps from crypto into precious metals, or perhaps even moving some into your dream fund - setting aside money to start a new business or take your family on the trip of a lifetime.

Again, it doesn't matter exactly which rules you have - the important thing is to have rules, clear rules that are visible to you, so you remember that it's time to move into the next phase.

Be rich and be cool

Like many people, I was caught with my pants down in the boom of 2017 and the crash of 2018. I knew that crypto was a good thing and I would probably get wild returns at some stage... but I had no plan of what to do when I got it.

It's likely that crypto will again enter a hype cycle, probably around the time of the next bitcoin reward decrease - the next "halvening" in 2020. History will rhyme, some will become hysterical and others will remain clear-headed.

My fear says that crypto might end up another playground for bank managers and hedge fund managers, getting rich by messing around with the market. My hope and faith says that the trend I've seeing will continue - that regular people will invest and gain wealth in one way or another, and end up living the lives of their dreams, brightening the world with art, beauty and magic. But before one lives in the castle in the clouds, one must lay the foundation.

Please plan ahead.

Thank you

Thanks for reading, watching and listening to Cryptonomics. Remember to subscribe on YouTube, like on Facebook, listen on any podcasting app, and ask questions in the comments.

As always, stay grateful!

The Episode

You can listen to the episode on Anchor and other podcasting services here: Cryptonomics - Don't Lose Money!. Or watch on YouTube below:

In the world of trading and investing is pretty hard not to loose money. Specially because investments involve risk. So I think those rules are pretty pretty hard to do.

The issue of diversifications is that is hard to know how all markets work. So is hard to be a crypto expert but also a stock expert and a derivate market expert. Althought you might go under the same rules, the amount of knowledge you need to have is pretty hard.

Of course you can get out of financials and invest into more ethereal ways of investment like a business, real state or invest in your brain.

What I like about crypto, it invites you to learn about the fundamentals of all of the other asset classes as well. The Euro did not teach me anything, it just comes from somewhere... Nobody talks about that (today times are changing).

Congratulations @cryptonomics1! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Aye man, awesome guide on how to be more successful. I find this really helpful for others in need of trying to learn.

Resteemed for ya. @cryptonomics1

This post is supported by $30.0 @tipU upvote funded by @churdtzu :)

@tipU voting service guide | For investors.

img credz: pixabay.com

Nice, you got an awesome upgoat, thanks to @churdtzu

Want a boost? Minnowbooster's got your back!

very nice info thanks for sharing. bcn coin price