Finding The Silver Lining In The Plunge Of Altcoins

It’s happening again. The cryptocurrency market is bleeding.

Every respectable coin in the cryptoverse, since the turn of the year, have shed a significant portion of their value. And although it’s a bust and pop cycle, the losses during this period have been bigger than the gains.

For most altcoins, one day in the green is followed by a series of days in the trenches. The total value of all altcoins, which was more than half a trillion dollars in January, dropped to under $100 billion this week, the lowest it has been since November 2017.

In the past 30 days, Ethereum, Litecoin and Monero have shed more than a third of their value, according to CoinMarketCap. VeVhain almost reached zero and XRP, which saw a bull run early in the year, has dropped by about 90% to 30 cents. Of the whole bunch of notable altcoins, Stellar bled the least - shedding just 2% of its value since July.

This big sea of red worries the average cryptocurrency investor. I hold a number of altcoins, and boy, keeping a tab on them has not been easy. It’s hard when your coins gradually lose value, right before your eyes. To ease my stress, I had to uninstall my Blockfolio. Doctor’s orders.

But it’s not all doom and gloom. There’s a silver lining in this cloud most people fail to see - and that’s why I wrote this piece. But first, let’s have a look at the reasons behind the fall.

It’s all Bitcoin’s fault

As usual, people are quick to point accusing fingers at Bitcoin, and they’re mostly right. Bitcoin is the Moses that turned the sea of altcoins red. It is the biggest coin in the industry. So, whenever it sneezes, the whole market catches a cold or a flu - depending on how dominant it is at that moment.

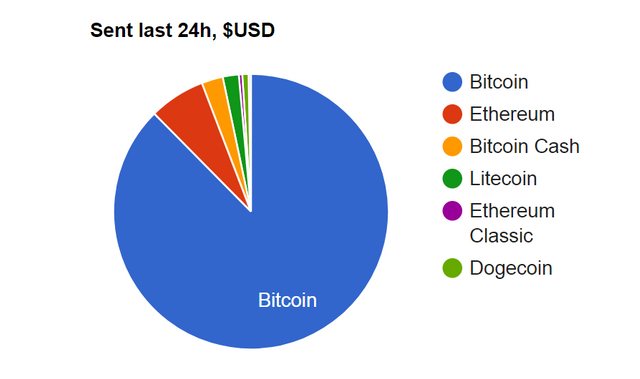

Bitcoin’s dominance has been rising steadily since mid 2018. It grew from 36% in May and is now worth 53% of the whole market. This indicates that a lot of people are selling their altcoins to buy Bitcoin, and when they do this, it is usually in expectation of a major shift in price.

The last time Bitcoin was this dominant was July 2017, when investors were buying copious amount of the coin so as to benefit from the impending Bitcoin Cash hard fork. It was regarded as a dividend of some sort at the time, which many benefited from.

Source: bitinfocharts.com

However, the recent Bitcoin grabbing is due to news of a possible Bitcoin ETF approval by the SEC. The decision was set for August 8th but was later postponed to September 30th and many people believe it will be approved by February 2019.

If approved, it will be the first ever listing of Bitcoin ETF in the United States. A lot of people see this as a form of recognition of Bitcoin by the government and think it will open the door for more institutional funds to enter the market. Bitcoin’s price would shoot up as a result, leading to an appreciation in the price of altcoins, as ETF approval of a commodity usually causes a rise in its price.

The expanding world of Altcoins

Another reason for the drop is the significant increase in the number of altcoins in the market- thanks to Ethereum and ICOs. There have been more than 500 additions in the past year alone, all vying for the attention of a small (but growing) number of crypto enthusiasts.

In addition to this is the little trust placed in altcoin projects by the public. For almost every hot altcoin project out there, there exist critics constantly pointing out flaws in the technology or its lack of a viable product. For some, owning altcoins has no meaning other than the opportunity of selling it for a profit as soon as possible.

These factors contribute to the altcoin nosedive (and nosebleed) we are currently experiencing. But they shouldn’t make you lose hope or give you sleepless nights because they unlock new opportunities.

Regaining your faith

One good thing about cryptocurrency prices is that they rely heavily on Bitcoin. And Bitcoin itself still has a lot of potential to give, despite going through a tough time at the moment. Bitcoin got altcoins into this mess and will be the one to get them out of it.

So, what should you do?

If you’ve got some dearly beloved altcoins, your best bet, at this moment, is to do nothing. Sit tight, and HODL.

Source: sounasdesign.com

You won’t gain anything by hastily selling your holdings in order to cut your losses. It’s a crazy world and volatility is the order of the day. In June 2017, Ethereum crashed from $319 to 10 cents in seconds on GDAX, only to rebound moments later.

Over the years, Bitcoin has seen lots of ups and downs. We’ve been through a lot of bear runs, this is just another one. Put your FUD in check. If possible, buy the dip. As long as you’ve done your homework and see the potentials of your altcoin, you have nothing to worry about.

It’s only a matter of time before the bulls return and the trend reverses. There’s a lot of research and effort going into Bitcoin to make it better but unfortunately, investors don’t focus on that.

Work on the Lightning Network has been going on steadily and the technology has seen leaps in development. You can expect a bull market once any positive announcement is made on the subject.

Apart from this, Bitcoin ETFs will eventually be approved by the SEC, and irrespective of what this means for the ecosystem, it will positively impact the price. That momentum will see some of the new institutional money spill from Bitcoin into altcoins.

Towards the end of November, Bitcoin hit an all-time high of 20,000 USD and altcoin prices were their highest during that period. Ethereum was worth $1,353, up from 300 bucks the previous month; and ripple hit an all time high of $3.30. We could be set for another bull run.

Furthermore, this plunge opens up a rare window of opportunity to buy your favorite altcoins, or the ones you’ve been meaning to buy, at a low price. If you’ve researched a coin and have the intention of owning some, now is a good time to get in. A better chance might not present itself anytime soon.

And if you are yet to begin your research into altcoins, why not start Here? It could be the best decision you made in 2018.

I can't change the direction of the wind, but I can adjust my sails to always reach my destination.

Congratulations @cryptomaniaks! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Will 2019 the year of Altcoins rise ??

If you believe so too, have a look of our selection for the 5 best cryptocurrencies to buy for 2019 :

https://cryptomaniaks.com/latest-cryptocurrency-news/investing/5-Best-Cryptocurrencies-to-Buy-for-2019

Let us know if you agree about that ;)