How to Spot the Cryptocurrency Market's Trend ? Bulls VS Bears

Hello Steemians,

In this article we are going to talk about the market trend. It is vital to spot the trend to survive. You can have the best strategy in the world but if you don't identify the trend before enter on the market you can lose your shirt. You just need 30 seconds to see the trend and measure market sentiment. Then you can adapt your strategy and your money management to maximize your probabilities of success. The trend is your friend so just follow it.

Source : https://www.sketchplanations.com/post/103270521023/bull-market-bear-market-i-could-never-remember

When the market go-up we are in a bull market and when it go down we are in a bear market. The Bull swipes up and the bear swipes down when attacking.

What are the 3 market trends ?

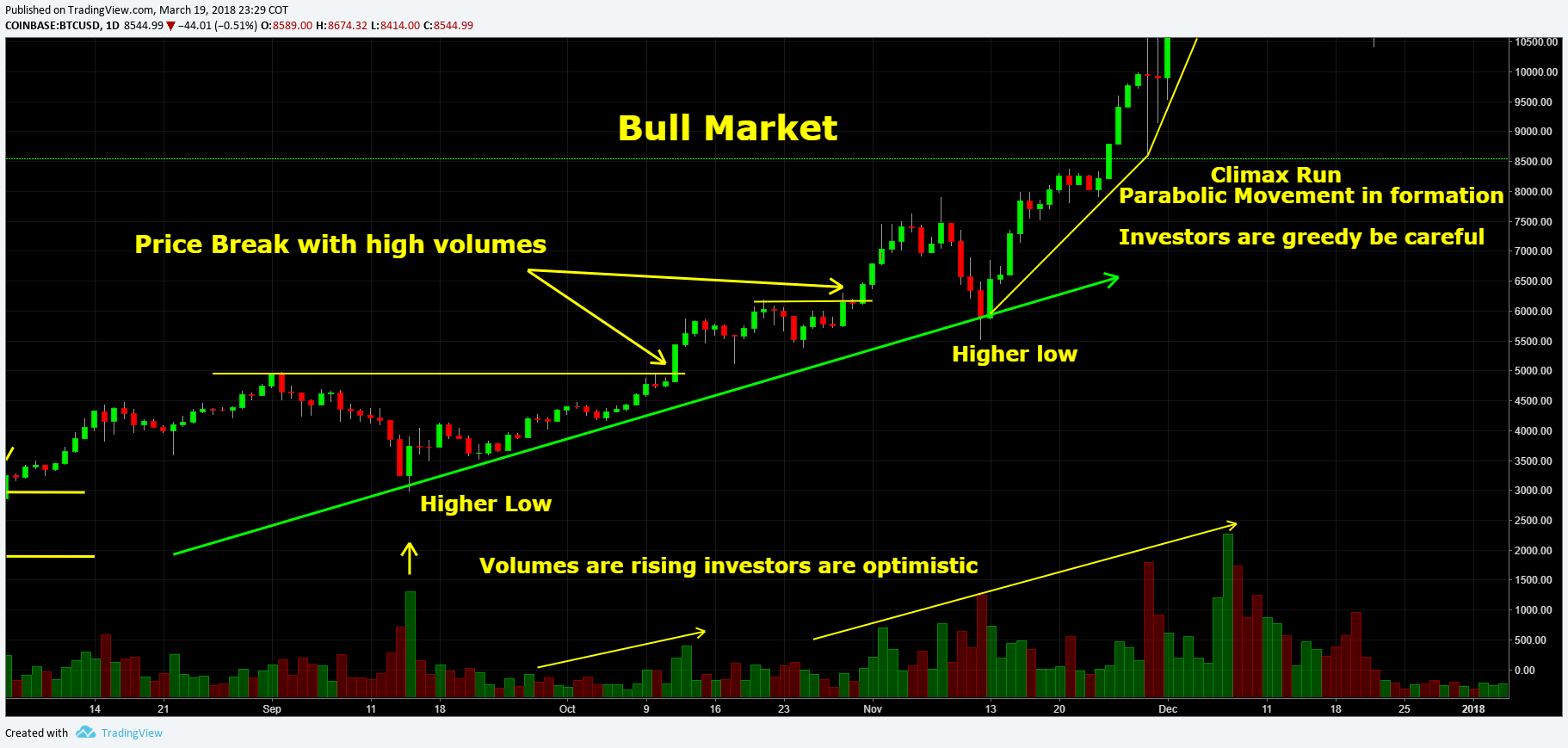

Bull Market when the market is an uptrend. Prices are rising they make higher highs and higher lows. The market sentiment is positive. Investors are optimisitcs and greedy, they are buying.

Range Market or Range bound market, the price bounces between two points. The high price act like a major resistance and the low price like a support. The price is volatile. Investors are nervous.

Bear Market When the market is in a downtrend. Prices are falling. The market sentiment is negative. Investors are fearful, they are selling.

John Boik has realized a study on the Dow Jones Industrial Average. He has concluded that 33 % of the time the market is in an uptrend, more than 50 % in a range and only 10 % in a downtrend. So if you are a swing trader you can play the rise 80/90 % of the time and short the stock market 10 % of the time.

Source First Trust https://www.ftportfolios.com/Common/ContentFileLoader.aspx?ContentGUID=4ecfa978-d0bb-4924-92c8-628ff9bfe12d

How to identify the trend ?

30 seconds and one or two lines are necessary to define the market sentiment and spot the trend.

I use 2 ways. It is important to study every scenarios possible.

- First you can use your cryptocurrency portfolio. If your positions are green, neutralized (you can't lose money on the trade) and yours stop loss are not touched, we are in a bull market. We don't have any alerts, investors are buying more coins, they are greedy and accumulating. The sentiment is positive. Just be careful when the trend accelerate and enter in a climax run we have to be fearful and prepare us to sell.

On the contrary like in the current situation. If you don't find bull opportunity, yours stop loss have been triggered, investors are selling. Sometimes we are seeing panic sell scenes. We are in a bear market. The sentiment is negative. With the pivot points method we can anticipate a possible change in the trend and be ready to sell our positions just after the trend reversal.

2)The pivot points are very useful to measure the market sentiment. We can use the technical analysis with a general cryptocurrency index or the Bitcoin to determine the general trend. Just draw the pivot point with resistance, support, trend line and the Darvas Box. After that search for price breaks. When you see the confirmation of an important support or resistance broken you can anticipate a trend reversal. You can feel the spirit of the investors. Bull, Bear or range.

For swing trading you can analyze the BTC on daily, weekly or monthly but the more you are working with a lower time frame the more you have market noise and the analyze will be less accurate.

Everything depends on your trading style, short term, Mid term or long term. We can have various trend in the long term trend. In general the market follow this order : Range, bull and finally bear then repeat this cycle with 6 different phases. We can adapt our money management with the trend. It is better to take more risk in a bull market and reduce the risk in a range or in a bear market. Actually we are in a bear market in the short run. I have no idea how long is going to continue but in crypto the market cycles are short, just a few months. I just try to manage my risk to survive then to start the next bull market with a fresh and positive mind.

Great post. So many people invest and trade "hoping" that the asset will go up. Unfortunately, hope doesn't make capital budge.

Thank you ! Agreed, hope in one of the worst enemy of the trader. We don't know where an asset can go, we can just manage our risk and play the odds.

For future viewers: price of bitcoin at the moment of posting is 8531.30USD