Zeepin: A blockchain economy for creative industries

There is a video link at the bottom for those who prefer an audio version

Zeepin describes itself as “A distributed new economy for the creative industries.”

What is the creative industry?

The creative industry is monetising of anything creative. So you might be an artist and do good paintings or record good music, or you might be a technological whiz who can write good programs, or even a group of people who are working on a project to create a game or educational series. Any content that is original can be taken and sold or hired out to earn money. That process of earning money from your original creation is called creative industries.

A lot of people are not aware of how big an industry this is. Currently, per annum, creative industry brings in a revenue of almost $2.5 trillion dollars. Not million, or billion, but trillion. That’s almost 10x the current marketcap of the entire cryptocurrency market. It’s more than the general revenue of some countries. And that huge market is the target field of Zeepin.

Zeepin is a project that aims to help creative creators monetize their creation. Whether it’s a book or a song or a game, Zeepin is the one-stop shop that will provide the financial services e.g. accounting services, the copyright services basically everything they need to launch a successful operation.

The entire infrastructure e.g. the copyright services, the financial services etc.. will run in a tokenised ecosystem and use blockchain technology such as smart contracts to carry out it’s business.

The combination of Blockchain and the creative industry is essentially what the Zeepin project is all about.

Zeepin comes from a mother company called Arting365 media which is a China based creative content company that has been around for over 15 years with over 1.2 million users and have done collaborations with big companies like dreamworks.

And Zeepin is not just a branch of Arting365, because if it was a branch model, the staff of Arting365 would a different staff from Arting365, the Arting365 guys would simply help oversee and advice the project. But in this case, the team that is developing Zeepin are actually the same team that built and are still running Arting365. This is a team with a lot of experience who have already proven they can build a successful company in this market.

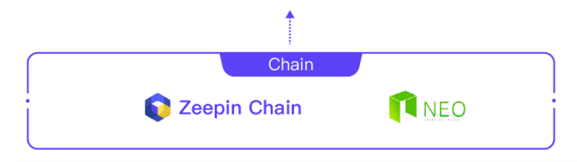

In terms of their technology, Zeepin will have it’s own Blockchain called the Zeepin Chain. This is part of the NEO ecosystem, which in my opinion is the best ecosystem in the crypto space currently. Subsequent projects that want to use Zeepin’s services e.g. a game etc.. will be built on Zeepin as a decentralised application/ Dapp.

Now the Blockchain itself is only the foundation technology for content creators to lauch their project. E.g. an album, a song, a game etc…

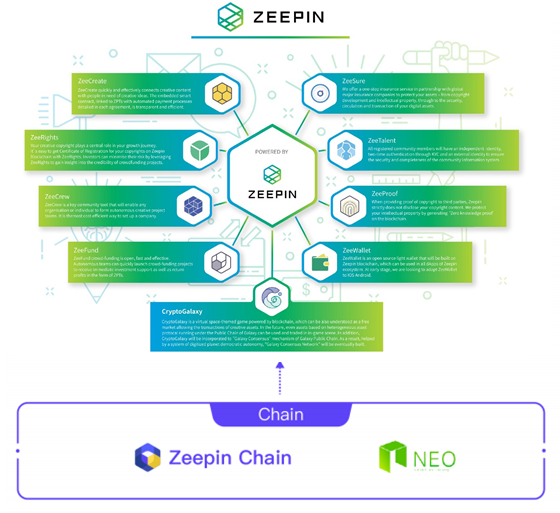

In order to additionally provide services for the users e.g. copyright service, financial-legal services etc… Zeepin will launch it’s own Dapps to provide these services.

So far, they are announced 9 Dapps that they are creating/ have created to provide services for the industry.

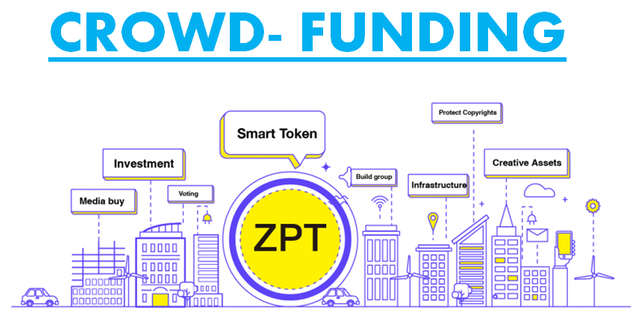

Now all of these native Dapps/ services will use ZPT tokens. So e.g. if a user uses the copyright service called Zeerights, they pay in ZPT tokens. If they use ZeeTalent to recuit team members, they pay again in ZPT tokens. So not only does this project use ZPT tokens for the platform, which is the main way most platforms e.g. Ethereum or NEO assures token use, in addition to that, Zeepin has 9 Dapps that provide essential service to their users which will run on the ZPT token. And 9 Dapps is only the starting, they plan to release more Dapps to provide more services to users over time. So there will definitely be a lot of token use case which is great for token investors.

I just want to quickly run through a couple of the native Dapps/ services that they are currently building on the platform so you get a feel of how important these features are to the users.

The first service offered is crowd funding service offered by the Dapp ZeeFund. For those who don’t know what it crowd funding is, every new project needs capital to create the content, pay legal fees etc… crowding funding is a process where an upcoming project e.g. a video game being created, can raise funds from early investors who believe in the project. And in return for donating or investing in the project, early users get some benefits or advantages. Crowd funding services e.g. Kickstarter has become very popular recently, and even other Blockchain projects e.g. Loom and their upcoming cryptozombie game is using Kickstarter to fund raise the project, where people who pledge a donation will get special access to certain features like the beta testing and more. Loom for those of you who are not aware of the project, is a second layer platform solution for Ethereum that specialises in creating crypto games, but even though they are a platform that specialises in creating Blockchain games, they don’t have a crowd funding service and they themselves have to go off chain to use a non-blockchain service like Kickstarter to fund raise. So nothing wrong with Loom, I think it is a great project, but being aware and providing a service like crowd funding shows you the difference between a good project that is built from scratch versus another good project like Zeepin who already has 15 years’ of experience in the field and is already very aware of exactly what is needed by their users.

So Crowd funding is a much needed service for new projects to raise capital and Zeepin is offering that service through the Dapp Zeefund, and of course it will use ZPT tokens as the fundraising currency. This will be attractive as the Zeepin community grows, because like any platform, when you build an app of Zeepin, you immediately have your project announced to all their tens of thousands of users, who are keen to invest, as opposed to launching independently on a platform like Kickstarter where you have to market and raise awareness for your new project from scratch.

Zeerights is Dapp that will provide the service for copyrighting the creator’s content. Pretty self-explanatory and I’m sure everyone can see how important this service is.

The thing is I’ve seen projects like Po.et provide copyright service in the Blockchain space and I’ve seen other platforms like Loom, Chimaera, Enjin that allow content creators to build original content on their platforms, but as common sense as it sounds, Zeepin is the first Blockchain projects where I see everything come together. It’s a platform to build your Dapp, but it also provides all the necessary services needed to make the project work practically.

So many times in Blockchain, you see a project boast about it’s technical prowess, e.g. transaction speed etc.. and those features are often boasted because the people behind the project are technical people coders and developers. But what we keep saying on this channel when reviewing projects like VeChain which has tailored made enterprise features, and now Zeepin which has tailor made creative industy features, is that when it comes to mass adoption, the people who are considering which platform to use, aren’t going to base their decisions based on throughput or latency alone, they are going to look at utilities offered by the platform and it’s ability to cater for their needs. That’s why platforms like Zeepin who are thoughtful enough to include specific features to cater to their niche clientele will do very well in the longer term.

Other Dapps/ services includes ZeeSure Asset Insurance, which create which uses ZPT tokens as a medium of exchange on an embedded smart contract, ZeeProof which is used to provide proof of copyright without revealing the copyright contents, ZeeTalent which facilitates a recruitment service and more.. There’s a total of 9 essential services which are highlighted for now and there will be more in the future.

I’ve actually been wanting to do a Zeepin review for sometime now, but the reason I’ve been holding off is because their mainnet is due in August (next month) and there is an updated whitepaper that will be released before that, so sometime very soon. The last whitepaper version was at the end of 2017, so it’s quite dated and there have been a lot of changes that will take place. So that’s why I’ve been holding off on this project review, hoping to get a bit more clarity before doing the review.

Last night, less than 24 hours ago, Zeepin released an important piece of information about their upcoming Blockchain structure for mainnet and also the use of a second currency, the GALA currency. So it’s big news, it doesn’t give us all the information yet, but it does give us a big picture of where this project is headed and also, I feel this information is potentially time sensitive to some degree because of the unique low pricing of ZPT token which I will talk about later. For those reasons, I decided today is the day to do this Zeepin review.

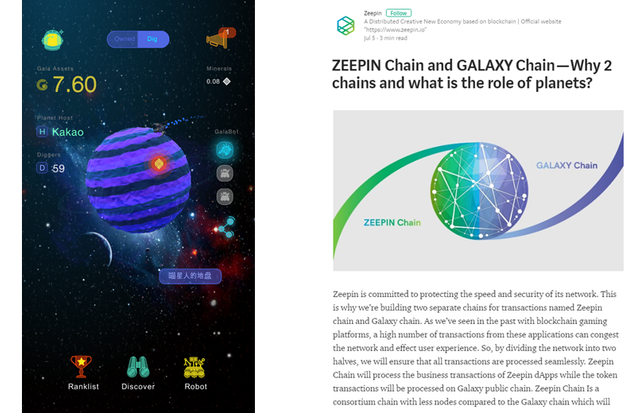

So most of you may know, Zeepin actually launched a crypto game on it’s platform called Cryptogalaxy. It’s a working game where users can buy planets and mine cryptocurrency on the planets. As you mine more, you can buy more and better miners who can mine even faster etc…. So it’s basically a mining game. Zeepin did hint before that Cryptogalaxy was going to be more than a game, it was a gametised version of the Zeepin system. So we knew it was going to be significant, but we were unsure of how that it would work. Until now.

This article released last night explains that at mainnet, Zeepin platform will consist of not one but two Blockchains. The Zeepin Chain and the Galaxy Chain. This is all new information not available on their current whitepaper, it’s only available in this article for now.

The reason for having two chains is to ensure speed and security of the network. Zeepin Chain will process the business transactions of the Dapps, whilst the Galaxy Chain will proves the transactions. Zeepin Chain then, will have less nodes that the Galaxy Chain which will improve the efficiency of processing the business transactions.

Cryptogalaxy then, becomes more than just a game. GALA tokens mined in the game will become an actual currency you can trade. But also the planets then acts s a network node to help the network reach consensus. So the mining on the node becomes the mining of the system and that’s how rewards are distributed. In addition, there will be economic synergy between ZPT and GALA tokens, so users can stake ZPT tokens in the in-game wallet to produce GALA tokens (its like NEO and GAS, except you’d be getting into NEO at $0.03) or if they own a planet, they can lock in ZPT onto the planet that will increase the yield of mining GALA from the planet. This will also improve the resale value of the planet. So in the next game update, planets (which are the nodes) will be tradable with tokens.

This is really smart, because it means that there is only a limited number of nodes, and not everyone who has tokens can be a node. You need to buy a planet, this is really going to inflate the prices of planets. And there will are also plans for masternodes which will also be planet based and the details are to be released soon.

I love this concept of gamifying the mining and staking process. Firstly it makes it fun, but it also makes it easy to understand the process and easy to achieve. Finally, but gamifying it, they can limit the number of platents/ nodes and manage inflation accordingly. Currently the rate of planet release is already very high in demand and new planets get snatched up within seconds. Furthermore there is a very high demand for GALA tokens even in the current game to buy planets and diggers.

And that demand is expected to get even higher, because they have also announced new features in the game e.g. the option to upgrade your digger etc.. which will prob be using the game currency which is GALA tokens.

Any currency is affected by demand. The more use there is the higher the demand, that’s why we always examine token in any project, and in this case, GALA tokens not only has use, but the limited features of the game itself will also create demand e.g. planets will potentially costs more tokens as its usefulness increases. And everyone loves a passive income, so the staking option is going to be very attractive. I’m really looking forward to checking out the numbers when the new whitepaper is released.

I don’t usually do follow up article after I've reviewed a project, because there’s so many other projects to review. But in this case I will personally be following this project up, so if you would like me to do a follow-up article, let me know in the comments below, and if there’s enough requests, I do a follow up when the full details are known.

Coming back to just Zeepin as project, Zeepin will introduce a “Credit Score” to incentivise positive content and behaviour on the platform.

A user’s credit score will be affected by the following factors:

i. Frequency of participating in community activities

ii. Quantity of works or copyrights done

iii. Transaction volume on ZeeRights

iv. Helping to promote and sell crowd-funding products

v. Participant in ZeeCreate creative project

vi. Other positive activities…

Users with positive credit scores will be rewarded with incentives such as ZPT tokens issued each year by the foundation.

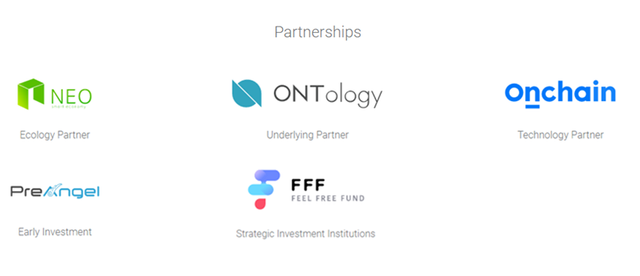

These are their partners. Neo, Ontology and Onchain are all familiar names. Onchain is mother company behind the technology of NEO. Neo is the centre of the ecosystem on which other great projects like ONT, SwitchNeo, Zeepin and the rest are part of, and Ontology is actually the closest partner to Zeepin. In fact, Zeepin’s mainnet Blockchain structures, is apparently modelled after Ontology’s Blockchain rather than Neo.

The Neo ecosystem is in my opinion one of the strongest ecosystems in the space. There is a lot of relevance and partnerships within the projects and there are a lot of very good projects in this ecosystem. The community is very strong and projects generally gain a lot of traction when their time is ripe. Also with investing in projects early, e.g. before mainnet is launched, there is always the risk that the project will not take off. That’s why established platforms like Ethereum with lots of business already, is a much safer investment. But it’s the early projects that haven’t launched mainnet that potentially give a much higher yield. So high risk for high gains.

In Zeepin’s case, the two major risks are the market penetration, and actual Blockchain technology. However, in terms of their product having market penetration, we know it is likely to succeed because they are basically Arting365 and already have over a million users and contacts in the industry. In terms of their technology, they are modelled after Ontology mainnet which is working well, and they also already have a working game cryptogalaxy functioning on their platform. So the chance of their platform working well is high. So these type of considerations, lowers the risk of investing in this project for a token investor like me.

This is not financial advice, just me sharing my thought process with you.

Furthermore, theres two capital investment firms invested in them, and as I always say, that’s good news, because these are professional investment companies who are professionals in doing their research, and they definitely are more competent than me in their assessments, so if I see a capital investor in a project, it is a reassuring sign to me.

Finally, the last thing that attracts my attention to Zeepin right now, is it’s current price point.

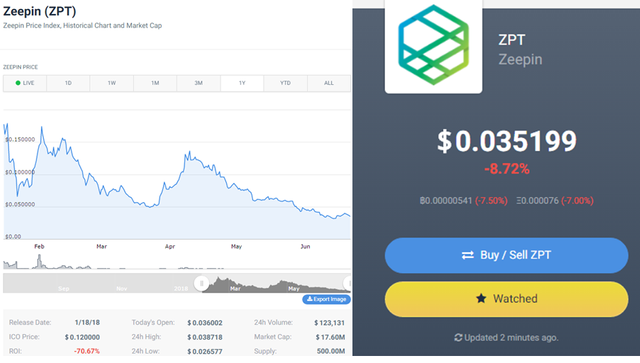

Currently, ZPT token is sitting at $0.035 which is cheap. Let me show you something called the ROI to show you how cheap it is, and why I’m excited about this project.

Recently in the bear market, in my attempt to try and sieve out which small cap coins are really worth paying to, I’ve been noticing this thing called the “return of interest” or “ROI”. So on Coincodex, which is the website I used to check pricing, the ROI is listed here at the bottom left corner of the table, just under the chart.

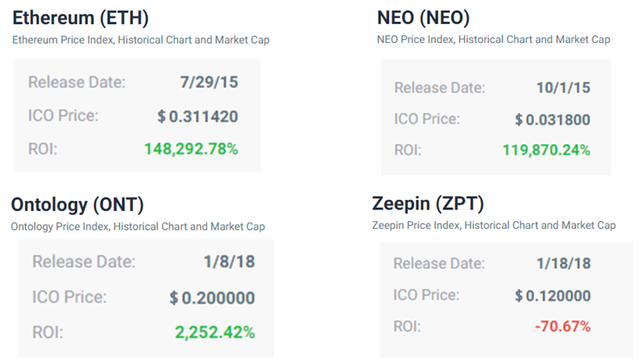

Now most good coins, with good fundamentals have a positive ROI. Big coins that are established e.g. Ethereum and NEO have ROIs over 100,000%. So if you got in at ICO that’s that percentage gains you would have seen by now.

Even new coins with good fundamentals like Ontology has seen over 2200% ROI. So its all very positive numbers. In fact, most crypto projects are actually positive in ROI despite this bear market. If it’s a project is like Ethereum with a massive ROI of 148,000%, I don’t expect it to 50x or 100x anymore, the ROI’s already too big. It will prob still go up, but no 50x. So what I’ve been looking for in this bear market is a coin that has good fundamentals but a red ROI. It’s actually surprisingly hard to find. But I found Zeepin.

Zeepin I feel has good fundamentals. And it’s ROI is -70%. That’s crazy. This coin is now 70% less than it’s ICO price. Very few good coins drop below ICO. And I’d be happy with any negative ROI, but 70% is really eye catching. So a project like this, with an established successful company of 15 years history, in a multi-trillion dollar industry. One of the more well-known prominent projects in the NEO ecosystem, with mainnet and staking options just around the corner. I personally think this is a great entry point for Zeepin, with a tiny marketcap of only $17.4 million. If you do the mathematics, it’s the equivalent of getting into NEO at $0.30. So again please, this is not professional advice, just me sharing my thoughts with you. This whole channel and my reviews are like my personal blog on crypto. It is NOT financial advice. Always do your own research and make your own decisions.

So guys, that’s it for me, that’s why I really like Zeepin right now. Thanks so much for joining me. Let me know in the comments section below what you think of Zeepin and also let me know if you would like me to do a follow up article once the full details are out. Depending on the market, I really think the price could rise once all of the details come out and that’s why I wanted to get this review out now.

Have a great day and weekend wherever you are and Il catch you guys again soon!