Enigma (ENG) Token Review (2018)

Hi guys, welcome to another Cryptolite post. Today I would like to talk to you about the blockchain project Enigma. Enigma has actually been around for about 6 months on the market, at one point in time, it was hailed as the most promising coin of 2018. It’s since, lost a bit of momentum and I think of new investors are not aware of this coin, but I personally think it’s still a very good investment, especially at it’s current price, so today I’m going to introduce to you the Enigma project.

Enigma describes itself as “a blockchain based protocol that uses groundbreaking privacy technologies to enable scalable, end-to-end decentralised applications.” Let me explain what that means in layman terms.

Oftentimes in the blockchain space, we use the terms protocol and platform interchangeable. But they are slightly different.

A platform is the technology on which other programs or blockchains are built upon. E.g.Ethereum is a platform.

A protocol is the system of rules that govern the communication.

So for example, if you’re using a windows PC, Windows is your platform and the language which it uses to communicate with the programs is called the protocol.

Enigma currently is primarily a protocol, that is an off-chain solution to help existing blockchains achieve privacy and scalability.

Imagine that I have a blockchain like Ethereum.

Currently if I build a Dapp on the blockchain, the blockchain is responsible for taking care of all the processing and storage requirements of the Dapp. If the Dapp is a big Dapp, this can be burdensome for the blockchain.

Off-chain scaling is the process of moving the Dapp off the blockchain, do the bulk of the storage and processing off the blockchain and record just a tiny snapshot of the transaction on the blockchain. It’s a very smart process, and different off-chain solutions achieve this via different methods.

The way Enigma achieves off-chain solutions is through what is through a combination of 2 technologies known as multiparty computations (MPCs) and Distributed hash-table (DHT). It sounds complicated but it’s really not, il explain it to you in simple terms in the next 30 seconds.

On the off chain, you have multiple nodes. The Data that is to be processed is first encrypted, then segmented into different segments, like a jigsaw puzzle.

Each node holds a different part of the data and because it is encrypted, they have no idea what the actual full data looks like. That’s why it is private. Furthermore, instead of every node processing the whole data, each node only processes part of the data, speeding the whole process up tremendously.

Finally not the entire data is recorded on the blockchain, only a confirmation of the data is recorded, the individuals input and information are kept private. So someone can check that the transaction did occur, but they would be unable to trace the details e.g. of the person’s wallet content and previous transaction history as they can now.

MPCs that we mentioned above is basically the method of distributing the data pieces and DHT is the technology for storing this information off-chain. Together they achieve both privacy and scalability.

Where Ethereum introduced smart contracts to the blockchain world, Enigma is introducing the improved version of smart contracts, which is secret contracts to the blockchain world.

Enigma is currently running on the Ethereum blockchain, but it is designed to be blockchain agnostic, meaning it’s off-chain protocol can be employed by any traditional platform. When we look at the roadmap later, you will notice that they are also planning to launch their own blockchain platform later on.

Catalyst

Enigma already has a working product in the field and it’s called Catalyst. Catalyst is the first Dapp to run using the Enigma protocol and it is created by the Enigma team themselves.

Catalyst is actually a game changer in itself. It is the world’s first algorithmic trading library for crypto assets. Let me explain what this means.

Big traders e.g. Hedge funds etc.. use big databases like Catalyst to firstly, obtain data on the market, and secondly to test it against market algorithms or strategies. E.g. someone could suggest a strategy like “buy ethereum everytime it drops 20% and sell it after 2 hours.” And this strategy or algorithm would be put up for traders to try. Traders don’t have to try it risking their current money, because they have all the data consolidated by Catalyst, they can simply run this algorithm on past market data and see if it is profitable. If it is, they can then take it and use it to earn money in the real market. It’s a very useful tool that many people in the stock market use, the most well known platform for this is Bloomberg. So basically Catalyst is trying to be the Bloomberg of Cryptocurrency and currently they already have 10,000’s of users and are a success.

Other potential use cases for the Enigma protocol include industries such as protection and monetization of personal data (this is a very popular blockchain industry currently), healthcare and genomics, credit establishment and finally the Internet of things.

Token use

The Enigma (ENG) Token has uses on both the protocol and catalyst.

Catalyst is probably where there will be a larger volume of use initially. Users have to pay with ENG tokens to start using the Catalyst platform, and every algorithm they choose to use, they will have to pay in ENG to use it again.

On the platform, ENG tokens are used for storing data, any sort of action/ computations and finally as a security deposit. This is a deposit that participating nodes have to lay down initially, so that if they are noticed to have malicious behaviour, their deposit will be forfeited. This discouraged sabotage of the system.

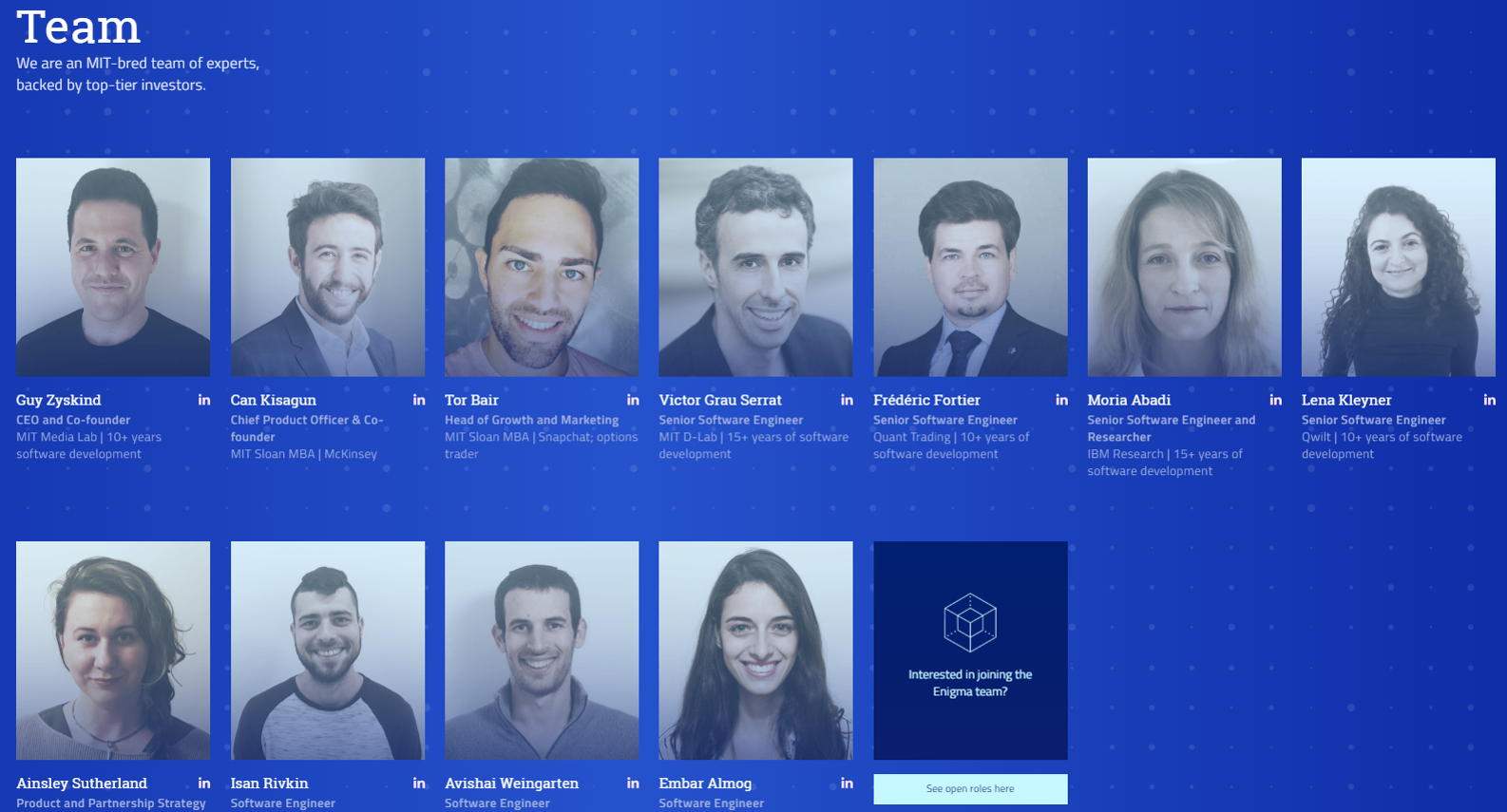

Team

This is the team behind the project, most of the members are from MIT.

Guy Zyskind, the CEO and founder was previously the CTO of Athena Wisdom which is an MIT medialab spinnoff. He has authored several academic papers on privacy and blockchain, and he has also previously led the development of several strat up companies. Obviously graduated from MIT and he taught the first ever class on blockchain at MIT.

Can Kisagun the other co-founder previously founded Eximchain, a blockchain based supply chain solution and before that he was a consultant at McKinsey and Company for 3 years. He is also quite involved still in MIT and coordinates blockchain efforts between the business school and engineering schools.

You can go through the rest of the individual resumes yourself. My impression is this is a fairly young team with quite a few having less than 15 years work experience, but they are smart, successful and they have MIT’s backing which is a big factor.

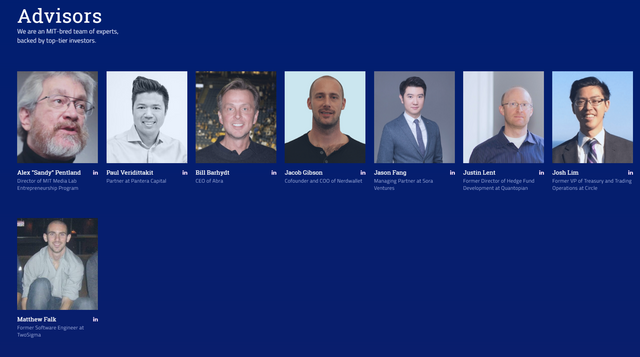

Advisors

These are their advisors, there are quite a few capital investment partners, e.g. Paul Veridittakit from patnera Capital and Jason Fang from Sora Ventures. Other notable names includes Alex Pentland who is the Director or MIT Medialab entrepreneurship program, Bill Barhydt the CEO of Abra, and Josh Lim, the former VP of Treasury and Trading Operations at Circle.

So it’s well balanced team and board of advisors. Not blockchain superstars, but definitely very successful in their own individual fields

Partners

For some reason their website doesn’t list their current partners, but reading around, the names of partnerships I could gather include AION, Kyper network, Endor, Etherdelta, Ethlend and Investfeed. These are very significant names in the blockchain space.

If anyone else is aware of any other partnerships I haven’t listed, please write it in the comment section below so others can read it too! With my thanks in advance!

Roadmap

This is their roadmap. It’s divided into different stages, called Discovery (which we are currently in), Voyager, Valiant and Defiant. It’s long roadmap that goes into 2020. Il summarise the main highlights of each stage.

Discover which is 2018—will see the introduction of secret contracts, and also see them be completely compliant with Ethereum.

Voyager which is the first half of 2019 will see a focus on privacy and the development of MPC. This will also mark the first step towards chain independence, and launching its own chain.

Valiant which is the later part of 2019 will see an emphasis on scalability and decentralisation.

And finally Defiant is about growing and improving Enigma to achieve global adoption. And that’s not the end guys, that’s really the start when the project is fully built and plans to impact the world. Enigma is one of the most ambitious projects to provide both scaling and privacy to any blockchain project.

Why I like this project is because everything they are doing is new. There is no other project like Catalyst now, yet we need it and it is a proven service that works in the stock market with multi-billion dollar profits every year. Already Catalyst is gaining momentum and achieving adoption well. The main thrust of the project is however, the Enigma protocol, the solution they are offering is a unique combination of both scaling and privacy. There are scalablity solutions, and there are privacy coins, but there is no combined solution to provide both to ANY blockchain platform. So if you’re a blockchain platform and you can choose between two solutions, one that offers scalability and the other that offers scalability and privacy options. Which will you choose? Of course the one that has more features. That is why I think Enigma will have a demand and grow to become an important core technology in the blockchain world in the future.

Price prediction

Finally let’s take a look at price prediction. Currently the token price is sitting at $2.30 with a marketcap of $174 million. I remember about a month ago thinking, anything below $3 for this project is a good price. So $2.30 is a steal in my opinion.

There is no equivalent project in the market which makes it hard to identify a benchmark.

A prominent data storage marketplace project is Siacoin which has a marketcap of about $660million, which is about 4x Enigma’s current price. The top privacy coin is Monero which is worth $3.2 billion which is about 19x their current price. You can’t exactly compare Enigma with these projects because they are different, but those numbers kind of give you an idea of the demand for those features in the blockchain space. If anything, Enigma marketcap estimate should be the addition of those numbers.

This is just me speculating, but I definitely see Enigma a 20x coin in the next 1-2 years. I think the current price which is because of the recent bear market, is a very attractive entry point.

But this is just my personal opinion, I am only human and can make mistakes, furthermore, I’m not even a professional so please always do your own research and make your own decisions.

That’s my thoughts on Enigma guys! Thanks for joining us. I hope you found this post helpful! If you did, do give us that upvote and follow. I just want to say a big personal thanks to everyone who has been supporting us, you guys are the best and I absolutely cannot do this channel without your support. So thank you so much!

Hope you all had a great Sunday! Have a fantastic Monday coming, and I’l catch you guys again soon!

enigma is good coin and have pretty future

indeed!

Coins mentioned in post:

No había escuchado sobre ese proyecto, gracias por al información.

good coin and a nice entry point at the moment