HOW TO CRYPTO TRADE

A BEGGINERS GUIDE TO CRYPTO TRADING

This is a short guide on the basics of crypto trading: Reading the charts and taking profit from market volatility.

There are many strategies to invest in crypto trading. Investors who buy coins and hold on to them until they go up in value are know as HODLERs and have a passive investment strategy. Crypto trading is an active investment strategy. By placing buy and sell orders, crypto traders profit when the market is either going up or going down. This guide will introduce how to automatically buy a crypto asset when its low and sell it when its high.

1

Get a trading account: Open an account with a good exchange. I will not recommend any specific exchange but it must have detailed charts and indicators. It must have functions to place buy orders known to traders as 'limit orders'. The exchange I use is Ethfinex but other capable exchanges are Binance, Cryptopia and HitBtc. For the purposes of this guide, I will be using Ethfinex.

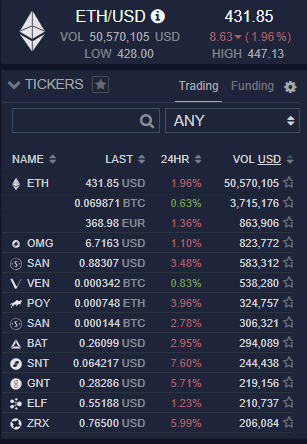

Pick a cryptocurrency from the tickers panel to bring up the chart. We are going to lookat Ethereum vs US Dollars, so click on ETH/USD to bring up the chart

- Candlestick charts:

Looking at the chart: Each candlestick represents the highest and lowest points the currency traded at every day interval. On the top left of the chart we can see a box saying 1D which is the length of the candle stick or 1 Day. On the bottom is the overall time scale. In the chart above it runs from April 21 until July 11.

- Lines of support and resistance: The next chart shows the two lines known as lines of support and lines of resistance. The chart is oscillating within this scale. If it goes outside of these two lines, there is likely to be a correction to the cryptocurrency and we expect it to trade back within these two lines The green line is the line of support, or the buy line. The red line is known as the line of resistance and is where we want to sell.

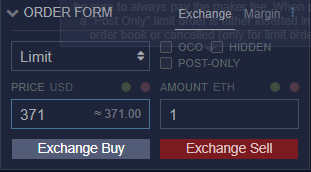

3: Buy and sell orders

Now we place buy and sell orders from around these two lines. For this trade we aim to automatically buy Ethereum for $371 and sell for $800 to achieve a profit of $429. For example, go to the ORDER tab, select LIMIT ORDER. Type in 371 in the price box andtype in 1 ETH in the amount box

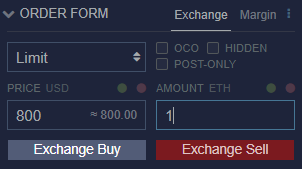

Then create a sell order near to the line of resistance, or the red sell line, in this case set to $800

You chart should now look like this

If the price of Etheruem falls outside of its usual price range, we will automatically buy when it hits the green line at $371 and execute an Auto sell, or Limit order at $800 if the price of Etheruem falls outside its upper range to close the trade for $429 profit. Crypto traders generally have many orders open at any one time.