Crypto Diversification

The concept of diversification should be familiar to most investors. However crypto investments involve risk aspects that typically don't apply in more traditional markets.

Diversification is an important strategy in managing risk. In cryptocurrency we approach diversification in three dimensions:

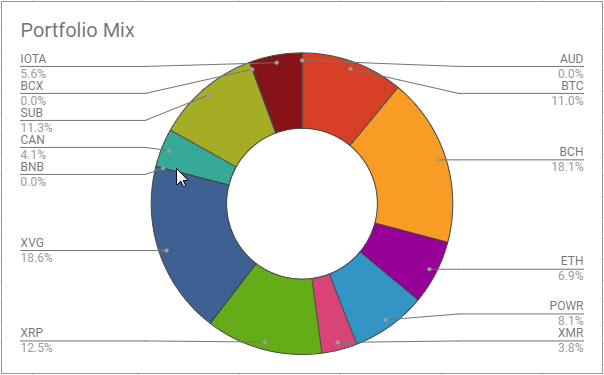

- Exposure to multiple cryptos

- Balanced exposure to cryptos at different stages of adoption

- Balanced holdings across wallets and exchanges

All of these factors should be considered when developing a risk management strategy.

Holding Multiple Cryptos

Similarly to holding a range of different stocks or other securities, we may hold multiple cryptos to balance the risk of devaluation as well as exposing our portfolio to different sources of potential growth and utility.

Many investors new to cryptos will be limited to those offered by their fiat onramp exchange; often a subset of the top ten by market cap. Even then they may be tempted to limit themselves to a market leader such as $BTC while they familiarise themselves with the ecosystem. Even taking on one or two additional cryptos can reduce volatility in a portfolio, and in the case of a catastrophic devaluation in one coin, can insulate a portfolio against total loss.

Of course the relative holdings can and will vary as the value of each crypo changes, and new holdings or airdrops are introduced. There is of course an opportunity cost to diversifying holdings in that any potential gain in a specific crypto will also be diluted.

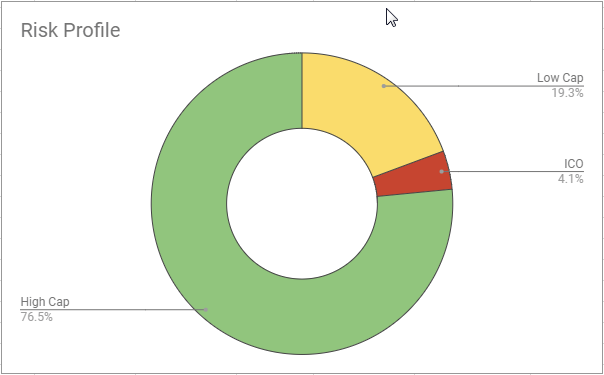

Adoption Stage

We can grade cryptos by adoption in many ways; in this case we will look at three brackets:

- Mature or High Cap (top 50 by market cap)

- Developing or Low Cap (below top 50 by market cap)

- Initial Coin Offering or ICO

If we accept that the risk of catastrophic devaluation or never achieving growth reduces as the market capitalisation increases, this can help an investor balance their crypto portfolio by growth risk. A comparatively less risky portfolio may be heavy on High Cap cryptos, whereas a high-risk high-growth strategy may be heavy on ICOs.

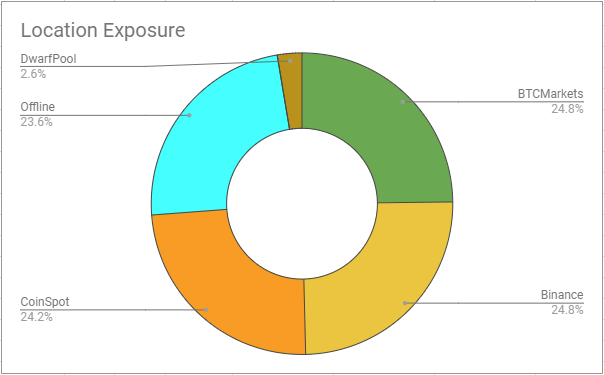

Location Exposure

Traditional investors may never give thought to the stability of the exchange on which they trade, nor of the institutions who hold investments on their behalf. While it's not unheard of for a bank to fail, it may not be perceived as such a risk as to diversify across banks.

With crypto markets being largely unregulated, and the ability to trade cryptos on multiple exchanges, there is some sense in diversifying across wallet locations. As those who held $BTC on the Mt. Gox exchange well remember, there is nothing technically preventing any exchange absconding with the cryptos held in wallets they control. As Andreas Antonopoulos put it:

"If you control the Bitcoin keys, it's your Bitcoin.

If you don't control the Bitcoin keys, it's not your Bitcoin."

For this reason it is typically recommended to keep any long term or significant holdings in a wallet for which the individual investor holds the keys - i.e. off-exchange. Where holdings are actively traded, multi-exchange diversification can be used to limit exposure to a single exchange's failure or criminality.

James

Thanks for reading! If you think this content is valuable, please upvote, follow and comment. I aim to release a cryptocurrency-related post like this every two days, and I'm happy to engage in adult discussion in the comments.

I use and endorse Binance, KuCoin and Cryptopia for cryptocurrency trading.

The author is not a financial advisor and nothing in this post constitutes or is intended as advice. You are responsible for your own investment decisions. Header image courtesy of Rebekah Howell. The author holds the following cryptos mentioned in this article: $BTC

Yeah, I do this too. However, when the crypto market goes down, most of the time everything goes down. Same with when it goes up. Even really shitty cryptos can do great.

That's right, there's high risk and lower risk, but there's never no risk. But you also have to factor in the risk of doing nothing.

Diversification can be simplified relative to the relative cost - selecting top 50 that is below a dollar, within a dollar to ten dollars. Alas the so-called market cap is not entirely true or measured correctly. For instance many coins lost, or the new Bitcoin Gold, satoshi won't be using his coins so those are still calculated in the pool.

I'm not a big fan of judging cryptos on the price, I mean look at $XRP and $BTC. They couldn't be more different in price. The market cap is the best basic indicator of how much the world is invested in the currency, which is why I use it as a breakpoint for risk. Agreed on the distinctions, e.g. circulating supply vs total supply, escrows etc, but that data isn't readily available for spreadsheets :)