BASIS (Basecoin) - stable crypto-currency: myth or reality?

BASIS (Basecoin) - stable crypto-currency: myth or reality?

Crypto market is overloaded with projects, that spend hundred thousand dollars on marketing, participate conferences, publish materials in top media sources, but don’t have any unique idea or technology.

BASIS (previously Basecoin) - is a totally different kind of project, that is going to change the stable coins' market and add more transparency into an unclear monopoly of Tether & Co.

Intro

Basis - a stable cryptocurrency with an algorithmic central bank, that is designed to keep prices stable by algorithmically adjusting supply.

When demand is rising, the blockchain will create more Basis. The expanded supply is designed to bring the Basis price back down.

When demand is falling, the blockchain will buy back Basis. The contracted supply is designed to restore Basis price.

The Basis protocol is designed to expand and contract supply similarly to the way central banks buy and sell fiscal debt to stabilize purchasing power. For this reason, team refers to Basis as having an algorithmic central bank.

(https://www.vividoctor.com/true-sucess-story-crowdfunding-campaign/money-2696219_1920/)

Product

Basis - a digital asset that stabilizes its own value and protects it from market volatility. Whitepaper draft describes a blockchain concept with built-in artificial intelligence, that manages monetary politics.

A global idea is that Basis protocol defines a pegged asset (this might be the USD, another fiat currency, an index like the Consumer Price Index (CPI), or a basket of goods), monitors price levels and adjusts the money supply by executing open market operations

In a short-term perspective, this idea is a good alternative for fiat currencies for crypto traders, in long-term - the instrument for stability ensuring that now centralized monetary systems are offering.

Basis team is going to separate themselves from previous tries of stable coins launches, by using the tokens combinations, in order to replace a centralized control how it’s implemented in Tether.

How does it work?

To keep price stable Basis protocol expands or contracts the supply of three classes of tokens:

Basis, Basis Bonds, Shares tokens.

- Basis. These are the core tokens of the system. They are pegged to the USD and are intended to be used as a medium of exchange. Their supply is expanded and contracted in order to maintain the peg.

- Bond tokens.Called bonds for short, these tokens are auctioned off by the blockchain when it needs to contract Basis supply. Since newly-created bonds are sold on open auction for prices of less than 1 Basis, you can expect to earn a competitive premium or “yield” for your bond purchase.

- Share tokens.Called shares for short, these are tokens whose supply is fixed at the genesis of the blockchain. When demand for Basis goes up and the blockchain creates new Basis to match demand, shareholders receive these newly-created Basis pro rata so long as all outstanding bond tokens have been redeemed.

Example 1: Expansion.

Suppose there are 500 bonds in the Bond Queue, 200 of which were created more than 5 years ago. Additionally, suppose there are 1,000 shares in circulation.

Suppose the system needs to create 1,000 new coins.

The system expires the 200 oldest bonds, leaving 300 bonds in the queue. If the

system needed to create fewer than 300 coins, it would only redeem the oldest bonds. However, the system needs to create 1,000 coins, so it redeems all 300 bonds.

The system still needs to create 700 more coins. The system distributes these 700 coins evenly across the 1,000 shares. Each share receives 700 / 1,000 = 0.7 coins. If you hold 100 shares, for example, you would receive 70 coins during this expansion, which you can then sell for USD.

Example 2: Contraction.

Suppose the system needs to take 100 coins out of circulation.

Suppose that there are two buy orders on the order book: One bid for 100 bonds

at 0.8 Basis each, and one bid for 100 bonds at 0.4 Basis each.

The system will fill the first order, giving the user 100 bonds in exchange for 100 * 0.8 = 80 coins. It will then partially fill the second order, giving the user 50 bonds in exchange for 50 * 0.4 = 20 coins. In total, 100 coins have been destroyed.

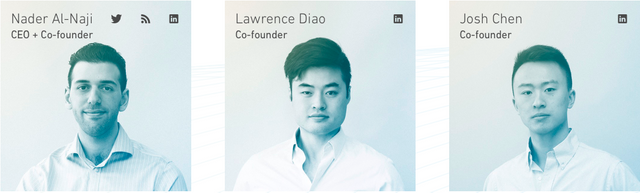

BASIS TEAM

The core team consists of three friends, who studied in Princeton and graduated together with degrees in computer science. All of them have excellent experience in leading world companies and worked together in The D.E. Shaw & Co - a multinational investment management firm with 1300 employees and US$47 billion assets under management.

Nader Al-Naji

Worked on Search and Ads at Google and in algorithmic trading at D. E. Shaw & Co.

Lawrence Diao

Worked in tech and quantitative finance at Google Search, Google Ads, and Radix Trading, and interned at D. E. Shaw & Co.

Josh Chen

Worked in Algorithmic Options Market-Making at D. E. Shaw & Co.

Partners and ICO

The project didn’t have a standard ICO, all investments were gathered on closed rounds from the leading crypto funds.

In October 2017 Bain Capital and Andreessen Horowitz announced that they participated in the pre-sale of Basis. The project raised $ 3 million, and team focused on technologies R&D.

The hype around the Basis started in April 2018, when the team announced that they raised $ 130 million from different crypto funds on the main round. Just take a look at these companies:

Conclusions

Basis - not just another token, that will be launched during ICO hype. Cause it’s based on the conception of how to apply monetary theory to the latest technologies. As a results Basis has all chances to how public distributed registers (blockchains) and tokens could change the existing monetary system, which now is subject to human influence and mistakes.

Project founders claimed excess of US dollars transaction volume with Basis volume because of the fact, that Basis can carry out the work of the Federal Reserve - to maintain the stability of the assets. The protocol also could be used for the payments of salaries, loans, futures, options and other operations.

The core team is sure that a lot of traders, who want to become first currency holders and rapidly enter new markets, will support them.

So, we can suppose that someday Basis protocol will execute central bank functions. This will remove the human factor from the monetary system and make it’s work more stable, predictable and transparent.

Basis website: https://www.basis.io/

Read also our previous article: QuarkChain - blockchain that aims to achieve millions of transactions per second!

Resteemed to over 18500 followers and 100% upvoted. Thank you for using my service!

Send 0.200 Steem or 0.200 Steem Dollars and the URL in the memo to use the bot.

Read here how the bot from Berlin works.

#resteembot #bestofresteembot #winwithresteembot

Feel free to join our partner crypto exchange: https://www.binance.com/?ref=10230705.

@resteem.bot

You just planted 0.25 tree(s)!

Thanks to @cryptohook

We have planted already 4802.77 trees

out of 1,000,000

Let's save and restore Abongphen Highland Forest

in Cameroonian village Kedjom-Keku!

Plant trees with @treeplanter and get paid for it!

My Steem Power = 26009.39

Thanks a lot!

@martin.mikes coordinator of @kedjom-keku

Greetings! I am a minnow exclusive bot that gives a 4X upvote! I recommend this amazing guide on how to be a steemit rockstar! I was made by @EarthNation to make Steemit easier and more rewarding for minnows.

Thank you for this great read! Would you also be interested in reviewing World Wi-Fi project?

Maybe in the future. I know about this project, buddy.

Please make sure you source all of your images and content to avoid getting flagged by our service.

I checked. I used images from my article and Basis website which I posted in the end of this article :)

Oh great! If you could do us a huge favor and just note that on your post it would help us a lot. We try to combat plagiarism as much as possible but it is time consuming to have to go digging through the hundreds of submissions we get everyday. Even if they're open source images it helps if their sourced. To make it look cleaner on your posts you can type it this way:

[Source, Pictures, whatever word you want to use](actual link to where you got them)

Okay, I will do it :)

This post has received a 7.41% UpGoat from @shares. Send at least 0.1 SBD to @shares with a post link in the memo field.

Interested to earn daily? Delegate Steem Power to receive 95% payout rewards. Use this link https://on.king.net/shares to delegate SP to @Shares. Join us at https://steemchat.com/ discord chat.

Support my owner. Please vote @Yehey as Witness - simply click and vote.

This post has received a 62.50 % upvote from @voterunner thanks to: @cryptohook. BIG NEWS: Build your passive income with daily payouts from @voterunner! Read more about earning SBD with me. Daily. The easy way!

Sneaky Ninja Attack! You have just been defended with a 1.47% upvote!

I was summoned by @cryptohook. I have done their bidding and now I will vanish...

woosh

A portion of the proceeds from your bid was used in support of youarehope and tarc.

Abuse Policy

Rules

How to use Sneaky Ninja

How it works

Victim of grumpycat?

You got a 1.79% upvote from @brupvoter courtesy of @cryptohook!

You got a 4.07% upvote from @emperorofnaps courtesy of @cryptohook!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!