COSS vs KCS vs BNB | In-Depth Analysis And Comparison of Potential!

I have done an analysis of BNB before here and two of KCS here and here(updated).

Today I would like to do an analysis of COSS coin and compare it to BNB and KCS.

TL;DR

- Currently shitty website but with a lot of potential

- A quality team that I believe in with strong ethics, trust and most importantly TWO-WAY communication

- Amassed a 30 page report on COMMUNITY SUGGESTIONS

- Current price (around $1.00USD) gives ~2% ROI, thus overpriced in terms of objective usefulness, more than half the price is speculation

- If exchange reaches Kucoin level, can expect $12 per coin at a normal 5% ROI, not including other fees they might earn from their other platforms such as there soon to come merchant list.

- However, I expect COSS coin's price to be ALWAYS objectively over-valued (less than 5% ROI) since the coin has so much potential if all targets are met, so if volume reaches Kucoin, I expect price to reach $30-50.

- Reaching Kucoin level could take many months or even a year, COSS is a long term hold

A bit about myself

I have personally had a lot of success with exchange tokens, first making a x11 profit on BNB (small holding) and going all in on KCS and making around a x8 profit. I sold KCS at around 0.00125btc and bought COSS at around 0.00017btc... sadly COSS dropped heavily and I lost 6 figure money from COSS due to the recent dip but it's slowly recovering!

What is COSS??

Coss.io is an ambitious exchange with a lot of improvement to go ahead of it. They have a small team (two new staff starting late Jan and early Feb) who have spent a long time building that website, but there's a long long way to go before it's anywhere near in competition with exchanges like Kucoin or even Binance.

Not only are they planning to be an exchange, they also want to implement FIAT trading. This is ambitious in itself and will likely take money months if not a year before things can begin to run smoothly as their current backend systems and website infrastructure still has a lot to be improved upon.

However, I believe in the team. They have proven their ability to communicate through many updates that they post somewhat regularly. However, communication is two way and they have recently announced a 30 page document they have compiled filled with COMMUNITY SUGGESTIONS. No other exchange have I ever heard of doing this.

Furthermore, they had a recent technical error which caused their exchange to suspend operations for around 12 hours. However, prior to shutting down many users were negatively and positively affected by the error (limit orders were executed as market orders). COSS decided to reimburse those losses out of their own pocket and let people keep their gains if they made a profit from this. This shows a profound level of ethics and builds trust in the community.

That aside, they still have a long long way to go before any of their major objectives are met... if they are at all.

Analysis of COSS price

Currently, their ROI is around 2%, compared to aounrd 5% for Kucoin Shares. This suggests that COSS is currently overpriced at around 1USD each... and I believe as a profit sharing coin, it objectively is over priced. However, most of that price is speculation, what the coin COULD become in the future. That's what makes this such a high risk investment is that if they don't meet targets, the price has a long way to go... downwards. However, sitting at rank 217 at the time of this writing, it suggests it has a long way to go upwards as well if everything goes well.

If COSS reaches the volume of Kucoin, the market cap should be 3 times higher than KCS (since COSS profit share is always 50% and KCS will be reducing it to 15% over 2 years). KCS is around $9.33 right now (following the China ban FUD which I don't really believe), with a market cap of $850 billion. If COSS reaches the same volume, we can expect a reasonable market cap of $850 billion, thus around $12 dollars per coin and 1.1cents dividends per week, thus 10,000 coins will earn you around $110 weekly (disclaimer: I hold over 31k). However, COSS also gets fees from merchants and other avenues, thus likely increasing their dividends in the future once everything is set up, the fees from there is unpredictable for someone like myself so I'll just assume it's 0 for now.

However, many tech companies have their shares extremely over-valued due to anticipation of parabolic growth. I expect COSS to be way over-valued until they have met all their goals or announce the give up on them haha.

INVESTING IN THIS COIN IS EXTREMELY HIGH RISK HIGH REWARD!!

I am not a financial advisor so do your own research before undertaking such a risky investment

Here's their reddit, Twitter, Facebook! They also have a community development Trello board which is available by invite.

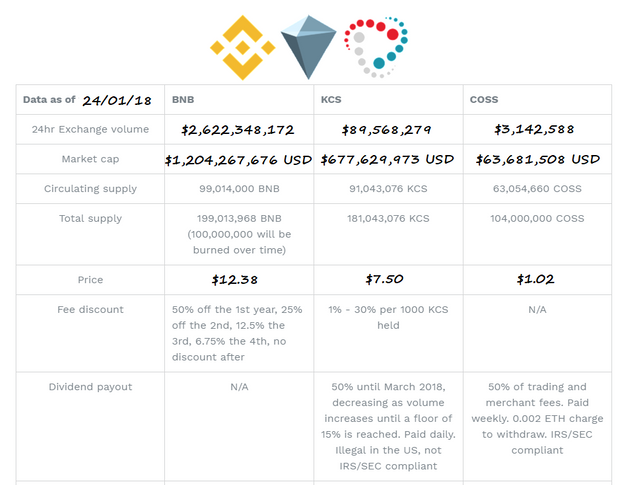

COSS vs KCS vs BNB

As someone who have invested in KCS and BNB before, I can attest that COSS is something different. By the time I invested in BNB and KCS they were already quite well established and working exchanges.

I bought BNB because it seemed like a good investment, it made sense! More people = more demand and coin burn = less supply which leads to an increase in price.

I bought KCS for the dividends that were daily and due to the rapid increase in volume, the dividends just kept going up along with the price of KCS! However, the price is startnig to correct and we won't see an all time high for a while unless the volume goes up dramatically.

COSS on the other hand is most speculation. This makes it extremely volatile. The price could drop to 10 cents. However, I wouldn't be surprised if it was $10+ by the end of Feb, or 10 cents by the end of Feb. For this reason, if anyone is interested, I suggest buying a small amount of COSS and be ready to buy more if there is any news. Their new engine is likely coming up soon so I'm expecting a massive price jump or dip when that is released.

Actual stats (Original Template From Some Reddit Post)

My Ref Links:

@cryptoeater: thanks for sharing!

Ps FYI: something must have gone wrong editing: the content in your post has doubled ;)

HAHAHAH, thanks for this, I didn't realise! I was moving between devices so I copy pasted it to myself and must have pasted twice?? I'll fix it up right now!!

I think COSS will go far. There aren’t a lot of coins out there with an actual distribution scheme attached to it. This makes COSS extra attractive to investors looking for a normal return on top of speculation.

Other coins with a return - like masternode coins- work differently. In case of a masternode (like Masternodecoin (MTNC)) the masternode is paid coins for being a masternode. In case of COSS the distribution is derived from an actual business activity.

yeah, I believe in COSS in the long term. I don't think any other exchange can come close and exchange shares/tokens are the simplest type of dividend paying coins! Perfect for people looking for a passive income haha

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cryptoeater from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has received a 15.38 % upvote from @voterunner thanks to: @cryptoeater.

This post has received a 5.32 % upvote from @kittybot thanks to: @cryptoeater.