Bloody Friday: News from China Affect the Crypto Market

IMPORTANT: The fake news can be part of a strategy to manipulate cryptocurrency prices.

For better understanding, we recommend you read our articles "China government aims to become the global leader in blockchain technology. Here's how they plan to do just that" and "The ViaBTC CEO is spreading fake news".

Today, this was reported by Caixin a Chinese news website which used statements of an high authority journalist to power up their story. According to the website allcryptocurcurrencies.news are fake news

Translated from its original in Chinese

The end of the virtual currency exchange era

The domestic exchange between all the virtual currency and the renminbi, represented by Bitcoin, Etherbeat, OKcoin, will be closed within the deadline; but the regulation is not against the virtual currency itself, nor does it prohibit the one-on-one off-exchange of the virtual currency.

The supervisory authority has decided to close the exchange of virtual currency in China, which involves all the currencies and currencies of the currency , such as "currency line", "coins" and "Bitcoin China", which are represented by the " The new exchange of journalists confirmed the news from the person who came close to the Internet Financial Risk Special Rectification Working Group (hereinafter referred to as the Leading Group) and learned that the resolution had been deployed to the local level.

#Bitcoin plunges by almost 7% as #China to shut local Bitcoin exchanges, local media reports. - @Schuldensuehner

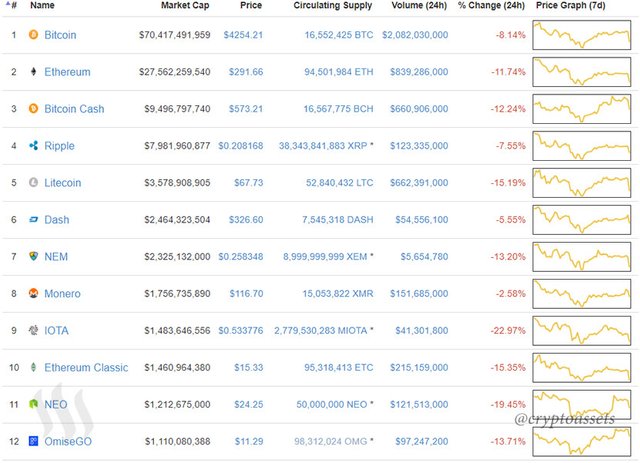

Today in CoinMarketCap - Last updated: Sep 08, 2017 3:40 PM UTC

September 8, the third-party trading platform to pay the announcement, announced on September 5 and September 8, the spirit of Beijing Financial Work Conference and requirements, since the beginning of 17:30 to suspend all currency transactions.

This is following the September 4 People's Bank of seven ministries and commissions joint announcement (hereinafter referred to as the announcement) after further supervision action. The announcement will mark ICO (Initial Coin Offering) as "illegal financial activities" and order the ICO to be banned on the date of publication of the announcement. All ICO tokens trading platforms need to be cleared to close the transaction.

The purpose of regulation is not limited to more than 60 ICO tokens trading platform, will not engage in a number of ICO virtual currency trading platform into the clean-up range, limited to close.

"In other words, the future in China can not have the so-called virtual currency and the currency between the trading platform." The close to the leading group, said: "In this way, there is no so-called tokens, virtual currency and RMB between the two Can not trade the problem. "

The investigation by the regulators on virtual currency trading places did not suddenly hit, but began research earlier this year. At present, the leading group has made judgments and careful deployment.

The central seven ministries and commissions in the September 4 joint announcement, has issued a signal: Notice Article III "to strengthen the management of tokens financing trading platform" that since the announcement date, any so-called tokens financing transactions The platform shall not engage in legal currency and tokens, "virtual currency" between the exchange business between each other, not trading or as a central counterparty to buy and sell tokens or "virtual currency", not for the tokens or "virtual currency" to provide pricing, information intermediary And other services.

It should be noted that this decision is closed between the virtual currency and the currency between the trading platform, that is only prohibited in China within the virtual currency trading, not to prohibit all the virtual currency and French currency transactions in China. "Close to the spot currency exchange, not against Bitcoin." The aforementioned close to the leadership group stressed that banning and Bitcoin exchange-related activities do not affect the development of block-chain technology.

According to the close to the leading group sources, from the perspective of risk prevention, so that virtual currency and currency trading activities out of China, mainly in the market risk, financial risk and social risk of three levels of consideration.

The distorting effect of the secondary market

Since 2013, regulators have been at risk of distorting the secondary market of virtual currency. At that time, Bitcoin's trading volume in China surpassed 90% of global trading volume and pushed Bitcoin to a record high of 8,000 yuan. Individual exchange to do the village, put the lever and even the practice of self-theft has been exposed. Five departments jointly issued the 289, the price of special currency and fall.

Did not expect to enter 2017 years later, Bitcoil comeback, not only re-boarded the historical high of 8,000 yuan, more repeatedly refresh the record, in July 2017 up to 30,000 yuan each, once known as the target 50,000 yuan. According to the new financial reporter to understand that the regulatory authorities are deeply risky, as early as the first half of this year has brewing the relevant regulatory measures. Did not think that then the ICO came so fierce, Bibi currency rose more fierce is the standard Bitcoin, the ether square of the various types of tokens, which first triggered for the tokens issue and transaction of strong supervision.

According to the National Internet Financial Security Technical Committee issued the "July domestic bit currency transactions monitoring report", in July 2017, the domestic spot transactions turnover of 30.17 billion yuan, down 11.6%. From a global perspective, accounting for 30% of the global total trading volume. Since the exchange began to receive transaction fees since the February-April domestic bitco currency turnover has declined. With the rapid rise in transaction prices, since April the turnover of Bitcoin continued to rise.

From the perspective of market risk, regulators have argued that virtual currency trading places, including its secondary market risk is quite large. "It is not clear what the basis of these values, the so-called value is the imagination of technology space, there is no qualified investment standards." This "value" with the real economy has nothing to do, so the rapid rise in the price of the secondary market , Once the price fell, ordinary investors bear the loss is very large. In the first half of this year, regulators have voiced this market risk.

Suspected illegal securities activities

Regulators believe that virtual currency investment activities for illegal fund-raising and other types of illegal financial activities provided a hotbed, easy to cause greater financial risk. Because ordinary investors can not distinguish between the difference between Bitcoin and Leigh coins, but also can not identify the difference between the various pseudo-virtual currency. And a large number of "money" illegal fund-raising activities are from the bitter currency frenzy, including the special currency trading places frenzy. "The bitter market is hot all the crazy 'currency' market and one of the root causes of illegal activities chaos, ICO crazy also from Bitcoin crazy. Bitco currency trading place chaos and bit currency hot , Triggering the use of Bitcoin to support illegal financial activities, including pyramid schemes, fraud and other issues.

In the first half of this year, regulators organized an approach to some exchanges, followed by a 90% drop in domestic sales. "In fact, because there are a lot of false transactions, some both the trading platform and the transaction side, such a place how to ensure the interests of investors?" The source said that despite the supervision of the beginning of this year, The real name system, anti-money laundering and other requirements, but a large number of exchanges have failed to implement.

"Some platforms in order to make the market look very prosperous, to carry out financing coins, leveraged transactions, the opening of futures, as well as split the sale of virtual currency behavior. Now spend 100 to buy Bitcoin, buy only a bit of currency A small part, in fact, is the currency of the rights and interests of the split, which means that the case of this split has become a class of securities, while the split is actually easy to speculation, essentially belong to illegal securities activities.

The close to the leading group pointed out that the need to draw three concepts, namely, block chain, Bitcoin and Bitcoin Exchange. "Bitcoin can not be equated with the chain of blocks; Bitcoin can not equate with the bitcoin trading floor; Bitcoin trading and block chain technology do not have the slightest relationship." He said that the virtual currency market, in essence, To provide a place to match the transaction, some virtual currency exchanges and even financial financing function, "with the general financial exchange is no different."

Be wary of social risks

In addition, the regulatory authorities believe that the virtual currency, represented by Bitcoin, is increasingly becoming an "accomplice" for all kinds of criminal activities. It facilitates activities such as money laundering and terrorist financing, and it is easy to create a large society outside the financial system risk. For example, Bitcoin has become an important cornerstone of darkline trading, criminals through the bit by currency in the sale of drugs and contraband, the annual profit of about 100 million US dollars.

Regulatory authorities found that in recent years the country can focus on a number of transactions related to virtual currency transactions, virtual currency has become illegal elements of the implementation of fraud, illegal fund-raising, network pyramid schemes and other illegal activities of the important subject and illegal funds circulation carrier. One of the original intentions of the invention is to avoid supervision, its anonymity and global characteristics to make it into the regulatory system is extremely difficult, if allowed to develop, it will combat the underground economy and other illegal problems, virtual currency transactions The existence of the great convenience to the lawless elements to obtain and transfer the virtual currency.

The close to the leading group said that the virtual currency trading venues did not have any benefit to the development of technology, at the same time its existence also conducive to criminals to obtain virtual currency and the use of virtual currency difficult to track the characteristics of illegal financial activities and criminal activities, Therefore, the regulatory authorities decided to close it.

"Now the tone is strict control of financial risks, but the existence of Bitcoin Exchange on the real economy what? We can not see." The close to the leading group said.

Previously the market had discussed whether it should "open the door" to virtual currency floor trading, including setting the investor threshold or "sandboxing". The close to the leading group said that setting the investor threshold may reduce market risk, but can not avoid financial risks and social risks. If you recognize the virtual currency trading platform, it is inevitable to endorse it. "Bitcoin's market risk, financial risk and social risk are uncontrollable.

At present, the three largest virtual currency trading platform for the domestic OKCoin (accounting for 22.5%), Bitcoin China (accounting for 19.7%) and the coinage network (accounting for 18.2%), the three together accounted for 60% The As the Chinese regulatory authorities have been in the account real name system, prohibit the use of leverage, anti-money laundering and other restrictions on the implementation of the relevant exchange, the current currency in China accounted for the proportion of global trading volume, has dropped from 90% in 2013 to the current To three into.

Editor: Ling Hua Wei | Layout Editor: Li Lisa

***********

According to the website allcryptocurcurrencies.news are fake news

Time to load bags?

Sources:

» http://finance.caixin.com/2017-09-08/101142797.html

» http://www.allcryptocurrencies.news/bitcoin/bitcoin-crash-of-8-september-due-to-fake-chinese-news/

Hope a temporary Ban , so i can buy cheap Neo :)))) or other lambo coins

Disclaimer: I am just a bot trying to be helpful.