SALT - Cryptocurrency Backed Loans

#SALT Highlights*

Started: July 28, 2017

Market cap: $188,253,477

Price per token: $3.84

Reddit subscribers: 633

Twitter followers: 10,700

Facebook likes: 7,330

Circulating supply: 49,025,364

Max supply: 120,000,000

Consensus method: ERC20

Whitepaper: https://membership.saltlending.com/files/abstract.pdf

What is SALT?

SALT is a secured automated lending platform which aims to break down traditional financial barriers and reinvent the way we look at borrowing money. Typically, getting a loan involves passing a credit check, filling out endless forms, waiting on approval and, if successful, the borrower agrees to pay back a certain sum (plus interest) by a certain date. In a traditional loan, the borrower is borrowing against future earnings rather than existing assets.

SALT is different. Loans taken out on the platform are cryptocurrency backed, meaning the borrower can stake blockchain assets (bitcoin, ethereum, etc.) as a form of collateral in order to receive money from lenders. Rather than borrowing against future earnings, which there's no guarantee they'll have, users can leverage an asset they already own. Furthermore, there's no need for credit checks - the blockchain assets staked are proof of ability to repay.

Ultimately, the SALT platform is working to be the bridge between traditional financial systems (and lenders) and the vastly growing blockchain economy (and it's borrowers).

How does it work?

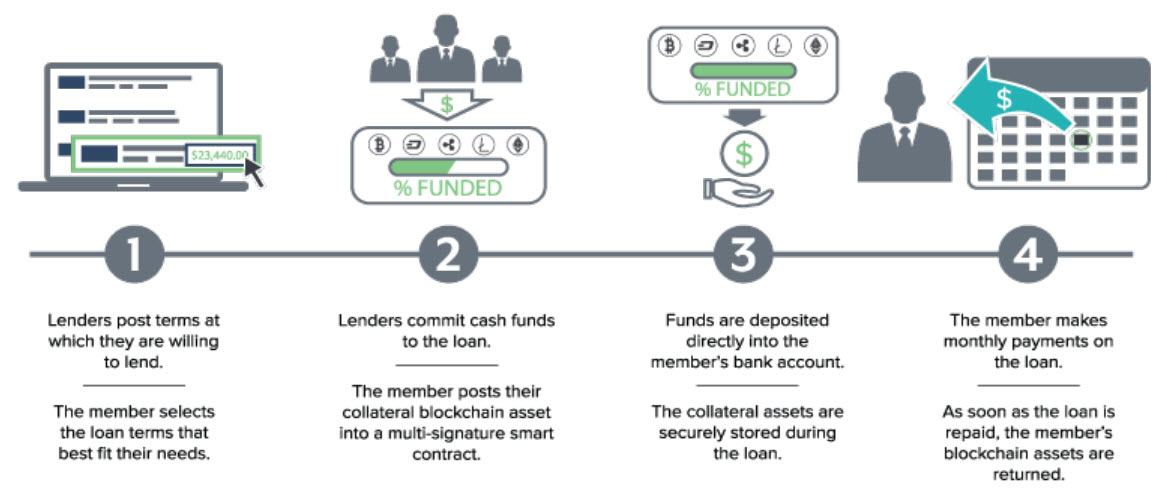

First of all, users have to sign up to the platform, which is expected to initially launch in Q4 of this year. Although there are no credit checks involved, anti-money laundering (AML) and know your customer (KYC) requirements will still be applicable, at least for loans of $2,000 or higher. As far as the actual loan process, here's a great graphic from the SALT whitepaper which sums up the basics:**

On the surface it doesn't sound that different from a normal loan - the platform connects borrowers with lenders and the borrowers make regular payments on the principal amount (plus interest) until the loan is paid off. However, SALT has a lot going on which sets it apart from a typical loan.

Borrowers stake blockchain asset to prove their creditworthiness which removes a number of barriers of the traditional loan system - no credit check, approvals are quick, geographic location is irrelevant and, since the assets are already owned, repayment isn't really a concern. There are no fees other than initial membership, starting at 1 SALT per year, meaning there's no closing costs or penalties for early repayment.

SALT also takes a new approach to storing the assets and resolving loan conditions. All collateral is stored on a multi-signature wallet with a private key given to the lender and borrower, as well as the SALT oracle and a third-party custodian. The platform then makes use of smart contracts to automatically release funds and collateral - no need for a middle party.

The SALT oracle is the main actor behind the scenes, making everything between loan origination and conclusion work. The oracle acts to:***

- Monitor the loan origination and payments made by the borrower;

- Monitor the value of the assets held as collateral;

- Generate alerts if the value of the assets drop below an agreed upon threshold;

- Trigger maintenance calls;

- Store collateral until loan conditions are resolved; and

- Disperse and/or liquidate the collateral, according to loan terms.

The oracle pulls real-time market prices from several exchanges across the world in order to determine the value of collateral at the origin of the loan and will continually monitor those values through the lifetime of the agreement. If at any time the value of collateral changes dramatically relative to the loan (the whitepaper states this threshold will be dynamic and will depend on the individual loan agreement) the oracle will act to rebalance the loan.

Now that some of the details are covered, let's walk through an example of what this process could look like:****

John, a borrower seeking a 1-year loan of $100,000.00, is matched with Eric, a lender offering cash at a 10% APR (annual percentage rate). The terms of the loan are that it will be repaid in 12 monthly payments of $8,791.59 which accounts for the principal repayment and interest. John puts up 50 bitcoin as collateral which the oracle assigns a value of $2,500.00 per bitcoin at the time of origination, making the loan-to-value ratio 80%. Once the oracle has determined that Eric has deposited the $100,000.00 and John has sent his 50 bitcoin to a multi-signature wallet, the private key is given to both Eric and John and Eric's funds are released to John's bank account.

A month later, John makes his first monthly payment of $8,791.59 thus reducing the loan balance to $92,041.74 and the loan-to-value ratio to 73.6%. However, soon after the price of bitcoin drops to $2,000.00, causing the loan-to-value ratio to rise to 92%, crossing the agreed upon threshold. The SALT oracle then triggers a collateral maintenance notice to John via email and SMS, instructing him to either deposit an additional 7.53 bitcoin or make a payment of $12,041.74 by a certain date, either of which would return the LTV ratio to 80%.

If John is unable to, or chooses not to act on either of these, the oracle will begin to liquidate some of the collateral to meet these requirements. Pending three confirmation signatures, the oracle will sell 30.1 bitcoin for a value of $60,200.00 in order to reduce the loan balance to $31,841.74. This remainder would then be secured by the leftover 19.9 bitcoin at $2,000.00 each, restoring the 80% LTV.

However, in this case John is able to contribute the additional 7.53 bitcoin, thus restoring the LTV and avoiding liquidation. However, there is again a dramatic change in price and bitcoin rises to $3,500.00, causing the SALT oracle to trigger a maintenance notice to John with the option to increase the loan principal, withdraw some of the original collateral to restore the LTV ratio, or do nothing. John chooses to withdraw 25.96 bitcoin, thus once again achieving an 80% LTV.

The rest of the loan term goes on uneventfully and John makes his final repayment 15 days before the end of the term. The oracle acknowledges the loan terms have been fulfilled, and returns the balance of the collateral to John.

Thus we can see an example of how the SALT platform works from origination to conclusion, as well as the critical role the SALT oracle plays in it. The entire process occurs over globally distributed servers, though the back-end marketplace is centrally owned by SALT.

Why use blockchain assets as collateral?

At first glance, blockchain assets may not seem like the ideal asset to stake against a loan. After all, look at bitcoin the past few months - the price has been all over the place and as shown in the example above that these fluctuations can force the borrower to take action in order to rebalance the loan. This is one of my concerns with the SALT lending platform. It's not clear how far the LTV ratio can differ from the loan terms before triggering a maintenance call, but I can't help but wonder if maintaining a loan during particularly volatile periods might be a hassle which would detract from the user friendly loan experience SALT is promoting.

However, most blockchain assets do have an inherent advantage over traditional collateral. They can easily and instantly be transferred, can be split into fractional amounts and are easy to store and secure during the length of the loan.

Furthermore, imagine the possibilities if blockchain technology really took off. Right now, blockchain companies like Factom are working with business and government on creating immutable records. Think of all the assets that record of ownership could capture in this manner - cars, houses, maybe even collectibles. If that were to happen, theoretically almost any owned asset could be staked as collateral on the SALT platform in the future.

Platform adoption

Adoption and use of the SALT platform is by far the biggest barrier faced by the team. This could be said of virtually any cryptocurrency out there, but the issue is multiplied with the SALT lending platform. Why?

There are 7.6 billion people in the world, but only a fraction of them are involved in cryptocurrencies; that number is a bit harder to get at, but let's go with 15 million which is the number of blockchain wallet users in September 2017.***** Assuming that only a fraction of this number are interested in borrowing money, and an even smaller number are both willing to lend money and are comfortable loaning against a highly volatile asset, what does the pool of potential users become? Then add in the consideration that not all currencies will be initially supported (USD will be the only supported currency under the basic membership) and that regulations in different countries may restrict platform use and what's realistically left in terms of a user base?

Of course as cryptocurrency adoption grows as a whole, it would make sense that this pool grows as well. The thing is, that initial pool of lenders are probably going to want to be adequately compensated for being the first to jump in and offer their capital against a volatile, relatively unknown, asset. That means APR's may not be all that appealing out of the gate and without affordable lending rates, adoption by borrowers is going to be limited as well.

See the potential issue here? The entire possible pool of users is already small. Lenders may be limited which means little competition and those that do partake are going to want to be compensated more than they would in a less risky, more established venture which could then potentially alienate borrowers faced with lofty APR's.

That being said, there are factors at play that could drastically reduce these barriers. Firstly, the borrowers in this space may very well be people who are unable to secure a loan via traditional means (poor credit or no access to financial institutions) and are therefore willing to pay a premium to secure a loan. On the other end of the spectrum, lenders eager to gain exposure in the cryptocurrency space may be willing to take on that risk at a reasonable APR, or SALT may even secure agreements with lenders to provide low rates at the outset.

At this point in time, there's simply not enough information to know what the adoption outlook will be but it's certainly worth keeping in mind while evaluating the potential of SALT.

SALT membership******

The SALT platform offers three membership tiers with the amount of capital available to be borrowed, currency availability, flexibility of loan terms and supplementary features improving from tier to tier.

The annual pricing, as outlined in the membership portal, is 1 SALT for the basic membership, 10 SALT for the premier membership and 100 SALT for the enterprise membership. In terms of dollar valuation, the whitepaper states the SALT tokens will be $10 but logging into the platform gives a different story:*******

Therefore it seems the initial price of 1 SALT token will be $25, putting the membership packages at an annual cost of $25 for basic membership, $250 for premier membership and $2500 for the enterprise membership. Membership values are in USD but SALT will accept any traditional/cryptocurrency available in ShapeShift.

Supplementary features

The SALT platform has a number of offerings that are available depending on membership tier. The first one that is interesting, particularly from an investment standpoint, is the ability to use SALT credit to lower the cost of interest payments. This adds utility to the SALT token beyond just memberships access and could potentially create additional demand for SALT tokens.

SALT also offers branded hardware wallets (Ledger Nano S) in both of the upper tiers and cold storage enterprise wallets in addition for the top tier. Line of credit backed credit and debit cards, which I don't believe will be available at launch, are a great feature which should help with adoption and make the transition between blockchain asset and spendable funds even more seamless.

The SALT team

The SALT team is one of the main things that drew me to this project in the first place. For starters, Erik Voorhees, who started ShapeShift is an advisor. Shawn Owens, the CEO, is an entrepreneur with a background in hospitality; the financial lending space is definitely a pretty dramatic change but he has a fairly extensive resume of management and leadership positions. Josef Schaible has been involved in companies like WealthForge and NexTrade and has more than 20 years of experience in senior roles within the financial space. David Lechner has a resume of financial roles going back 15 years, with the last 6 years being senior management roles. These are just a few of the leadership team that really stand out, and that's not even covering any of the other 17 members of the 21 person team (the site lists 21 team members but the FAQ states there are 25).

One other thing I really love about the team is that even though there was a seed round to raise funds, the founding members of the team all put some of their own money into the project and are therefore personally invested.

What makes SALT great

- It's a disruptive play that bridges a massive traditional market with a rapidly growing, under-served market;

- The team is fantastic;

- Appear to have the regulatory side covered (at least for the US market), including a partnership with First Bank to hold USD;

- The platform will be up and running soon and first impressions are positive;

- Asset-backed loans eliminate the need for credit checks and offer a number of advantages over traditional loans;

- Using blockchain assets overcomes a number of limitations that traditional assets would have;

- Market potential is massive (assuming continued crypto adoption); and

- Loans are a great application of smart contracts.

Concerns about SALT

- Adoption is a major concern;

- Volatility in the market could lead to a frustrating loan experience;

- Unclear what obstacles there may be to wider adoption in terms of regulations and available currencies;

- Possibility that a large portion of borrowed capital could be reinvested into cryptocurrencies, which could lead to extensive defaults in a downturn; and

- Token value will require platform demand to increase.

Competitors

Othera. Othera is an Australian based company working on building a blockchain lending platform and token exchange. They appear to have a solid team with some good partnerships and have been operating since 2015. The demo of the platform isn't publicly accessible and information is limited so it's difficult to make much of a judgement. However, Othera seems to be working directly with other businesses to implement blockchain platforms rather than targeting the consumer side and don't appear to be focusing on asset-backed loans.

Credit Suisse and other banks. A few articles suggest that Credit Suisse are working on a blockchain loan platform of their own. If successful, they'll be making use of smart contracts like SALT, however at this stage it doesn't look as though they will be asset-backed loans.

Is SALT a good investment?

SALT currently sits 34th on coinmarketcap.com with a market cap of $188M and a price of $3.84 per token. The total supply of SALT tokens is 120 million, with 20 million being allocated for platform development and to employees, leaving 100 million to be sold. Of this, 45.5 million were reserved for retail sales (directly through the SALT platform) while the remaining 54.5 million were offered through the ICO.

However, this is one case where I think it's worth looking beyond market cap. The SALT tokens are being priced at $25 each and there's a total supply of 120 million, meaning the actual net valuation of the platform is $3B. Looking long term, it's important to ask yourself whether that's a realistic valuation or not. The service is only going to be applicable to those that have blockchain assets to stake and right now, the total market cap of all cryptocurrencies is a little over $200B. That puts SALT at a valuation of around 1.5% of the existing market.

You might notice there's a bit of a gap between the current price ($3.84) and the retail price of a SALT token ($25). I think at the current price point, this makes for a good pickup at least in the shorter term but don't expect the price to increase 6x just because the platform launched and $25 is what the tokens are being sold for. The platform will offer 45.5 million tokens at retail price and there will be up to another 55.5 million available on the market so unless there's a massive amount of initial demand, the available supply of tokens will likely keep the tokens at least somewhat discounted. I expect there to be a bit of a run up in price closer to platform launch which could provide some short term gains, but I'm guessing the token price settles in the $9-$13 range, pending sufficient platform adoption, at least for the first while.

There's a few scenarios that could impact this figure though. The SALT team could start buying up the circulating tokens to restrict the supply of discounted tokens (this has been rumored as a possibility) which would drive the price up a lot closer to retail value. However, there's also the chance that initial demand for the platform is low in which case the value would be limited in the short term.

One wildcard that could impact long term price is the ability lower the cost of interest payments, effectively using SALT to repay part of the loan. The additional functionality of the tokens could lead to more tokens used per loan, reducing supply and driving price up. The actual retail price of SALT tokens could also be raised in the future which of course increases long term valuation.

Overall, I think there's a play to be made here both in the short term and long term. However, adoption is going to be a significant price factor.

Conclusion

SALT is a disruptive play which aims to be a bridge between an increasingly valuable, under-served market and the massive traditional financial market. There's a real opportunity here to cater to individuals who are unable to obtain loans from traditional means while giving more traditional lenders a chance to tap into the crypto market.

The team is fantastic, the platform launches soon and the project addresses a real-life use case; however, I have concerns about market size and platform adoption, as well as if volatility in the market will make the process painful for the borrower.

I think it's worth a small investment with an opportunity to flip leading up to platform launch or hold long-term for the potential at $20+ per token if you believe the platform can achieve wide-scale adoption.

If you have any comments, post below! If you enjoyed the article and found it informative, please consider leaving a small donation to help support the site. You can let me know how much you appreciated it with a donation of SALT or any other ERC20 token to the following address:

0xEFC6eb094CA849DB9b8628B6cC9c1e601ECf21bc

Alternatively, I'm more than happy to take other donations:

Bitcoin: 1NMsXX96CiMnS5WPy9KQbFJCbzqXPM2qbv

Litecoin: LWBN5P3vj8F6zrCB2pbFS8ynU5194hbA7W

If you are unable to donate, consider supporting Crypto Advocate in other ways - learn how at https://www.cryptoadvocate.net/contribute

References and Notes

This post originally appeared at https://www.cryptoadvocate.net/single-post/salt-cryptocurrency-backed-loans and was modified slightly for relevancy and for the steemit audience.

*Logo, as well as all stats are from coinmarketcap.com with the exception of social following which is taken directly from the social pages

**Image taken from SALT whitepaper, page 7

***Adapted from "Key features of the SALT Oracle" on page 12 of the whitepaper

****Adapted from the example of "overcollateralized loans" on page 7 of the whitepaper

*****https://www.statista.com/statistics/647374/worldwide-blockchain-wallet-users/

******Image taken from https://www.saltlending.com/

******Pricing info and screenshot taken directly from SALT membership portal

All other information is either adapted from the whitepaper and other research or is personal opinion.

Crypto Advocate does not have any holdings in SALT at this time (full disclosure - will likely purchase some in near future).

Congratulations @crypto.advocate! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP