Power Ledger: Reinventing Energy Distribution (Altcoin Review)

What is Power Ledger?

Power Ledger is a trustless platform with the goal of reinventing energy network distribution. They will do this in three ways: <2>

- Providing an incentive for connecting to distributed energy resources;

- Including individuals in high-density or limited access housing in the distributed energy economy; and

- Mitigating the risks associated with the centralization of major network assets.

In the current system energy is distributed by a centralized electricity provider which is the main entity profiting from the distribution of energy. The first issue with this model is that there is a single point of failure - the energy provider. In the event of a natural disaster the entire network can be wiped out quite easily leaving everyone reliant on that network without access to energy for an extended period of time; even a storm can leave entire neighborhoods in the dark for several hours. The second issue is that although prosumers (both a consumer and generator of energy) can offset some energy costs by generating their own electricity via solar panels and the like, they are not adequately incentivized to generate excess. Lastly, consumers have little to no control over what types of energy they receive or who they receive it from.

Power Ledger wants to flip this model on it's head by democratizing the consumption and distribution of energy. This new system will enable peer-to-peer energy trading, allowing prosumers to use their excess energy as they see fit whether that's to make profit, to power the community or to give energy to those in need. As a result, a clear incentive to invest in renewable energy production is developed and it brings high-density housing into the fold as well. Under the current system, users have little to no choice about energy as the entire complex is likely all fed by the same distributor. With Power Ledger, users can purchase energy via the peer-to-peer trading platform, giving them control over the type of energy they consume and the prices they pay for it. For the first time ever, landlords stand to benefit from installing renewable energy generation assets, expanding adoption further. As the different actors in the platform expand, the network becomes a massive micro grid meaning there is no single point of failure and even if parts of the network were to fail, it's unlikely the failure would be widespread enough to bring down the network.

At first glance, it seems like existing energy providers would strongly oppose this and thus make it difficult to build up a network vast enough to supply a large number of people. However, "there is an inconvenient truth facing the traditional energy supply industry: at some stage, it will be cheaper and more effective to self-supply than to rely on the network to provide low-cost and reliable clean energy." <3> With rising demand and increasing affordability of renewable energy sources, it's only a matter of time before these providers will be forced to adapt. However, Power Ledger isn't aiming to push these organizations aside; in fact, they have reserved a large portion of the tokens for these organizations and have struck up partnerships with several of them already.

Power Ledger Highlights <1>

Started: May 2016

Market cap: $242,469,927

Price per token: $0.69

Reddit subscribers: 4,904

Twitter followers: 25,400

Facebook likes: 11,848

Circulating supply: 351,088,694

Max supply: 1,000,000,000

Consensus method: ERC20

Whitepaper: https://powerledger.io/media/Power-Ledger-Whitepaper-v3.pdf

How does it work?

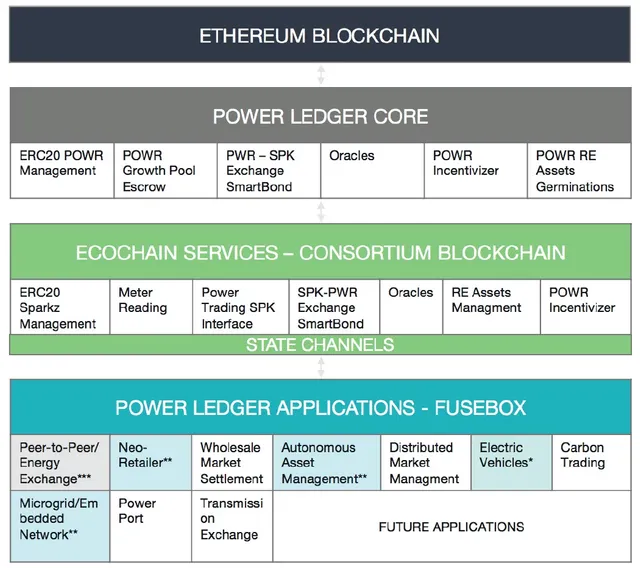

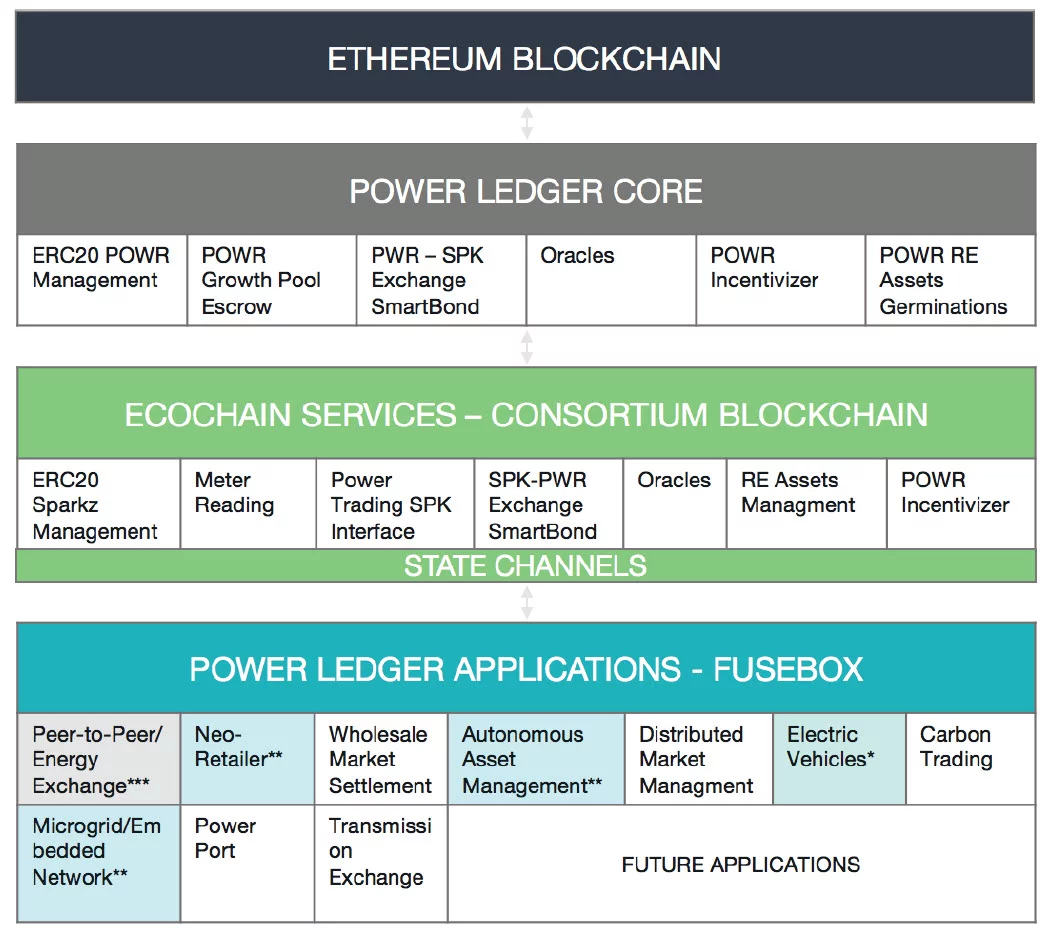

Power Ledger can be thought of as a suite of applications revolving around the participation and management of a distributed energy resource market. To make these applications work, Power Ledger utilizes a number of different layers of technology: <4>

At the top level is the Ethereum blockchain which Power Ledger is built off of. The Ethereum layer is used for token distribution, interactions with token exchanges, and it provides smart contract functionality. The Power Ledger Core layer handles public smart contracts including the exchange of POWR/Sparkz, Green Energy Loyalty Rewards Program, renewable energy asset germination and gathering external information via the oracle. The Ecochain layer is a private proof-of-stake blockchain developed by Power Ledger which handles the creation and management of Sparkz tokens, processes payments, stores and verifies meter reading and manages autonomous assets. State Channels then provide a way to execute blockchain transactions in an off-chain manner via multi-signatures or smart contracts which are then sent to the blockchain. Lastly, the application layer or Fusebox, is where the actual use cases of Power Ledger come out such as peer-to-peer energy trading and autonomous assets. <5>

Applications of Power Ledger

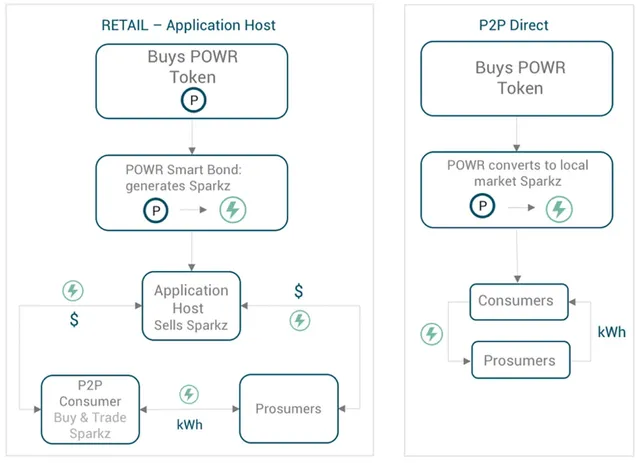

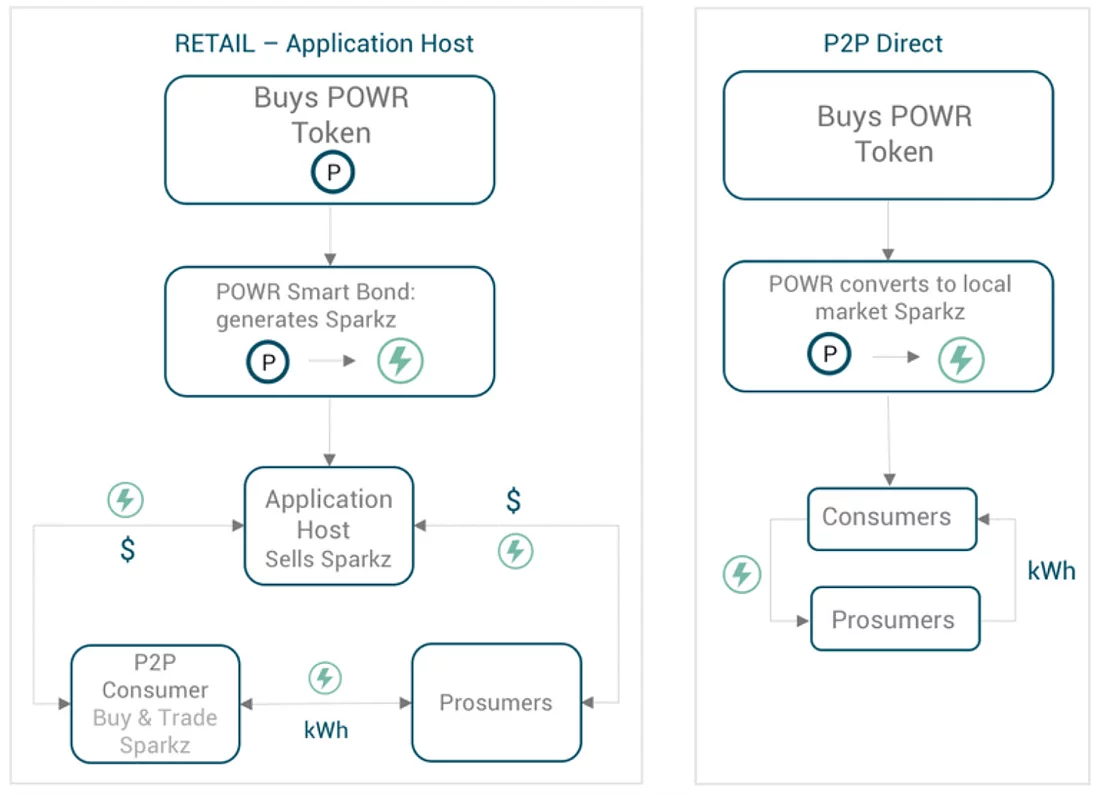

One of the primary applications of the Power Ledger platform revolves around the conversion of POWR into Sparkz, which are a transactional token representing the value of energy traded and are valued at the lowest denomination of local currency (E.g. 1 Sparkz is equivalent to $0.01 AUD). Sparkz then power the peer-to-peer energy trading market and can be converted back to POWR or into fiat. This market can take place either in a decentralized manner or in a more traditional retail model: <6>

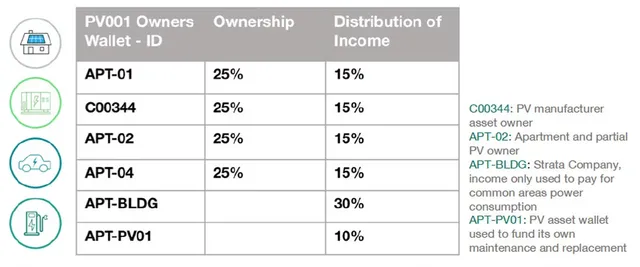

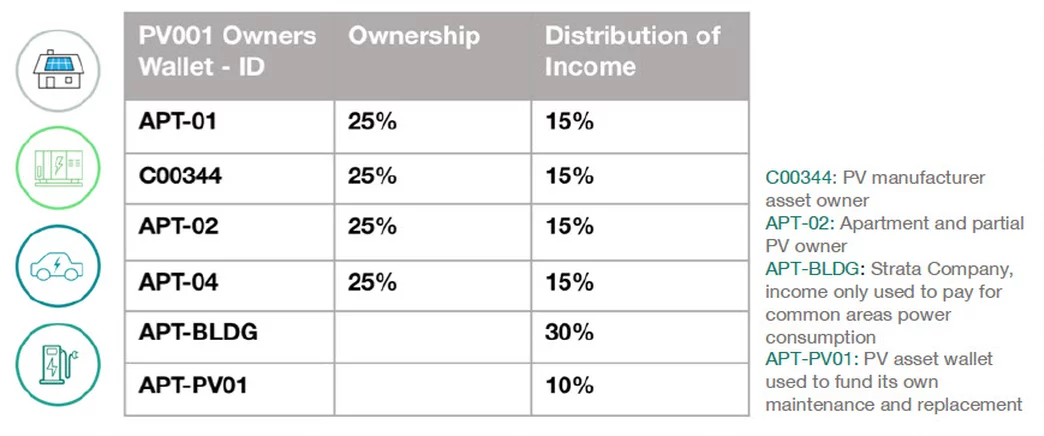

Another application of Power Ledger is autonomous asset (AA) management which allows users to share ownership of and trade renewable assets. For example, POWR holders could crowdfund new solar panels for an apartment complex, with earnings distributed amongst the contributors: <7>

Applications of the platform go well beyond just peer-to-peer energy trading and autonomous asset management. Other use cases include: <8>

- Smart demand and supply management as well as instant payment settlements for retailers;

- Electricity metering, big data acquisition and grid management at scale for microgrids/embedded network operators/strata;

- Fast, low-cost and transparent wholesale market settlements;

- Rapid transaction settlement, network load balancing and management via distributed market management;

- Electric vehicle data and transactions;

- Automated power ports;

- Carbon trading; and

- Transmission exchange.

The POWR token

Power Ledger is is built off the Ethereum blockchain and as such POWR tokens are ERC20 tokens. At a high level, these ERC20 tokens acts as the fuel of the Power Ledger ecosystem, enabling application hosts and participants to interact with the platform and make use of the various applications within it.

The POWR token can be traded on third party exchanges either in return for fiat or cryptocurrency pairs such as ETH or BTC. It can also be traded within the platform, as described above, via Sparkz and the peer-to-peer energy trading market. As an example, in the retail model an application hosts would surrender their POWR tokens, which are held in escrow, and are given the equivalent value of Sparkz (ie: $1,000 worth of POWR for $1,000 worth of Sparkz). These Sparkz are then sold to consumers and are spent in return for energy generated by prosumers who in turn cash in Sparkz to the application host in return for fiat, replenishing the host's pool of Sparkz. These Sparkz can then either be distributed back to consumers or surrendered in order to redeem POWR tokens.

Throughout this process, Power Ledger takes a small transaction fee whenever energy is traded. This fee is then used by Power Ledger to buy POWR and distribute it to platform users under the Green Energy Incentivizer. The "greener" the user, the higher rewards they receive thus giving financial incentive to application hosts and prosumers to generate and distribute clean energy. This buy back of POWR tokens also serves to increase demand for the POWR token itself. <9>

POWR tokens can also be pledged towards autonomous assets, essentially crowdfunding renewable energy assets. The example of solar panels for an apartment was given above, though assets available to be funded could include everything from solar water heaters to a mass scale battery farm. Users must hold POWR tokens to partake in these asset germination events and are then given a percentage ownership of the asset and the income it generates (based on the funding plan and amount of POWR pledged). Additionally, users have the ability to trade ownership of these assets at any time.

In summary, the POWR token:

- Can be traded for fiat or cryptocurrency pairs;

- Is required to make use of Power Ledger applications;

- Can be used to generate Sparkz and partake in peer-to-peer energy trading;

- Grants access to, and can be used to fund, asset germination events;

- Provides further incentive for participation and clean energy production via the Green Energy Incentivizer; and

- Increases in demand as tokens are bought up for platform rewards and as supply is diminished due to POWR being held in escrow for Sparkz and/or autonomous assets.

Accomplishments <10>

Power Ledger, unlike many ICO's, already has a working product that is in use and has been for more than a year. An Australian pilot project was first carried out in Q3 2016 with National Lifestyle Villages, connecting more than a dozen dwellings to a blockchain-powered community energy marketplace. In Q4 2016 the first international deployment was carried out in partnership with Vector Ltd. in New Zealand and in Q2 2017 Power Ledger became the first company to use distributed ledger technology to facilitate electricity trading and settlements without an electricity retailer.

All of this was before the ICO in October 2017. Since then, Power Ledger has partnered with Synergy (a state-owned electricity retailer in Western Australia) to deploy an electric vehicle trading platform built on the blockchain, was one of the recipients of more than $8M in government funding to trial a blockchain-powered distributed water and energy network in Fremantle, <11> and has struck up several partnerships with industry leaders, energy retailers, community developments, developers and not-for-profits.

The Power Ledger team

Jemma Green, the co-founder and chair of Power Ledger, has more than 15 years experience in finance and risk advisory including nearly 6 years in global environmental and social risk management at J.P. Morgan. On top of this, Jemma is currently Deputy Lord Mayor of Perth, a research fellow at Curtin University and the RSA, chair for Climate-KIC Australia, on the board for Carbon Tracker and Water Corporation and is a founder of the Global Blockchain Business Council.

Honestly, if Jemma Green was the only notable team member the project would still have a lot of credit; however, the talent doesn't stop there. Dave Martin, a co-founder and managing director, has been in the electricity industry for nearly 20 years with much of this time spent in executive roles at state-owned electricity companies, and has spent the past 6 years consulting the industry on distribution networks and renewable technology. John Bullich, a co-founder and director, has spent nearly 3 years working on distributed ledger technology as the co-founder and executive director of Ledger Assets. Gov van Ek, also a co-founder and director, founded Ledger Assets alongside John and is also the co-founder of Bitcar.io, an exotic car ownership blockchain company. Jenni Conroy, another co-founder, has more than 30 years of experience in the energy industry and is the managing director of Future Energy, an energy consulting company. Marc Griffiths, CTO, has over 10 years experience as an engineer and has worked on a number of projects making use of blockchain technology and solidity (the coding language of Ethereum). Lastly, acting as board advisor is Bill Tai, a venture capitalist who has sat on the board of 7 publicly listed companies including Bitfury, Voxer and Scribd, as well as serving on the World Economics Forums Technology Pioneer Committee.

What makes Power Ledger great

- It's a disruptive play but rather than excluding the current participants, it's enabling them to participate while incentizing consumers and prosumers to take a bigger role;

- The team is fantastic;

- There is a working product that is in use and gaining adoption by the day;

- The platform addresses a real world issue;

- The idea is socially conscious and ethical as it democratizes access to resources and promotes the use of clean energy;

- The platform provides a number of applications with the potential to expand further in the future;

- As technology advances, clean energy becomes more affordable and adoption increases meaning increased demand for the platform and related technologies;

- Everyday consumers can participate; and

- The POWR token has multiple use cases and should increase in demand as the platform expands.

Concerns about POWR

- Even though the platform is in use, traditional energy suppliers have a lot of incentive to oppose the technology, especially in countries where clean energy has lower adoption than Australia;

- Although it aims to democratize energy networks, a large number of tokens are reserved for energy suppliers and theoretically the circulating supply could be bought up by these same suppliers, making the platform less decentralized;

- There are concerns around sensitive information including consumption, producers and transactions being stored on the blockchain;

- Many POWR tokens are reserved and therefore the circulating supply is low;

- The Community size is relatively small given the surge in market cap;

- At this stage it's unlikely anything beyond a small community could be powered via direct P2P meaning adoption by existing energy retailers will be key at the outset; and

- Although projections for renewable energy in the future are high, last year only $241.6B was spent on renewables across the globe. <12>

Competitors

Other peer-to-peer energy providers. Power Ledger isn't the first peer-to-peer energy network out there and it's not the only one to tackle the problem via the blockchain either. Powerpeers (not a blockchain company) was launched in the Netherlands in June 2016 and Energy Web Foundation, which is affiliated with some of the biggest names in utilities such as Shell, has launched a testnet recently. Other blockchain start ups such as LO3 Energy are launching soon as well.

Existing retailers. As mentioned, these companies make a lot of money from the existing model and they won't want that to change. Power Ledger has made some headway in Australia but it remains to be seen how many retailers come on board, especially internationally.

Is Power Ledger a good investment?

Power Ledger currently sits 38th on coinmarketcap.com with a market cap of $242M and a price of $0.69 per token, though it has recently been as high as $0.93 with a market cap of $324M. The total supply of POWR tokens is 1 billion, with 350 million (35%) made available in the ICO. A further 400 million (40%) are either held in escrow or given to the founders while most of the remaining 25% were reserved for platform hosts. <13>

Last year, $241.6B was spent globally on renewables with $4B of that coming from Australia, where Power Ledger is based and has some market adoption. <14> These figures provide some indication of the current market size and how much growth potential there is for Power Ledger. As mentioned, it already hit a high of $324M which accounts for almost 10% of the entire amount spent on renewables in Australia last year; clearly investors see value in the project. I'm not sure it's quite there yet but it's evident that as the renewables market grows and Power Ledger expands both domestically and internationally, the potential is certainly huge.

I think with the flood of news around Power Ledger recently, investors got a little too exuberant, leading to an increase of more than 15x the original ICO price, and the project arguably started to head towards valuations that weren't quite justified yet. However, the market has pulled back a bit and POWR is starting to become an attractive investment again, settling around 7k satoshi's.

Overall, I think if you're comfortable with Power Ledger being able to overcome some of the concerns raised, it makes for a great long term investment (provided you buy in at a reasonable point). There's other players in the energy blockchain space but the team at Power Ledger is second to none and the fact they already have a working product and are making progress is a testament to that. Personally, I'll probably look for a bit more of a discount before making an investment in POWR but if you strongly believe in the project the price is fairly reasonable right now. POWR is currently available on Binance.com and Changelly (referral links), as well as Bittrex.

Conclusion

Power Ledger is a trustless distributed energy platform working to reinvent and democratize energy networks as we know them.

The team is fantastic and there's a working product with a real world, ethical use case in market that is gaining adoption by the day. The renewable energy market is expected to grow extensively in the coming years and Power Ledger's blockchain has the capability to cover a wide range of use cases; needless to say the potential is huge.

However, I do have concerns over how democratized the platform will be if it gains mass adoption, how effectively they will be able to on-board energy distributors, and the recent rise in price has been a bit too exuberant for my liking, especially considering the community backing is pretty small compared to similarly ranked cryptos.

That being said, price has corrected a bit and there's no denying the potential of the project combined with the team behind it. I definitely like it is a long-term investment in a crypto portfolio and will look to pick some up myself depending on price action.

If you have any comments, post below! If you enjoyed the article and found it informative, please consider leaving a small donation to help support my ongoing efforts. You can let me know how much you appreciated it with a donation of POWR or any other ERC20 token to the following address:

0xEFC6eb094CA849DB9b8628B6cC9c1e601ECf21bc

Alternatively, I'm more than happy to take other donations:

Bitcoin: 1NMsXX96CiMnS5WPy9KQbFJCbzqXPM2qbv

Litecoin: LWBN5P3vj8F6zrCB2pbFS8ynU5194hbA7W

If you are unable to donate, consider supporting Crypto Advocate in other ways, such as sharing the site with your friends or using one of the referral links here. Even better, use my Binance.com referral link to pick up some POWR for yourself! You can also follow me here or on twitter @crypto_advocate.

References and Notes

This post originally appeared at https://www.cryptoadvocate.net/single-post/power-ledger-reinventing-energy-distribution and was modified slightly for relevancy and for the steemit audience.

<1> Logo, as well as all stats are from coinmarketcap.com with the exception of social following which is taken directly from the social pages

<2> Adapted from the whitepaper, page 17

<3> Whitepaper page 7

<4> Image taken from page 29 of the whitepaper

<5> Information about layers is adapted from pages 28-31 of the whitepaper

<6> Image taken from page 23 of the whitepaper

<7> Image taken from page 34 of the whitepaper

<8> Use cases taken from pages 15-16 of the whitepaper

<9> Adapted from page 8, https://tge.powerledger.io/media/Power-Ledger-Platform-Token-Interactions.pdf

<10> All achievements, unless specifically noted, are taken directly from page 12 of the whitepaper

<11> https://www.smartcompany.com.au/startupsmart/news-analysis/power-ledger-receives-part-8-million-government-grant-fremantle-blockchain-energy-project/

<12> https://arstechnica.com/information-technology/2017/04/global-investment-in-renewables-fell-in-2016-but-thats-not-a-bad-sign/

<13> Page 3, https://tge.powerledger.io/media/Power-Ledger-TGE-Token-Paper.pdf

<14> https://leadingedgeenergy.com.au/2016-4m-renewable-energy-spend/

Great piece by Jemma Green on blockhain taking on traditional energy: https://www.forbes.com/sites/jemmagreen/2017/10/04/how-blockchain-will-take-fossil-energy-by-storm/#26c99435288d

All other information is either adapted from the whitepaper and other research or is personal opinion.

Crypto Advocate does not have any holdings in POWR at the time of writing.