Australia sees the savings in a “smart money” cryptocurrency test

A blockchain trial has found potential savings of hundreds of millions of dollars for the NDIS

Existing limitations around what can and cannot be programmed by smart contracts are being pushed back

Smart money may carry enormous potential beyond the initial trial, for both better and worse

When you digitise money, a la cryptocurrency, with smart contracts, you get smart money. This was the foundation of a successful blockchain trial by CSIRO's Data61 and Commonwealth Bank.

Why crypto?

Each individual token in the test represented the amount of funds in AUD that the Australian government pays for specific disability services. This is the cryptocurrency of the system; although, whether it's technically a cryptocurrency depends on the exact definition one chooses to use. There's some overlap between terms like cryptocurrency, digital asset, token and smart money.

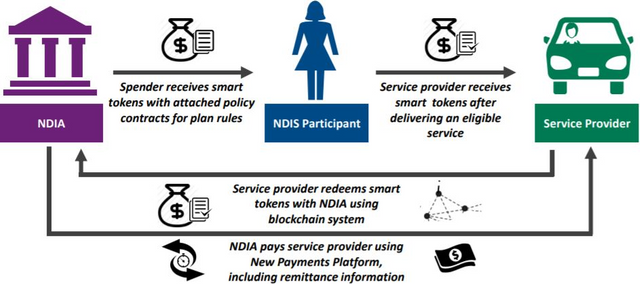

In this study, for example, if someone was entitled to $100 for a medical treatment related to their disability, they might get a $100 token which is programmed such that it can only be sent to a registered provider of that medical treatment.

That provider can then redeem this token through the National Disability Insurance Agency (NDIA) to receive $100 of real money after providing their services.

These tokens can be created, destroyed, programmed and re-programmed for different and changing circumstances. Generally, they can be programmed to absolutely anything at all, within the following limitations:

The technical boundaries of the blockchain platform. Some computational processes are too "big" and complex to easily run on some blockchains.

The kind of information that can be recognised by the system. For example, you need a data source to tell the blockchain who suitable service providers are, which means a registry of people who can provide certain services under the NDIS. More complete and reliable data sources mean more options.

Miscellaneous problems, such as whether there are loopholes which allow systemic abuse, or if it's worth the cost of doing certain things. Is it possible to check whether services have actually been rendered before tokens are transferred? Can any of the smart contract-feeding information sources be manipulated? Are the benefits of closing certain loopholes worth the cost of doing so? Do certain applications require the collection of too much information to be practical?

One's imagination. You have to think of something before you can do it.

As you can imagine, related developments like reliable self-sovereign identity systems and emerging blockchain data marketplaces can vastly expand the types of information that can be pumped into these kinds of systems, which in turn vastly expands its potential applications.

"Smart money that can "auto-regulate" is only the start," says Bit Trade managing director Jonathon Miller. "I think this is a really positive step in building out real world applications of blockchain without further encumbering government agencies with the regulatory burden of maintaining a centralised solution, and we expect many more exciting use cases for blockchain in Australia to play out in the months ahead."

And this is the kind of system that can theoretically be implemented with existing technology, rather than just being a vague promise somewhere down the line.

"Unlike a lot of previous examples of blockchain technology deployments that we've seen in Australia which have relied on the promise of utility for ecosystems that are yet to evolve, what’s exciting about this use case is that it shows us immediate utility that can be embedded into a variety of existing industries," says Huobi Australia head of marketing and communications Lien Truong. "It cuts out the middle men, reduces processing times by speeding up overall processes and reduces costs - particularly in both staffing and administrative functions."