Altcoins Receive Much Needed Enema

For the last few weeks, altcoins have emerged as truly viable alternatives to bitcoin’s previous omnipotence. As many analysts expected, with bitcoin prices soaring well above the $10,000 barrier, most newcomers found the king of cryptocurrencies cost prohibitive. But not wanting to forego the blockchain entirely, they sought out cheaper pastures.

Looking back, I believe this was one of the reasons why the so-called “banker owned” ripple coin skyrocketed the way it did. First, throughout most of 2017, ripple was priced well under a buck. But what separated this digital token from other cheap altcoins was that in terms of market capitalization, it rivaled the big boys, such as ethereum or litecoin.

Fundamentally, though, this bullish argument was flawed. Apparently, most rookies to cryptocurrencies overlooked or deliberately ignored the fact that ripple was extremely diluted. At more than 38.7 billion coins currently distributed, there’s a whole lot of ripple to go around. Contrast that with bitcoin, whose architecture limits the token to 21 million units.

This isn’t to pick on ripple: when you look at other altcoins, a good chunk of them feature extremely diluted token pools. As we learned from Economics 101, all other things being equal, increased supply necessarily decreases demand.

Essentially, cheapo cryptocurrencies had a license to print money. Everyone was jumping on the bandwagon, wildly skewing universal economic principles.

However, it appears that this strange dynamic is coming to an end, or at least temporarily so. Altcoins are suffering a brutal beatdown, a much needed enema. I use this descriptor because what makes this downturn different from the others is that the magnitude of decline appears correlated with economic law.

For instance, bitcoin, its offshoot bitcoin cash, and litecoin are currently registering single-digit losses against the prior day’s trade. Ripple, on the other hand, is down more than 16%, priced under $2 at Coinmarketcap.com. The aforementioned major cryptocurrencies have circulating supply in the millions. As previously mentioned, ripple is in the billions.

But that’s not all: Cardano, NEM, and stellar are all heavily diluted altcoins, and all are incurring double-digit losses. Having limited supply doesn’t guarantee protection from the downfall, but having too much supply clearly doesn’t help.

In the long run, I believe this correction to be a net positive for the blockchain. Too many cryptocurrencies have jumped for absolutely no reason other than they’re loosely associated with the bitcoin concept. Furthermore, investors will probably welcome the return of basic fundamentals to the digital markets.

Corrections are healthy and natural! I was beginning to wonder when things were going to drop down- it got a little scary how fast things were growing.

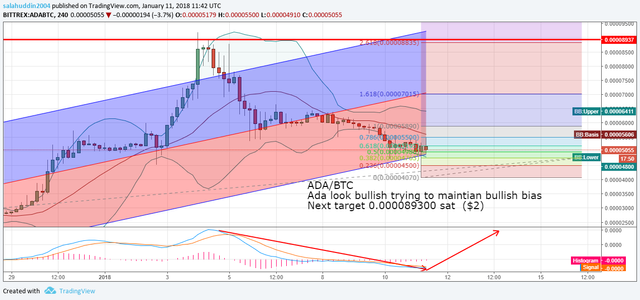

ADA Cardano Prepare for Bullish Rocket

Bitcoin made big gains in the beginning because of its structure and concept. After a skyrocketing price was obtained, I believe that the "powers that be" or those that print, mostly digitally create the world reserve currency, decided that they could purchase large amounts of Bitcoin. Therefore drive the price even higher and begin to gain some control in a system that they have no control over.

See when crypto currencies finally put themselves in a position where the public took notice, they also had to make a move that enabled them to retain the freedom of markets they were designed to do in the first place. This is about the time period when Bitcoin split and created Bitcoin Cash, like all good strategies, the split was said to increase the size of the block, and therefore make transaction times faster, which it did. But it also created an alternative angle for the people that were there in the beginning, that truly built the structure. They all received Bitcoin Cash based on the amount of Bitcoin they held, but only when the split took place. Everyone spending huge amounts of currency to get in afterwords were out of that loop, and therefore had to purchase Bitcoin Cash separately. Most other Altcoins really started springing up at this same time period, and could very well be following the same strategy. MOST, not all, obviously coins like Ripple appear to have a counter intuitive agenda.

Part of the idea behind Crypto currencies was to eliminate the banking system as we know it. Until that system is taken down, the bankers will always create there power out of thin air and manipulate any and every system that remotely stands in there way. As long as they can purchase in U.S. Dollars, Japanese Yen, or any other currency they can create for nothing, we'll have a constant cat and mouse game taking place. Take a look at this link from the Dodgecoin builder..

https://motherboard.vice.com/en_us/article/9kng57/dogecoin-my-joke-cryptocurrency-hit-2-billion-jackson-palmer-opinion