UniDapp: A Better Alternative to Uniswap

Cryptocurrency exchanges make it easy for people to buy and sell crypto assets. Over the years, the development of crypto exchanges has seen an exciting rise in innovation. Uniswap is a new exchange that brought a new dimension to crypto trading. It is a decentralized exchange that operates solely on the Ethereum blockchain.

This means you can only trade Ethereum-based assets on it. Uniswap acts as a platform where cryptocurrency swapping takes place through the use of 2 smart contracts. Basically, you can instantly swap ETH for other tokens and vice versa on the exchange platform.

Although Uniswap has been functioning since 2018, it didn’t get its big break till the advent of Decentralized Finance (DeFi) projects in 2020. DeFi-based coins listed on Uniswap saw a huge pump in their prices as investors scrambled to acquire these new gems.

Consequently, trade volume on the exchange climbed and even surpassed the 1 billion mark within 24 hours. In terms of trade volume, Uniswap is now third, behind the big boys – Binance and Okex respectively. However, while Uniswap continues to break records and gain more liquidity, huge questions have been raised over its sustainability for the long-term. Some of the problems faced by Uniswap include;

Disadvantages of Uniswap

Uniswap acts similarly to an OTC exchange. Users can swap their tokens instantly without the need for a 3rd party or middleman. Unfortunately, some users have reported that their transactions have gotten stuck on more than one occasion.

There’s also the problem of rising gas costs. Since the supply of tokens, especially DeFi-based tokens, on Uniswap is often low, several investors are trying to buy simultaneously and only those who pay the highest transaction fees will be able to buy successfully. Thus, a bidding war is at play whenever a new project lists their token on the exchange.

Furthermore, the exchange platform is created for manual trading only. Granted, stuck transactions and high cost of gas can be difficult to control, however, to keep traders at a disadvantage via manual trading is quite unfair.

Major centralized exchanges come with interesting features like auto trading, order aggregation, trading charts, stop loss, analytics, etc. These features help guide and (to an extent) protect traders from suffering heavy losses when trading crypto assets.

These downsides have discouraged experienced cryptocurrency traders and investors from shifting focus to decentralized exchanges. These drawbacks are what UniDapp is trying to solve.

UniDapp

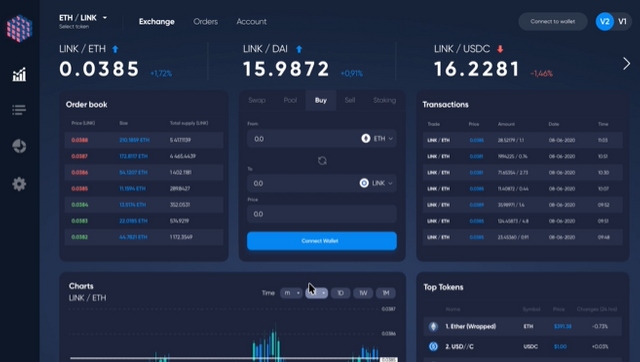

UniDapp is a new decentralized platform currently in the works that aim to make the trading experience easy and convenient for users. It will be based on Uniswap’s platform but will feature a unique set of tools that you’d normally only find on centralized exchanges. This won’t in any way affect the decentralized nature of the exchange. Rather, the plan is to integrate that experience you’d feel when trading on centralized exchanges into UniDapp decentralized exchange.

UniDapp will ease the problems of Uniswap by providing exceptional tools like liquidity charts, analytics, order aggregation, notifications, and much more. This will be achieved using a technical yet simple interface that will link directly to Uniswap’s API.

Features of UniDapp

Uniswap already has a host of exciting features that will also be integrated into UniDapp. Some of them include tight security where your transactions take place straight from your wallet and not transferred into a separate exchange wallet. Other features UniDapp is bringing include;

Limitless order placement

Users can set an uncountable number of orders on the UniDapp platforms. They can set orders for high or low prices according to their trading strategy. All orders are automatically triggered as soon as the price and relative liquidity is met. You can set your orders and engage in other activities while your trade is automatically executed.

Trading Notification

Users can get notification of tokens upon reaching certain price limits. This allows professional traders to easily observe market movements and take relevant actions in relation to their trades.

Trading Chart

Unlike Uniswap, the UniDapp decentralized exchange will come with a trading chart so users can view and monitor their trades in realtime. This gives them an advantage when it comes to buying or selling tokens as they can better interpret charts to give a better insight into entering and exiting trades.

Sleek and Interactive Interface

The user interface of UniDapp is smooth and quite simple to use. The developers have made it so that even the most inexperienced newbies will find it easy to understand.

Staking is Available

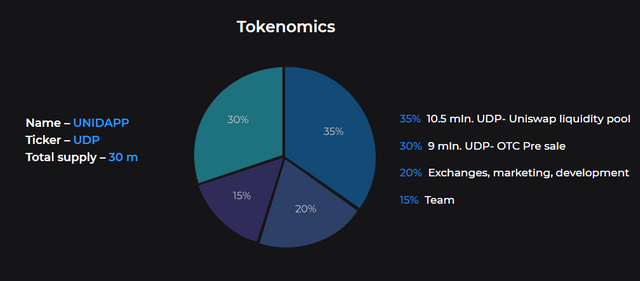

Another striking thing you won’t see on Uniswap is staking. The UniDapp platform comes with staking options available for holders of UDP token (the official token of the UniDapp exchange). UDP token holders can get passive income by staking. This will help draw a market demand for the token and subsequently drive up its price.

In addition, UDP tokens will be relevant to the UniDapp platform as they will be used as transaction fees. 0.25% will be charged as transaction fees from your UDP holdings. 90% of the fees charged will be set aside to reward UDP token holders. The remaining 10% will be stored in the UniDapp fund.

You can purchase UDP tokens before the UniDapp platform is officially launched. They can be bought on Uniswap, albeit, at the end of the 3rd round of OTC. Other exchanges that UDP will be listed on will be communicated later.

website medium telegram twitter

Author - Melody2

Bitcointalk