Crypto Primers: Loopring (LRC)

This is the continuation of my Crypto Primers series. Today I am introducing you to a very new addition in the cryptocurrency space. A proposal that could potentially change the way exchanges work forever. This is: Loopring.

There are hundreds of cryptocurrency exchanges around the world. Some of the bigger ones are well known. Bithumb, Bittrex, Huobi, Binance and GDAX to name just a handful of the big names in the space. Coinmarketcap alone lists 170 exchanges at the time of writing this article.

While this sounds like a great opportunity for end-users as they can essentially go “fee-shopping” (i.e. go with the exchange offering the lowest fees), it also creates a problem of liquidity that can lead to arbitrage trading or more practically, can and likely will get you a worse-than-possible price.

Take just the three classic examples: Bitcoin, Ethereum and Litecoin. At the time of writing this primer, Bitcoin has the largest volume on Bitfinex (8.87%) while Ethereum and Litecoin have their largest volumes on Bithumb (15.44% and 28.11%

respectively).

If some big players are taking large pieces of the cake, this ultimately leads to liquidity issues on other exchanges and pairs. Take ETH/USD on Yobit for example. Only 0.01% ($128,018) volume in 24 hours. If you wanted to liquidate your 400+ Ether for USD on YoBit, you would have a problem as the exchange simply doesn’t have enough volume (liquidity) to match all your Ether to buy orders. Not without a market order, draining the order book and producing significant losses on your side.

Loopring (and others which I will mention later) aim to solve this problem by providing what they call a “Decentralised Exchange and Open Protocol”.

From their website and whitepaper:

Loopring is not only a protocol but also a decentralized automated execution system that trades across the crypto-token exchanges, shielding users from counterparty risk and reduce the cost of trading. By essentially rising the liquidity of cryptocurrencies, we are building the financial system of the future.

Analysis

Let’s start by analyzing the buzzwords on their homepage.

Zero Risk

Truly decentralized trading implies that your assets never leave your wallet until you have actually sold them. To allow for this, smart contracts need to be authorized to access your wallets. In return, your funds are always within your control. This has huge benefits, such as if an exchange disappears, gets hacked or becomes insolvent for other reasons, you still own your assets.Decentralized

Essentially already explained above. Decentralized exchanges mean that nobody can control what is being traded or when (except for the deployed immutable smart-contracts). The only way to stop the trades on those platforms would be to shut down the internet. This is clearly the future and other projects already have working products for this (i.e. Blocknet).Order Sharing

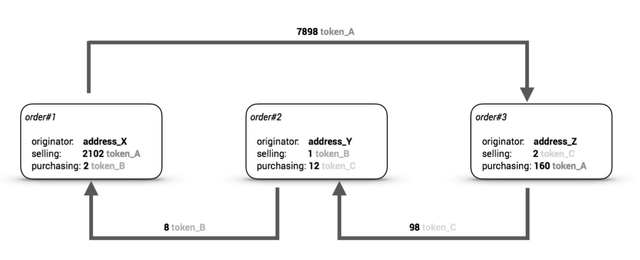

This is a big one that – to the best of my knowledge – is not supported by any other protocol and implies that your order may be split into several smaller orders, getting you the best price from every participating exchange. Basically, this means you are always buying the cheapest ask and selling the highest bid, across multiple exchanges.Ring-Matching

Here it becomes a little bit more complicated. If I understood this correctly, most exchanges simply match up the buy and sell

orders. What Loopring is trying to accomplish however is a ring-based loop of orders to match. Loopring uses an internal balance sheet of all participating exchanges to build those rings, increasing the overall liquidity significantly and offering very advanced order matching. Please let me know in the comments below if you think I am wrong.Cross-chain Protocol

Last but not least the entire protocol is, while currently being developed on the Ethereum network, envisioned to be platform/blockchain agnostic. The project is backed by NEO and Qtum, so adding 1+1 together, you can probably expect that it will come to more blockchains than Ethereum.

Competitor Analysis

Now, taken that we all understand what the protocol aims to do, I guess we could all agree that this kind of technology, if or once adopted, could be groundbreaking and potentially game changing for the entire industry.

Unfortunately, Loopring is not the first one to have (most of) the idea, there are competitors that have better marketing, bigger communities and generally simply better exposure.

The most technically implemented of these would need to be Blocknet. Not only do they already have a working platform (granted, with very limited offerings), but they also recently had a second meeting with Ethfinex and are being considered to be the underlying technology powering it.

Another interesting and lately very popular competitor is the 0x project. The ICO ended successfully and the token (also built on the Ethereum network) is currently relatively cheap($0.292 at a $146m market cap) as it’s become oversold recently.

KyberNetwork I know literally nothing about at this point. If you know about it or have invested into it, please share your thoughts in the comments below.

From running through the whitepapers of all 3, I can draw that the main competitive advantage for Loopring is that it enables match-ring orders, not only splitting your orders up but also enabling liquidity that will provide you with the best ask or bid, wherever you trade your assets.

Investor Benefits

As an investor, I’m always trying to identify the underlying value within a token. Most crowd sales exist for the sole purpose of fund-raising, and offer nominal long term-ROI to the investor.

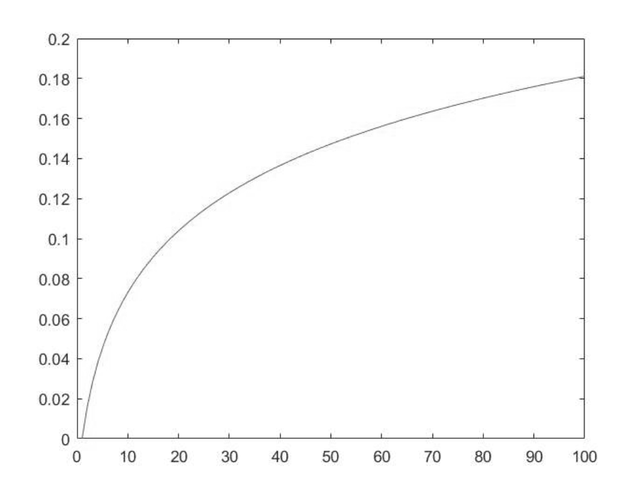

In Loopring’s case the main value I could determine by reading the whitepaper was that exchanges need to provide a discount for transactions made through their protocol. The percentage of this fee can be negated by depositing LRC tokens into the protocol and the rank of the exchange determines the discount that needs to be provided.

So, if I understood this correctly, exchanges will try to buy as many LRC tokens as cheap as possible to increase their ranking, therefore decreasing the discount they have to provide, ultimately increasing their profits.

Their whitepaper states the following discounts by rank:

- Rank 1: 0%

- Rank 2: 1.57%

- Rank 3–10: 7.31%

- Rank 11–20: 10.39%

- Rank 21–99: 18.06%

- Rank 100–999: 18.11%

- Rank 1000: 29.55%

- Rank 1001+: 30%

Possible Problems

I joined their Slack yesterday and was unable to get any of my questions answered. There is one user (“bitepan”) that was helpful, but the actual team behind it – while being online in Slack – didn’t care to answer any of my questions, even 24 hours later.

Furthermore, it appears that their (Chinese) team is focusing mainly on the Chinese market. All documents are always available in Chinese first and being translated into English only days later. The presentation on their website is still not available in English either.

Open Questions

I am yet awaiting to get answers to the questions below and will update the article once / if I get them answered.

What differentiates it from particularly 0x and KyberNetwork?

The most pressing question I could not find an official statement for. My guess as previously mentioned is that it is the order splitting and ring-based order matching. But an official answer here would do wonders. The only thing I could find is that in their whitepaper, they state that 0x has issues (i.e. is inferior) but that they learned a lot from them.How do incentives work?

The team behind Loopring offers incentives that were translated to English today and are difficult to understand. Apparently you

can get a free Etherum loan in return for depositing your LRC into a smart contract (for 6 or 18 months if I understood it correctly). This would essentially allow you to hold LRC for the duration of the smart contract while locking in a fixed Ethereum rate (1 ETH = 7500 LRC).What does the discount apply one?

To my best knowledge, nowhere it is mentioned if the discount applies to the exchange fee or the price of the order. If it is the price of the order, it would be hard to imagine that exchanges are willing to pay up to 30% for higher liquidity. More explanation is in order.What other blockchains can officially be confirmed?

While it is backed by the NEO council and Qtum (as well as CoinDesk), this does not answer officially what other platforms the team will work on next after the prototype is built and launched on the Ethereum network.What is the roadmap for a prototype and MVP launch?

When can investors expect to have a working protocol and how is Loopring incentivizing exchanges to adopt their protocol over 0x, KyberNetwork or Blocknet?

Distribution

The ICO sold a total of 697,538,027 LRC tokens while the team holds the other 50% bringing the total market cap to 1,395,076,054 LRC of which only half are in circulation. The remaining half is **locked into a smart **contract and released at a rate of 25% every year over 4 years and the exact pricing in USD is unknown as the ICO lasted approximately 2 weeks while selling 5000 LRC for 1 ETH.

Early bird contributors received up to 6000 LRC for 1 ETH.

My best guess, therefore, is that the real price was somewhat between $0.05 and $0.07 depending on when the ETH was sent to the smart contract for exchange.

The Team

The most convincing reason to potentially invest into this protocol is their team. People I personally have never heard of, but their resumes speak for themselves. Most notable, many with Google background.

Daniel Wang | Founder

→ Google Tech LeadJay Zhou | Chief Marketing Officer

→ PayPal Risk OperationsJoe Mikhail | Sr. Developer

→ Sr. Developer / Google ArchitectHoss Ma | Sr. Engineer

→ Chief Researcher / Senior Engineer at Google

→ Cofounder and CTO at Coinport ExchangeLeon Wang | Sr. Developer

→ Google ResearchFreeman Zhong | Sr. Developer

→ Bank of China

→ UnionpayDa Hongfei | Advisor

→ Founder of Antshares/NEO and OnchainAlex Cheng | Advisor

→ Vice President at Baidu

→ Google Director of Research & DevelopmentSimon Zhu | Advisor

→ PayPal APEC Ops Site Leader

→ Google Trust and SafetyJuxie | Advisor

→ YOYOW Co-Founder

→ Board Member of Bitshares

Market Comparison

It always helps me compare a project that I am interested in to the market caps of its competitors. So I interpolated the market cap of Loopring to a few to give you a better idea of where it currently stands.

The current price of Loopring is $0.071 with a market cap of $50m.

- Price on 0x’s market cap: $0.21

- Price on Blocknet’s market cap: $0.17

This would still allowing for at least a 2x growth if not 3x since 0x was heavily sold lately. For KyberNetwork there are no numbers available yet.

Moreover, it is important to note that that the decentralized exchange protocol market is still very small. The only implementation I know of is EtherDelta, which uses 0x. Once bigger exchanges start implementing decentralized protocols, the market cap will quickly rise significantly.

Final Thoughts

It is no secret that I, personally, prefer to invest into platforms and protocols over products. Think Blocknet, 0x, and Loopring over Siacoin, Basic Attention Token or Monaco. For this reason I also invested a small percentage of my portfolio into this protocol. Would I recommend this one to you? Probably not. The lack of community (less than 300 users on Slack), priority to their Chinese supporters and ultimately no answers to my questions are worrisome.

Nevertheless, I would keep an eye on this and see what happens. With a current market cap of $48m it is not considered a big player, but it is still in the top 100 and therefore a (more than average) speculative play.

There also is no prototype, no roadmap and nearly no exposure. This is all just a fancy idea that has not even been validated yet.

As always, do your own research and make sensible investment decisions.

This article is by no means financial advice.

Sources

CoinTrackr.com

A free cryptocurrency portfolio manager. One simple interface that aims at

making cryptocurrencies more accessible for everybody.

https://cointrackr.com 🚀

Great and fair explanation. :) I hope the freefall will soon reverse

Btw, am following you now! :)

Thanks!

Nice text. But where can I buy it ?

@janosik Buy Loopring at HitBTC >>> https://hitbtc.com/?ref_id=59cd4bdf2b801

Make sure to get in before it's re-listed on Binance Oct 18! I think its going to fly....

Congratulations @cointrackr! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPToday it is up more than 500%. Likely amongst the biggest gainers if not the biggest gainer. 🌊🏄

Here's a step by step guide to buying and storing Loopring: https://getcrypto.info/loopring/

Congratulations @cointrackr! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!