2019 Could See Ripple Pull Away From The Rest Of Crypto

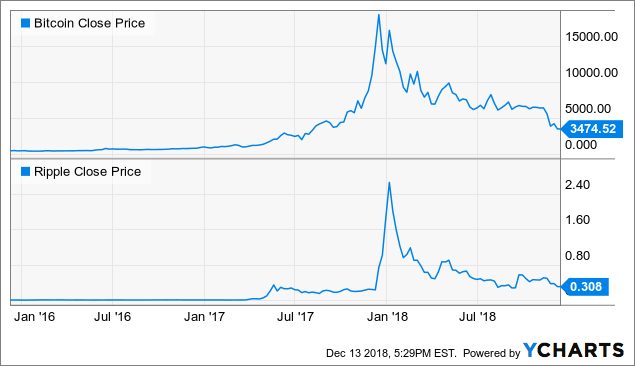

Relative to its peers in the crypto neighborhood, Ripple (XRP-USD) has actually weathered the down market of2018 Sure it's down practically 90% from its all-time high, however while Ethereum (ETH-USD) and Bitcoin (BTC-USD) have actually dropped considerably (50%- plus) in the last 3 months, Ripple's XRP cost practically is precisely where it was. And sure it saw a spike of almost double that in October, however it was the only significant coin to surge, an indication that the marketplace could be thinking about XRP, if just it could "decouple" from its primary trading couple with BTC.

RippleClose Price information by YCharts

And that's what it's going to consider XRP to retreat in 2019, days and weeks where Ripple rates proceed worth produced by the San Francisco- based business, and not simply on how Bitcoin is moving. Because the truth is revealed listed below: Where the 2 - and Ripple is no exception to name a few coins here - have actually relocated connection with each given that XRP started selling early 2017.

BitcoinClose Price information by YCharts

But there's beginning to appear some tips of a split, in which Ripple can run on its own and with a financial investment chance that concentrates on the business's concept to change loan motion, and not simply as another financial investment in the "crypto" classification. This is primarily excellent, with maybe one exception.

DecouplingFrom Bitcoin

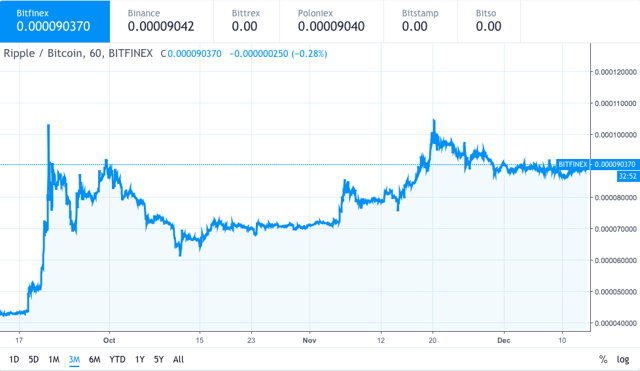

The very first indication of decoupling can be found in November this year when XRP eked out the gains we see aboveamidst a falling Bitcoin We saw it once again this month when XRP remained, fairly, unsusceptible to the fights within the Bitcoin Cash hash war, revealing maybe financiers weren't stressed over what was occurring somewhere else. But the genuine favorable indication is the usage of xRapid, a blockchain item with absolutely nothing to do with Bitcoin, Ethereum, or wise agreements, much of what the remainder of the market is based upon.

Charts likewise reveal things relocating that instructions. Despite the sags in USD cost, Ripple has actually been getting on its trading set ratio with Bitcoin given that October, and gradually even given that its healing from its spike in the middle of that month.

But xRapid and adoption, not by the masses, however by banking organizations that will utilize xRapid, is essential. And today saw more excellent news, on top of an impressive list of partners that Ripple's collected this year. AsReuters reported this week, Ripple will assist UAE Exchange cross-border payments in Asia beginning in early2019 That's a substantial action. Ripple has a remarkable list of collaborations currently, however the majority of do not have concrete dates or information about the collaboration. This is huge and the UAE Exchange declares to be actively attempting to target a 10% market share of a cross-border remittance market that sent out $613 billion throughout Asia alone in 2015. In addition, as this article mentions, "UAE Exchange is one of the oldest and largest money transfer houses in the Middle East. It’s one of a growing number of financial institutions in the region to join Ripple, including National Bank of Ras Al Khaimah and Kuwait Finance House." Now if you check out the post connected above noting out some partners (link here again), you'll see that we composed of some doubt in the monetary chance that xRapid can attend to XRP financiers. That still stands, however the short-term chance is still there. And if Ripple can reveal adoption by banks, and any paying consumers selecting to use the benefits offered when buying xRapid, it could be a short-term benefit that surges the XRP/BTC ratio towardsRipple Don't forget that Ripple as soon as had a "market cap" of almost 10 x where it is now, so there's loan waiting on the sidelines to see if the ingenious remittance innovation can work. I stated previously that a Ripple decoupling would have excellent and bad ramifications. Above is the excellent. The bad is a possibility: That if Ripple turns away from the rest of cryptocurrency, it opens itself approximately analysis of "what" precisely it is. And, particularly, whether its a security. That problem has actually been weighing over Ripple's head, and in early courtroom conversations given that in 2015. No decision has actually been reached. But the argument has actually raised around once again. Binance CEO, Changpeng Zhao said, "The lawsuit might take years. But if XRP is ruled as a security, it would seriously injure a great deal of United States users, and to a specific level, other users all over the world too. It definitely does not appear like a security to me, however that's simply a single person's viewpoint." He's right. The "security" concern is among the staying concerns for Ripple, and definitely the most existential. It could reduce an increasing star if the U.S. courts pick to restrict its possible as a financial investment. An crucial point of view on this is fromCoinbase The biggest trading platform in the United States has actually been adding coins quickly this quarter, however has actually not included XRP. Why? Many are hypothesizing since the legality of what the XRP is, in regards to United States guideline, is still uncertain.

TheThreat: Regulatory Uniqueness

Conclusion

Ripple continues to lead the crypto area in adoption and the UAE Exchange offer just sweetens the pot and the timeline. It's possible that we'll see XRP trade by itself benefits, far from the remainder of the crypto market, in 2019, especially with any statement from a banking organization making a huge play in XRP ownership. The just thing at this moment that could ruin that enjoyable is a regulative piece focused entirely on XRP that slows its development. All will require to be kept track of.

Bitcoin might have boiled down from the stratosphere, however there's still an abundance of chances in cryptocurrencies. At the Coin Agora, our focus is on altcoins - the smaller sized cap cryptos that have enormous capacity to interrupt service communities. Invest with us for your opportunity to participate the ground flooring. Our objective is to assist you discover little, brand-new and growing coins and gain abundant returns.

Posted from Cryptotreat Cryptotreat : https://cryptotreat.com/2019-could-see-ripple-pull-away-from-the-rest-of-crypto/