Is July 18th the Day for Ethereum ETF Launch?

As the cryptocurrency market braces for potential recovery, recent filings suggest that approval for spot Ethereum exchange-traded funds (ETFs) by the US Securities and Exchange Commission (SEC) could be imminent. Several key players, including BlackRock and Fidelity, have updated their S-1 forms, signaling readiness pending regulatory approval.

Market Reaction and Price Surge

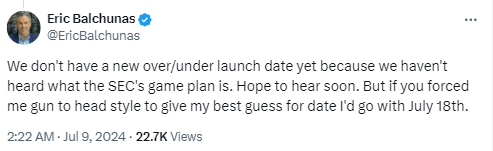

Following the updated filings, Ethereum's price has surged over 5% within a day, reflecting growing optimism among investors. Analysts at Bloomberg predict a potential approval date around July 18, highlighting a bullish sentiment in the market.

Key Players and Their Moves

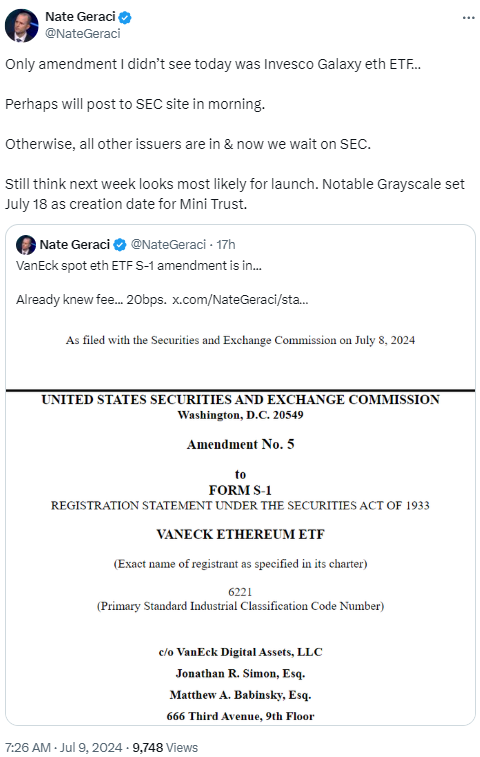

Prominent asset managers like Grayscale and 21Shares have also submitted their updated S-1 forms, although some details, such as fee structures, remain undisclosed. Despite these updates, Invesco Galaxy has yet to follow suit, prompting speculation about its imminent submission.

Regulatory Landscape and Predictions

Eric Balchunas from Bloomberg Intelligence suggests that while the SEC has requested filings, specifics like launch dates remain pending official guidance. This uncertainty underscores the cautious optimism prevalent among market observers.

Potential Impact on Market Dynamics

If approved, a spot Ethereum ETF could represent a pivotal moment for the crypto market, offering institutional investors a regulated avenue to invest in Ethereum. This development is expected to enhance liquidity and potentially influence market volatility as institutional demand for Ethereum grows.

The upcoming decision on Ethereum ETFs by the SEC stands poised to reshape the landscape for cryptocurrency investments. As anticipation builds, market participants are closely watching regulatory developments for clues on the timing and impact of this potential landmark approval.