How Will U.S. Inflation Impact Bitcoin's Price?

Bitcoin, the leading cryptocurrency, saw its price retreat to $61,000 on July 3, driven by concerns over worsening U.S. inflation forecasts. This marked a reversal from recent gains, with the digital asset experiencing a 2% decline at the daily close and hitting local lows of $60,561 on Bitstamp.

Impact of Economic Indicators on Bitcoin

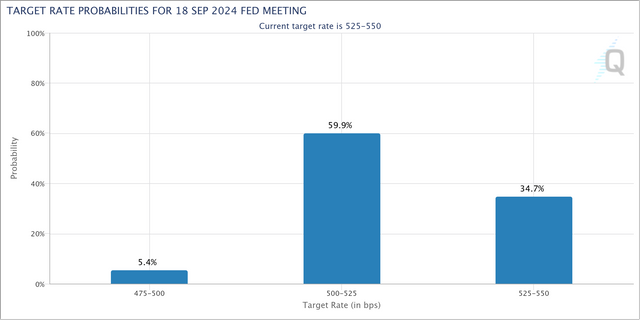

Fed target rate probabilities for September FOMC meeting. Source: CME Group

The downturn coincided with remarks from Jerome Powell, chair of the U.S. Federal Reserve, at an economic event in Portugal. Powell's cautious stance on monetary policy, emphasizing a gradual approach to rate cuts despite market expectations, added to the bearish sentiment.

Technical Challenges and Market Dynamics

Market analysts observed manipulative practices such as order "spoofing" on exchanges, contributing to volatile price movements and creating overhead resistance around key levels like $60,000. Spot demand on major exchanges like Binance showed support levels hovering around $60,000 and below, underscoring a cautious market sentiment.

Institutional Perspectives and Investor Sentiment

Charles Edwards, founder of Capriole Investments, expressed concerns over the Fed's reluctance to expedite rate cuts, which are closely monitored by cryptocurrency and risk asset investors alike. Market probabilities, as reflected in CME Group's FedWatch Tool, indicate a reduced likelihood of imminent rate cuts, currently standing at approximately 65% for the upcoming September meeting.

As Bitcoin navigates through these economic uncertainties, market participants are closely monitoring both technical indicators and broader economic signals to gauge future price movements. The recent pullback underscores the cryptocurrency's sensitivity to global economic dynamics and regulatory developments, shaping investor sentiment in the digital asset space.