How Will Mt. Gox’s Bitcoin Repayments Affect BTC and ETH Prices?

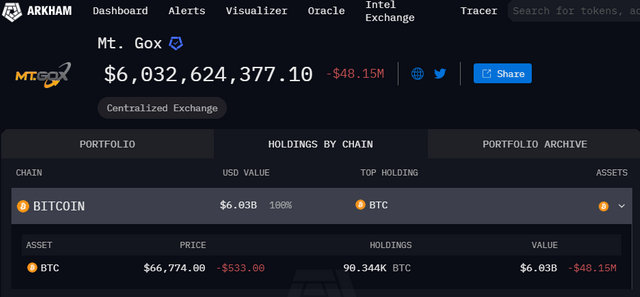

On July 23, Mt. Gox, the Bitcoin exchange that collapsed in 2014, transferred over $2.8 billion worth of Bitcoin as part of its repayment plan to creditors.

Details of the Recent Transaction

Mt. Gox moved 42,587 BTC, worth about $2.85 billion, to an internal wallet. Additionally, 5,110 BTC were added from another internal wallet, indicating preparations for BTC repayments. The exchange currently holds 90,344 BTC, valued at approximately $6 billion.

On July 22, the exchange started its repayment process. This news coincides with the launch of Spot Ethereum ETFs, stirring speculation about its effects on Bitcoin and Ethereum prices.

Recent Transfer Patterns

On July 22, Mt. Gox made several smaller Bitcoin transfers. The latest involved 0.021 BTC, worth about $1,390, sent to an address shortly before the report was released. This transaction mirrored one from six days earlier, suggesting these transfers might be part of a testing phase.

On July 16, Mt. Gox announced it began repaying Bitcoin and Bitcoin Cash to 13,000 out of approximately 20,000 creditors. This was preceded by a $6 billion Bitcoin movement, similar to today’s transfer.

Market Reactions and Impact

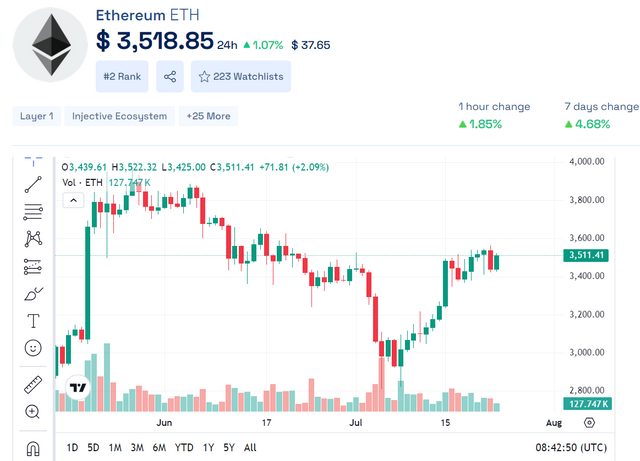

The timing of these Bitcoin movements led to speculation. The transfer coincided with the launch of the Spot Ethereum ETF, affecting the market with a "sell the news" sentiment.

The crypto market saw a downturn as Ethereum whales sought to profit from the ETF hype. Analysts warned of a possible drop below $3,000 for Ethereum, though ETF adoption could push prices above $4,000. Bitwise CIO Matt Hougan set a $5,000 target for ETH following the ETF launch.

At press time, both BTC and ETH saw declines. Bitcoin fell to $66,676.33, a 1.34% decrease, while Ethereum increased to 1.85% to $3,518.85