Crypto Market Crash: How Much Lower Could Bitcoin's Price Drop?

As Bitcoin (BTC) struggles to regain its footing, market observers are closely watching key price levels and market dynamics that could influence its next moves.

Bitcoin Extends Losses as Bullish Momentum Falters

On June 17, Bitcoin saw further declines, reaching as low as $65,066 on Bitstamp, a level not seen since mid-June. Despite a brief uptick over the weekend, the start of the trading week in Asia failed to sustain the momentum, echoing lackluster sentiment in US markets.

Trader Sentiment and Key Support Levels

Traders like Jelle are closely monitoring BTC's performance, emphasizing the importance of establishing a higher low above $62,000 to avoid further downside risk. Many are eyeing critical support levels around $60,000, with concerns growing about potential multi-month lows if these levels fail to hold.

Liquidity Concerns at $65,000

The $65,000 mark emerged as a focal point for liquidity, especially after Bitcoin dipped below $66,000. Analysts, including Daan Crypto Trades, noted that such levels can attract significant trading activity, acting like magnets for price movements.

Technical Analysis Points to Potential Reversal

Some traders remain cautiously optimistic, pointing to an inverse head-and-shoulders pattern in recent charts. This pattern, if confirmed, could signal a potential turnaround if a local low has indeed been established.

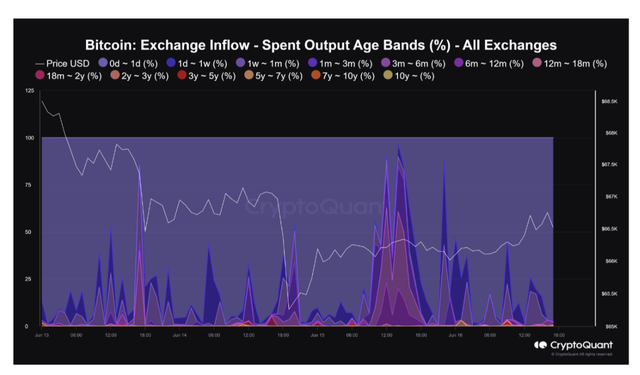

Increased BTC Inflows to Exchanges

Meanwhile, onchain analytics from CryptoQuant highlighted a notable increase in Bitcoin being transferred to exchanges. Coins that have been dormant for three to six months, and even up to a year, are now being moved, suggesting potential selling pressure building up in the market.

Market Outlook and Investor Strategy

Analysts are wary of the implications of increased BTC inflows to exchanges, as historically, such movements have preceded periods of heightened volatility and price corrections. This influx could amplify selling pressure, potentially leading to further price declines if market sentiment remains tepid.

As Bitcoin continues to navigate challenging market conditions, investors and traders alike are closely monitoring key technical levels and market indicators for signs of a reversal or further downside. The coming days will be crucial in determining whether Bitcoin can find stability above critical support levels or if additional selling pressure will push it into a deeper correction phase.