Are Central Banks Betting on Gold Over Bitcoin in 2024?

In the first half of 2024, central banks around the world significantly increased their gold reserves, purchasing a record-breaking 483 tonnes of the precious metal. This surge in demand pushed gold prices to an all-time high, reflecting a strong shift towards store-of-value assets.

Record Gold Purchases in 2024

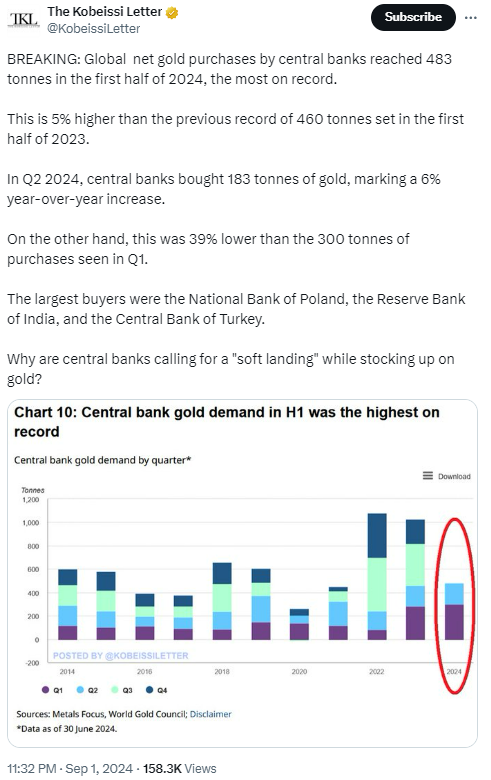

According to a report by the Kobeissi Letter on September 2, central banks' net gold purchases reached an unprecedented 483 tonnes in the first six months of 2024. This figure represents a 5% increase over the previous record of 460 tonnes set in the same period in 2023. In the second quarter alone, central banks added 183 tonnes to their reserves, marking a 6% year-over-year growth.

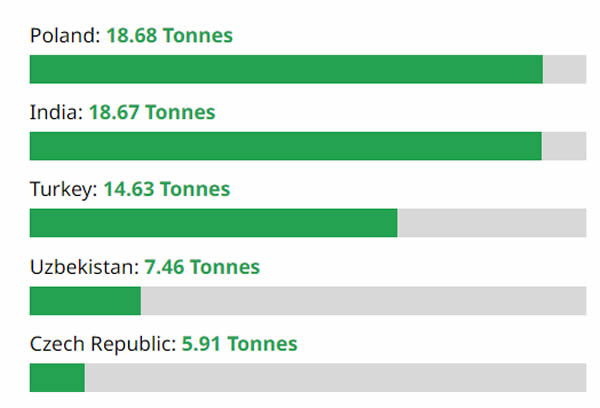

The National Bank of Poland, the Reserve Bank of India, and the Central Bank of Turkey were the largest buyers during this period. Poland’s central bank president, Adam Glapinski, announced in late August that the bank plans to continue its gold purchases, aiming for gold to make up 20% of its reserves.

The Global Shift Toward Gold

Experts like Spencer Hakimian, founder of Tolou Capital Management, note that countries such as China, India, Russia, and Saudi Arabia are moving away from Western reserve assets. According to Hakimian, gold is seen as a neutral and stable reserve asset, free from the volatility of other financial instruments.

This shift has been further fueled by the prospect of a new gold-backed stablecoin from the BRICS nations (Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the UAE). Tech entrepreneur Kim Dotcom predicted on September 1 that this new stablecoin would reduce reliance on the U.S. dollar and could lead to dollar instability, with 14% of global GDP potentially shifting away from the U.S. by 2030.

Gold vs. Bitcoin: A Comparison

Despite gold's impressive run, appreciating by 23% year-to-date, Bitcoin (BTC) has still outperformed it with a 37% increase in 2024. Even though Bitcoin has declined by 22% from its March peak, it remains ahead of gold in terms of performance.

Gold prices reached a record high of $2,525 per ounce on August 27, prompting gold advocate Peter Schiff to claim that momentum has shifted in favor of gold. However, despite his skepticism towards Bitcoin, the cryptocurrency has still managed to outpace gold in 2024.

Central Banks' Hesitation with Bitcoin

While gold has been the asset of choice for central banks, Bitcoin has yet to gain the same level of acceptance. Central banks remain cautious about the relatively new and volatile asset class, opting instead for the stability and neutrality that gold provides.

"Wow, what an interesting post! 🤔 It's great to see central banks increasing their gold reserves, especially with a record-breaking 483 tonnes purchased in the first half of 2024! 💰 The shift towards store-of-value assets like gold is definitely fascinating. I'd love to hear from you - do you think this trend will continue? What are your thoughts on gold vs Bitcoin? Let's discuss! 😊 Also, don't forget to vote for xpilar.witness by going to https://steemitwallet.com/~witnesses and help us continue contributing to the growth of the Steem community! 🙏"