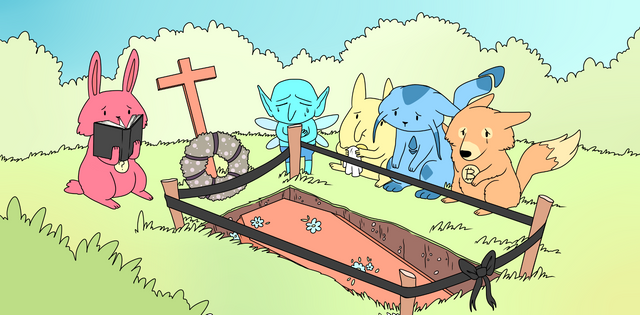

What Happens to My Cryptos When I Die?

Here Lies My Formerly Owned Crypto

Life is a fragile, extraordinary, and unpredictable journey for every single person on this planet. With so many different ways to go through the “human experience,” you can easily end up doing something you may have never once thought was possible… let’s say… purchase and invest in digital coins. Internet money? Virtual currency? Online assets? Who knew that these would all come to exist in today’s society as a cryptocurrency. However, there is one thing we know for sure that won’t exist in the future: you. As daunting as it may sound, we are not immortal beings here on Earth. So what does that mean? Unlike cryptocurrency, we will stop existing and have to decide what to do with all of our material possessions which will continue to exist. As such, you may be wondering what will happen to your precious little crypto coins? Let’s find out…

This is not financial investment advice.

This article will discuss potential ways to distribute your digital assets in the event of your death.

In this article

- Can Cryptos Ever Be Recovered After Someone Dies?

- How To Plan For Leaving Your Assets To A Beneficiary

- How Does Leaving Large Amounts of “Frozen” Cryptos Affect Market Prices and Value?

- Conclusion

Can Cryptos Ever Be Recovered After Someone Dies?

To cut straight to the point and answer this question, no. In theory, you cannot recover someone else’s crypto after they pass away unless you have the passcode to access their wallet or wherever it is stored. So technically you can inherit someone else’s digital assets, and all you need to do is figure out what their intricate passcode is.

Cryptocurrency is a virtual form of money protected by unbreakable cryptography. This makes it a secure way to store wealth but also creates a new risk with it as well. As soon as these crypto owners die, their digital fortune will be out of reach forever. That’s a major problem for the relatives of tech-savvy individuals who have invested in a market currently worth about $200 billion.

Well, it turns out that there’s actually another way to retrieve crypto assets which may be unattainable without the passcode. We get it, life is unpredictable and a bit cruel for that matter, but what about the people who have not figured out what to do with their assets?

Blockchain and cryptocurrency holders might want to store their credentials and private keys in a safe place and let a family member know where it is. Or, they might keep these credentials and private keys in a password manager, store the access details somewhere, and let a family member know where to find that. This way, the actual passcode is not known but people know where to go once you’ve passed.

Unless you know the actual passcode or key to access the wallet or whatever is used to store the assets, you cannot retrieve the coins and automatically gain access. Thus, if you are a crypto owner, it’s relatively important to find out how you plan on dealing with your assets after you’ve passed.

How To Plan For Leaving Your Assets To a Beneficiary

As a crypto owner, you are at risk of unexpectedly passing away and leaving your digital fortune to nobody at all. With that being said, it’s always smart to have some kind of plan formulated so that someone you know or your family can take over your assets for you. One of the most important things NOT to do is leave your private keys in your will, as the document itself can very well become public. Resultantly, all that kind of information will be available for everyone to see, including the key that unlocks your digital fortune. Here’s what you should be doing instead.

Step 1: Figure out what you have and what you want to protect. Make a list of your total current holdings, where they’re held (wallets, exchanges, etc) and the corresponding current value. It’s best to do this step privately and offline, as this is sensitive information which you shouldn’t be sharing with anyone.

Step 2: Separate your assets into tiers. Decide how much you want to keep easily accessible, like petty cash, and how much to keep in long-term storage that you’re unlikely to touch for years. There may be one or more intermediary tiers between these two extremes.

Step 3: For each of the tiers, start by thinking about what kinds of storage you’re currently using. What do you like about it? What’s not working for you? How could it be better? Could your heirs access your storage devices and/or passwords if needed? Do some research on software and hardware wallets and test a few of them out to see which one works best for you.

Step 4: Decide who you want to inherit each tier and exactly how that will happen. Who gets what? Do you want one person to inherit all of your cryptos? If you want more than one person or organization to get a share, use percentages instead of hard values (10% not 10 Bitcoin).

Also, be sure you know how it will eventually happen. Do your heirs understand this technology? Can they create and provide their own addresses for transfer? Or will the assets be liquidated to fiat currency that will be distributed to your heirs? Regardless, who will help your heirs through the process? If you don’t know, that’s completely okay, but it’s worth considering these issues.

Step 5: Store backups. Store your backups in geographically-diverse, secure, access-controlled locations. Many people use bank vaults, fireproof safes at home, and/or attorneys or accountants.

Follow the aforementioned steps to get started with making the decisions regarding ownership of your digital assets following your death.

How Does Leaving Large Amounts of “Frozen” Cryptos Affect Market Prices and Value?

In the event that you are unfortunately not able to construct a precise plan of what to do with your assets following your death, your coins will simply end up sitting in your wallet and become stock. These “frozen” cryptos do have an effect on the market since they will most likely never be seen or used again as the passwords and keys are unknown. Depending on the size and value of the frozen funds, it could definitely impact trading volumes in a negative way and potentially drive the price of a particular coin down.

If cryptocurrencies are not listed in a will, it’s likely that they will be susceptible to what estate attorneys refer to as “probate by truck,” a situation in which heirs claim property under the assumption that the deceased would have “wanted them to have it.” The difference in this case, however, is that instead of gaining access to jewelry or antique furniture, a relative may walk off with the private access key to a cryptocurrency portfolio worth millions of dollars.

Depending on the size and value of the frozen funds, it could definitely impact trading volumes in a negative way and potentially drive the price of a particular coin down.

Conclusion

Death is an inescapable part of life that all of us should be prepared for. Part of that preparation which nobody really thinks about is deciding the ownership of your cryptos following your inevitable death. Although this may seem trivial, it’s actually extremely important that you formulate a well-thought out plan for someone or multiple people to inherit your fortune. We cannot escape the powerful hands of Father TIme, and with every additional second that goes by, you’re creeping closer and closer to death. Do yourself a favor and set up a system for transferring your assets to someone you know following your death.

As always, happy investing!

Have you already formulated a plan for transferring your cryptos after you die? Let us know why in the comments!