Bitcoin Crash! BTC Lost 50% in a Single Day

The situation with the cryptocurrency market is something that even some of the more experienced market players didn't see until today. Bitcoin crash has hit the market so hard that it pulled all altcoins down the drain as the majority of cryptocurrencies lost around 50% of their value.

Yesterday, on March 12th, 2020, at exactly 1 AM GMT, a single Bitcoin was worth $8,000. The majority of market actors considered that price to potentially be the bottom of the correction after the $10,500 spike. Yet, the price simply made a freefall towards the $3,500 at 2AM GMT today. Meaning that Bitcoin lost more than 50% of its value in 25 hours.

The first wave of the sell-off took the majority of investors by surprise, to say the least as BTC dropped to $5,800 in a matter of hours. The rapid decline triggered the major FUD which led to catastrophic results.

Source: coinalyze.net

The COVID19-Induced Bitcoin Crash

Many holders always believed that cryptocurrencies are an alternative market that isn't prone to traditional issues. However, this time, reality proved them wrong.

Bitcoin, along with all other crypto assets, followed the rapidly declining traditional markets. Meaning that it fell victim to the widespread coronavirus panic. This market-wide bloodbath once again proved that, without a doubt, the cryptocurrency market is most vulnerable to the traditional fundamentals.

The Bigger Doom

This 50% decline isn't everything that Bitcoin took from its investors. Far from it. Since the $10,500 peak, the first decline towards $8,000 happened during the 30 days period. During that time, BTC recorded a loss of 24% following a two-month-long steady rally.

Since percentages don't work in a way that we can just add one percentage to another, let's say that, since $10,500, Bitcoin lost approximately 65% of its value. In other words, if you invested $1,000 on February 13th, today, you'd have just $350.

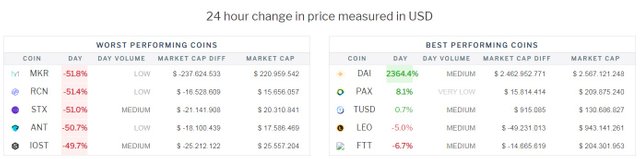

To make matters worse, only cryptocurrencies that remained in green in the entire market are stablecoins, DAI, PAX, and TUSD.

Source: CCOWL

Could This Be Foreseen?

Well, no... And yes.

This kind of market crash could hardly be predicted. However, as CoinSyncom published, some technical analysts did warn the wider audience that something similar is possible.

Furthermore, our in-house team of technical analysts also predicted a decline in the article published on February 21st. However, our predictions didn't account for such a drastic possibility. Instead, the obvious reversal aimed at some of the mid-levels of the Fibonacci retracement.

Adding the global threat of COVID-19, which today became a global pandemic, it was natural that the panic kicked in. Despite the decentralized nature of cryptocurrencies, it seems that investors are still unprepared to look towards cryptocurrencies in a different way.

The last point can mean two things. Either the majority of cryptocurrency investors don't understand the basic nature of assets they invest in. Or they believe that they will be able to re-enter the market at a better price. Be that as it may, those who are left holding bags don't seem to be panicking at all.

Bitcoin Crash Optimists

During the heaviest crypto bloodbath, #Bitcoin was on fire on Twitter.

Interestingly, the majority of Tweets revealed a peculiar kind of positive thinking that we even found strangely refreshing.

Nevertheless, we have to say that our favorite tweet is somewhat sarcastic.

When you start feeling the irresistanbe urge to share our content and click on one of the icons below, you'll be rewarded with Sharpay (S) Tokens.

Now, ain't that cool or what? Getting paid for sharing!!

Of course, to receive your tokens, you'll need a Sharpay crypto wallet. Therefore, first you need to register on Sharpay's OFFICIAL WEBSITE and the wallet is there.

Thanks for sharing!

mark {

background-color: GAINSBORO

;

font-weight: normal;

font-style: normal;

}

</style>

😉

Originally published on CoinSyncom: https://coinsyn.com/news/bitcoin-crash-btc-lost-50-in-a-single-day/