Centralized Exchanges in a Decentralized Wonderland

Removing the middle man has been the driving force pushing the development of Blockchain and cryptocurrencies. This brand-new technology has created a greed-powered miniaturized stock market. But with it, solutions to existing problems and new ways to improve our lives have emerged

Amongst this decentralizing craze, one sore thumb sticks out: exchanges. And more precisely centralized exchanges. They are the most used tools for people trying to cash in on the next pump or invest in promising technologies. However, with the whole premise of crypto-assets being about creating a trustless system, it doesn’t seem like many people realize how contradictory it is to keep pushing the middleman-less narrative while staying silent on the most used crypto-related platforms.

Centralized exchanges (CEX) and their issues.

Of course, one shouldn’t be following ideological guidelines strictly. There are good sides to having centralized trading – mostly related to efficiency. But how would we go about to push the “no-middlemen” narrative to the broader public without applying it in our own space?

Not to mention all the issues stemming from trading on centralized platforms. Sacrificing efficiency for security is easier in our day-to-day lives. But when breaches come down, they come down a lot harder. I don’t need to mention all the hacks and deficiencies in exchanges – from the 2014 hack of Mtgox to the more recent QuadrigaCX scandal. The sentence “Not your keys, not your crypto”, even though it is one of the most basic rules of thumb to follow, isn’t widely respected.

I am not implying that CEXs are inherently bad. They are simply answering a demand by providing a supply. Basic economics. However, now that we finally have the tools to run the whole system relying on objective, mathematically-proven third-parties, it is time for decentralized exchanges to rise up, even more than they already have.

Decentralized exchanges and what can be improved

The more popular DEXs have seen a steady growth throughout this bear market. IDEX has seen its volume increase ten-fold.

There are still some pullbacks preventing DEXs from being able to compete with giants like Binance or OKEx. The UI’s are generally pretty poor, leaving most newcomers in confusion. And you can forget it about using them comfortably if it’s your first experience trading on an exchange. You also need to validate each transaction individually, which can be quite a hassle at times. One of the more annoying things is trying to place a buy or sell limit order. Between the time when you click on the order and the time to confirm your transaction, bots can quickly remove and add their orders again, forcing you to market buy with uncertainty regarding the price you will actually pay.

A third alternative? Hybrid exchanges.

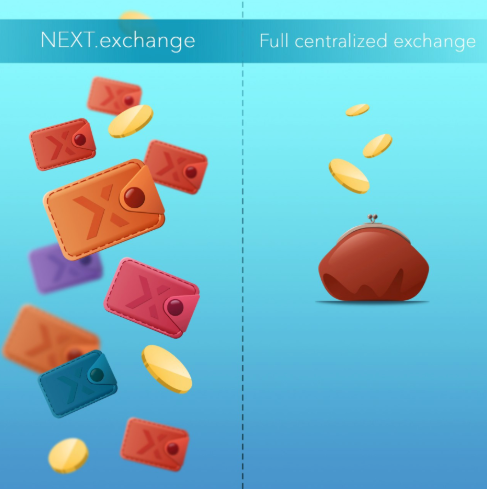

Now, I was being a little bit dishonest on IDEX. They are in fact more of a hybrid exchange than a fully decentralized one. But what is a hybrid exchange? It’s an exchange that combines features from both centralized and decentralized exchanges. Most notably, it intends to keep your tokens and crypto-assets safe without compromising efficiency. Some innovative solutions have appeared in the space, intertwining different elements of both. An example of this would be https://NEXT.exchange.

By using their own blockchain, they intend to leave you the sole ownership of your private keys, while allowing you to trade as if the orderbooks were on a centralized exchange, à la Binance or Bittrex.

It could be a potential bridge between the glaring security issues that we have seen appear throughout the year, while enabling high-volume and intuitive trading, which is needed for a more universal access to crypto-assets.

What can we take away?

Exchanges need some tuning. They are currently the main bridge to enter the cryptocurrency world. As such, they need to be held up to great standards of transparency that the crypto-sphere rightfully craves. We are currently on a path to a world where subjectivity plays a less important role. We should follow the correct path from the start.