CREDTIS 1 Million Transaction/Sec!?

CREDTIS 1 Million Transaction/Sec

Highspeed Blockchains for the win

This will be the second episode out of 10 in which I will look into an ICO, its whitepaper, website, team and so on, and explain how to grade it, in terms of how likely it will increase in Value in the short term as well as in the foreseeable future. As always this is not financial advice, but merely a guideline to help you find your way in the confusing world of ICO Investing.

Hard Facts

Project Name: Credits, a new generation of blockchains.

Token Symbol: CS/ OCS (ERC20)

ICO Price: 1CS = 0,24 USD (0.0002 ETH)

Hard Cap: 20,000,000 USD -> Presale cap: 3,000,000 USD (15%)

Total Token: 1 Billion ->Sold during ICO: 60%

Whitelist: YES (JOIN)

Website: https://credits.com

Okay… What are this the things you should look at in the very beginning? Often when you find an ICO the first values that you will see will look a bit like what you see above. So whats important? Here are some questions that you should ask:

What type of ICO am I looking at?

For me there are three main types of Projects out there.

Most common are DApp (Ether based Decentralized Application), such as the Upcoming ICO Bee Token.

Next are the Infrastructure projects. Project that still works on the Etherum Blockchain, but wants to create its own Ecosystem. For example GoNetwork

Are the Blockchain Projects. There are several subdivisions within the Blockchain projects, but to keep it simple we will just call them 1st, 2nd and 3rd gen. Blockchains. Examples of a 3rd gen Blockchain would be Arcblock, or ICON. And there is a small group of exceptions, that are simlar to IOTA and are Tangeled based.

Introduction:

Credits Platform aims to become a decentralized financial system for direct interactions on a peer to peer Basis. The systems vision is to create a platform that brings participants all over the world to the site, and to provide enabling them to create and utilize financial services.

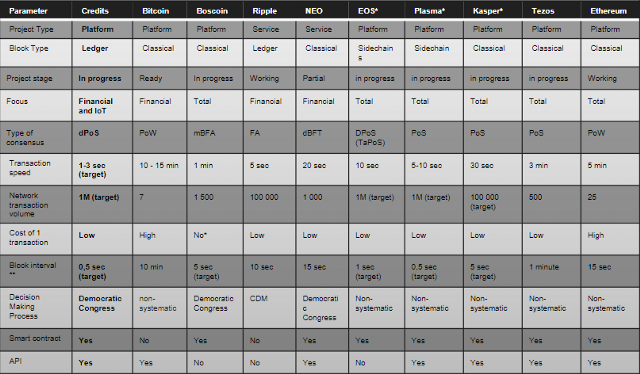

So you should notice Credits goes into category Blockchain project, and sector financial. Now you can start comparing it with other existing centralized and decentralized companies. Bellow is a nice graph that shows all the aspects of a Blockchain. You can find these easily all over the web.

The world of crypto is similar to the world of famous meme website, probably because the average investor is a millennial and also because memes are a big part of crypto at this point. Similar to memes crypto undergoes waves of hype phases for different aspects in the list above. A few months ago we had the hype for privacy coins, and before that smart contracts were hot. At the moment it seems like interblockchain and fast transactions speeds are the trending investment point. RaiBlock recently hit a market cap of 2B in just a few weeks. The only reason for its massive success is its transaction speed and the fact that there are no tx. fees.

One of the biggest Bonus points for Credits are the 1 Million transactions per second. With an average tx time of about 3 seconds. A major use-case for Credit will the its application into the Internet of things (IoT). There will be no mining for CREDITS, which is a good thing from an Investors standpoint as most tokens will be allocated in the ICO stage of the projects. In the case of CREDITs that will be 60%. (Anything over 50% will get 0.5 Points over 65% is 1 Point.)

Prototype:

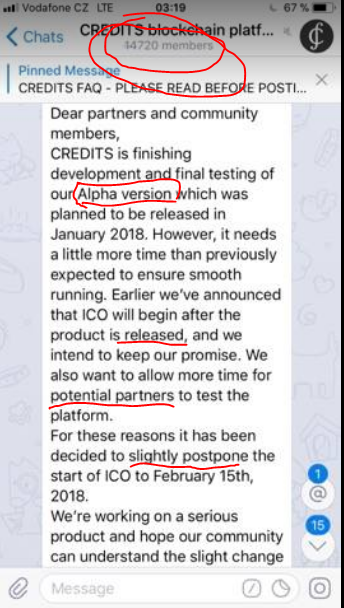

Once you know what your looking at, and the ICO Stats are all in the green, then you should start looking for a prototype. These come in different shapes and colors. Look for things like alpha testnet, BETA version or at best an ios or android application. If you cannot find any then go into their Telegram group and write one of their admins. At the same time you can check their support levels anything over 8k Members is fine. More then 15.000 members is great and more then 25k members means you probably wont get into the ICO due to congestion.

What you should look for on Telegram:

TEAM & ADVISERS

When looking into teams, these are the things you should look out for:

How many Blockchain experts do they have. Nowadays blockchain programs are a scarce resource and hard to find post ICO, for example Monetha took 3 months to find someone.

How long have they been working in their fields. What companies have they worked for? Did they already start a company before.

Sources to use: Look into Linked for CEO, Github of their programs and developers, if they are good at what they do then you should fine a ton of code there.

Marketing: If there is no marketing then there will be no hype, no hype means no ROI. Marketing is extremely important in the world of ICOs

Size of Team: Anything over 10 people is good over 15 is very good.

Age: A success of an ICO can be very dependent on the age of a Team. Big investors often do not trust a younger team, and secondly networking is an important part of building a decentralized platform. A young team will not know as many influential people

Whitepaper:

https://credits.com/Content/Docs/TechnicalWhitePaperCREDITSEng.pdf

Social Media Links:

Telegram: https://t.me/creditscom

Twitter: https://twitter.com/creditscom

BitcoinTalk: https://bitcointalk.org/index.php?topic=2401248.0

Now that you have more tools to grade ICOs please go through CREDITS ICO and tell me what you think. I will soon release the graded version of all the ICOs, but I want you to learn and not just trust everybody blindly.

If you found this Blog useful please Clap, like and share :D

You can also follow us on Twitter, Instagram and soon at www.icodog.com

Coins mentioned in post: