THE OLD FINANCIAL SYSTEM REJECTS AGAINST THE NEW (Cryptocurrencies)

[Source: Google]

The war continues and there are casualties in cryptocurrencies.

Definitely all the revolution that has created the cryptocurrency system has represented a threat to the financial industry. The new system opened doors to:

- New ways of doing business.

- Simplification of procedures for public administration.

- Instant payments.

- Personal banking services for users in poor countries.

- Financing for new entrepreneurs.

- Enter the 21st century in the wave of the use of new financial technologies.

- And in general, all this represents "economic freedom".

All of the above can mean prosperity and at the same time a way to break free from the yoke imposed by the old financial system. But these freedoms represent a loss of economic power, which automatically translates into money, so it is a freedom that said system is not willing to grant.

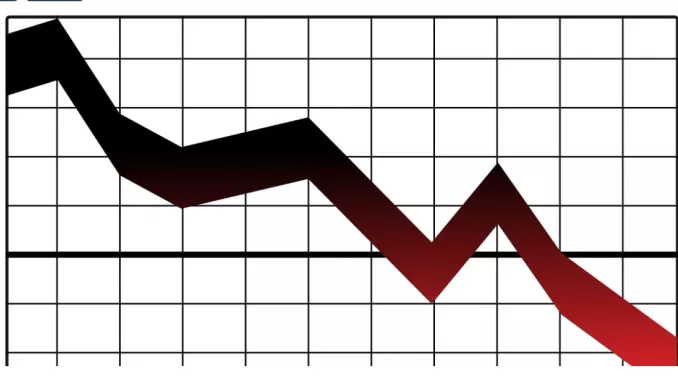

If we observe the meters and monitors of cryptocurrency behavior in recent weeks, it can be seen that 80% of the first 30 cryptocurrencies have had their indexes in red, this is a bad symptom for some but not for others. Those who have invested and betting on the rise are seeing how their investment vanishes as time goes by. Selling and buying short-term is quite an adventure, predicting an increase is made uphill.

[Source: Google]

Those interested in the failure of the cryptocurrency system use their great and powerful weapon to take advantage of and accentuate the volatility of this market, for that reason they make use of their large chains and means of communication, which are nothing more than companies to their services and of the which are mostly the owners. Additionally, they locate and declare people with a lot of study or with a reputation in the matter to try to make their statements credible (this we have already seen in other financial crises).

This is how we can see and hear, for example, things like:

"The economist who is credited with predicting the global financial crisis of 2008 said that the fall in the value of bitcoin was the most recent proof that the cryptocurrency is the largest bubble in history and is doomed to collapse."

Another:

According to Nouriel Roubini, professor of economics at New York University, bitcoin is "the mother of all bubbles" supported by "charlatans and swindlers," Angela Monaghan writes for The Guardian newspaper.

Likewise:

According to Roubini, "the sharp drop is the beginning of a collapse that will bring the value of the digital currency down to zero."

Or also:

Various financial institutions such as the IMF, the World Bank, G-20, G-7, their spokespeople have been sending direct messages on the acceptance of cryptocurrencies by investors, they all speak the same language, there is danger, as ; "Money laundering", "financing of terrorism", "evasion of obligations" and "corruption"

It is an open secret that some specialists interested and supported by large companies receive "something in return", to offer catastrophic information, so that small and medium investors sell, then take advantage of the largest and most economically powerful, buy when the value can represent short-term gains Then the cycle is repeated.

But in this case it would seem that it is not simply taking advantage of a situation, but annihilating an enemy, neutralizing the threat and ending the Financial War.

Congratulations @checheoreo! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP