Crypto Market Decoupling Signals a Bullish Regime Change

If you’d rather see this presented in video form, you can view the replay of the live stream I host every Sunday night:

Previously, I wrote about how the price action in the past few weeks has been extremely bullish, but was due for a correction. What we are seeing now is the correction continuing in some coins, but already finished in others. This sort of decoupling is further confirmation that we are transitioning into a more bullish market regime. I’ll expand on this further in the Altcoins section.

Let’s get started!

Bitcoin

Somewhat surprisingly, nothing has changed since the last Strategy Notes that I sent out. Which is good! It means that my work was correct.

Daily Chart

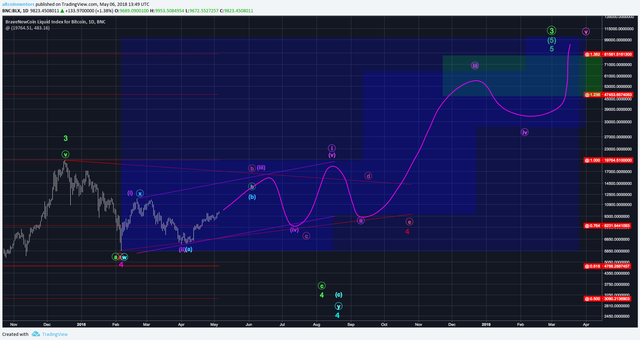

Since nothing has changed, for fun, I drew out the (very) rough path that I expect Bitcoin to take in the next 6 months to a year. The blue boxes are the general ranges that are expected if the count I have is right.

If you haven’t read the analysis presented last week, there are four likely paths that Bitcoin could take according to Elliott Wave Theory. As you can see, there are still two viable counts that lead to breaking below the Feb 5 low of $5900. As Bitcoin breaks more resistance and holds more supports, these become more and more unlikely.

The two likely bullish paths are a triangle and leading diagonal. The leading diagonal is traced out above, and the triangle is not that much different (see the red on the chart above).

Just like before, this is all invalidated by a break below $3000.

Intraday Chart

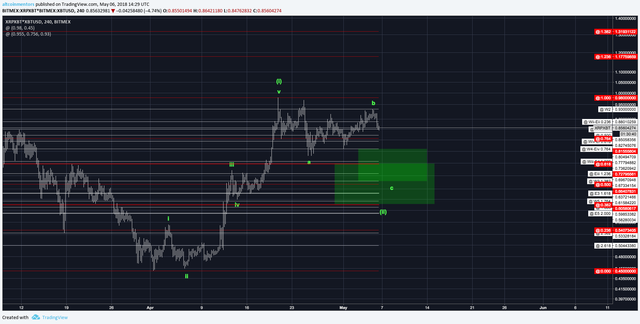

We are still waiting to see whether support for the 4th wave of the pink leading diagonal will hold or whether there is further downside to finish c of 2.

The main thing of note in this chart are the long-standing MACD trend lines. A break of the trend line to the upside will be the first sign that the lows are behind us. I don’t expect the price to break the trend line supports, but that will the first sign of trouble.

Altcoins

As I said in the intro, we are seeing a sort of decoupling. Of course, they are not and will not be (at least for a while) fully decoupled from Bitcoin, but some are running ahead and others lagging behind.

The crypto market cycle consists of four phases: Bitcoin bull run, altcoin bull runs, correction, recovery.

On a larger time frame, Bitcoin went on its bull run from November to December, altcoins ran during December to January, both corrected/crashed from January to April, and we have now seen the recovery. This decoupling is the first sign that we are transitioning into the phases where we see major bull runs.

Ripple is keeping parity with Bitcoin (in technicals)

Ethereum is leading Bitcoin (in technicals)

BCash is lagging Bitcoin (in everything)

Strategy

Last week’s strategy was to buy the dip. I was really expecting the dip to be over with by now, but alas, the market seems to be in slow-motion lately (which BTW, is a sign of increasing volume. I’ll simply repeat what I wrote last week:

This retrace is the time to be a buyer.

You might be tempted to go “all-in” on one or just a few of the coins with the highest potential returns. That would be a mistake. While it would certainly be profitable, the best way to play these altcoin runs is to “rotate” between them.

Start off with a variety (as many as you can effectively keep track of) of coins. Some will pop off before others. Even though those early leaders might not have reached their targets yet, you should rotate those profits into other coins that are earlier in their cycle. The reason to have many coins is because you don’t know which ones will be the leaders.

To get into the weeds more on executing entries, you’ll want to get starter (read: small) positions on the alts that you most like. As they correct, you add more and more size the better price you get. In a market like this, many alts will not get to the bottom of their ranges and thus you may have to wait for the 1-2 of 3 to size up even more.

Always remember to stay patient and let the market come to you. FOMO is a strong emotion, but to be a successful trader, you cannot let it dictate your actions.

If this analysis has been helpful and you want to receive it in your inbox every Sunday, you can sign up at https://altcoinmentors.com/strategy. If you would like to support us, please upvote and share this article with someone else who would find it useful!

To keep up with us during the week, we have a Telegram Channel where we post charts, market updates, and trade ideas every day! You can join by going to https://t.me/altcoinmentors.

We also have a model portfolio that contains all of the moves we are making in the market. You can grab that at https://altcoinmentors.com/portfolio.

Happy trading!

Charlie You

Altcoin Mentors, Inc.

twitter.com/iamcharlieyou

twitter.com/altcoin_mentors