Data analysis of recent ended ICO's

Introduction

I am a fan of cryptocurrency and have been following the recent news about them. I believe that the future belongs to cryptocurrencies.

ICO is relatively new to me. I wasn't able to join the ICO's due to the KYC policies. However, as I follow the ICO results, I found that the most of the recent ICO's are currently selling at a lower price than the ICO price. To be exact, according to my analysis the number is 65%! That is to say, 2/3 of the ICO investors are losing money. Very naturally I wonder if we can predict which ICO will be successful.

Here I am summarizing the data I found on icodrop.com.

At the time of writing, I was able to find 242 ended ICO on the platform (some of them haven't got a price yet).

This is a glimpse of what the ICO data look like. Here ROI stands for return of investment, and the ratio column is the amount raised/target amount

One ICO stands out obviously; confido has an astonishing 19X return since its debut. That is the best for recent ICO's.

How does the interest from the crowd have an impact of the return

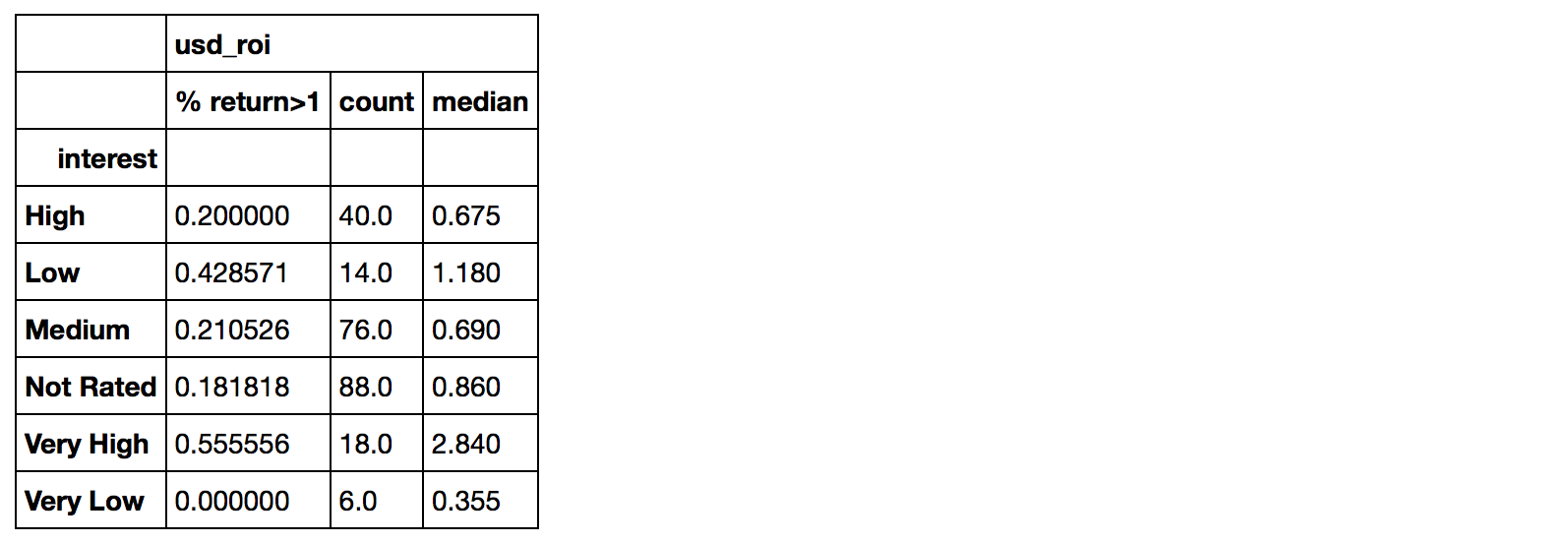

icodrop has an index for assessing the crowd interest. I guess it is generated from the trend in social media platform (correct me if i am wrong). Here I am showing the USD return for different categories.

Very intuitively, the ICO with Very High interest from the crowd has gained the most and the ones with Very Low interest lost values for all of them. What I am surprised to find is that the Low interest ICO's seem to do better than ** High** interest ICO's!

The following is a summary of the interest vs. usd ROI.

Out of the 18 Very High interest ICO's 55% has risen in price. However, only 20% of the High interest ICO's has a higher value than their ICOs. This perhaps is not statistically significant due to the small data size. A comprehensive study is beyond the scope of the post.

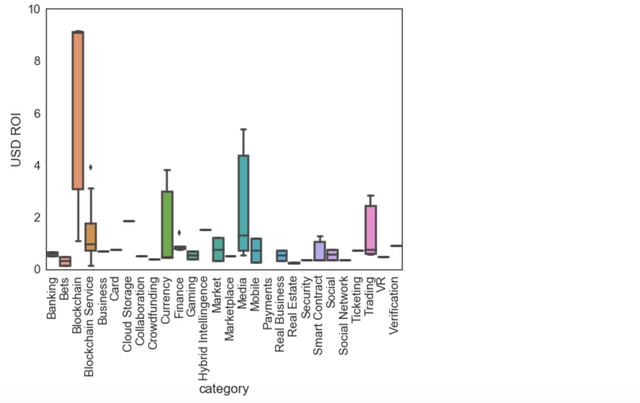

The impact from categories

What kind of ICO's are most likely to yield a positive return? gaming, blockchain or what?

It turns out, Blockchain, Media, Currency and Trading are the winners. To my surprise Bets, Social Network and Gaming are not doing so well, hmm.

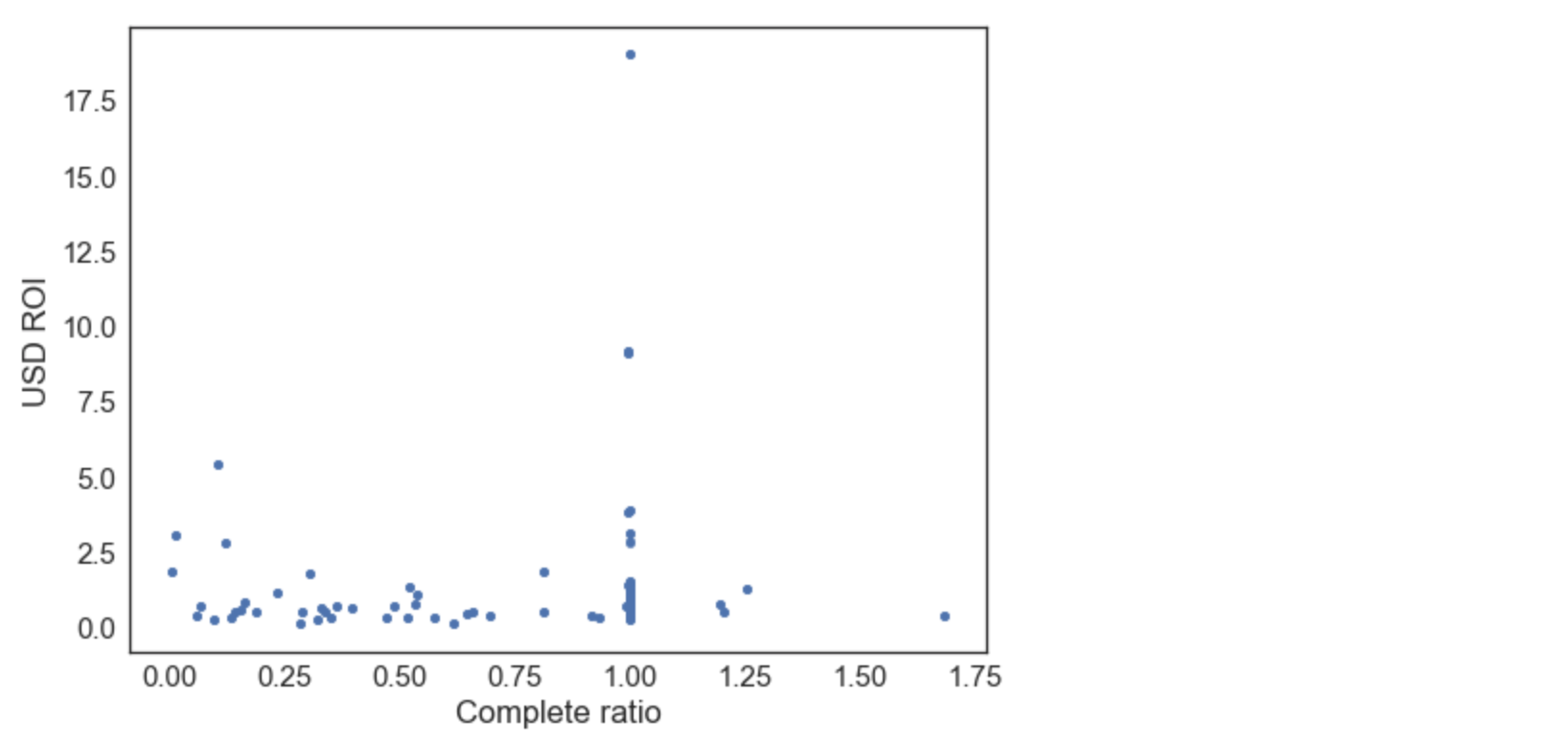

Correlation with complete ratio?

The following shows the USD ROI vs. the complete ratio. The two with >5 ROI are confido and ICO. Both of them have reached their targets (100%).

However, the ones that oversold their tokens are not performing that well. We will wait and see how Filecoin performs (ratio is 6.42).

Conclusion

That's all for now. I am just listing the data analysis. It was just out of my personal interest and is not investment suggestions.

If you like my content, you can upvote or donate to my ether address at:

0xf706A4C3A0c129745aa1103E96805B9d0268ba54

Thank you.

Great information. ICOs are so new. I believe this is the first, well put together, and quick analysis I have seen since I first started trading crypto a few months ago. Thank you so much for sharing. I plan on following you!

Thank you for the appreciation!

Congratulations @cchen! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!