A Beginner's Guide For My Friends and Family (Please Read and Give Feedback)

A Beginner's Guide To Crypto & Blockchain

Let’s start with blockchain technology.

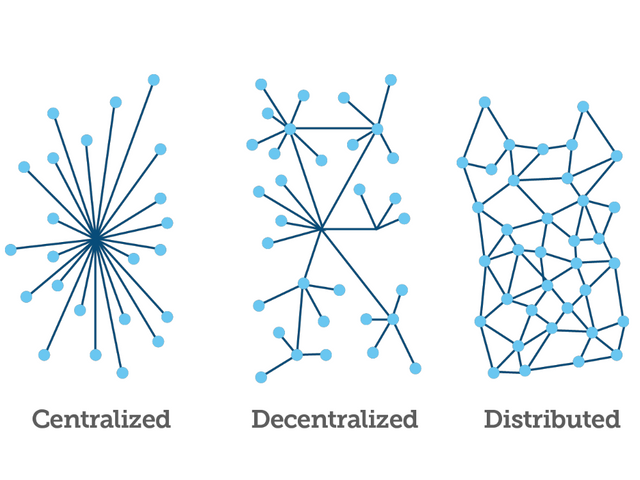

Blockchain isn’t that complicated. In its simplest form, it’s a cryptographically modified form of decentralized data. There are two important aspects to that statement:

- The blockchain is a “block” of numbers linked and secured using cryptography. The same way the Allies and Axis powers used algorithms to safely disseminate information to thousands of soldiers, blockchains are locked up information that is only accessible with the correct key (there must be knowledge of the chain of algorithms to decipher the current one).

- Decentralization is the most important aspect. Just because you have data stored through cryptography, doesn’t mean it’s secure. Famously, Turing deciphered the Nazis codes, allowing all of their “secret info” to be instantly accessible to the allies. The best way to combat this (especially in a digital context) is to decentralize the data and the keys, while simultaneously keeping them linked. This way, you would require all the keys to all the blocks to corrupt the network. The more chained blocks (blockchains), the more difficult it is to hack, perform DDOS attacks, or diversely compromise the network. The longer the blockchains, the safer the network. Any damaging nodes can be quickly recognized and removed, while the rest of the network retains an ability to run unimpeded.

Why does it matter?

This technology will change everything. No, I’m not promising you neon green Lambos, millions of dollars, or galactic exploration. Simply an objective realization that having a secure, decentralized network will be desired, and eventually necessary, for any business, government entity, or even Wi-Fi hot spot.

Want to check your email? Not if the network is compromised.

This technology will make all transactions and transfers of data,

- Thousands or millions of times faster than present.

- Will be able to transmit this data through secure, decentralized networks, without concerns of hacking, manipulation, or other antagonistic issues.

So, I get the decentralized, security aspect, but wtf is Bitcoin?

![]()

Bitcoin was first. That’s pretty much it. The concept of blockchain was implemented by the anonymous (individual or group) “Satoshi Nakamoto” to create cryptocurrency & Bitcoin – the design being that it’d be used as a digital, ethereal currency (more secure and less traceable than credit cards, PayPal, or bank transfers).

There are numerous methods to create new blockchains, but Bitcoin is “mined”. To “mine” Bitcoin, a “miner” has to devote computing power to solving problems for the network. Once a computer (or sets of computers/servers) has devoted enough resources to the “mining” process, new blockchains are created, and the “miners” are rewarded with Bitcoin and user generated transaction fees. You may say there's no value for a Bitcoin to USD (or any fiat currency) at this point, but valuables have gone into its creation, mainly: time and energy.

But wait… doesn’t that mean the value of the Bitcoin is only based on trust?

You bet your sweet a** it is.

Before you decide that means you’re writing it off, take a long, hard look at the trusty, reliable US Dollar.

The (Not So) Simple History of a 250 Year Old Currency

The US Dollar was, as you're aware of, originally the English Pound. This was scrapped when we became independent. Next, was the Continental Currency, which was crushed due to runaway inflation (because every state printed as much of it as they wanted), hence the reason you’ve never heard of the damn thing. In 1792, the US Dollar (courtesy of the Mint Act) was pegged to something shiny (silver - precisely 23.2 grams). Over time, this shifted to the gold standard, again pegging the dollar to something very real, and very shiny. There was no paper money as we understand it today, only issuances backed by a resource. As the reserves of both gold and silver largely remained the same over the 19th century, but paper issuances increased, the valuation of the issuances decreased. All value was tied to tangible resources.

Then there was the Civil War.

Courtesy Wikipedia:

One of the first attempts to issue a national currency came in the early days of the Civil War when Congress approved the Legal Tender Act of 1862, allowing the issue of $150 million in national notes known as greenbacks and mandating that paper money be issued and accepted in lieu of gold and silver coins. The bills were backed only by the national government's promise to redeem them and their value was dependent on public confidence in the government as well as the ability of the government to give out specie in exchange for the bills in the future. Many thought this promise backing the bills was about as good as the green ink printed on one side, hence the name "greenbacks.”

And there it is. After thousands of years of currency being based on valued supplies* (of metals or commodities), it was decided that real world issuances would be no better than a promise. Think “Sticks and stones may break my bones, but words will never hurt me,” except, “Gold and silver is real, you’re offering me valueless words.”

* Fiat currency has been used in past societies such as the Ancient Egyptians, but was always temporary.

As the US worked its way out of the 19th Century we continued to flip-flop on Dollar value. Sometimes the promissory notes could be turned in for gold and silver, but usually they couldn’t be. Battles took place between those that wanted a silver standard and those that wanted a gold standard. At times, the Dollar was a bi-metal based promissory note, at other times, mostly a gold standard. In the end, these “meaningful currency battles” proved fruitless. Why?

Having Fun? Well, stop it. THE GREAT DEPRESSION.

As inflation and economic woes began to spiral out of control throughout the world, the gold standard (or bi-metal standard) was dropped by country after country. This was due to the fact that their reserves could no longer keep up with demand.

Essentially, as bank runs occurred, and the value of paper notes decreased daily, citizens began to distrust banks and paper money. What can you use to trade and barter if paper notes are valueless? Why, you use the metals that the promissory notes are supposed to be backed by. So, the citizenry starts hoarding precious metals, reserves are depleted, and what is paper backed by again? UH OH. Wall Street, we’ve got a problem.

Even through 1933 US bills were denoted as “United States Note”, and had the phrase, “Will Pay To The Bearer On Demand” stamped on the front. However, to combat the depleting gold reserves, FDR implemented a series of laws that “suspended the gold standard except for foreign exchange, revoked gold as universal legal tender for debts, and banned private ownership of significant amounts of gold coin.” United States Notes became Federal Reserve Notes.

This gold standard suspension was considered temporary, but wasn’t reinstated by any meaningful measure until…

World War II and the US Decides to be Boss

We leapt out of the Great Depression by helping England and Russia whoop some ass in Europe, Asia, and Africa. What we weren’t prepared for was how devastated the rest of the world would be in the aftermath. Nearly every nation – from England, to Japan, China, to The Netherlands – found itself utterly wrecked in 1945-46 – well, except for one: the good ole USA.

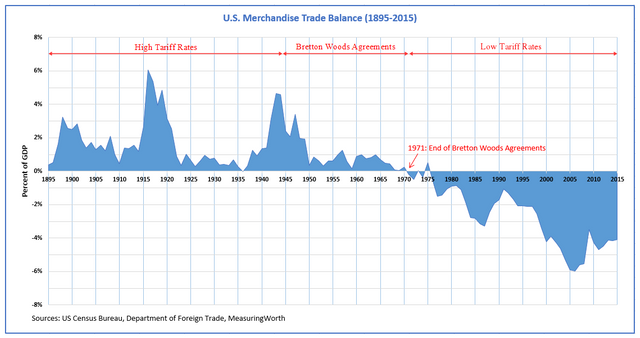

Using a combo of the Marshall Plan and the Bretton Woods System, the US became the strongest and most giving nation on Earth. This allowed us to flood the world with US dollars that were, once again, pegged to gold. And we all lived happily ever after.

Nah, just kidding. Everything was smooth for awhile, ‘til the Crook from Cali took some currency liberties in 1971.

Nixon's One Finger Salute to the World

Ever increasing inflation and unemployment freaked Nixon out – we’re all well-aware now that he’d do about anything to get re-elected – so he, literally overnight, decided that dollars were no longer guaranteed by gold backing. After years of toying with the idea of making the US dollar a fiat currency (money a government has declared to be legal tender, but is not backed by any physical commodity), we dove in headfirst and never looked back.

That means my US Dollar is worth… my confidence?

That’s about it, yeah. You can factor in costs, like the price of the paper and ink it’s printed with, the energy consumed by printing machines, and the cost of distribution, but if these were the only factors that determined our valuation of US Dollars, a $1 bill would be worth the same as a $100 bill. There is no real difference in the bills besides

- Less $100 dollar bills are in circulation than $1 bills, and,

- $100 bills are printed with the number 100, $1 bills are printed with the number 1*.

*There are additional differences, such as Washington’s portrait vs. Franklin’s. These miniscule details are being ignored.

That's okay, I'll convert my money to a non-fiat currency, now that I'm aware.

Good luck. The last currency even kind of sort of similar to the gold standard was the Swiss Franc, which kept 40% of the value of their currency in gold in their reserves at all times. They broke with this structure by way of a referendum passed in the year 2000. Find me a non-fiat physical currency, and I'll show you a commodity.

I still trust paper money more than digital cash.

There are further problems with paper currency, as well.

- Criminals (and some countries) make fortunes counterfeiting bills, and most of us would be hard-pressed to see the difference between reals and fakes. This devalues and delegitimizes actual bills.

- Next, people or governments can do whatever they want with dollar bills (though it’s claimed there are repercussions if you defame or destroy them). Lock it up, burn it, hoard it, overcirculate it. This makes proper valuation almost impossible to accomplish.

- And then there’s transfer times. Want to send $1000 to your friend? They’re gonna have to wait 3-5 days. Or, you can write them a check that they can deposit, in which case they’ll be waiting for 1-3 days for the balance to settle. Don’t want to wait? You can send the money through PayPal or Venmo, but you better believe they’re taking some cream off the top.

You’re saying we already base our currency on confidence, but how does cryptocurrency and blockchain fix any of the issues you’ve described with paper money?

- You can’t forge blockchains. Due to the fact that they’re decentralized, linked, and locked with a personal key, you’d have to counterfeit an entire network, which would cost billions of dollars in computing power, energy, and time. There is no such thing as a duplicate blockchain: Mining is a record-keeping service done through the use of computer processing power. Miners keep the blockchain consistent, complete, and unalterable by repeatedly verifying and collecting newly broadcast transactions into a new group of transactions called a block.

- The decentralized nature of Bitcoin and cryptos (though not all are actually decentralized – do your homework before buying) means no government, corporate entity, or person can single-handedly determine the price. The market won’t get flooded with Bitcoin because the Fed decides to print more, you can’t take existing Bitcoin and burn them, and the number of blockchains on the ledger is countable – the supply and demand is able to constantly be monitored.

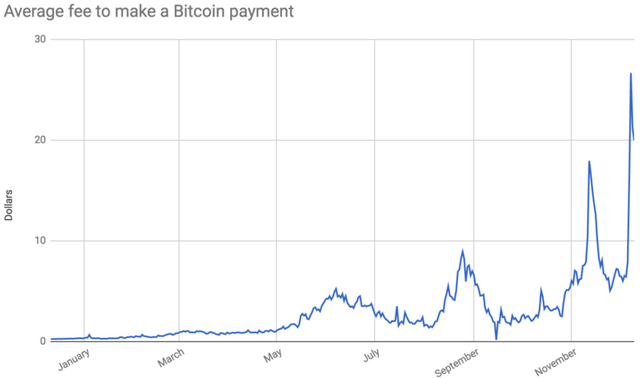

- Transfer times are faster, and, on a good day, transaction fees are lower. This is where you start to get into the nitty-gritty. In relation to the dollar and banks, Bitcoin transfer times are significantly faster – think anywhere between a few minutes to a day. This is easily outpaced by credit card transaction speeds, and is no longer considered speedy in the world of cryptocurrencies - one of the many reasons Bitcoin has become a value holder rather than a means of currency distribution (the difference between currency and value holder being: no one goes to the supermarket and pays for their groceries with gold nuggets, you keep gold in a safe deposit box for emergencies, or peak price times).

You said “on a good day” transaction fees are lower. What does that mean?

The cost and speed of a transfer (a buy or sell order) is determined by a multitude of factors.

- How many people are on the network?

- How big are the sets of data contained on each blockchain?

- What is the volume of trading at any given time period?

- Is the network built for low-cost, fast transfers, or for tighter security and more stringent privacy?

Using Bitcoin as an example: when the process began, mining fees were low, transfer fees were low, volume of Bitcoin holders was low, and the currency itself was nearly worthless. Unfortunately, as Bitcoin has continued to scale up, it’s run into numerous problems that weren’t understood thoroughly when it was created. One of these major issues is that Bitcoin blockchains are limited in size to one megabyte.

Here’s a summary of why that is important:

Bitcoin blocks carry the transactions on the bitcoin network since the last block has been created. In contrast to Visa's peak of 47,000 transactions per second, the bitcoin network's theoretical maximum capacity sits between 3.3 to 7 transactions per second. The one-megabyte limit has created a bottleneck in bitcoin, resulting in increasing transaction fees and delayed processing of transactions that cannot be fit into a block.

On one particularly high volume-trading day, any transaction, be it .0001 Bitcoin or 1,000 Bitcoin, would’ve cost the user an equivalent of at least $50. This is a major problem, and there’s been a tug-of-war regarding how to resolve it since July 2017. If you want read up on the way programmers have decided to take it on, search for: Bitcoin scalability problem, Segregated Witness, and Bitcoin Cash.

Bitcoin wasn’t designed with fees in mind, but fees have become essential – basically, if you want to have your Bitcoin exchanged, you have to pay a large transaction fee to entice a computer to validate your command, because everyone else is willing to pay a large fee for that computer’s time and energy, as well. With a cap of 3-7 transactions a second, and more users wanting to buy and sell everyday... you, uh, see the issue. But we won’t delve any further into that. Interested in how programmers are attempting to solve this (and it is a very solvable problem)? Many of Bitcoin's competitors have made low fees and fast transactions their selling point, but this doesn't mean they're better or more trustworthy than Bitcoin.

That sounds like a risky place to put my money.

Right again. Any emerging market is going to be riskier than established markets. It would’ve been risky to be one of the firsts to invest in Google, Amazon, Microsoft, or Apple, but if you told someone you had an opportunity to get in on the ground floor and skipped it, they’d call you an idiot now. On the other hand, no one would pat you on the back for investing in Cisco Systems at its ATH (77$ in 2001, $38 in 2017). The crypto markets are still in the Wild West phase – many will vanish or be useless, but a few will succeed and be a solid investment. This isn’t a theory, this is the reality.

But you just got through saying that Bitcoin has all these issues. How is that proof of success?

Bitcoin is the Ford Motor Company of cryptocurrencies: they made the scene and remained the only player for years. This gives you name recognition and accolades, but the world shifts faster and faster these days. Just because Ford isn’t the biggest car company in the world, doesn’t mean the company has zero value or doesn’t still make quality vehicles – they’ve simply seen their market share decrease as competitors flooded in. This is what's happening with Bitcoin, but instead of taking fifty years for the product to lose market dominance, it took less than ten.

There are thousands of coins in the ethos, the main players currently being: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and, to a lesser extent, privacy coins like Dash and Monero, or cheaper, faster, more centralized alternatives like Ripple. Every coin brings something to the table, and also takes something away. Ethereum is largely considered a developer-friendly coin, Litecoin has been termed, “the silver to Bitcoin’s gold”, and Ripple is working with banks to utilize its nodes and networks for faster transactions. To understand why any of these factors may be important to you, you’ll have to research what matters to you.

You’ve piqued my interest, but I only want to put in a very small amount of money – ya know, to see what happens. How can I go about doing this?

There are plenty of ways to get your hands on cryptocurrency, roundabout or direct. These range in concept from Bitcoin ATMS, where you can make a purchase through a physical stand, to $GBTC, an investment trust that holds shares of Bitcoin. If you follow the stock market, you're probably aware that the price of stocks such as Overstock.com, Nvidia, and Micron Tech have been heavily affected by the correlating price of Bitcoin and Litecoin. Some money managers or investors will tell you to stay far away from these companies, some will tell you they're a sure-fire home-run. Don't trust anyone except yourself. Research, research, research.

The easiest way to get your hands on cryptos is exchanges (similar in concept to the NYSE or S&P500). It’s here where you’ll find long lists of coins ranging in price from .00001 cent to $20,000. Not all coins are the next Bitcoin, and most will indubitably disappear, lose value, be bought out, or go bankrupt - this is the way any realistic failure/success ratio tends to pan out in a given industry.

The most user-friendly app for beginners is Coinbase. This doesn’t mean every beginner should rush over and dive in - Coinbase charges pretty extensive fees (1.5% for bank transfers, 5% for credit card purchases). That may not sound like much if you’re transferring $50, but that’s $15 taken from $1000 – which means for $1000, you’re actually getting $985 worth of the crypto of your choice (hence the, “It better go up!” sentiment). Coinbase has incredibly limited choices for exposure, leaving you with (at the time of this article) only four options for purchasing with the Euro, Dollar, or Pound. But, if your intention is to throw $50 in and forget about it for a year or two, Coinbase isn’t a bad choice.

If you feel a little more comfortable in the crypto-realm, and want the ability to monitor prices continuously, look into Gdax. This exchange is owned by Coinbase, but gives lower fees, and affords breaks to market makers (if you set a limit order instead of a market order, you’ll be rewarded with lower fees). The graphs are complex, the transfers slightly complicated, but orders are more exact and easier to make. There are numerous exchanges, many owned and operated outside the US. A few of the larger ones are: Bittrex, Binance, Gemini, and Kraken. These exchanges offer alternatives to the three or four mainstream coins (called Alt Coins) and usually better, more controlled transaction fees. Many exchanges have been hacked. Understand that if you keep your cryptocurrency on an exchange, it is always at-risk of disappearing. Some exchanges are insured up to certain amounts, but you’d need to prove your purchases. ALWAYS READ THE FINE PRINT.

What? You said blockchains are secure.

They are. However, if you don't put the coins in a “cryptowallet” you aren’t in total control of it. A way to think of it is simply: having your crypto stored on an exchange is equivalent to holding your money up in the air and waving it around, rather than keeping it in your pocket. Money in the hand and out is undeniably accessible, but anyone can yank it from you if they have the willpower and intention. In your pocket it’s safer and almost never stolen, but every time you want to use it, you have to take it out.

What’s a cryptowallet and how does it work?

These wallets are storage units for your crypto, ya know, like a wallet. A better comparison, actually, is a safe deposit box. Wallets come in software and hardware forms – software generally being free, hardware ranging in price from $40-$250+. A software wallet will commonly give you an account name, an account password, a backup 25-word phrase, and 2FA enabling (Two Factor-Authentication). A hardware wallet is a thumbdrive with a pin code, a 25-word phrase, and further security measures to ensure safekeeping of your coins. If the hardware wallet is lost, it does not mean the coins are lost. Since the blockchains still exist, as long as you know your password, pin, and phrase, you can receive all the currency despite the loss of the physical hardware. If you plan on holding your coins for any extended period of time, get a software or hardware wallet. (The Nano Ledger S shown below is an example of a hardware wallet)

Why are the prices so volatile? Doesn’t that volatility put me at a disadvantage if I store my crypto on a wallet?

In a sense, yes. If you're actively trading with hundreds of thousands of coins, spread across dozens of cryptos, and need to make a quick exit in the event of the slightest market correction, you're at a disadvantage. But really, no, it doesn’t. Will it take you longer to make a transfer or trade? Sure. Will your crypto vanish overnight without you having any idea where it went and how to recover it? Probably not, but you’d feel like a grade-A a**hole if it did happen to you. Hacks have materialized before (see: MtGox or NiceHash) and will surely happen again. Don’t be that a**hole – get a wallet.

As for volatility, there are a multitude of reasons for this: growing public awareness, easier access, institutional investors, and “whales” (holders of large quantities of any given coin who can flood or buy back enormous swaths of the market). Everyday more good news and bad news is reported, everyday a government or bank declares crypto horrible and risky, while others back it whole-heartedly. The swings are because there’s an abundance of speculation. Does this mean a bubble will pop soon? Probably. Does it mean crypto will suddenly be a valueless realm overnight? Most likely, no. There are people waiting to jump on every mainstream coin as soon as it hits a random dip number they feel safe buying in at. I will again express, however, that many alt-coins, like many internet-based companies during the Tech Bubble, will appear, gain immense, completely speculative value, and then evaporate. People will make fortunes, people will lose everything, but most of us will dip our toes in and watch it from the sidelines. Up and to the point that…

Cryptos and blockchains will replace the current means of transacting?

Don’t say this is pie-in-the-sky thinking. It’s actually more realistic than diving into the cryptosphere to get-rich-quick. Before we know it, most of our business and personal transactions will take place through blockchains and cryptos. It might be a decade or two, and there’ll likely be a transitionary period where dollars are pegged to a specific crypto, but it’ll all slip into your life like smartphones:

Stage 1: It doesn’t exist.

Stage 2: It is created.

Stage 3: Only rich folks and weirdos dive in.

Stage 4: Everyone decides it’s worth it. "Guess I’ll get one," becomes the underlying sentiment.

Stage 5: None of us can even remember life without it.

Right now, we’re somewhere between Stage 3 and Stage 4.

Do you have US Dollars in cryptos?

Yeah, I’m in cryptos, but not more than I’m comfortable with losing.

There are human behaviors that affect our ability to react rationally to volatile markets: when prices go up, there’s a strong sense of FOMO (fear of missing out) if you aren’t already involved, when prices precipitously drop, FUD (fear, uncertainty, and doubt) overwhelms your synapses. Try to keep these in check if you decide to put any of your physical cash into crypto. Is a coin up 80% for the day? That doesn’t mean buy now – and could very well insinuate the opposite. Just lost 40% of the value of the coin you bought last night? That doesn’t mean sell, sell, sell.

Read up on irrational exuberance and the role it played in previous financial crises, how humans are prone to herd behavior, and brush up on the first recorded commodity bubble, “Tulip Mania”. Scare the pants off yourself before you assure yourself this is a move you’re willing to make, and if you still feel like it’s a good idea… Do it.

Since I’m new to this, can you tell me what coins you recommend and why? How do you decide what coins to invest in?

I will not post which coins I’m invested in on steemit, but feel free to message me if you want to discuss risk, rewards, and prospects of any given coins.

I am by no means an expert, nor will I ever claim to be. This is not written as a shill to get investors to buy into coins I believe in, or into the crypto marketplace at all. Investments and purchases are exceptionally subjective, and require any investor to assess what kinds of risks they are willing to take. If you’re 95 and living Social Security check to Social Security check, you’d be doing yourself a disservice to invest in cryptocurrencies. I’d almost recommend buying lottery tickets instead.

But no, please don’t do that, either.

The point is, if you want to know what the quickest way to get rich through crypto is, you’re asking the wrong guy. I love blockchain technology and cryptocurrency, not because of a desire to be wealthy (though I think everyone shares in that longing), but because I genuinely believe in the tech and see the real-world applicability throughout every industry. Want to talk shop in that respect? Let's shoot the sh*t!

Reddit has proven to be a wonderful resource for finding information regarding up and coming coins, though be wary of people who claim a coin is going, "TO TEH MOOON!1!!" or "It'll be lambos for everyone!" Use your own discretion, and understand that more often than not, the people posting know as much as you or I.

The reason Reddit is a great resource is that it provides a communal space where you can ask questions, get answers, see how welcoming the coins user base is, and most importantly, find out if the leadership reaches out and discusses issues and additions to their coin.

The SEC has little regulatory control over cryptocurrency (expect that to change this year), so you want to be able to trust the leadership, resonate with the goal, and believe in the product, because it wouldn't take much for a disreputable huckster to swoop in with a fancy video and steal millions of dollars. As David Mauer says in The Big Con, "There's a mark born every minute, and one to trim 'em and one to knock 'em." Don't be the mark.

Find coins with understandable, logical, and well-written whitepapers. Don't search for any ICOs (Initial Coin Offerings) to invest in, expressly at the beginner's stage. Is this a solution to an existing problem? Or is it a, "let's take advantage of the word 'blockchain'" scheme? (Long Island Blockchain Company) Are the founders and Chief Officers distinguished in their respective fields? Or can you only find a half-baked LinkedIn resumé with companies you've never heard of (and probably don't exist)?

This, hopefully, provides you with enough information to begin to clear your own path through the dense jungle that is cryptocurrency.

Questions? Concerns? Feedback? Leave a comment or message me. Thanks for reading.

Hepimiz daha fazla kazanırız insallah

Now this knowledge was very impressive & valuable! Makes me think about creating an cryptocurrency of my own on the blockchain, LOL, I still need to learn more though, superb post too! @caspiancey

Thanks so much! It took time, but I want less tech-savvy individuals to be able to understand cryptos, too.

Ook! I'm good & well at understanding technology, but this blog helps me cope with things I didn't know far as accounting plus how stocks are involved.

:D

Actually, how cryptos are taxed and how to deal with them as far as accounting purposes are concerned is a topic that could be emphasized more, and probably an issue many people haven't given thought.

I think that could be addressed further and will look into making an addendum. Thanks for the feedback!

Anytime, sure your welcome!

Fantastic. All new Steemian's should read this post. Unfortunately, the average attention span is less than a gold fish. As you state, when it comes to the value of a currency, it all boils down to trust.

Perhaps chunk your highly informational posts into smaller, digestible ones. Just a thought.

I think blockchain, cryptocurrencies, and the decentralization behind it will give us the ability to scale entire economies - giving the power back to the people. Of course, the banks and Fed aren't happy.

Just out of curiosity, what are your opinions on the origins of Satoshi Nakamoto, (AI) Sophia and Han, and Superintelligence?

Again, great post - welcome to the community.

And wow 44 kittens!

Appreciate this. Used to writing longer, more in-depth work, so I'll try to tighten things up and break 'em into parts.

As for Nakamoto, it's hard to say, isn't it? The complexity and reliability of bitcoin leads me to believe it's a group of individuals whose intentions were to disrupt the current monetary system and get a cut for themselves. AI and tech is generally heading in a direction that lends credence to Simulation Theory. But what do I know?

What's your opinion?

Yes, in a similar fashion - I've read crazy things about Satoshi etc., it's hard to discern the truth. My gut tells me it's a group of a highly anonymous, coordinated programmers that perhaps used/supplemented forms of rudimentary AI to create it.

Idk - but I can't get behind the explanation that the Government created it.. what purpose would that serve? It's decentralized, they lose influence/power? But again, who really knows?

As for the Simulation theory, it seems feasible, but I hope Musk and his fanboys aren't just promoting it for publicity because Tesla will be strapped for cash in 2018. If you are further interested, I would read some of Nick Bostrom's work.

Regardless, exciting times and happy soon to be New Year, maybe we'll get some more answers.

What I appreciate about Simulation Theory is that it doesn’t change anything.

Whether we’re in a sim or not, why would that alter the way you live your life?

I haven’t heard the theory that it was a government entity, can you direct me to a website, tweet, or post that says that’s a possibility?

Conspiracy theories abound when there’s an unknown piece of the puzzle - I’ve read a lot of articles concerning Nakamoto’s identity and all I’ve gained from it is that far more skilled writers and journalists than myself have been duped by wannabes. I can only imagine how many staff writers at the NYT, WSJ, and WikiLeaks are trying to figure it out.