What Is Cryptocurrency ?

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets.[1][2][3] Cryptocurrencies are a kind of digital currency, virtual currency or alternative currency. Cryptocurrencies use decentralized control[4] as opposed to centralized electronic money and central banking systems.[5] The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[6][7]

Bitcoin, first released as open-source software in 2009, is generally considered the first decentralized cryptocurrency.[8] Since the release of Bitcoin, over 4,000 altcoins (alternative variants of Bitcoin, or other cryptocurrencies) have been created.

History :

In 1983 the American cryptographer David Chaum conceived an anonymous cryptographic electronic money called ecash.[9][10] Later, in 1995, he implemented it through Digicash,[11] an early form of cryptographic electronic payments which required user software in order to withdraw notes from a bank and designate specific encrypted keys before it can be sent to a recipient. This allowed the digital currency to be untraceable by the issuing bank, the government, or a third party.

In 1996 the NSA published a paper entitled How to Make a Mint: the Cryptography of Anonymous Electronic Cash, describing a Cryptocurrency system first publishing it in a MIT mailing list[12] and later in 1997, in The American Law Review (Vol. 46, Issue 4).[13]

In 1998, Wei Dai published a description of "b-money", an anonymous, distributed electronic cash system.[14] Shortly thereafter, Nick Szabo created "bit gold".[15] Like bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange, BitGold) was an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published. A currency system based on a reusable proof of work was later created by Hal Finney who followed the work of Dai and Szabo.

The first decentralized cryptocurrency, bitcoin, was created in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[16][17] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[18]IOTA was the first cryptocurrency not based on a blockchain, and instead uses the Tangle.[19][20] Built on a custom blockchain,[21] The Divi Project allows for easy exchange between currencies from within the wallet.[22] Many other cryptocurrencies have been created though few have been successful, as they have brought little in the way of technical innovation.[23] On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[24]

Formal definition :

According to Jan Lansky, a cryptocurrency is a system that meets six conditions:[25]

The system does not require a central authority, its state is maintained through distributed consensus.

The system keeps an overview of cryptocurrency units and their ownership.

The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

Ownership of cryptocurrency units can be proved exclusively cryptographically.

The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them.

In March 2018, the word cryptocurrency was added to the Merriam-Webster Dictionary.[26]

Altcoin :

The term altcoin has various similar definitions. Stephanie Yang of The Wall Street Journal defined altcoins as "alternative digital currencies,"[27] while Paul Vigna, also of The Wall Street Journal, described altcoins as alternative versions of bitcoin.[28] Aaron Hankins of the MarketWatch refers to any cryptocurrency other than bitcoin as altcoins.[29]

Architecture :

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. In case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by the group or individual known as Satoshi Nakamoto.[30]

As of May 2018, over 1,800 cryptocurrency specifications existed.[31] Within a cryptocurrency system, the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: who use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme.[16]

Most cryptocurrencies are designed to gradually decrease production of that currency, placing a cap on the total amount of that currency that will ever be in circulation.[32] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[1] This difficulty is derived from leveraging cryptographic technologies

Blockchain :

Main article: Blockchain

The validity of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[30][33] Each block typically contains a hash pointer as a link to a previous block,[33] a timestamp and transaction data.[34] By design, blockchains are inherently resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".[35] For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

Blockchains are secure by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.[36] It solves the double spending problem without the need of a trusted authority or central server.

The block time is the average time it takes for the network to generate one extra block in the blockchain.[37] Some blockchains create a new block as frequently as every five seconds.[38] By the time of block completion, the included data becomes verifiable. This is practically when the money transaction takes place, so a shorter block time means faster transactions.[citation needed]

Timestamping :

Cryptocurrencies use various timestamping schemes to "prove" the validity of transactions added to the blockchain ledger without the need for a trusted third party.

The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256 and scrypt.[18] The latter now dominates over the world of cryptocurrencies, with at least 480 confirmed implementations.[39] Some other hashing algorithms that are used for proof-of-work include CryptoNight, Blake, SHA-3, and X11.

The proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. It is different from proof-of-work systems that run difficult hashing algorithms to validate electronic transactions. The scheme is largely dependent on the coin, and there's currently no standard form of it. Some cryptocurrencies use a combined proof-of-work/proof-of-stake scheme.[18]

Mining :

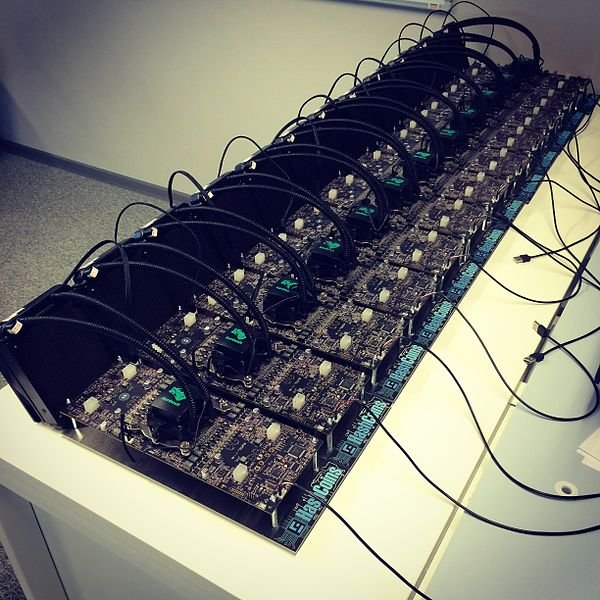

In cryptocurrency networks, mining is a validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized machines such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and Scrypt.[40] This arms race for cheaper-yet-efficient machines has been on since the day the first cryptocurrency, bitcoin, was introduced in 2009.[40] With more people venturing into the world of virtual currency, generating hashes for this validation has become far more complex over the years, with miners having to invest large sums of money on employing multiple high performance ASICs. Thus the value of the currency obtained for finding a hash often does not justify the amount of money spent on setting up the machines, the cooling facilities to overcome the enormous amount of heat they produce, and the electricity required to run them.[40][41]

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

Given the economic and environmental concerns associated with mining, various "minerless" cryptocurrencies are undergoing active development.[42][43] Unlike conventional blockchains, some directed acyclic graph cryptocurrencies utilise a pay-it-forward system, whereby each account performs minimally heavy computations on two previous transactions to verify. Other cryptocurrencies like Nano utilise a block-lattice structure whereby each individual account has its own blockchain. With each account controlling its own transactions, no traditional proof-of-work mining is required, allowing for feeless, instantaneous transactions.[44][better source needed]

As of February 2018, the Chinese Government halted trading of virtual currency, banned initial coin offerings and shut down mining. Some Chinese miners have since relocated to Canada.[45] One company is operating data centers for mining operations at Canadian oil and gas field sites, due to low gas prices.[46] In June 2018, Hydro Quebec proposed to the provincial government to allocate 500 MW to crypto companies for mining.[47] According to a February 2018 report from Fortune,[48] Iceland has become a haven for cryptocurrency miners in part because of its cheap electricity. Prices are contained because nearly all of the country’s energy comes from renewable sources, prompting more mining companies to consider opening operations in Iceland. The region’s energy company says bitcoin mining is becoming so popular that the country will likely use more electricity to mine coins than power homes in 2018. In October 2018 Russia will become home to one of the largest legal mining operations in the world, located in Siberia. More than 1.5 million Russians are engaged in home mining. Russia’s energy resources and climate provide some of the best conditions for crypto mining.[49]

In March 2018, a town in Upstate New York put an 18 month moratorium on all cryptocurrency mining in an effort to preserve natural resources and the "character and direction" of the city.[50]

GPU price rise :

An increase in cryptocurrency mining increased the demand of graphics cards (GPU) in 2017.[51] Popular favorites of cryptocurrency miners such as Nvidia’s GTX 1060 and GTX 1070 graphics cards, as well as AMD’s RX 570 and RX 580 GPUs, doubled or tripled in price – or were out of stock.[52] A GTX 1070 Ti which was released at a price of $450 sold for as much as $1100. Another popular card GTX 1060's 6 GB model was released at an MSRP of $250, sold for almost $500. RX 570 and RX 580 cards from AMD were out of stock for almost a year. Miners regularly buy up the entire stock of new GPU's as soon as they are available.[53]

Nvidia has asked retailers to do what they can when it comes to selling GPUs to gamers instead of miners. "Gamers come first for Nvidia," said Boris Böhles, PR manager for Nvidia in the German region.[54]

Wallets :

Main article : Cryptocurrency wallet

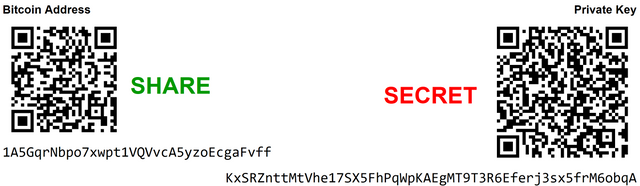

A cryptocurrency wallet stores the public and private "keys" or "addresses" which can be used to receive or spend the cryptocurrency. With the private key, it is possible to write in the public ledger, effectively spending the associated cryptocurrency. With the public key, it is possible for others to send currency to the wallet.

Anonymity :

Bitcoin is pseudonymous rather than anonymous in that the cryptocurrency within a wallet is not tied to people, but rather to one or more specific keys (or "addresses").[55] Thereby, bitcoin owners are not identifiable, but all transactions are publicly available in the blockchain.[55] Still, cryptocurrency exchanges are often required by law to collect the personal information of their users.[55]

Additions such as Zerocoin have been suggested, which would allow for true anonymity.[56][57][58] In recent years, anonymizing technologies like zero-knowledge proofs and ring signatures have been employed in the cryptocurrencies Zcash and Monero, respectively. Cryptocurrency anonymizing implementations such as Cloakcoin, Dash, and PIVX use built in mixing services, also known as tumblers.[59]

Fungibility :

Main articles: Fungibility and Non-fungible token

Most cryptocurrency tokens are fungible and interchangeable. However, unique non-fungible tokens also exist. Such tokens can serve as assets in games like CryptoKitties.

Economics :

Cryptocurrencies are used primarily outside existing banking and governmental institutions and are exchanged over the Internet.

Transaction fees :

Transaction fees for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. The currency holder can choose a specific transaction fee, while network entities process transactions in order of highest offered fee to lowest. Cryptocurrency exchanges can simplify the process for currency holders by offering priority alternatives and thereby determine which fee will likely cause the transaction to be processed in the requested time.

For ether, transaction fees differ by computational complexity, bandwidth use and storage needs, while bitcoin transactions compete equally with each other.[60] In December 2017, the median transaction fee for ether corresponded to $0.33, while for bitcoin it corresponded to $23.[61]

Exchanges :

Main article: Cryptocurrency exchange

Cryptocurrency exchanges allow customers to trade cryptocurrencies for other assets, such as conventional fiat money, or to trade between different digital currencies.

Atomic swaps :

Main article: Atomic swap

Atomic swaps are a proposed mechanism where one cryptocurrency can be exchanged directly for another cryptocurrency, without the need for a trusted third party such as an exchange.

ATMs :

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on 20 February 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[62] By September 2017, 1,574 bitcoin ATMs had been installed around the world with an average fee of 9.05%. An average of 3 bitcoin ATMs were being installed per day in September 2017.[63]

Initial coin offerings :

An initial coin offering (ICO) is a controversial means of raising funds for a new cryptocurrency venture. An ICO may be used by startups with the intention of avoiding regulation. However, securities regulators in many jurisdictions, including in the U.S., and Canada have indicated that if a coin or token is an "investment contract" (e.g., under the Howey test, i.e., an investment of money with a reasonable expectation of profit based significantly on the entrepreneurial or managerial efforts of others), it is a security and is subject to securities regulation. In an ICO campaign, a percentage of the cryptocurrency (usually in the form of "tokens") is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often bitcoin or ether.[64][65][66]

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach“ to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.[67]