Btcpop's Plans to Expand Decentralized Finance

Btcpop.co has recently launched its updated ETH wallet with ERC20 token capability opening up the door to 100’s of Ethereum tokens including USD based stablecoins such as USDC, DAI, TUSD and more. As a primarily Bitcoin based exchange and P2P lending/financial service Btcpop is excited to take this step towards more currencies and sees tremendous potential to act as a bridge connecting BTC and other altcoins to users of Ethereum’s rapidly growing decentralized finance ecosystem.

As a bridge, Btcpop will not only allow BTC based users access to Ethereum’s thriving decentralized finance community. But through Btcpop, Ethereum’s community can expand their use of finance and services into 100’s of non-Eth cryptocurrencies supported by Btcpop.

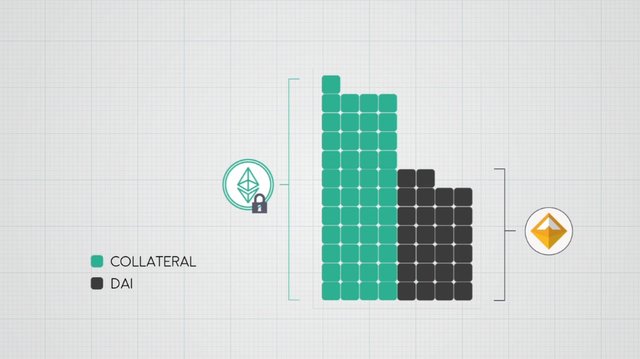

Once stablecoin denominated loans are enabled, with a little critical thinking one can see tremendous potential of USD based P2P loans using BTC or any altcoin as collateral. It will essentially create a market driven P2P MakerDAO-esque CDP system for the whole Cryptocurrency world.

Stablecoins

Everyone in cryptocurrency knows it is a very volatile asset class. Because most everything purchased via a loan is priced in stable fiat like USD, taking out decentralized BTC or ETH loans quickly becomes impractical. As borrowed or lent assets can drastically move in price leaving borrowers or lenders in a bad position relative to fiat.

Stablecoins are the answer to volatility, and the new non-tether stablecoins are nearly all issued as ERC20 tokens on the Ethereum blockchain. These coins for now are almost all pegged to the USD, but other currencies like the EURO can be expected in the future. Arguments can be made against the level of decentralization of these fiat backed stablecoins like USDC, TUSD, PAX, and GUSD. this is in part because they can be frozen by their issuers. But, for the most part these coins are legitimate and have traded throughout exchanges and Dex’s without much issue.

One stablecoin stands out among them all is DAI. MakerDAO’s DAI has become the pinnacle and central point for decentralized finance. Created from a smart contract which locks 150% of DAI’s value in ETH (eventually more tokens) as collateral. DAI is about as decentralized and trustless as stablecoins come.

MakerDAO and the DAI project have been growing rapidly since their early 2018 launch. DAI is slowly becoming integrated into all ETH DEX’s and many centralized exchanges. Because you can trade stablecoins on an increasing number of DEX’s and in many places trade one stablecoin for another, they are all fantastic tools for decentralized finance in a stable currency.

MakerDAO and the DAI project have been growing rapidly since their early 2018 launch. DAI is slowly becoming integrated into all ETH DEX’s and many centralized exchanges. Because you can trade stablecoins on an increasing number of DEX’s and in many places trade one stablecoin for another, they are all fantastic tools for decentralized finance in a stable currency.

Integrating stablecoins into Btcpop P2P loans

The new Btcpop ETH wallet launch with ERC20 compatibility, USD stablecoins such as USDC and DAI will initially only be traded in BTC pairs and able to be used as collateral for Bitcoin loans. But, in the near future P2P loans will be able to be taken out in these stablecoins. Which will allow all Btcpop supported currencies like BTC, BCH, LTC to be used as collateral for USD based P2P loans.

This will enable users to create useful USD based loan offerings for 100’s of ETH based and non-ETH cryptocurrencies at Btcpop. And because a user could have more than 1 type of collateral in a loan (BTC+ETH+DGX for example) the loan combinations are truly endless.

Describing Decentralized Finance

Before enthusiast bite my head off for this article, I acknowledge Btcpop is a centralized exchange. And as a centralized exchange, its services don’t fit into the “Decentralized Finance” bucket in many people’s opinion. Btcpop acts as a “trusted 3rd party” for its P2P loan offerings and for all exchange and staking activities.

However, decentralized is a subjective term, and is more of a spectrum than black and white. Even the top so called “Decentralized Exchange” IDEX is implementing KYC and banning users from certain geographical areas. MakerDAO as one of the most decentralized projects still requires a certain level of trust from the people making and implementing the smart contracts, though admittedly less trust than the people behind fiat backed stablecoins like USDC. So even the most decentralized solutions still have some centralization for now.

Btcpop’s Version of Decentralized Finance

Btcpop is dedicated to individual freedom and truly P2P decentralized free-market finance as an end goal. In order to build this new industry and enable P2P finance across blockchains, Btcpop’s services are necessarily centralized. Btcpop always remains dedicated to being an open and useful platform for global users, and interfering the least amount possible in P2P free market commerce.

Based in the Marshall Islands for maximum regulatory freedom, Btcpop fully backs users funds with a disclosed BTC cold wallet, has covered prior management's hack mistakes with its own funds, and continuously works on and improves its services to provide users with a honest secure and completely transparent platform. While borrowers need to verify identity, lenders are still able to invest without any verification. And in the future should there be any case where Btcpop centralization is tested by someone like government “authorities”, Btcpop promises to fight for its user’s privacy within the terms of the law.

So while Btcpop is not as decentralized as say MakerDAO and Oasisdex. It is a non-fiat, crypto only, free-market, and freedom oriented P2P financial platform that I believe qualifies under the term “decentralized finance”.

Other more centralized Crypto backed Loan services

Leveraging crypto assets for USD loans is a highly demanded and rapidly growing service. Nexo, Salt, and Blockfi just to name a few have grown rapidly since the 2017 crypto boom. These services are all slightly different, but all act similarly. They allow borrowers to take out reasonable APR USD loans at a set rate using cryptocurrency as collateral with specific collateral requirements. They all currently support the main high cap coins (BTC, ETH, LTC) with more high liquidity coins added regularly to the platforms. In most cases, if the collateral reduces too much in value or payments are missed assets will be liquidated to pay off the debt before the lender service loses any money.

This crypto backed USD loan service has great appeal to the cryptocurrency community as users are able to affordably access equity in their cryptocurrency without selling and incurring taxes or missing out on potential gains. Some services are also starting to enable withdrawals in stablecoins.

Most if not all of these platforms issue the crypto backed loans themselves acting like banks. And many actually have at least 1 fiat banking relationship. And like banks, they payout a small % interest to attract depositors. Similar to a savings account or CD, depositors are not exposed to default risks, and because of this earn less on their funds. Because the issuing company takes on more risks for these loans, they also retain most of the interest paid by the borrowers.

How Btcpop’s P2P stablecoin Loans will Compare

The fundamentals of P2P stablecoin loans will be very similar at Btcpop, but with some key differences:

- No set terms: Btcpop loans are completely customizable and borrowers set their own collateral percentages, interest rate, payback frequency, and loan length.

- Peer to Peer Loans: Unlike other services Btcpop only acts as a platform. Other users not Btcpop fund loans in a P2P fashion, deciding for themselves what terms are acceptable for them as investors. Btcpop just provides tools and platform for peers to reach a deal in exchange for a 1% listing fee. Btcpop does not fund any loans. Besides and all the interest paid goes to the lender.

- More Collateral options: Btcpop allows all altcoins on its platform (200+) and P2P shares to potentially be used as collateral for loans. The investor has to decide what type and how much collateral they trust in a market. Borrowers and lenders than agree on loan terms in an open market fashion by loan offerings being funded or not.

- Liquidation: To start, liquidation of cryptocurrency collateral will remain as it currently is. If a loan payment is missed and the loan is in default for 14+ days, all collateral is put into a liquidation script which places sell orders at market price within Btcpop’s internal exchange. Proceeds from selling the collateral are applied to late fees and payments. This liquidation process is the potential risk lenders take and get compensated for as asset volatility or slow liquidation could lead to losses even if the loan was originally backed by 100% its value in a certain collateral.

- Restrictions: Btcpop does not have many restrictions and offers its services to the world wide web (only in English which could be considered a restriction). If you are able to receive a letter in the mail and verify your identity you are likely free to take out a loan*. And if you have the technical skills to deposit cryptocurrency and invest, you are free to do so through Btcpop’s platform.

- Instant Loans: if you are in need of a quick loan or don’t have time to verify and create a P2P listing Btcpop does offer collateralized instant loans at set terms.

Bright Future for Decentralized Finance

Rome wasn’t built in a day, and neither will the decentralized finance industry of the future. Btcpop is dedicated to help build this industry, and incorporating ETH and ERC20 tokens is an important first step. It becomes more evident every day that Ethereum’s 2nd killer app is decentralized finance. Less than a year old, one could still effectively without 3rd parties mint $1M+ DAI for 0.5% APR on MakerDAO. And from there: borrow/lend decentralized loans via ETHLEND, do leveraged trading with DYDX, Earn interest or borrow with Compound’s money markets, and trade 1000’s of assets within ETH’s ever expanding DEX ecosystem.

As a platform Btcpop hopes to enable traders, speculators, and decentralized finance enthusiast new tools to leverage assets. Whether its as simple as DAI loans with BTC based collateral, or risk arbitrage borrowing at a low rate on Btcpop and lending it out in Compound Finance’s money market. The future is bright and Btcpop is excited to expand the possibilities.