BTC TA (Technical Analysis) - ANALYSTS DAILY SUMMARY - JUNE, 21st

SENTIMENT SUMMARY

ANALYSTS OPINIONS

JD MARSHALL

Type of Trader: Medium/Long Term Trader

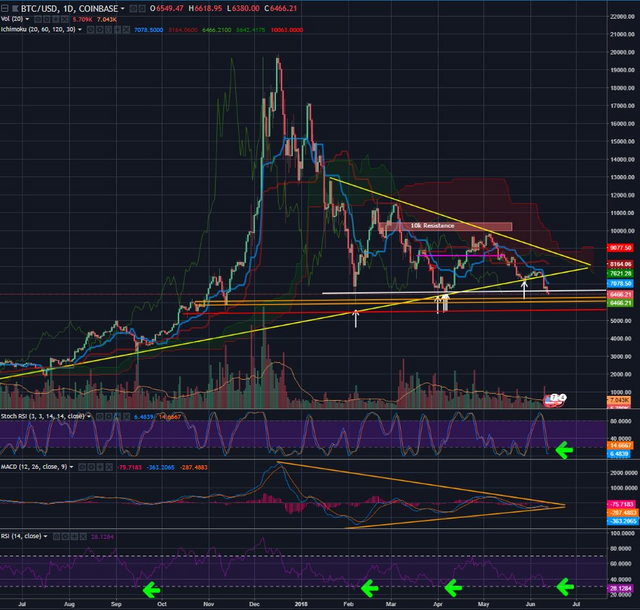

[Macro argument is that BTC is consolodating at these levels and building steam for higher highs in the FUTURE is still his macro perspective. In his opinion we're not seeing BTC reaching all time high any time soon. BTC next big resistance is the top of $9990. Since Feb. BTC's seen 3 major bottoms around the 6k-7k level. Which is an indication of forming higher lows and confirms a macro bullish trend (Green Line on Chart). Patience will be the key word for medium/long term investors in the BTC Market]

BTC seems to be forming another bear flag. The previous bear flag produced a significant fall from those levels, so if BTC is forming a Bear Flag at these levels, we could easily go below $6k. Another puzzle piece that fits this argument (for lower future prices) is the fact that the buying volume is very low. Price is not in sync with the volume, which historically has meant eventual lower prices.

Bullish Scenario: If we see volume increase and see BTC spike in 500 dollar increments and break $7800, will Marshall be bullish.

@tradedevil

@tradedevil still has a bullish bias, but cannot yet be confirmed. For the bullish scenario to be maintained, BTC's previous support of $5920-$6000 will have to hold.

BULLISH COUNT:

BTC just finished it's second wave (within a 5-wave structure) and is busy with it's 3rd wave. Target is aroudn $7400. From the current levels, this would be a very bullish move.

![]()

BEARISH COUNT:

BTC completed a fouth wave and are going lower to complete that 5th leg of the 5-wave structure lower.

Crypto Guru (NO NEW UPDATE)

Type of Trader: Short Term Trader

Bitcoin is getting ready for a bounce based on indicators on the daily and weekly. Stoch RSI is oversold / aligned on both time-frames and MACD is ready for a breakout. Lastly, check out what happens each time the RSI gets to this level.

CoinDesk Markets

Type of Trader: Short Term Trader

Outlook: Short-term bearish pullback

#BTC entering bearish MACD on the 1-hr daily chart

RSI would benefit from cooling off period and pullback in price action

$6,755 and $6,736 support levels.  A break below $6,736 would invalidate bullish revival

A break below $6,736 would invalidate bullish revival

Also, BTC is trapped in a falling wedge. Lower prices ahead.

Trading Room

Type of Trader: Short Term Trader

Big Picture:

From current area $BTC & ALTs are likely to lose 15%-40% while the bounce potential is 5%-15%

Expect boring markets until downside break. Expect an upside bounce from 5400-4500 area & mini Bull Run For ALTs which will post 50-150% gains.

SHORT TERM:

This is a Sell $BTC Call.

Nick Cawley

Type of Trader: Long Term Trader/Investor

Little conviction in price action over the last week despite two pieces of important news. Late last week the US SEC said that Bitcoin and Ether should not be classified as securities, before warning a large section of the ICO market my fall under this classification. And earlier today, Korean exchange Bithumb revealed that it had been hacked and around $32 million of tokens had been lost. Both pieces of news would normally spark a notable market reaction but apart from a slight pull-back last week after the SEC statement, markets remain rangebound. Current tight ranges may well break shortly but cryptocurrency charts are currently neutral and are giving no clues to the direction of the next move.

One way to trade the cryptocurrency market is via the Ethereum/Bitcoin spread which reduces market sentiment risk.

EXTRA OPINIONS

Lord Ray

BTC/USD (4hr chart). Clear price contraction, hence the symmetrical triangle pattern. This is an inherently neutral pattern, so wait for confirmation of the break out to either side. Our daily chart still shows bullish divergence on the MACD.

Crypto Bird

Reason for possible strong rejection on 6,9-7,1k for BTC is the 'Rising Wedge'. Expect to see $6k again. Prices going lower.

@kidmartin-95

Weekly

Looking at our trend timeframe we see price still respecting our descending wedge pattern. Expecting some consolidation on the smaller timeframes before BTC makes any big moves. Stochastic RSI showing momentum looking bearish, however it is starting to slow down. A weekly close above $6,700 and we should see a small push towards $7,500. Two possible scenarios for BTC: either we come back down to hold for support have pushing towards $7,500 OR we break through and fall towards our $5,000 target.

Daily

Shifting over to our pattern timeframe we see price has been consolidating below $6,700-$6,800 for a couple of days now. A daily close above $6,800 and we should see a short BTC run, stochastic rsi showing momentum is heading towards the upside. Expecting a double bottom to form at our indicated zone.

Conclusion:

Buy: After Daily Close Above $6,800 / Bounce Off $5,000

Sell: NO