The Real Top 30 Crypto-currencies / How To Value A Crypto-currencies

I wanted to provide some perspective to crypto-currency traders / investors about circulating supply and the coinmarketcap.com website. It is a popular place to go to check prices, and conveniently ranks each currency based on their market capitalization (market cap).

Market Capitalization – for those that don’t know is the circulating supply multiplied by the current price. It is the same valuation used to determine the value of a company that has sold shares of its stock in the stock market. A share’s price times its shares outstanding is the company’s value (market cap). Same can be said for crypto-currencies.

The top 30 on this list (coinmarketcap.com) are considered to be a good index of value in this space. It is similar to the S&P 500 index in the stock market which tracks the top 500 companies in the United States. Indexing is a great way to keep tabs on the market as a whole; in fact, it is a popular investing strategy to trade the S&P 500 index by buying one share of each of the 500 companies. The total of what you would spend is the index’s price. This strategy has actually outperformed many professionals and fund managers on a yearly basis.

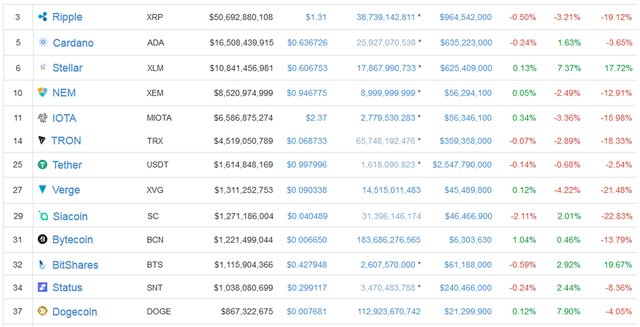

I was explaining to the traders, in my crypto splash text, that Ripple (XRP) is only #3 in the market cap rating because it has over 38 billion outstanding coins in circulation. This is a huge supply compared to Bitcoin, which will cap out at 21 million coins outstanding. We can compare these crypto-currencies to Bitcoin because it is the “gold standard” in this space, it has set a precedent for what a crypto-currency is supposed to resemble to some extent.

Ripple hit a high of $3.75 recently, at the time it passed Ethereum (ETH) on the market cap rating and reached the #2 spot. If it had just doubled in price to just $6-7 (and assuming Bitcoin had not risen in price at the same time), it would have passed Bitcoin as the #1 crypto-currency in the market cap rating. Essentially this means Ripple is more valuable than Bitcoin with a circulating supply of 38 billion and a price of $6-7. Is this really justifiable? I know many who would say that its position in the market cap currently (#3) is not justifiable.

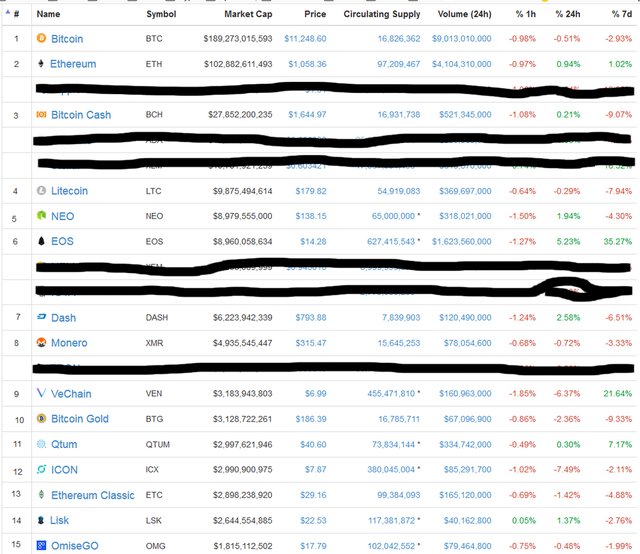

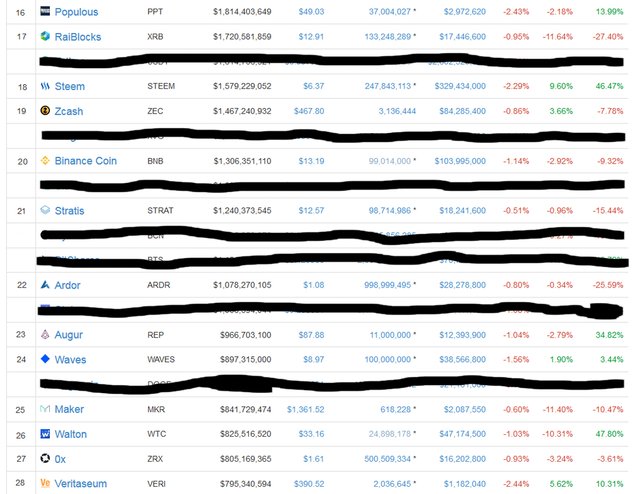

We know that scarcity is very important and is a contributing factor to what gives something value. It is not the only reason an asset has value, but it is a very important component. If Bitcoin is to be used as a “gold standard” comparison in the crypto space, then we would consider a circulating supply of a coin in the millions much better than those in the billions. So let’s go through the coin market cap website and cross off those that have more than a billion outstanding coins and see which we are left with. Then we can see the adjusted top 30 crypto currencies.

As you can see, 13 of the top crypto-currencies have been crossed off because they have a circulating supply over a billion. When we adjust the number rankings, we get the real top 30. These coins have a circulating supply in the millions, which is much closer to Bitcoin’s standard.

So which currencies were crossed off?

Right away we notice that most of the 13 are worth pennies or fractions of a penny with the exception of IOTA and Ripple. These can be compared to penny stocks in the stock market. Penny stocks are stocks that have a low price and a low market capitalization. They are cheap, with a high reward if they gain value, but are also very risky.

Novices like to put their money in these penny-cryptos because they think that they are a bargain, and the price volatility means that they can make very large returns on very small price swings. For example, a price swing from $0.03 to $0.06 is a 50% gain. But this is a risky investment because anyone can make a crypto-currency, and to get on the board, one only needs to issue enough coins. If I was to make a BretCoin that was valued initially at $0.005 and created 38,344,285,170,200 of them, I would knock Bitcoin out of the #1 spot on the market cap ranking and take its place.

0.005 * 38.34 Trillion = 191,721,425,851 (Bitcoin’s current market cap +1)

There are a few currencies on the list of 13 that I do not believe belong - one being Tether, which is pegged to the dollar 1 for 1. The supply is increased and decreased by the developers based on the demand in order to keep the price at $1. Its purpose is just to provide liquidity to the market. Also Bitshares I think has potential since its tokens were created to be used as a decentralized exchange for crypto-currencies. They had to issue a large amount of them in order to be scalable.

Bottom line: invest in crypto-currencies based on fundamentals and not just price action. Look at the use cases for each coin, pay attention to circulating supply. Ask yourself if its current valuation justifies its place on the market cap rating. For example, if your coin ranks #14 (like TRON currently), then the market is saying that this coin is worth more than the bottom currencies and projects that are #15 and under.

If you would like to trade cryptos along with us, you can be added to my crypto splash text

https://steemit.com/bitcoin/@bretjfeller/trade-bitcoin-and-cryptos-along-with-us-splash-text