Are Non-Custodial Exchanges Blowing Up?

Are Non-Custodial Exchanges Blowing Up?

Most traders are still getting most of their action (liquidity, volume, trading pairs) on custodial exchanges like Binance, Bittrex and Poloniex. According to CoinMarketCap, traders on Binance have exchanged $250,000,000 worth of bitcoin in the last 24 hours.

Custodial exchanges were a necessary part of the ecosystem in the early days. Buying bitcoin in person sucks. Buying bitcoin on forums sucks. And while holding your bitcoin on a custodial exchange can be a risky maneuver, it's a whole lot simpler to use than the alternatives available.

I've said before that there are numerous problems with the exchanges that take custody of your coins. Hacks, scams, frauds and pure stupidity abound in unregulated and volatile markets. The best defense, at the moment, is to know the risks and take ownership of your own crypto assets. This may change --companies like Commonwealth Crypto are working around the clock to help custodial exchanges provide the level of security traders really need in the long term.

Decentralized exchanges like EtherDelta, IDEX and others have been around for some time. They offer the ability to buy and sell crypto assets, with settlements occurring directly on the blockchain. If you're willing to deal with a user interface designed by a 6th grader in 1994, they can provide some limited liquidity for trading. EtherDelta has been particularly useful for me to exit ICO positions before they are listed on larger centralized exchanges, as you can trade even if they don't "list" the pair by plugging in the smart contract address to populate the order book.

More recently, I have become a shill factory for 0x. I won't get too deep into the protocol here, because the video below will cover this, but suffice to say I'm a big believer that relayers will usher in some competition for the established major custodial players. I have known Alan Curtis, the CEO of the largest 0x relayer (58% of market share in last 24hrs) Radar Relay for some time. He was a guest speaker on one of our early 2018 panels and did a great job conveying the non-custodial message.

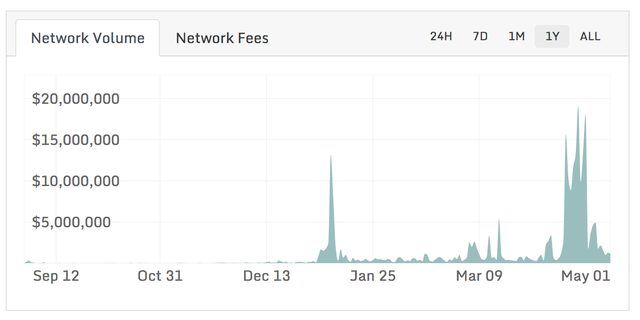

Since then, usage of the 0x protocol has quadrupled (or more), with more ICOs preferring to launch early with non-custodial exchanges rather than pay exorbitant fees to be listed on a custodial player like HitBTC.

You can see that the growth has been in fits and starts, with ICOs representing the peaks and slow days representing the valleys. But it's been growing, topping $11M in transactions in a single day in late April, 2018.

I caught up with Alan to discuss the protocol, Radar Relay progress, what they're hiring for and much more in the latest edition of The Blockchain Brief.

Enjoy.

Sign-up to The Blockchain Brief for more hot-takes here: http://eepurl.com/df86Qr