Cryptocurrency and Blockchain, a superior alternative to a debt-based, trust-dependent, financial system

The people who control our money, control the world.

Central banks have been at the top of the pyramid for generations. A necessary mean to establish trust in a market economy, until now.

With the invention of blockchain and open ledgers - a direct response to the 2008 financial meltdown from the so called Cypherpunkers - trust does not need a powerful intermediary keeping a closed ledger of who owns what. The identity of Satoshi Nakamoto remains unknown, but the revolution started with the creation of Bitcoin.

Albert Einstein famously stated: “Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn’t... pays it”. It is clear that central banks, governments, and “too big to fail” financial institutions have been profiting heavily from this centralised ledger system. It is time that people profit from their own storage of value, and that is why the mission of Blockbasis is to shift trust in the financial system from a series of centralised and insecure ledgers, to fewer secure and decentralised ledgers, also known as cryptocurrencies built on blockchains.

What is trust in a market economy?

Before the internet, authority were held in high regard. Few decisions by your politicians, your boss or even your doctor were questioned.

The internet meant that everything underwent public scrutiny with demand for transparency, and with that mistrust has taken the world by storm.

Ask former employees at Lehman Brothers if they trust their chief executives.

Ask England if they trust their fellow citizens to decide on foreign policy.

Ask Americans if they trust their president.

Ask Zimbabwe if they trust their government to issue money.

Trust is the bedrock of a functioning market economy where participants can trade without having to barter. The question is what medium the participants use to trade with each other. The solution in most countries has been central banks with a monopoly to issue money, using the government’s authority to collect taxes as backing.

Nobel Laureate, F. A. Hayek, in his classic, “Denationalization of money – the argument refined”, clearly explained, there is no more reason for the government to have a monopoly on money than there is for government to have a monopoly on the production of toasters.

Regardless, central banks gained monopoly on money across the globe, and the disconnect to the real world is becoming more and more extreme every day. Why?

Because in a market economy with a central bank issuing money, inflation equals more debt.

The show must go on: Inflation, debt and economic growth

Have you ever wondered what happened to the tax money you pay every month? They go directly to all the public services we all share, right?

Wrong. Most market economies on the planet today have accumulated so much debt that all tax income collected by governments across the globe goes directly to pay interest.

To understand this, it is important to understand the relationship between the government treasury and the central bank, like this video. The relationship is clear:

Source

How did we end up here?

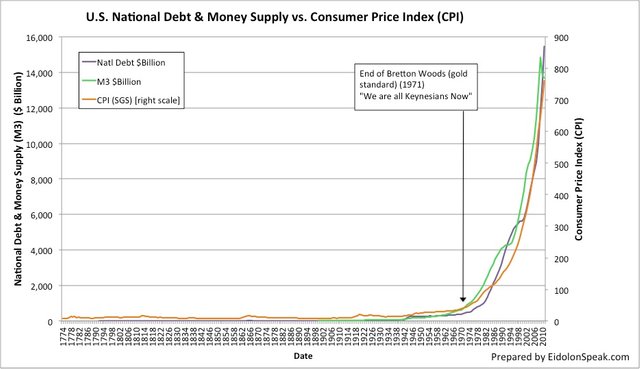

The world has been plagued with persistent and highly variable rates of inflation ever since the economies around the world began to erode the gold standard during the twentieth century. This was done as a direct result of having to finance major wars. Yes, war.

Transaction costs when using cash, credit or debit cards, check or wire transfers, are all unnecessarily high. These problems have undermined saving, investment, and trade – all of which have reduced GDP growth, employment and real wage growth.

The question remains, how long can this go on for?

Think of your own private budget. If your income rises it’s ok that your debt level rises. More income basically unlocks for more debt to accumulate. That is how increasing levels of debt is not a problem per se, as long as there is sufficient growth in income.

On a national level the numbers just get bigger. By throwing the central bank into the mix, more economic growth means more money, and more money means more seignorage.

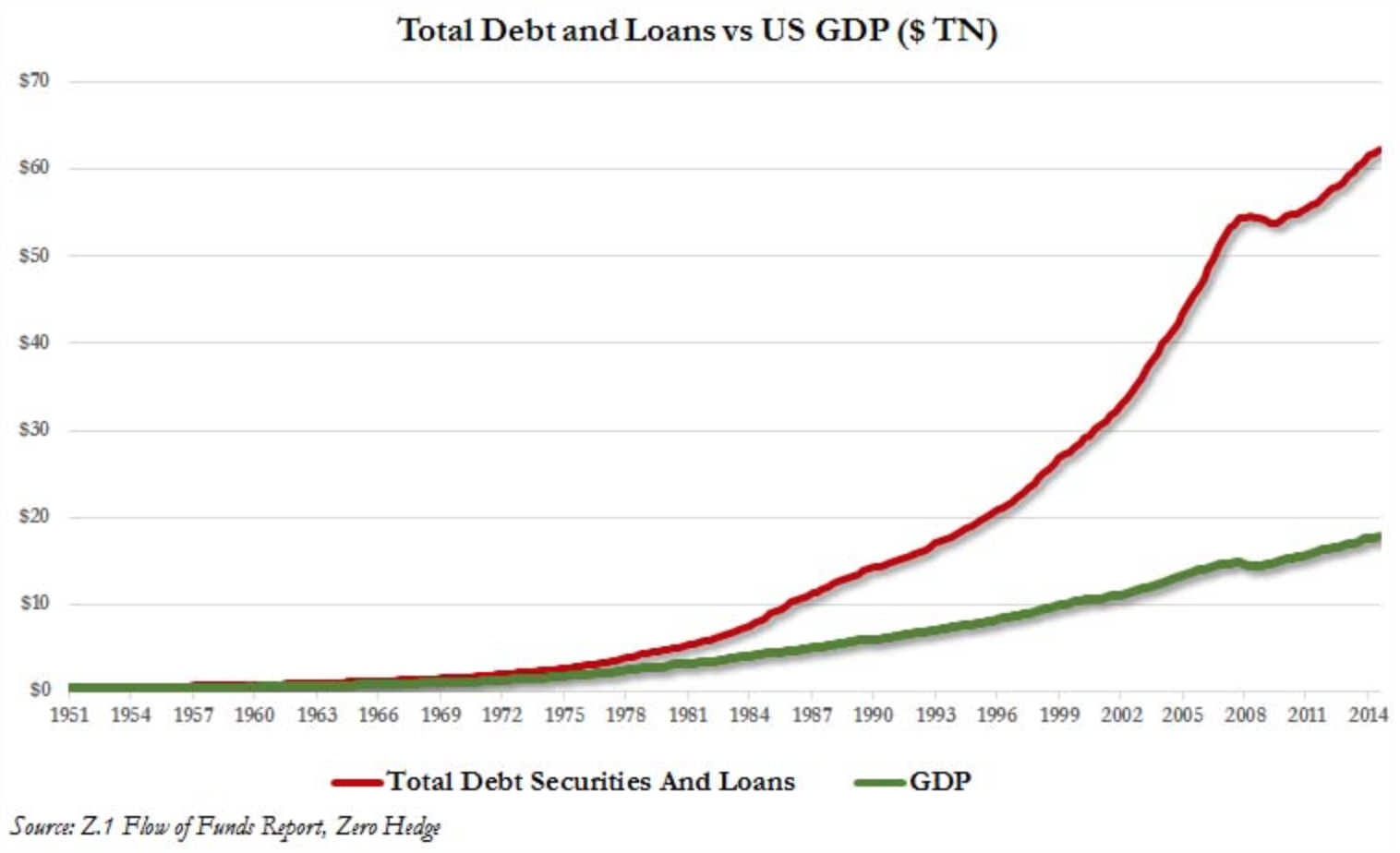

All that sounds safe and sound. There is a problem though. A gap is starting to debt and economic growth, and it’s getting bigger:

Source

It takes no genius to see that this is an unsustainable vicious circle where the people at the top will do everything they can to stay there. Why? Because it’s easy to win a game where the cards have already been dealt, by yourself.

The pyramid with the central bank at the top, trickling down money to participants through commercial banks, simply does not work very well. We need a better system. And finally there is an alternative system that can disrupt this vicious circle, and that system is based on decentralised open ledgers.

This is why Blockbasis wants to make public ledgers the basis of society, making trust an irrelevant ingredient in a healthy and well-functioning market economy.

RESOURCES

http://www.caymanfinancialreview.com/2017/10/17/the-future-of-money-how-cryptocurrencies-with-real-backing-will-become-the-ultimate-disruptive-technology/

https://www.tenx.tech/whitepaper/tenx_whitepaper_final.pdf

The recent dramatic price swings are due to the recent introduction of leverage to the market price discovery meta-workings, and perhaps even computerized trading algorithms. Now the big dawgs are in the game.

This is a fine piece of work. This is actually better than the piece I was working on. It needs a little editing, there are a few typos. Let me know if I can help.

Crypto IS the Revolution.

Thank you! It's our first post so we are new to the show. We would love to hear your suggestions.

Intersting post, check out my posts about "Banks to Big to Fail" and also my 2 part Rothschild history, you have a new follower welcome to Steem

Congratulations @blockbasis, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?