Bitcoin / Ethereum Predictions Inside!

To this day, there is still a lot of debate of whether Bitcoin Futures had anything to do with Bitcoin’s recent decline. Some say it does and some say it doesn’t. We all know Bitcoin Futures is not directly related to any Bitcoins as everything is settled in cash.

However, we have to remember that Wall Street and hedge funds can now place their money into futures rather than Bitcoin itself. This is a biggie as billions that should have flowed into Bitcoin is now flowing into future contracts.

And another thing to remember is that if these big whales bet the wrong way before expiration…you bet they will try their hardest to make sure they do everything in their power to manipulate the market so that they don’t lose money.

It is easy for these whales to manipulate simply because there are so many noobs that have come into the space. Whenever BTC drops there is a panic sell and whenever BTC rises there is a panic buy.

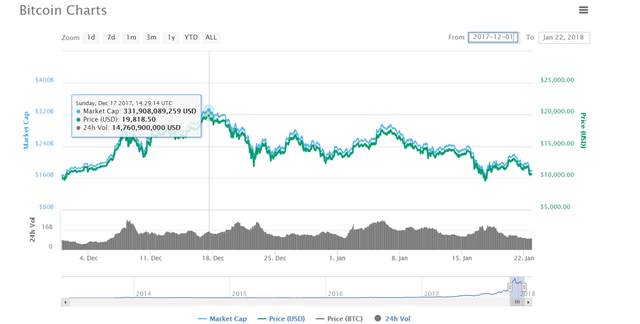

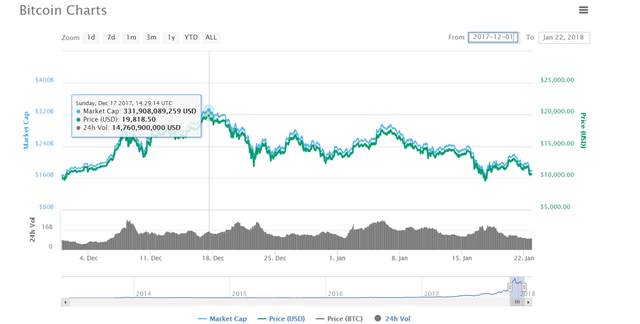

I decided to look at the Bitcoin charts going back to Dec 1st of 2017. Bitcoin’s all time high was on December 17th when it settled at $19,800 even though it did briefly hit $20,000.

Does December 17th sound familiar to you? Did something happen that day? Yup CME futures started trading on December 17th.

And since then altcoins exploded in a big way but Bitcoin did not. In fact, we are close to 50% off highs currently.

As much as I hate to say it, I might be wrong about Bitcoin reaching 150k this year. It’s very early in the year I know and we haven’t hit Feb yet but we will have to pay close to attention to futures now and see how Bitcoin reacts with every futures expiration.

Now if you look at Ethereum, it has gone from $445 dollars on Dec 1st to where it is now at $950 dollars. That is more double. That includes the major corrections we had in both Dec and Jan.

So what is my point?

I believe it is now better, at least short term, to make ETH the staple or hedge in your portfolio. So rather than have 50% or 40% or 20% in BTC, it is better off to make that in ETH.

I say this with hesitation because the charts only go back the last 1.5 months where this has been true but if you go back 2 or 3 months, BTC definitely still had been more stable and saw more growth.

However, if Bitcoin Futures is the true reason why Bitcoin is being held back, we might not see this let up for some time.

If you are a long time holder of BTC and can care less about the short term then ignore this all together.

But for those that are more active short term, I would suggest slowly converting your BTC to ETH until we can get to the bottom of what is truly dragging down BTC.

VeChain (VEN)

I’ve been mentioned VeChain in my daily videos for some time now but I’m now putting a big emphasis on it and recommending it. In fact, it’s already on the recommendation board. Buy why?

VeChain is already over $2 billion in market cap so there are NO WORRIES about this newsletter driving prices up. Calm down and finish the newsletter first.

First of all, let me give tell you about VeChain in a brief overview. VeChain is a Chinese based company that is in the supply chain management space. Sound familiar?

Wabi one of my previous picks is in that space but Wabi is concentrating on things people eat and use. Baby foods, liquor, cosmetics, and soon I’m sure into bathroom products such as mouthwash, toothpaste and other food industries such as canned foods.

Wabi is all about that tamper proof security tag. VeChain is not. VeChain is tackling authenticity of items. By utilizing RFID chips, they tag items so that you can easily verify if the item is real or not.

They use luxury handbags as a good use case. Some of the Chinese knockoffs are so real that employees from handbag companies can’t tell if they are real or not. This is especially a problem with returns. Now with VeChain tag, the bag can simply be scanned to validate if it is authentic or not. And with the tag, the bag can be tracked worldwide thru the whole supply chain process.

They also use expensive wines as another use case. By embedding a tag into the wine label, you know it has never been tampered. This is different than what WABI does though.

The RFID is propriety and not only can it be scanned for location; it can also be scanned for temperature. That means if a certain item somehow gets frozen or too hot and it goes bad, VeChain can help detect it.

As for partnerships, VeChain already partnered with Price Waterhouse Coopers which is one of the largest auditing firms in the world. VeChain and PwC want to partner to see how they can utilize these RFID devices to increase efficiencies within companies when auditing. Brilliant.

The other big partnership announcement is coming 1/31 and it is with DNV GL. Don’t know who DNV GL is?

DNV GL is huge company that offers many things. But QA, Risk Management are the divisions that VeChain will partner with first. DNV GL want to utilize VeChain’s RFID specifically in shipment that require temperature control.

BTW, DNV GL has over 86k customers worldwide, they employ 13k employees and have offices in over 100 countries. Their operating income in 2016 was $2.4 billion USD dollars. This is a big deal.

DNV GL is so excited about VeChain they already made an introduction and it’s a big one too. VeCHain has now signed an exclusive partnership with NRCC (National Research Consulting Center). Their first task is to focus on the tobacco industry in China. VeChain will be providing proof of origin and anticounterfeit technology to track Chinese produced tobacco products throughout the entire supply chain. This partnership came into place as China announced a crackdown on smuggled counterfeit cigarettes.

This is only the start.

Other things that make VeChain exciting:

- Their mainnet opens up Q2 of this year.

- They are rebranding on February 26th.

- They have over 48 developers on the team.

- Patrick Dai who is the CEO of QTUM previously worked at VeChain.

And in spite of everything I just said above, there is MORE.

Let’s start by taking a look at this picture:

Who is the guy standing left of the Chinese president?

That’s Jim Breyer. That picture was taken at a recent summit in China. Mark Zuckerberg, Tim Cook, Satya Nadella were in all attendance but where did they all stand? Not next to President Xi.

So who the heck is Jim Breyer?

Jim Breyer is a VC and CEO of Breyer Capital. He has invested in over 40 companies including Facebook and Breyer is no stranger to China. He helped set up huge mega joint venture investments in some of the biggest Chinese based companies such as Baidu and Tencent. And just last month, Breyer said he was going to look and invest into Blockchain based companies.

And guess the company he said that had the most potential? That’s right VeChain.

And yesterday: https://medium.com/@jimbreyer/announcing-our-vechain-advisory-role5e37b7722978

Breyer announced that Breyer Capital is now an advisor to VeChain.

And if these last 3 pages about VeChain haven’t excited you, maybe this last part will.

This is pure speculation but within the 4chan board, there is a guy called “Coca-Cola Kid” that makes predictions about cryptocurrency. Supposedly he has been spot on with everything he said in the past and the last thing he reported a few weeks ago said that VeChain is going to partner with PBoC (People’s Bank of China).

If that deal happens, VeChain will go up 10x pretty much overnight. But that’s a big IF.

Ok so the end has finally come.

I love VeChain. It is because the partnerships that Vechain keeps forming gets bigger and bigger and I do not underestimate Jim Breyer. He has tremendous pull within China. Out of all the tech leaders, he was chosen to stand next to the president.

VeChain is now one of the coins I consider a must HODL for 2018 regardless of short term gains. The $8 dollar price tag it sits at now is going to be a drop in the bucket come in a few months. I can see VeChain easily hitting $80 by year end. Easily.

Like I said at the very beginning, there is zero rush to go buy VeChain. This newsletter is not going to move a $2-billion-dollar company. I just wanted to keep this in front of you guys. Those of you guys that are HODLing, there is no reason to sell them off to buy $VEN right now. You can wait for the market to recover before buying VeChain. Those of you guys that have BTC/ETH on the side, you might want to consider VeChain.

And for those that think VeChain is already too high to move, let’s remember that I picked TRON when it was already over $1 billion dollars. And we all watched it go as high as $17 billion dollars before settling to where it is now. So don’t discount VeChain just because it is sitting at $2 billion.