Stablecoins: Cryptocurrencies with fixed prices.

What are Stablecoins?

Most cryptocurrencies’ value or price are determined by the supply and demand and trade freely on exchanges to find a market price. This pricing freedom combined with the speculative nature of pricing a brand new asset class makes cryptocurrency a very volatile asset class. With limited and expensive on and off ramps in and out of cryptocurrency, the market came up with a solution to store value volatility free within the blockchain ecosystem, stablecoins.

Stablecoins are cryptocurrency tokens whose price remain stable (usually fixed to a fiat currency like USD). Nearly all stablecoins today areERC20 tokens on the Ethereum blockchain, but the original and most controversial stablecoin tether is also a BTC omni protocol token. These tokens are used by traders on exchanges to store stable fiat currency in a liquid cryptocurrency form on and off exchanges.

Why are they important?

Cryptocurrencies are fantastic technology giving freedom and financial sovereignty back to the individual. However, as of now they are still to volatile to be used effectively for pricing, loans, or any store of value in stable non-speculative way.This is why stablecoins are so important, they allow the good parts of cryptocurrency (programmability, unseizability, decentralization) without the volatility. This means for example a decentralized betting app can allow users to place wagers on long term bets in dollars instead of volatile cryptocurrencies.It is also important for taxes, as if you sell your cryptocurrency for fiat it is a taxable event. This arguably applies to stablecoins as well, but if you are using a decentralized stablecoin such as DAI, that argument becomes a bit more tricky.This is of course not a financial advice, it would be best to consult with a CPA or someone who knows the laws regarding this matter before taking any action.

How Stablecoins work?

There are 3 ways to develop a cryptocurrency with a stable price:

- Fiat-collateralized

- Crypto-collateralized

- Algorithmic based (scam!)

1. Fiat-collateralized

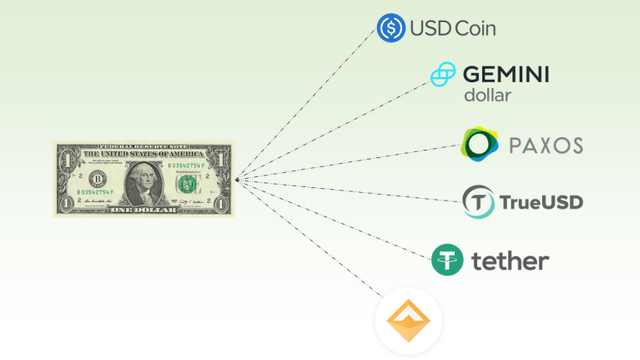

Is the least complicated system of stablecoin to implement. It’s fairly easy to understand. If you deposit any amount of fiat currency, (e.g. US Dollar, EUR,) to a third party, the third party will then issue/create a stablecoin unit equal to the amount of fiat currency you deposit. For cash outs, the third party burns the same amount of stablecoin units for every unit of fiat currency you withdraw. Some fiat-collateralized structure examples are, Tether, TrueUSD, USDC, GUSD, and PAX.Pros:

- Easy to grasp and conceptualize.

- Value or price will match USD or other fiat currency with certainty, if properly implemented (digitized dollars without capital controls)

Cons:

- Trusting a third-party to hold your fiat collateral

- Another third-party is needed to audit and verify to make sure that the number of Stablecoins issued matches the the number of deposits.

- Third party audits are slow and expensive.

The success of fiat-collateralized stablecoins relies on third-parties. So a third-party has to be really transparent, because, they’re responsible for custody and issuance, and auditing. This is where Tether.to became controversial as the USDT token grew dramatically in supply and stopped releasing audit reports.

2. Crypto-collateralized

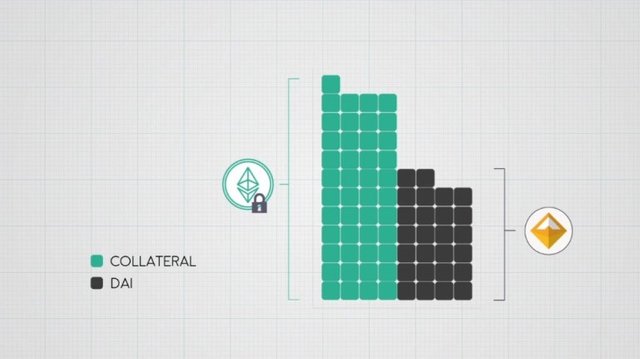

Crypto-collateralized stablecoins are a much more interesting project. The tokens act much the same, but in the backend they are much more complicated than just holding a USD in a bank account. Crypto collateralized assets rely on overcollateralization of cryptocurrencies to keep their peg. The 2 main examples are done using transparent smart contracts “on-chain” which eliminates the need for third parties and keeps the stablecoin quite decentralized.The concern with this method, however, is that cryptocurrency is a highly volatile asset. To reduce the high risk and to have some security against significant drops in crypto prices, the collateral ratios are higher than your typical margin lending ratio. Crypto-collateralized offerings usually have a 2:1 ratio, sometimes even greater to account for volatility. 2 examples of these are Bitshares Smart Assets’ (bitUSD, bitCNY), and MakerDAO’s (ERC20 DAI token.)

Pros:

- Eliminates third parties. No need to give custody and trust on a third party and relying on another to audit.

- Issuing and burning stable coin units are way faster, cheaper, and better liquidity because of the ability to conduct on-chain.

Cons:

- Not capital efficient

- Complex selection process if a basket of cryptocurrencies; questionable price stability/security if just one cryptocurrency

3. Decentralized Stablecoins

Decentralized Stablecoins paved the way for everyday adoption. Many crypto enthusiast, especially the OG’s (old guys) have become accustomed to the volatility and difficulty pricing cryptocurrencies. But, for new users it can be very complicated how a coffee costs .012 BTC one day, .008 the next, and .0183 the next after that. For those that support the P2P money movement, but also are not speculators or very knowledgeable, stablecoins are a great solution. Quick, easy, cheap, P2P payments denominated in a familiar currency are a much easier way to get introduced to the cryptocurrency space as opposed to complicated, slow, expensive BTC transactions of old.And for decentralized stablecoins like DAI and bitUSD the value is still captured in ETH, and BTS blockchains driving the cryptocurrency value up. Each DAI for example at the time of writing is backed by $3 worth of ETH. So that $3 worth of ETH is not for sale and taken out of supply in the supply/demand function of price. While stablecoins still have to deal with volatility on the backend through liquidation of undercollateralized tokens, that can be done by savvy crypto users. So the new crypto user with the decentralized stablecoin retains the easy user friendly experience on the front end.