Cryptocurrency Market Recovering After Massive Correction

The digital money advertise is getting recovered following a fierce day yesterday. The dominant part of coins have ascended by 10-20% throughout the most recent 24 hours after more than a 30% fall on Friday, Dec.22.

The aggregate computerized cash showcase capitalization went from $650 bln to $430 bln yesterday and has now bounced back to $585 bln.

Bitcoin went from the record-breaking high of over $20,000 to as low as $11, 970 in simply a question of days. By squeeze time it has somewhat backtracked its misfortunes and is presently exchanged at around $15,500.

Ethereum, the second biggest digital currency, lost nearly $30 bln in showcase top yesterday, yet has to a great extent recuperated. Its market capitalization is currently $72 bln. It now exchanges for around $720 on European trades and as high as $906 on South Korean markets.

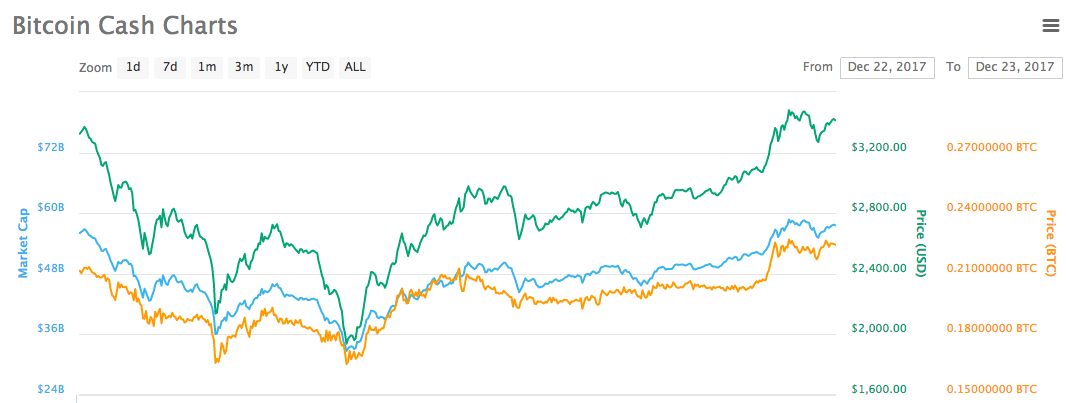

Bitcoin Cash encountered the best value instability of all major computerized monetary forms throughout the most recent 48 hours. The value tumbled from $3,909 to $1,970 yet at squeeze time has returned to $3,400.

The outrageous market turbulence came days after the affirmed insider exchanging at Coinbase, one of the greatest cryptographic money trades.

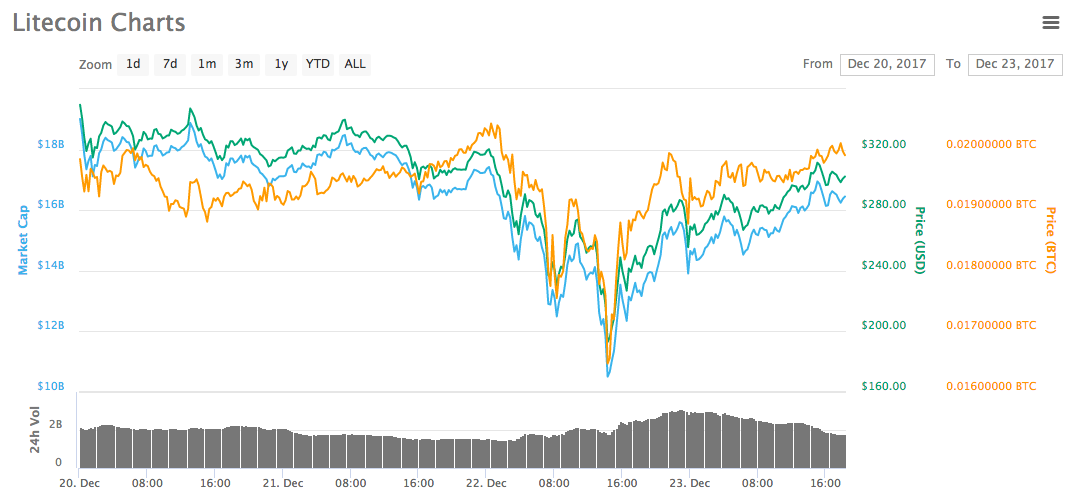

Uplifting news versus awful news It's been a to a great degree unstable week for the whole advanced money industry. Following CBOE's Bitcoin fates exchanging begin on Dec. 10, the CME amass propelled its very own prospects result. Exchanging at CME opened Dec.17, generally when Bitcoin's unpredictability started to increment. On Dec. 20 Litecoin maker Charlie Lee sold or gave all his Litecoins, apparently to keep away from "irreconcilable circumstance." However, some have scrutinized his thought processes, since only seven days sooner he anticipated a multi-year bear advertise which would see the cost of Litecoin drop as low as $20. Joining significant foundations like CBOE and CME in their Bitcoin motivation, Goldman Sachs declared its intends to set up a digital currency exchanging work area on December 21. It will be opened before the finish of June 2018.

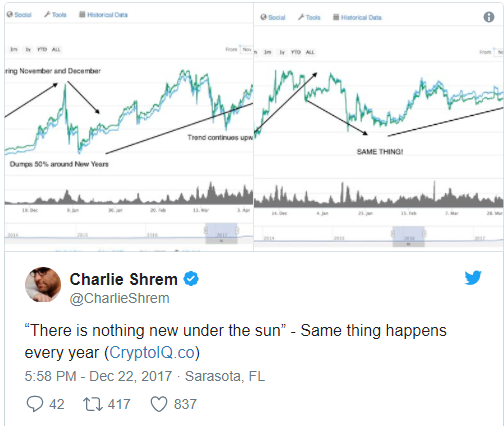

What incited the most recent plunge in the whole market is yet obscure. Charlie Shrem, an establishing individual from Bitcoin Foundation, trusts that the market has just observed comparative value developments and there is no motivation to freeze.