UST 2.0 - Not what you think

Introduction

There are different types of stablecoins. Some are collateralised by a fiat currency (e.g. USDT), some are linked to a basket of fiat currencies (e.g. that Facebook abomination coin), some are linked to a fiat currency and are collateralised by cryptocurrencies (e.g. DAI), some are collateralised by an underlying commodity (such as gold - anyone remember BitGold?), some use a mixture of methods (e.g. FRAX) and others try (and so far fail) to achieve price stability through the control of supply and demand (e.g. SBD/HBD).

Then one day, along came a chap called Do Kwon who said: “F*** that lads, let’s go full algorithmic!”*

*[Probably not his actual words]

So far Do Kwon’s little experiment seems to be working rather well, we know it as the Terra cryptocurrency ecosystem. Its flagship product is UST - an algorithmic stablecoin pegged 1:1 to the US Dollar.

Lyrebird

Flattery will get you nowhere.

Or will it?

It is often said that “imitation is the sincerest form of flattery”, a maxim which generally holds true. And so it has come to pass that Terra/UST has spawned a imitator. That imitator’s name is “Lyrebird”.

Named after a bird species endemic to Australia, it is ironic that lyrebirds are renowned for their abilities to mimic the sounds of their environment. The Lyrebird team will no doubt be looking to mimic the success of Terra/UST.

The operation of Lyrebird (ticker symbol “USDL”) is very similar to that of Terra stablecoins, a fact they don't try to hide. I consider this to be a good thing: why reinvent the wheel? On top of that, I strongly back the decentralised approach that Terra has taken to stabilising the price of its stablecoins, as opposed to directly backing them with fiat - as is the norm.

I won’t go into the details now (you may well already know them), but UST maintains its 1:1 dollar peg by always allowing 1 UST to be exchangeable for 1 USD worth of LUNA. Similarly, it allows people to mint UST using LUNA. In this way the price of UST is prevented from climbing higher than 1 USD (because people then mint UST using LUNA), and is prevented from dropping lower than 1 USD (because people then sell their UST for LUNA). Obviously there can be slight delays in this arbitrage system, but on the whole it works very well.

Lyrebird uses exactly the same system of arbitrage. In the case of Lyrebird, the role of UST is played by USDL, and the role of LUNA is played by the Lyrebird native token - LRB. Like Terra, Lyrebird also allows for other currencies in the form of what it calls “L-assets”, meaning that USD (with its USDL equivalent) is not the only fiat currency they hope to tokenise.

More about Lyrebird

There is of course the risk that Lyrebird could fail, success can not be guaranteed. It’s not impossible that LRB holders keep on selling to the point that USDL is unable to maintain its peg, and the whole project will tank. But technically the same could be said of Terra - though I acknowledge that we are then talking about a substantially more established ecosystem.

Knowing this, the Lyrebird team are attempting to launch their project in a responsible and intelligent manner. They have worked with Flamingo Finance (the de facto main DEX of NEO - visit it at https://flamingo.finance ) to establish a reverse liquidity Lyrebird pool: FRP-FLM-LRB. This pool will allow stakers to earn LRB. 20 million LRB has been allocated to Flamingo reverse liquidity pools, this number represents 20% of the initial Lyrebird token supply.

Speaking of the token supply: Lyrebird is being launched without any private sales. 50% of that supply is going to be dropped to the public by one means or another - which I consider to be a healthy and very positive move. Exactly how airdrops will work is not entirely known yet, at least not publicly, but early winners appear to be those who participated in the Lyrebird Discord discussions - who will get 1000 LRB apiece, and those who held LRB or UDSL on the testnet - who will get 5000 LRB apiece.

Apart from airdrops and reverse liquidity pools - which, when combined, account for 30% of the initial token supply, there is also another 20% which will be given to the community by methods which have yet to be determined. The other half of the token supply is made up as follows: 20% allocated to the team (locked for a year), another 20% to the “stability reserve” and 10% to project development.

I can’t say that the 20% team allocation sits well with me, but sadly that is now par for the course. I stated (in a yet-to-be-published post I’m writing about recently launched crypto projects), that the project teams of almost all projects tend to take a ridiculously large amount of tokens for themselves - a move which results in centralisation, price instability, a wealth gap, market manipulation - and various other things which we should have left back in the fiat world.

Lyrebird is not a Terra project and it does not run on the Terra blockchain. It’s a NEO project which runs on the recently launched NEO “N3” ecosystem, a hard fork which is basically the third iteration of the NEO economic system. While NEO is not so well known these days, those of us who have stuck with the project since the early days are well aware that it’s a truly beautiful mature and tested blockchain system which is meticulously planned and well thought out. If you think Do Kwon is a smart guy, you must see Da Hongfei...

NEO ran a DeFi contest to attract and incentivise new projects on the N3 ecosystem. After Da Hongfei noted that the lack of a native NEO stablecoin could hold the ecosystem back, Lyrebird founder William Song and his team stepped up to the plate, winning the award for “Best DeFi Project” in the NEO Frontier Launchpad. The NEO ecosystem is still rather small and close-knit, with projects supporting one another and NEO management keen to see them all succeed.

Where to next?

If it does well - and its success will probably be linked to the future successes (or lack thereof) of NEO in general, then Lyrebird will continue to expand. For instance, it is envisioned that there will also be Lyrebird versions of “synthetics” such as the tokenised stocks of Mirror protocol on Terra. The idea is to have a decentralised community voting on what they would like to see added to the protocol as it develops.

In theory I consider this to be sound, but in practise crypto is a capricious mistress and who knows which projects will succeed and which will not? For all we know, Terra itself could implode tomorrow, brought down suddenly by something such as Anchor yield issues or opposition to recent BTC purchases.

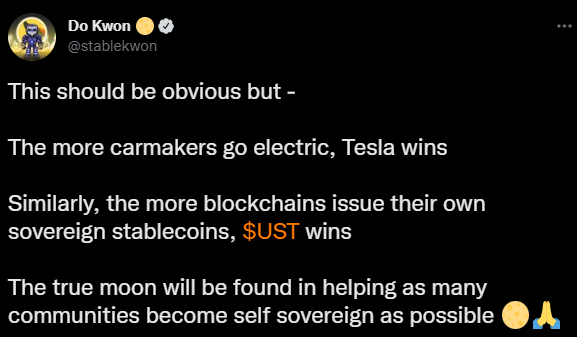

Do Kwon himself seems to think that the more native stablecoins in crypto, the better. His reasoning is that the more of them there are, the more likely it will be that UST “wins”. In his own words:

https://twitter.com/stablekwon/status/1517134429294313472

He has also been openly critical of Tron’s UUSD and has also stated that he will kill DAI off.

https://twitter.com/stablekwon/status/1506494471873081352

Whether his predictions and combative attitude are right or not remains to be seen. Personally I prefer it when there are competitors in a market, competitors keep one another honest, they prevent abuse by a monopolistic entity and also act as redundancies to one another. I’m not saying that stablecoins should be like NFTs - with every second person issuing them - but it would be healthy for the crypto space if we could have alternative algorithmic stablecoins. To quote Do Kwon again:

https://twitter.com/stablekwon/status/1517293459886936065

A statement such as that I can wholeheartedly agree with.

Conclusion

Irrespective of who survives and who does not, I’m just glad that we have algorithmic stablecoins now, and full credit to Do Kwon and the Terra team for leading the way. I never supported traditional stablecoins, and actually flat-out refused to use them, except during short-term trades when there was no other option. I think that the more algorithmic stablecoins we have, the better for crypto in general, even if one dominates all the others. Decentralisation remains an absolutely critical key tenet of crypto, one which will become increasingly important as the global economy continue to implode. The more fiat systems weaken and fail, the more our crypto systems appear robust by comparison - and that’s a win for us all - even a win for humanity as a whole.

Oh yes, one more thing, Lyrebird goes live tomorrow: 0900-1000 UTC at an initial price of $0.01 per LRB. Remember to DYOR.

Yours in crypto

Bit Brain

For more information about Lyrebird, I suggest that you visit their homepage at https://lyrebird.finance, or visit https://lyrebird-finance.medium.com and/or https://neonewstoday.com/?s=lyrebird.

"The secret to success: find out where people are going and get there first"

~ Mark Twain

"Crypto does not require institutional investment to succeed; institutions require crypto investments to remain successful"

~ Bit Brain